A Hawaii Pot Testamentary Trust is a legal arrangement that allows individuals to establish a trust to manage and distribute their assets after their death. It is specifically created to address the unique laws and regulations governing trusts in the state of Hawaii. A testamentary trust is established through a will and does not come into effect until the granter's death. It allows individuals to retain control over their assets while ensuring that their wishes are carried out in terms of asset distribution, tax planning, and protecting the interests of beneficiaries. In the context of Hawaii, the term "Pot" refers to the pooling of assets from multiple sources into a single trust. This type of trust is commonly used when there are multiple beneficiaries, and the granter wants the assets to be managed collectively to simplify administration and provide flexibility in distributing funds. Hawaii Pot Testamentary Trusts can be further categorized into various types based on their specific purposes and requirements. Some common types include: 1. Charitable Pot Testamentary Trust: This type of trust allows the granter to designate a portion of the trust's assets to be distributed to charitable organizations or causes of their choice. 2. Special Needs Pot Testamentary Trust: Specifically designed to provide for the long-term care and support of beneficiaries with special needs, this trust ensures that their government benefits are not impacted while still providing additional financial assistance. 3. Education Pot Testamentary Trust: This trust is established to support the educational needs of beneficiaries, such as funding college tuition, vocational training, or other educational expenses. 4. Family Pot Testamentary Trust: This type of trust aims to provide ongoing financial support and protection for the granter's family members, including minor children, spouse, or future generations. 5. Discretionary Pot Testamentary Trust: With this trust, the trustee has the discretion to determine how and when to distribute the assets to the beneficiaries. This allows for flexibility based on individual circumstances and needs. It is important to consult with an experienced estate planning attorney when considering a Hawaii Pot Testamentary Trust, as they can provide guidance on the specific requirements, tax implications, and legal considerations associated with each type of trust.

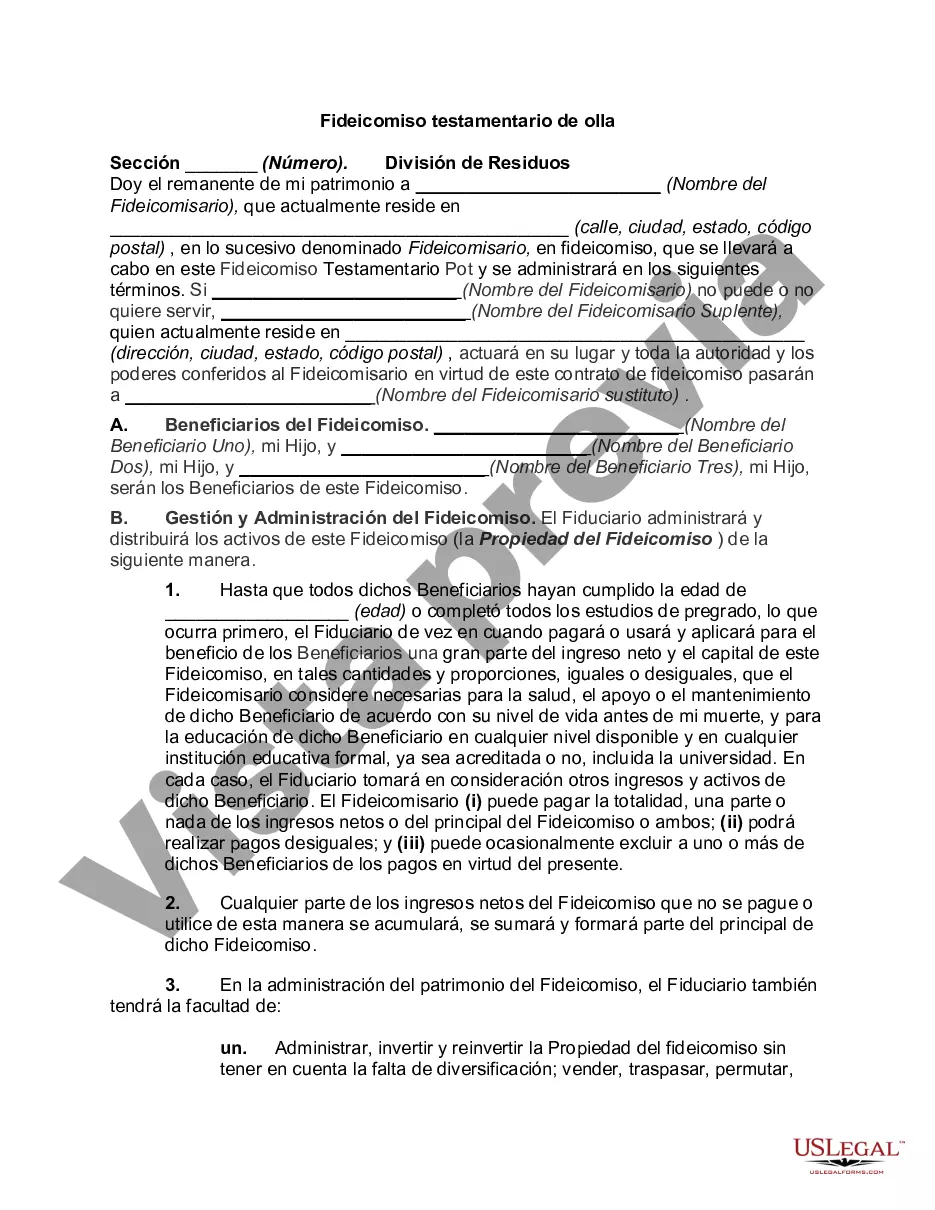

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hawaii Fideicomiso testamentario de olla - Pot Testamentary Trust

Description

How to fill out Hawaii Fideicomiso Testamentario De Olla?

US Legal Forms - one of many largest libraries of authorized types in the USA - provides an array of authorized record themes you are able to acquire or produce. While using website, you may get a large number of types for enterprise and individual purposes, sorted by classes, claims, or keywords and phrases.You can find the latest variations of types much like the Hawaii Pot Testamentary Trust in seconds.

If you currently have a membership, log in and acquire Hawaii Pot Testamentary Trust from the US Legal Forms local library. The Obtain key will appear on each form you look at. You have accessibility to all formerly downloaded types within the My Forms tab of your own bank account.

In order to use US Legal Forms the first time, listed here are simple recommendations to help you started:

- Ensure you have picked out the best form for your town/county. Go through the Preview key to review the form`s information. Look at the form description to ensure that you have selected the proper form.

- In case the form doesn`t fit your specifications, utilize the Research industry at the top of the display screen to discover the one who does.

- When you are pleased with the form, validate your option by clicking on the Acquire now key. Then, opt for the costs strategy you like and give your references to register to have an bank account.

- Procedure the purchase. Make use of your credit card or PayPal bank account to perform the purchase.

- Find the format and acquire the form on your system.

- Make modifications. Load, change and produce and signal the downloaded Hawaii Pot Testamentary Trust.

Each and every format you included in your account does not have an expiration time and is also the one you have for a long time. So, if you want to acquire or produce yet another copy, just check out the My Forms section and then click about the form you require.

Obtain access to the Hawaii Pot Testamentary Trust with US Legal Forms, probably the most substantial local library of authorized record themes. Use a large number of professional and condition-distinct themes that fulfill your company or individual requirements and specifications.