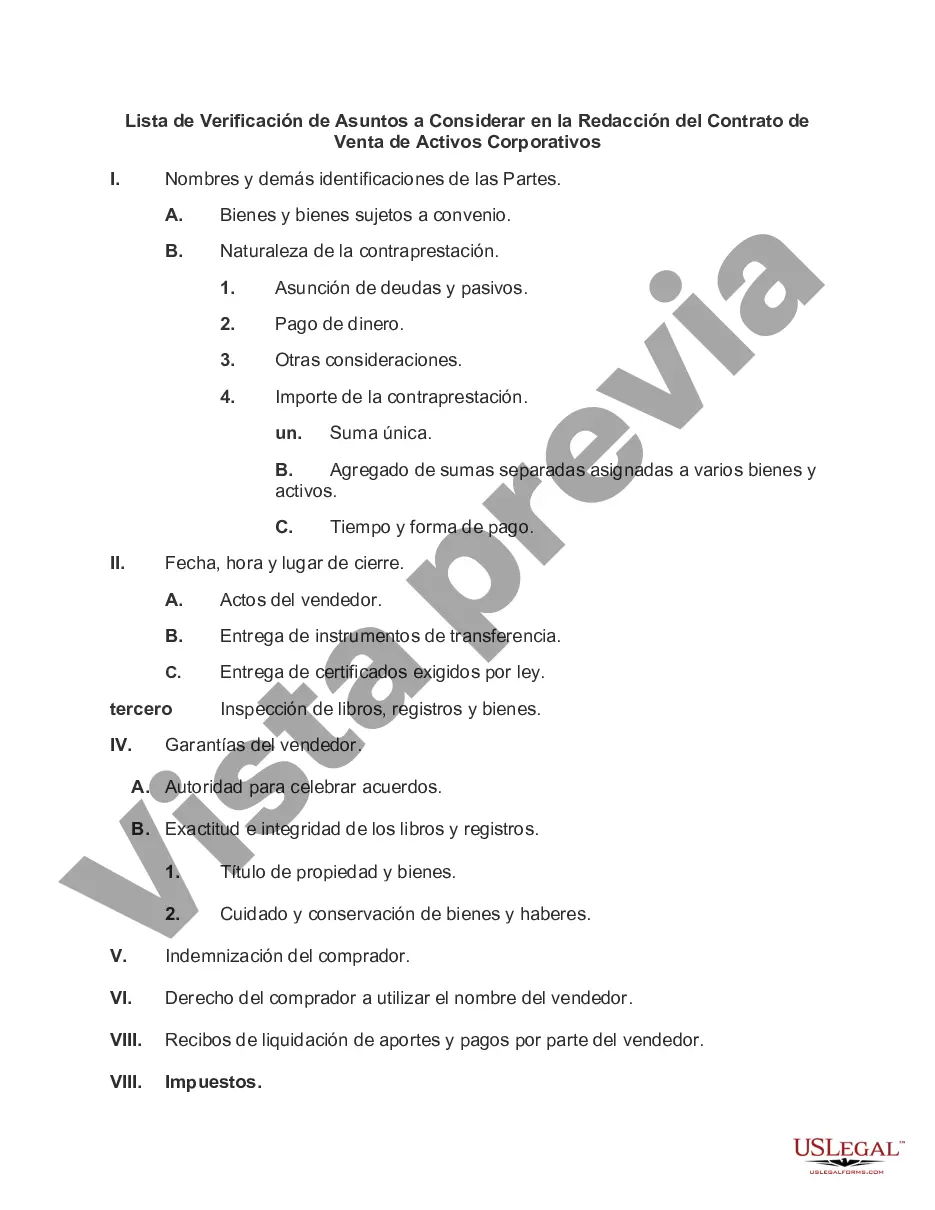

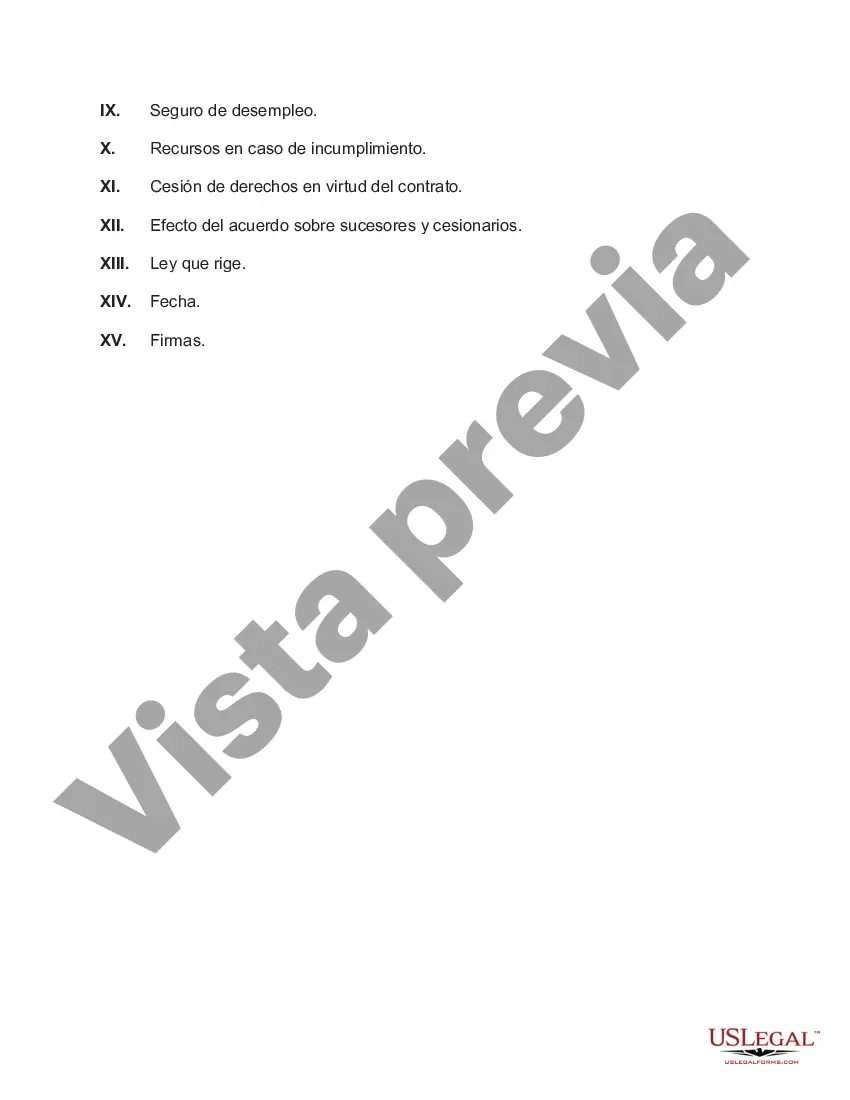

Title: Hawaii Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets Keywords: Hawaii, Checklist, Matters to be Considered, Drafting Agreement, Sale, Corporate Assets Introduction: When engaging in the sale of corporate assets in Hawaii, it's crucial to ensure a well-drafted agreement that covers all essential aspects of the transaction. This checklist serves as a comprehensive guide, exploring key considerations and essential components needed when drafting an agreement for the sale of corporate assets in Hawaii. Types of Hawaii Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets: 1. Legal and Regulatory Compliance Checklist: Ensure compliance with state and federal laws, Hawaii Revised Statutes, rules and regulations specific to asset sales, securities laws, and any industry-specific regulations governing the sale of corporate assets. 2. Asset Identification and Description: Provide a thorough and accurate description of the assets being sold, including detailed specifications, location, and condition of the assets. 3. Purchase Price and Payment Terms: Clearly outline the agreed-upon purchase price, payment terms, including any potential adjustments based on contingency factors, and the arrangement for compensation, such as cash, stock, or debt assumption, if applicable. 4. Representations and Warranties: Include comprehensive representations and warranties from both parties regarding the accuracy of financial statements, absence of undisclosed liabilities, ownership of assets, title, intellectual property rights, and other material aspects of the assets being sold. 5. Due Diligence and Inspection: Define the scope and timeline for the buyer's due diligence, allowing them sufficient time to inspect the assets, review financial records, contracts, leases, and any other pertinent documents. 6. Assumption and Assignment of Contracts: Address the treatment of existing contracts, leases, licenses, permits, and other agreements related to the assets, outlining whether they will be assumed by the buyer or require termination or renegotiation. 7. Employment and Labor Considerations: Evaluate any potential employment or labor-related issues, such as the transfer of employees or necessary severance agreements, compliance with Hawaii labor laws, and employee benefit obligations. 8. Intellectual Property Rights: Ensure the protection and appropriate transfer of patents, copyrights, trademarks, trade secrets, or other intellectual property rights associated with the assets, including necessary registrations and assignments. 9. Indemnification and Liability: Define indemnification provisions to allocate potential risks and liabilities between the buyer and the seller, addressing potential breaches, infringements, or undisclosed liabilities pertaining to the assets. 10. Closing Conditions and Deliverables: Specify the conditions that must be met before closing the sale, including any required governmental approvals, consents, or waivers, and enumerate the necessary deliverables such as transfer of titles, assets, and necessary documentation. Conclusion: When drafting an agreement for the sale of corporate assets in Hawaii, it is essential to consider the unique legal and regulatory landscape of the state. By carefully reviewing and addressing each item in a comprehensive checklist, parties can ensure a well-structured agreement that protects their interests and facilitates a smooth and legally compliant asset sale transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hawaii Lista de Verificación de Asuntos a Considerar en la Redacción del Contrato de Venta de Activos Corporativos - Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets

Description

How to fill out Hawaii Lista De Verificación De Asuntos A Considerar En La Redacción Del Contrato De Venta De Activos Corporativos?

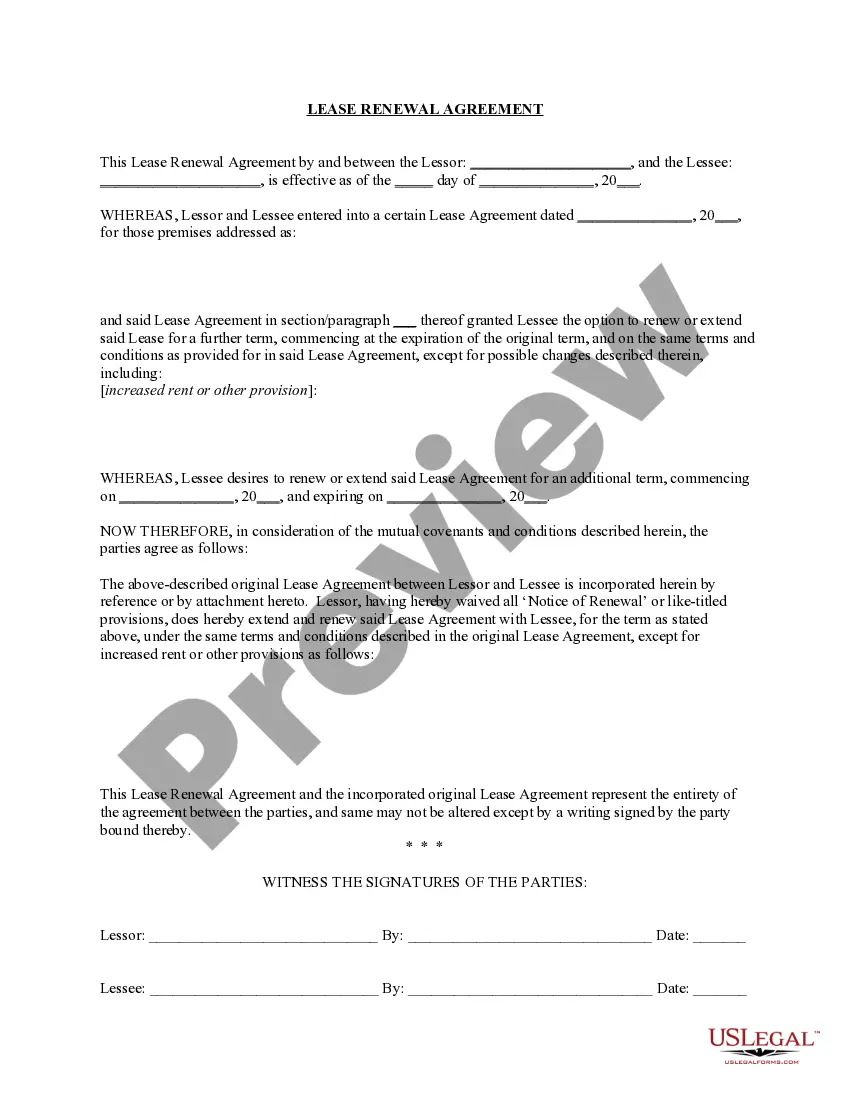

Are you presently inside a position in which you need paperwork for possibly organization or person reasons virtually every day? There are a lot of legal document web templates available on the Internet, but getting kinds you can rely on isn`t simple. US Legal Forms provides 1000s of kind web templates, like the Hawaii Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets, that happen to be published to satisfy federal and state demands.

When you are previously knowledgeable about US Legal Forms internet site and also have your account, simply log in. Afterward, you are able to acquire the Hawaii Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets template.

If you do not provide an account and need to start using US Legal Forms, follow these steps:

- Obtain the kind you need and make sure it is to the proper town/area.

- Take advantage of the Review switch to check the shape.

- Browse the description to ensure that you have selected the appropriate kind.

- If the kind isn`t what you`re searching for, take advantage of the Look for field to get the kind that suits you and demands.

- If you get the proper kind, click on Buy now.

- Choose the prices program you want, complete the required details to create your bank account, and buy the transaction using your PayPal or charge card.

- Select a hassle-free paper format and acquire your version.

Get each of the document web templates you might have purchased in the My Forms food list. You may get a further version of Hawaii Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets any time, if needed. Just click the essential kind to acquire or print out the document template.

Use US Legal Forms, probably the most substantial selection of legal varieties, to save time as well as prevent faults. The service provides expertly manufactured legal document web templates which you can use for a selection of reasons. Produce your account on US Legal Forms and initiate generating your daily life easier.