Hawaii Guaranty without Pledged Collateral is a financial service offered in the state of Hawaii, providing businesses with a means to secure loans and credit lines without the requirement of pledging collateral. This type of guarantee allows businesses to access funding and support for various purposes, including business expansion, working capital needs, and equipment purchases, amongst others. By opting for Hawaii Guaranty without Pledged Collateral, businesses can avoid the need to offer traditional forms of collateral, such as real estate, stocks, or other valuable assets. Instead, the guarantee is based on the creditworthiness and trustworthiness of the borrower. This type of guaranty is particularly beneficial for small enterprises or startups that may not have substantial assets to utilize as collateral. Hawaii Guaranty without Pledged Collateral is typically facilitated by financial institutions or government-backed programs that aim to promote economic growth and entrepreneurship within the state. These programs may include the Hawaii Small Business Loan Guarantee Program, which assists in providing credit enhancements to eligible businesses. Different types of Hawaii Guaranty without Pledged Collateral may include: 1. Hawaii Small Business Loan Guarantee Program: This program offers a guaranty to lenders participating in the program, covering a percentage of the outstanding loan balance. It provides reassurance to lenders by reducing their risk exposure, encouraging them to extend credit to small businesses without the need for collateral. 2. Hawaii Economic Development Loan Program: This program focuses on stimulating economic development within Hawaii by offering guarantees to viable businesses looking to expand or establish operations in the state. The guaranty without pledged collateral helps expedite the loan approval process and enables businesses to secure funding for their projects rapidly. 3. Hawaii Women's Business Loan Program: Specifically tailored to support women-owned businesses, this program offers guaranties without requiring pledged collateral. It aims to empower female entrepreneurs and provide them with equal opportunities for growth and success. 4. Hawaii Social Enterprise Guarantee Program: This initiative is designed to support social enterprises that have a positive impact on the local community. By guaranteeing loans without requiring collateral, this program encourages the growth of socially conscious businesses, allowing them to obtain financing for various projects that benefit society. In conclusion, Hawaii Guaranty without Pledged Collateral provides businesses in Hawaii with an opportunity to access funding and credit lines without the need to pledge traditional collateral. Through various government-backed programs, such as the Hawaii Small Business Loan Guarantee Program and others, businesses can secure loans for expansion, working capital, or equipment purchases, contributing to the economic growth and development of the state.

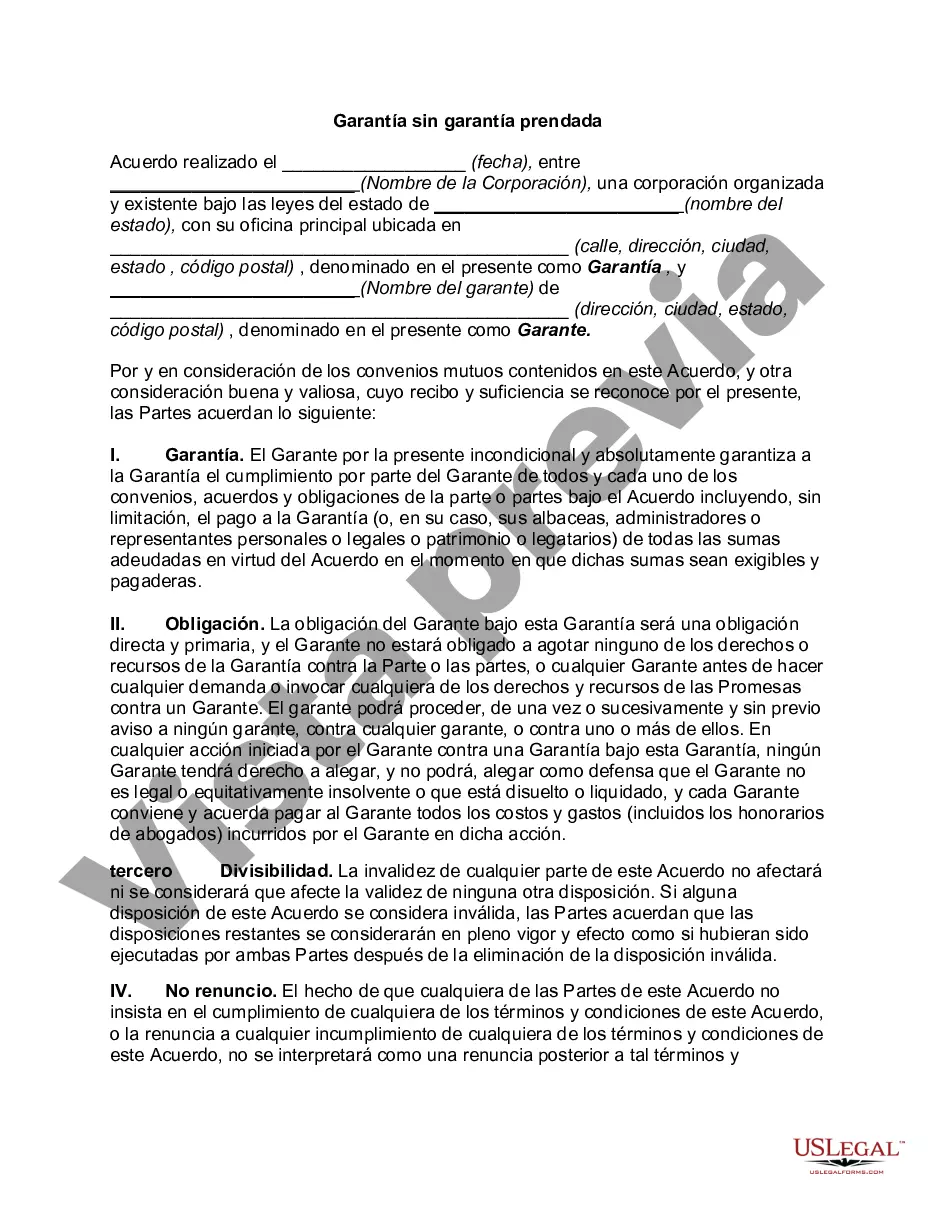

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hawaii Garantía sin garantía prendada - Guaranty without Pledged Collateral

Description

How to fill out Hawaii Garantía Sin Garantía Prendada?

US Legal Forms - one of the biggest libraries of legal forms in the USA - gives a wide array of legal document themes you can download or print. Using the site, you can find a large number of forms for business and individual uses, categorized by classes, states, or keywords.You will find the latest types of forms much like the Hawaii Guaranty without Pledged Collateral in seconds.

If you already have a subscription, log in and download Hawaii Guaranty without Pledged Collateral in the US Legal Forms library. The Obtain option will appear on every kind you look at. You have accessibility to all earlier acquired forms from the My Forms tab of your own profile.

If you would like use US Legal Forms the very first time, listed here are basic directions to get you started off:

- Make sure you have picked out the proper kind to your metropolis/region. Click on the Review option to check the form`s content material. Browse the kind explanation to ensure that you have chosen the proper kind.

- In the event the kind does not match your specifications, make use of the Research field at the top of the display screen to discover the one who does.

- If you are satisfied with the form, confirm your choice by simply clicking the Get now option. Then, select the costs strategy you want and provide your references to register for an profile.

- Approach the financial transaction. Utilize your Visa or Mastercard or PayPal profile to perform the financial transaction.

- Select the file format and download the form on the product.

- Make adjustments. Fill out, modify and print and signal the acquired Hawaii Guaranty without Pledged Collateral.

Each design you included with your bank account does not have an expiry day and is your own forever. So, if you wish to download or print another version, just proceed to the My Forms area and then click around the kind you need.

Obtain access to the Hawaii Guaranty without Pledged Collateral with US Legal Forms, one of the most comprehensive library of legal document themes. Use a large number of skilled and state-distinct themes that satisfy your organization or individual needs and specifications.

Form popularity

FAQ

Personal guarantees don't have a direct impact on your personal or business credit history, or credit score unless you run into trouble. "They don't typically show up on credit reports," Luebbers says. But, a personal guarantee could affect your credit if you have late payments or default on the loan.

Collateral is simply an asset, such as a car or home, that a borrower offers up as a way to qualify for a particular loan. Collateral can make a lender more comfortable extending the loan since it protects their financial stake if the borrower ultimately fails to repay the loan in full.

As nouns the difference between pledge and collateral is that pledge is a solemn promise to do something while collateral is a security or guarantee (usually an asset) pledged for the repayment of a loan if one cannot procure enough funds to repay (originally supplied as "accompanying" security).

Examples of collateral documents are a security agreement, guarantee and collateral agreement, pledge agreement, deposit account control agreement, securities account control agreement, mortgage, and UCC-1s.

A Pledge Loan means using money you have in savings or a CD as collateral for a loan. If you don't pay back the loan, the lender uses the money you pledged to pay back the loan. You will pay a slightly higher interest rate on the loan than you are earning on your savings.

Updated October 30, 2020: Guarantee vs collateral what's the difference? A personal guarantee is a signed document that promises to repay back a loan in the event that your business defaults. Collateral is a good or an owned asset that you use toward loan security in the event that your business defaults.

A personal guarantee is an unsecured written promise from a business owner and or business executive guaranteeing payment on an equipment lease or loan in the event the business does not pay. Since it is unsecured, a personal guarantee is not tied to a specific asset.

Collateral, a borrower's pledge to a lender of something specific that is used to secure the repayment of a loan (see credit). The collateral is pledged when the loan contract is signed and serves as protection for the lender.

An unsecured loan is a loan that doesn't require any type of collateral. Instead of relying on a borrower's assets as security, lenders approve unsecured loans based on a borrower's creditworthiness. Examples of unsecured loans include personal loans, student loans, and credit cards.

Types of CollateralReal estate.Cash secured loan.Inventory financing.Invoice collateral.Blanket liens.