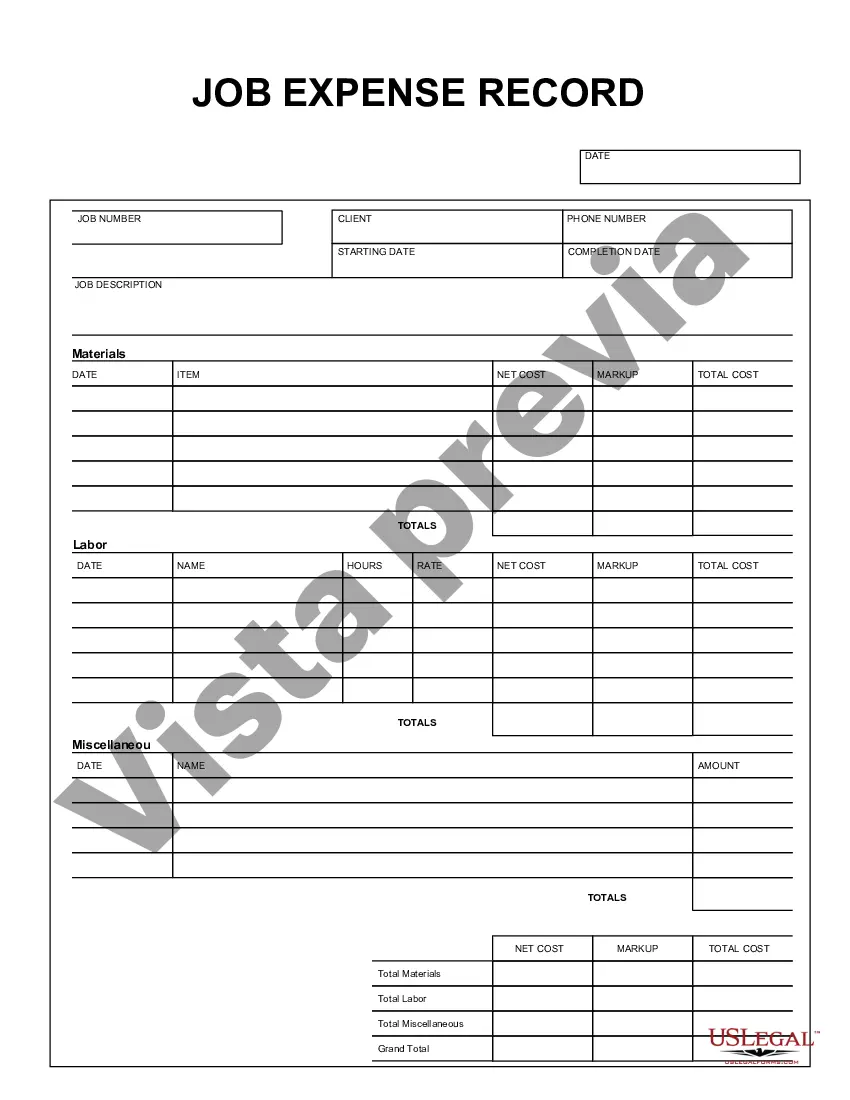

The Hawaii Job Expense Record is a document used by individuals employed in Hawaii to keep track of their work-related expenses. This record helps them effectively manage and document their job-related costs, making it easier to claim tax deductions or seek reimbursement from employers. The Hawaii Job Expense Record includes various sections and fields to cover different expenses. Some relevant keywords for this record may include: 1. Name and Personal Details: This section requires the employee's name, address, social security number, and other identification information. 2. Job-related Travel Expenses: Here, individuals can list all costs incurred during travel for business purposes, such as airfare, car rentals, mileage, parking fees, and lodging expenses. 3. Meals and Entertainment Expenses: This section allows employees to note expenses related to business meals and entertainment incurred while on the job, including meals with clients, business associates, or potential customers. Receipts need to be attached as supporting evidence. 4. Work-Related Supplies and Equipment: This field covers expenses for work-related supplies, such as stationery, computer software, tools, and equipment required to fulfill job responsibilities. 5. Internet and Phone Bills: This section records expenses related to internet services and phone bills specifically essential for work-related communications or research activities. 6. Education and Training Costs: Employees can document expenses related to job-related education or training programs, including registration fees, tuition, course materials, and travel costs associated with attending professional conferences or workshops. 7. Professional Memberships and Licenses: This field covers expenses associated with professional memberships, licenses, certifications, or subscriptions related to the employee's job. 8. Miscellaneous Expenses: This catch-all section allows employees to record other job-related expenses not covered in the previous categories, such as parking fees, postage, shipping costs, or home office expenses. Different types of Hawaii Job Expense Records may be categorized based on the nature of employment, such as: 1. Hawaii Job Expense Record for Self-Employed Individuals: This record is specifically designed for individuals who operate their own businesses or work as independent contractors. It encompasses a wider range of job-related expenses, including operational costs and business-related purchases. 2. Hawaii Job Expense Record for Employees: This type of record caters to employees who work for companies or organizations in Hawaii. It focuses on expenses the employee incurs during the course of their employment, which might be eligible for tax deductions or reimbursement. Overall, the Hawaii Job Expense Record is a vital tool for individuals employed in Hawaii to track and document job-related expenses accurately. It enables them to maintain organized records and maximize their tax benefits or potential reimbursement for work-related costs.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hawaii Registro de gastos de trabajo - Job Expense Record

Description

How to fill out Hawaii Registro De Gastos De Trabajo?

If you have to complete, download, or produce legal record web templates, use US Legal Forms, the most important assortment of legal varieties, that can be found on-line. Make use of the site`s simple and convenient look for to obtain the documents you will need. Different web templates for company and personal functions are categorized by types and suggests, or keywords. Use US Legal Forms to obtain the Hawaii Job Expense Record in just a few click throughs.

When you are already a US Legal Forms client, log in to the bank account and click the Obtain key to find the Hawaii Job Expense Record. You can even gain access to varieties you previously downloaded from the My Forms tab of the bank account.

If you are using US Legal Forms initially, follow the instructions listed below:

- Step 1. Be sure you have chosen the shape for the appropriate town/nation.

- Step 2. Utilize the Review option to examine the form`s content. Don`t overlook to see the explanation.

- Step 3. When you are not satisfied using the develop, utilize the Lookup area at the top of the display screen to find other variations of the legal develop design.

- Step 4. When you have located the shape you will need, click the Buy now key. Choose the pricing strategy you prefer and add your qualifications to register for the bank account.

- Step 5. Procedure the financial transaction. You should use your charge card or PayPal bank account to perform the financial transaction.

- Step 6. Choose the format of the legal develop and download it on your own system.

- Step 7. Full, change and produce or signal the Hawaii Job Expense Record.

Each and every legal record design you get is the one you have eternally. You may have acces to every develop you downloaded within your acccount. Go through the My Forms segment and select a develop to produce or download yet again.

Contend and download, and produce the Hawaii Job Expense Record with US Legal Forms. There are thousands of skilled and state-certain varieties you can utilize for the company or personal needs.