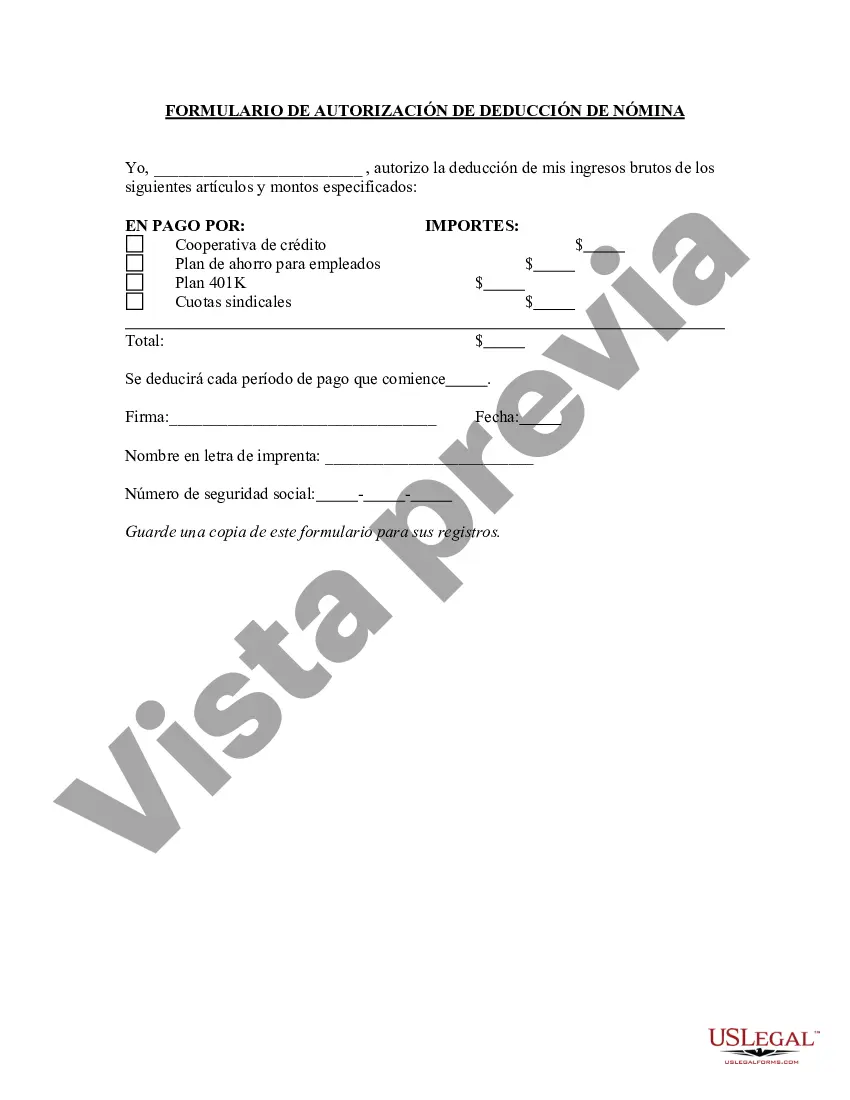

The Hawaii Payroll Deduction Authorization Form is a document used by employers in the state of Hawaii to allow employees to authorize specific deductions from their wages. This form is essential for ensuring that proper deductions are made in accordance with the employee's wishes and legal requirements. There are several types of Hawaii Payroll Deduction Authorization Forms, each serving a different purpose. These include: 1. Hawaii Payroll Deduction Authorization Form for Taxes: This form allows employees to authorize deductions for various taxes, such as federal and state income taxes, Social Security, and Medicare. It ensures that the appropriate amounts are withheld from an employee's wages to meet their tax obligations. 2. Hawaii Payroll Deduction Authorization Form for Benefits: This form is used to authorize deductions for employee benefits, such as health insurance premiums, retirement contributions, and flexible spending accounts. It allows employees to specify the desired deductions and ensure that they receive the benefits they have chosen. 3. Hawaii Payroll Deduction Authorization Form for Loan Repayments: This form permits employees to authorize deductions from their wages to repay loans, such as mortgages, car loans, or personal loans. It ensures timely payments without requiring manual interventions or reminders. 4. Hawaii Payroll Deduction Authorization Form for Union Dues: This form is used to authorize deductions for union dues. It allows employees to become union members and support their chosen labor organization by authorizing automatic deductions from their wages. 5. Hawaii Payroll Deduction Authorization Form for Charitable Contributions: Some employers offer employees the option to donate a portion of their wages to charitable organizations. This form enables employees to authorize deductions for charitable contributions, supporting causes that are meaningful to them. 6. Hawaii Payroll Deduction Authorization Form for Miscellaneous Deductions: This form covers other types of deductions not covered by the previously mentioned categories. It may include deductions for uniforms, tools, or other work-related expenses. In summary, the Hawaii Payroll Deduction Authorization Form is a vital document that allows employees to authorize various deductions from their wages. Whether it is for taxes, benefits, loans, union dues, charitable contributions, or miscellaneous expenses, these forms ensure accurate and efficient payroll deductions, giving employees control over their finances and obligations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hawaii Formulario de Autorización de Deducción de Nómina - Payroll Deduction Authorization Form

Description

How to fill out Hawaii Formulario De Autorización De Deducción De Nómina?

Finding the right legal file design could be a struggle. Needless to say, there are a lot of layouts available on the net, but how would you get the legal form you want? Take advantage of the US Legal Forms internet site. The service gives 1000s of layouts, including the Hawaii Payroll Deduction Authorization Form, which can be used for organization and personal requires. Every one of the varieties are inspected by specialists and meet state and federal specifications.

In case you are presently listed, log in to the account and click the Download option to have the Hawaii Payroll Deduction Authorization Form. Use your account to check with the legal varieties you may have acquired previously. Proceed to the My Forms tab of your account and obtain yet another version of your file you want.

In case you are a brand new user of US Legal Forms, allow me to share simple recommendations that you should follow:

- Very first, make certain you have selected the right form for your area/area. You may check out the shape while using Review option and study the shape information to guarantee this is the best for you.

- When the form is not going to meet your needs, take advantage of the Seach discipline to obtain the proper form.

- Once you are certain the shape would work, click the Acquire now option to have the form.

- Select the rates program you would like and enter in the necessary details. Make your account and purchase your order making use of your PayPal account or credit card.

- Pick the document formatting and download the legal file design to the device.

- Complete, revise and print out and signal the obtained Hawaii Payroll Deduction Authorization Form.

US Legal Forms will be the largest library of legal varieties for which you can find a variety of file layouts. Take advantage of the service to download skillfully-made files that follow express specifications.