The Hawaii Waiver of Qualified Joint and Survivor Annuity (JSA) is a legal provision that allows retirees or plan participants to waive their right to a joint and survivor annuity. This waiver provides individuals with the flexibility to choose alternative retirement income options that may better suit their specific financial needs. To fully understand the Hawaii JSA waiver, it is essential to delve into its types, benefits, and considerations. The primary purpose of a JSA is to ensure that a retiring individual's spouse is financially protected after their passing. Typically, a qualified retirement plan, such as a pension plan, must offer a Joint and Survivor Annuity as the default payment option. This annuity guarantees a lifetime income for the retiree and a reduced but ongoing income for the surviving spouse. However, the JSA waiver allows an individual to forgo this default option and explore other potential retirement income streams or payment methods. Different types of Hawaii JSA waivers include partial and full waivers. A partial waiver may enable the individual to modify the Joint and Survivor Annuity's terms, such as lowering the percentage payable to the surviving spouse. On the other hand, a full waiver allows the retiree to completely relinquish their spouse's right to a survivor annuity, providing them with more control over their retirement funds upon their death. To qualify for a JSA waiver, individuals are required to obtain spousal consent, ensuring that both parties fully understand the financial implications and potential risks involved. Furthermore, it is important to note that a Hawaii JSA waiver may have tax consequences and should be thoroughly discussed with a qualified financial advisor or attorney to make informed decisions. The Hawaii JSA waiver can offer retirees multiple benefits, including the ability to leave a legacy for their heirs or allocate their retirement funds towards other financial goals, such as investments or charitable contributions. However, it is essential to carefully consider the long-term financial well-being of the spouse, as the waiver eliminates the default survivor annuity protection. In conclusion, the Hawaii Waiver of Qualified Joint and Survivor Annuity (JSA) is a provision that allows retirees to waive their right to a joint and survivor annuity, offering them more control over their retirement funds. The different types of waivers include partial and full waivers, each with its own set of considerations and benefits. However, individuals contemplating a JSA waiver should seek professional advice to fully understand the potential consequences and ensure their financial plans align with their overall retirement goals and the well-being of their spouse.

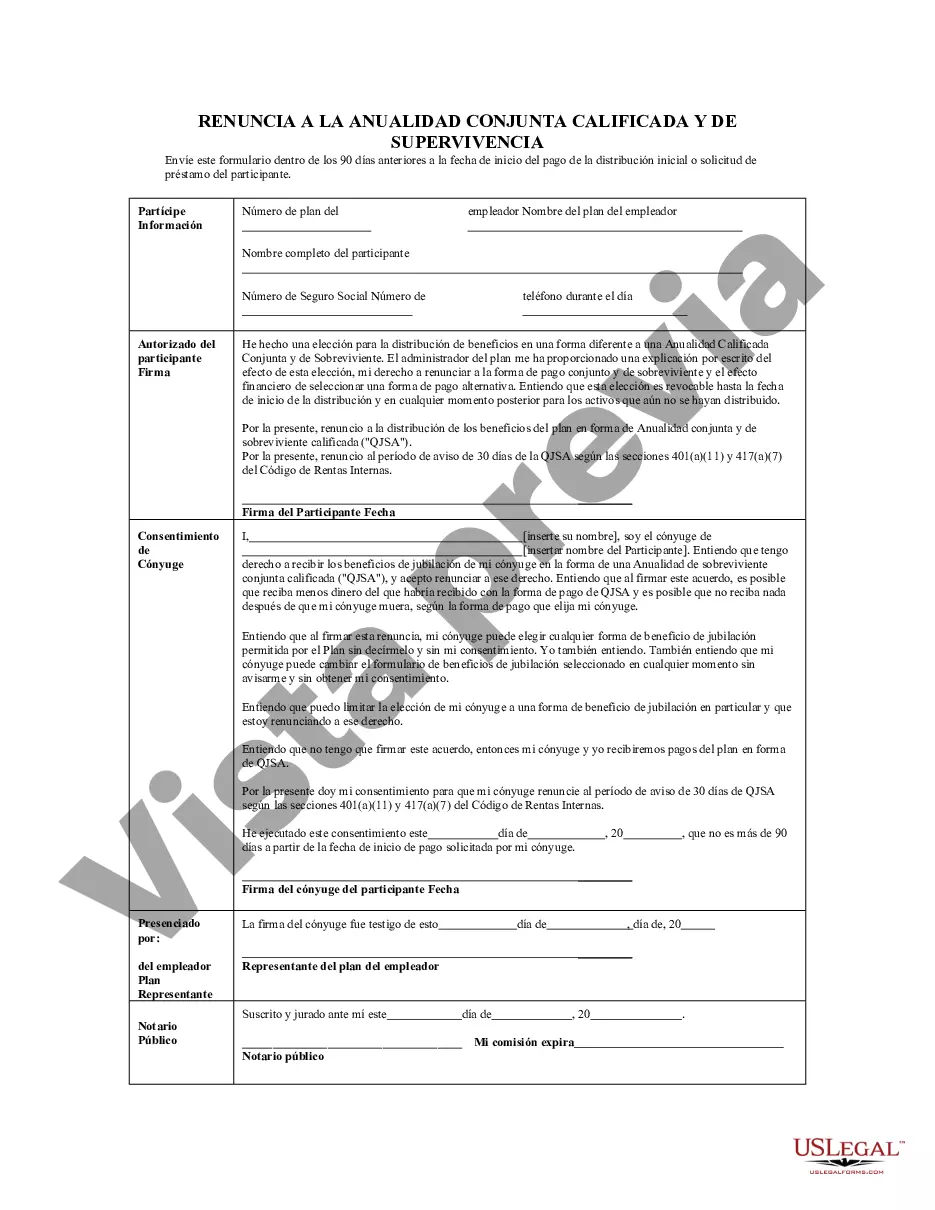

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hawaii Renuncia a la anualidad conjunta y de sobreviviente calificada - QJSA - Waiver of Qualified Joint and Survivor Annuity - QJSA

Description

How to fill out Hawaii Renuncia A La Anualidad Conjunta Y De Sobreviviente Calificada - QJSA?

Finding the right legal papers template might be a have a problem. Of course, there are tons of themes available on the net, but how will you discover the legal kind you need? Make use of the US Legal Forms site. The support offers thousands of themes, for example the Hawaii Waiver of Qualified Joint and Survivor Annuity - QJSA, which can be used for organization and personal needs. All of the forms are checked out by pros and meet state and federal specifications.

When you are currently listed, log in to the account and click on the Download option to have the Hawaii Waiver of Qualified Joint and Survivor Annuity - QJSA. Utilize your account to look with the legal forms you have acquired previously. Proceed to the My Forms tab of the account and get an additional duplicate of your papers you need.

When you are a new customer of US Legal Forms, allow me to share easy guidelines so that you can stick to:

- First, be sure you have selected the appropriate kind to your city/region. You can examine the form using the Review option and read the form explanation to make sure this is basically the best for you.

- When the kind does not meet your expectations, use the Seach area to get the correct kind.

- When you are certain that the form is proper, click on the Buy now option to have the kind.

- Select the rates program you would like and enter in the essential information. Build your account and buy the order utilizing your PayPal account or bank card.

- Pick the submit file format and obtain the legal papers template to the product.

- Full, revise and produce and indication the attained Hawaii Waiver of Qualified Joint and Survivor Annuity - QJSA.

US Legal Forms is the greatest catalogue of legal forms in which you can find numerous papers themes. Make use of the service to obtain skillfully-created paperwork that stick to state specifications.