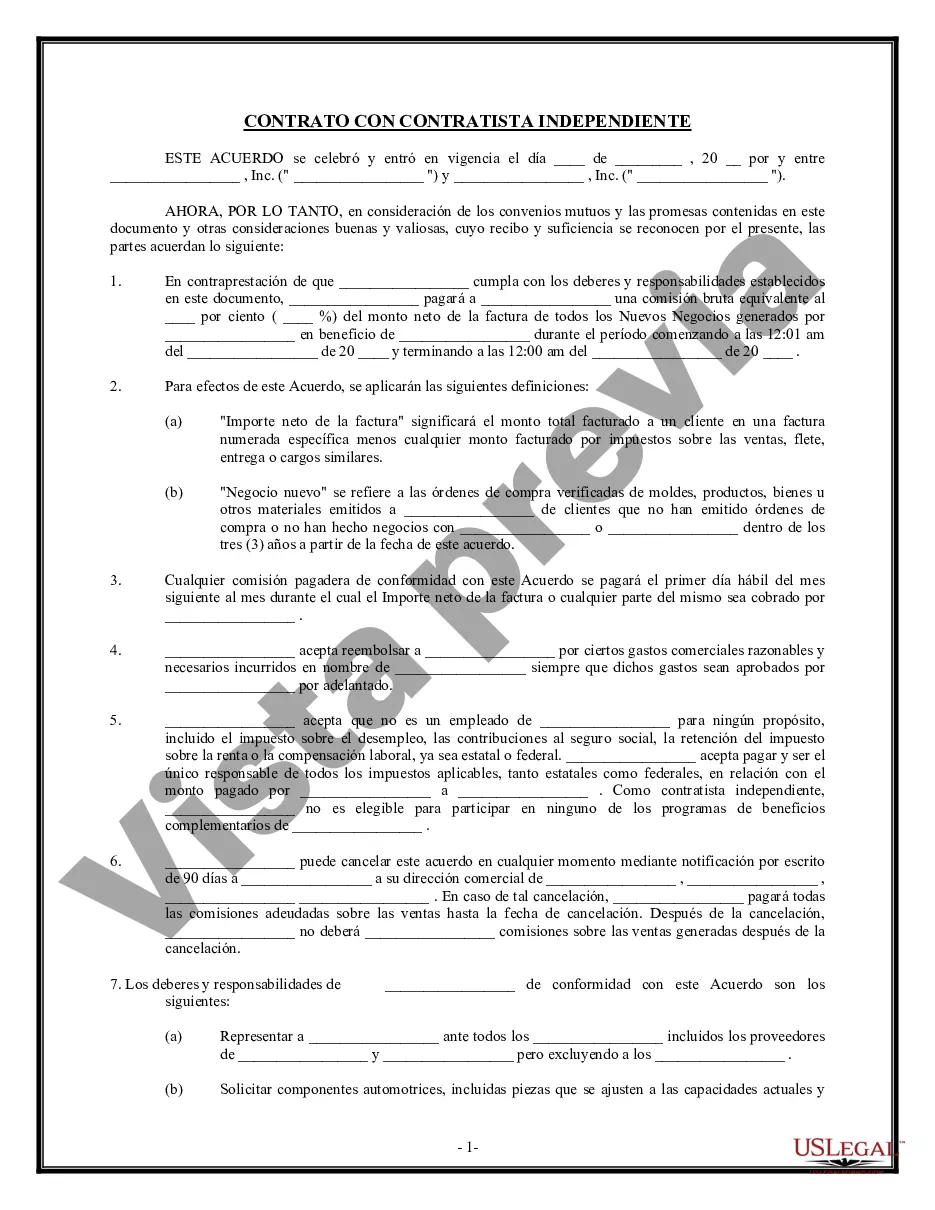

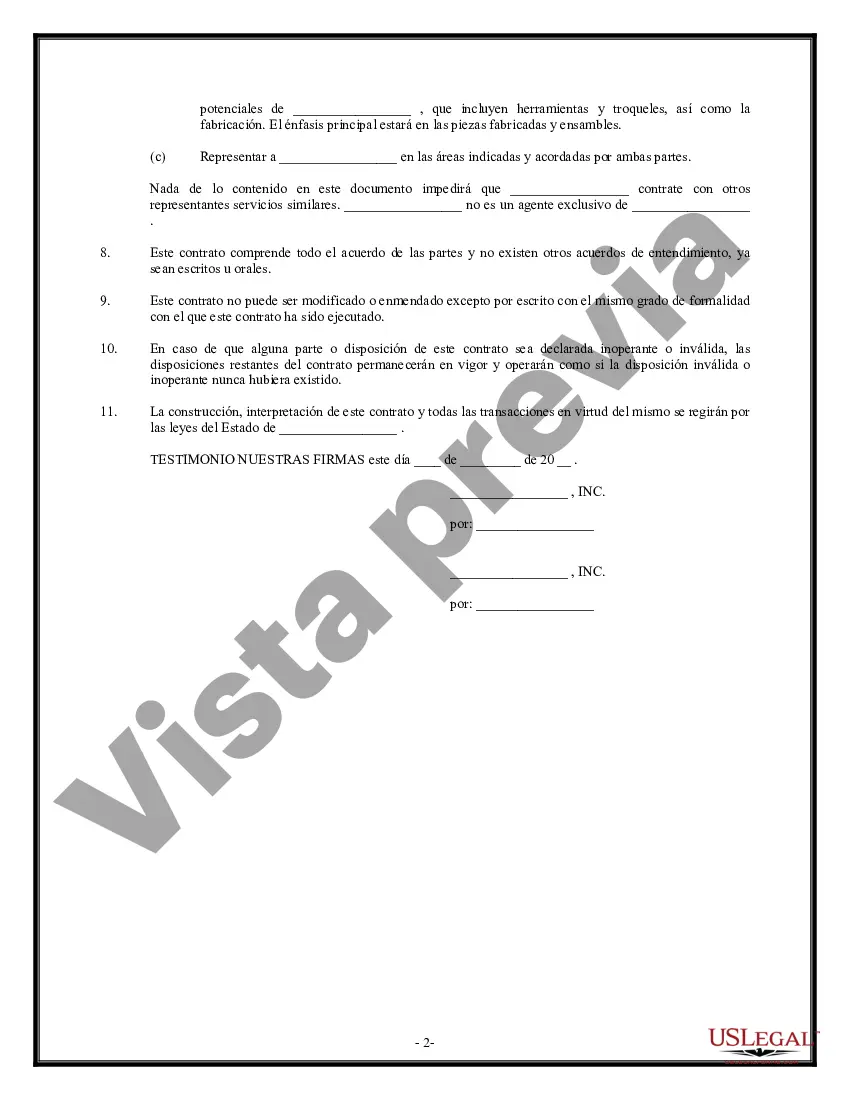

The Hawaii Self-Employed Independent Contractor Employment Agreement is a legally binding contract established between a business and an individual offering their services as an independent contractor. This agreement specifies the terms and conditions under which the contractor will provide services to the business and receive commissions for generating new business. Keywords: Hawaii, self-employed, independent contractor, employment agreement, commission, new business. In Hawaii, there are several types of Self-Employed Independent Contractor Employment Agreements that can be specific to different industries or professions. Some of these variations may include: 1. Real Estate Independent Contractor Agreement: This agreement is designed for independent contractors operating in the real estate sector, such as real estate agents or brokers. It outlines the commission structure and expectations regarding generating new business for the agency or brokerage. 2. Sales Independent Contractor Agreement: This type of agreement is commonly used in sales-driven industries to formalize the relationship between a salesperson or sales representative and the company they work for. The agreement specifies the commission structure based on sales targets and new business generated. 3. Marketing Independent Contractor Agreement: For marketing professionals or agencies offering their services as independent contractors, this agreement outlines the terms and conditions related to generating new business through marketing campaigns and activities. The commission structure is typically based on the success of these efforts. 4. Consulting Independent Contractor Agreement: This type of agreement applies to independent consultants or professionals offering specialized expertise or services to businesses. The agreement details the commission structure for any new business brought in by the contractor, typically based on a percentage of the project or contract value. Regardless of the specific type of Self-Employed Independent Contractor Employment Agreement, it is crucial to include key terms and provisions, such as the scope of work, payment terms, confidentiality clauses, intellectual property rights, termination procedures, and dispute resolution mechanisms. It is highly recommended that both parties seek legal advice to ensure compliance with the relevant laws and regulations in Hawaii.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hawaii Acuerdo de empleo de contratista independiente para trabajadores por cuenta propia: comisión por nuevos negocios - Self-Employed Independent Contractor Employment Agreement - commission for new business

Description

How to fill out Hawaii Acuerdo De Empleo De Contratista Independiente Para Trabajadores Por Cuenta Propia: Comisión Por Nuevos Negocios?

Finding the right lawful file design can be quite a have difficulties. Naturally, there are a variety of themes available on the Internet, but how can you get the lawful kind you need? Take advantage of the US Legal Forms internet site. The services gives 1000s of themes, including the Hawaii Self-Employed Independent Contractor Employment Agreement - commission for new business, that can be used for organization and private requirements. All the types are checked by pros and meet federal and state requirements.

In case you are previously signed up, log in to your account and click the Acquire button to obtain the Hawaii Self-Employed Independent Contractor Employment Agreement - commission for new business. Make use of your account to appear through the lawful types you have ordered formerly. Check out the My Forms tab of your own account and have an additional copy of your file you need.

In case you are a brand new customer of US Legal Forms, allow me to share basic guidelines that you should comply with:

- Very first, be sure you have selected the appropriate kind for your city/state. You are able to look through the form while using Preview button and look at the form outline to make sure it will be the right one for you.

- In the event the kind does not meet your needs, take advantage of the Seach field to find the correct kind.

- When you are certain that the form is proper, select the Buy now button to obtain the kind.

- Opt for the pricing strategy you desire and enter the needed information and facts. Create your account and purchase an order with your PayPal account or bank card.

- Choose the document formatting and download the lawful file design to your gadget.

- Total, edit and printing and sign the received Hawaii Self-Employed Independent Contractor Employment Agreement - commission for new business.

US Legal Forms may be the most significant collection of lawful types in which you will find a variety of file themes. Take advantage of the service to download professionally-created papers that comply with condition requirements.