Hawaii Sample Mortgage Loan Purchase Agreement Title: Understanding the Hawaii Sample Mortgage Loan Purchase Agreement between Credit Suisse First Boston Mortgage Securities Corp. and Credit Suisse First Boston Mortgage Capital, LLC Introduction: The Hawaii Sample Mortgage Loan Purchase Agreement is a legally binding document that outlines the terms and conditions governing the purchase and sale of mortgage loans between Credit Suisse First Boston Mortgage Securities Corp. (CFB Mortgage Securities) and Credit Suisse First Boston Mortgage Capital, LLC (CFB Mortgage Capital). This agreement serves as a crucial framework for mortgage loan transactions in Hawaii, ensuring a smooth transfer of assets and safeguarding the interests of the involved parties. Keywords: Hawaii, Mortgage Loan Purchase Agreement, Credit Suisse First Boston Mortgage Securities Corp., Credit Suisse First Boston Mortgage Capital, LLC 1. Purpose of the Agreement: The Hawaii Sample Mortgage Loan Purchase Agreement establishes the foundation for a systematic and secure process of buying and selling mortgage loans in Hawaii. It defines the responsibilities, rights, and obligations of CFB Mortgage Securities and CFB Mortgage Capital, ensuring a transparent and lawful transaction. 2. Parties Involved: The agreement is between two prominent entities, Credit Suisse First Boston Mortgage Securities Corp. and Credit Suisse First Boston Mortgage Capital, LLC, both recognized industry players in mortgage financing. The agreement details their respective roles and responsibilities throughout the purchase process. 3. Mortgage Loan Purchase Process: The Hawaii Sample Mortgage Loan Purchase Agreement outlines a step-by-step procedure for the purchase and transfer of mortgage loans. It covers important aspects such as loan selection, due diligence, purchase price determination, delivery of loan documents, and record-keeping requirements, ensuring a smooth flow of transactions. 4. Loan Representations and Warranties: To protect the interests of both parties, the agreement includes a section on loan representations and warranties. It specifies the quality and condition of the mortgage loans being purchased, ensuring they meet certain criteria and are free from any defects or misrepresentations. 5. Indemnification and Remedies: The agreement also includes provisions for indemnification and remedies, protecting the parties against any losses, damages, or liabilities arising from breaches of the agreement. It sets out the remedies available in case of default or non-compliance, allowing either party to seek redress through actions such as repurchase or substitution of non-conforming loans. Types of Hawaii Sample Mortgage Loan Purchase Agreement: 1. Conforming Loan Purchase Agreement: This agreement pertains to the purchase and sale of conforming mortgage loans that meet specific criteria set by government-sponsored enterprises (Uses) such as Fannie Mae and Freddie Mac. 2. Non-Conforming Loan Purchase Agreement: In contrast to the conforming loan agreement, this type of agreement covers the purchase and sale of non-conforming mortgage loans that do not meet the Uses' guidelines. These loans often have higher loan amounts or unique features tailored to specific borrower needs. Conclusion: The Hawaii Sample Mortgage Loan Purchase Agreement between Credit Suisse First Boston Mortgage Securities Corp. and Credit Suisse First Boston Mortgage Capital, LLC lays the groundwork for a secure and efficient process of buying and selling mortgage loans. It ensures compliance with regulations, protects the interests of both parties, and facilitates the smooth transfer of assets. By adhering to this agreement, the mortgage industry in Hawaii can operate with transparency, efficiency, and integrity.

Hawaii Sample Mortgage Loan Purchase Agreement between Credit Suisse First Boston Mortgage Securities Corp. and Credit Suisse First Boston Mortgage Capital, LLC

Description

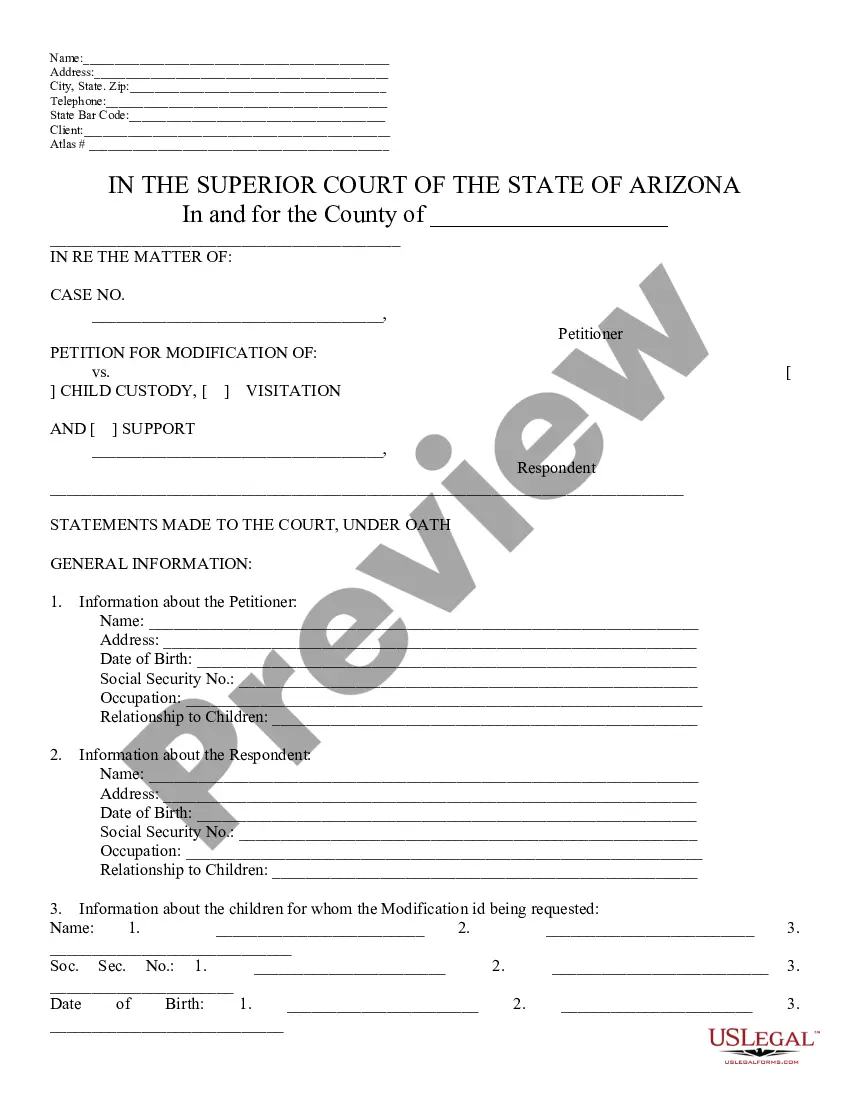

How to fill out Hawaii Sample Mortgage Loan Purchase Agreement Between Credit Suisse First Boston Mortgage Securities Corp. And Credit Suisse First Boston Mortgage Capital, LLC?

If you want to full, acquire, or print out legitimate record templates, use US Legal Forms, the most important collection of legitimate kinds, which can be found on the Internet. Make use of the site`s simple and easy hassle-free search to find the papers you will need. A variety of templates for company and individual purposes are categorized by groups and states, or key phrases. Use US Legal Forms to find the Hawaii Sample Mortgage Loan Purchase Agreement between Credit Suisse First Boston Mortgage Securities Corp. and Credit Suisse First Boston Mortgage Capital, LLC in just a couple of mouse clicks.

Should you be currently a US Legal Forms customer, log in to the account and click the Download option to obtain the Hawaii Sample Mortgage Loan Purchase Agreement between Credit Suisse First Boston Mortgage Securities Corp. and Credit Suisse First Boston Mortgage Capital, LLC. You can also accessibility kinds you previously saved within the My Forms tab of your account.

If you work with US Legal Forms the first time, refer to the instructions below:

- Step 1. Make sure you have selected the form for the proper town/country.

- Step 2. Use the Preview option to check out the form`s content material. Never overlook to learn the description.

- Step 3. Should you be not satisfied together with the kind, take advantage of the Look for industry on top of the display to get other models of the legitimate kind web template.

- Step 4. After you have discovered the form you will need, click on the Buy now option. Opt for the rates prepare you prefer and include your accreditations to sign up on an account.

- Step 5. Method the deal. You can use your Мisa or Ьastercard or PayPal account to complete the deal.

- Step 6. Choose the file format of the legitimate kind and acquire it on the product.

- Step 7. Comprehensive, change and print out or signal the Hawaii Sample Mortgage Loan Purchase Agreement between Credit Suisse First Boston Mortgage Securities Corp. and Credit Suisse First Boston Mortgage Capital, LLC.

Every legitimate record web template you buy is the one you have forever. You possess acces to each kind you saved in your acccount. Select the My Forms section and choose a kind to print out or acquire once again.

Compete and acquire, and print out the Hawaii Sample Mortgage Loan Purchase Agreement between Credit Suisse First Boston Mortgage Securities Corp. and Credit Suisse First Boston Mortgage Capital, LLC with US Legal Forms. There are many skilled and condition-specific kinds you may use to your company or individual requirements.