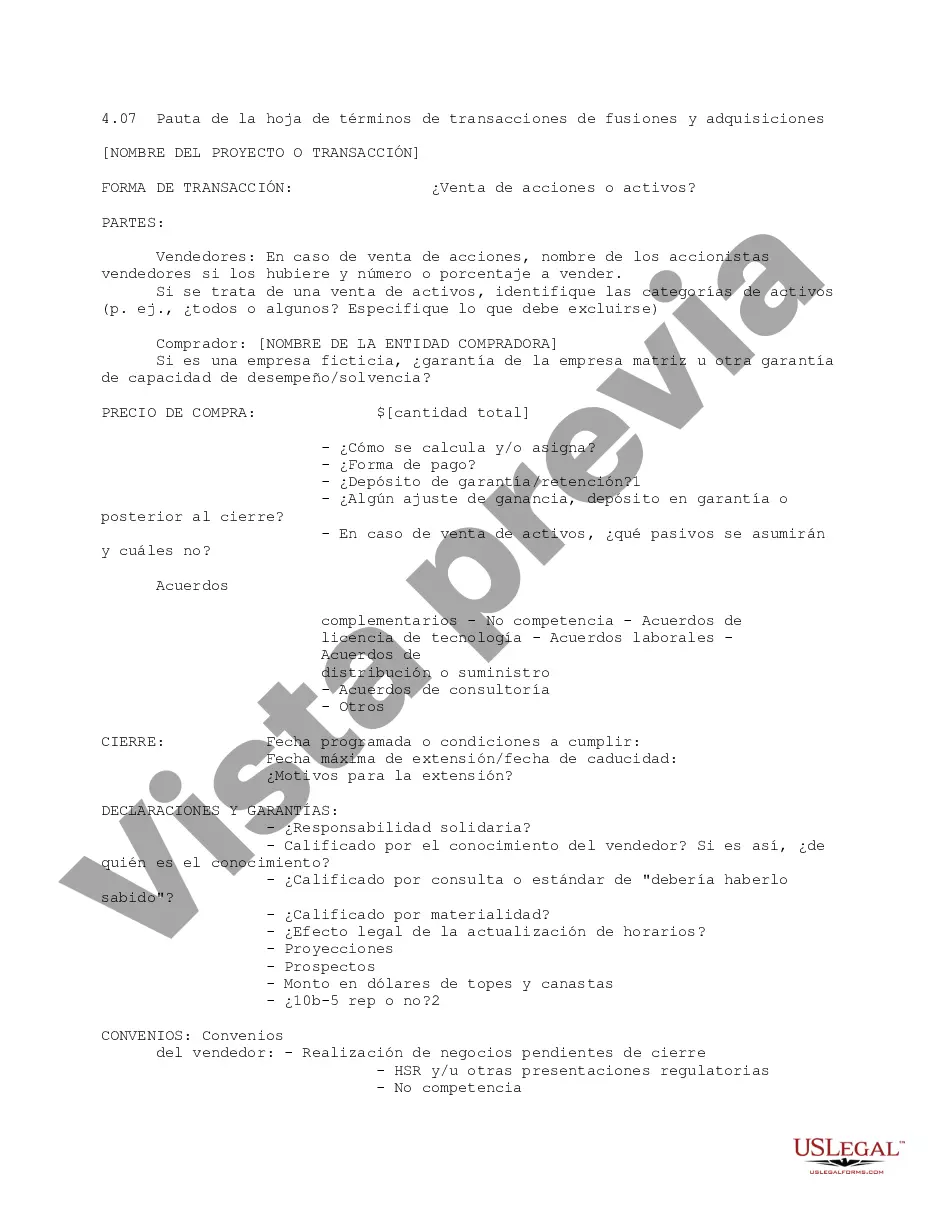

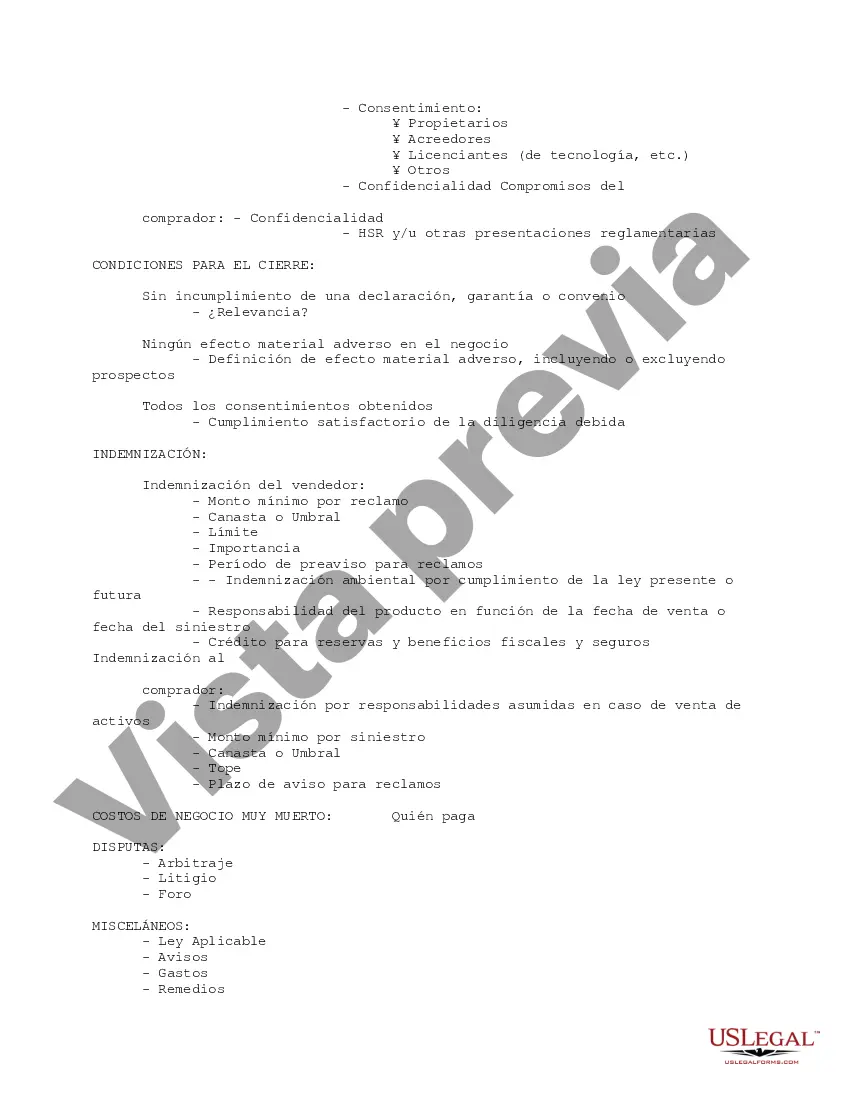

This is a checklist of considerations for a mergers and acquisitions transaction term sheet. It is a point-by-point reminder to consider whether it is a stock or asset sale, points on closing and warranties, covenants, indemnification, and other areas.

Title: Comprehensive Guide to Hawaii M&A Transaction Term Sheet Guidelines Introduction: In the world of business, mergers and acquisitions (M&A) play a crucial role in enhancing growth, expanding market presence, and increasing profitability. For any successful M&A transaction in Hawaii, organizations need to familiarize themselves with the M&A transaction term sheet guidelines. This guide aims to delve into the specifics of Hawaii M&A Transaction Term Sheet Guidelines, providing a detailed description of its importance, content, and key elements. Key Elements of Hawaii M&A Transaction Term Sheet Guidelines: 1. Legal and Financial Framework: — Ensuring compliance with Hawaii state laws and regulations. — Establishing the contractual basis for the transaction, including confidentiality agreements, exclusivity clauses, and dispute resolution mechanisms. — Specifying the financial aspects of the deal such as purchase price, payment terms, and any contingent payments or earn-outs. 2. Transaction Structure and Timing: — Defining the preferred deal structure, be it a share purchase, asset acquisition, or merger. — Identifying the desired timeline for the transaction, including key milestones, due diligence process, and closing date. 3. Governance and Management: — Addressing leadership and management structure in the post-transaction entity, including executives, board composition, and decision-making mechanisms. — Defining shareholder rights, obligations, and potential restrictions on share transfers. 4. Assets and Liabilities: — Outlining the assets and liabilities to be included in the transaction, distinguishing between tangible and intangible assets, intellectual property, leases, contracts, and debts. — Identifying any specific assets or liabilities subject to exclusions, adjustments, or warranties. 5. Conditions Precedent and Regulatory Approvals: — Listing any conditions that must be met before the transaction can proceed, such as financing contingencies, regulatory approvals, or third-party consents. — Determining which party is responsible for fulfilling these conditions and ensuring their timely completion. Types of Hawaii M&A Transaction Term Sheet Guidelines: 1. Stock Purchase Agreement Term Sheet: This type of term sheet outlines the key components and considerations specific to the acquisition of shares in a target company. 2. Asset Purchase Agreement Term Sheet: Focused on the acquisition of specific assets or business divisions rather than the whole company, this term sheet addresses asset valuation, transfer, and liabilities. 3. Merger Agreement Term Sheet: In mergers, this term sheet highlights the integration of two companies, setting out the terms governing the resulting entity, including share exchange ratios and governance structure. Conclusion: Hawaii's M&A Transaction Term Sheet Guidelines provide a vital framework for executing successful M&A deals in the state. By considering the legal, financial, and operational aspects of the transaction, these guidelines ensure transparency, mitigate risks, and facilitate a smooth transition for the involved parties. Understanding the key elements and different types of term sheet guidelines is essential for all businesses contemplating M&A transactions in Hawaii.Title: Comprehensive Guide to Hawaii M&A Transaction Term Sheet Guidelines Introduction: In the world of business, mergers and acquisitions (M&A) play a crucial role in enhancing growth, expanding market presence, and increasing profitability. For any successful M&A transaction in Hawaii, organizations need to familiarize themselves with the M&A transaction term sheet guidelines. This guide aims to delve into the specifics of Hawaii M&A Transaction Term Sheet Guidelines, providing a detailed description of its importance, content, and key elements. Key Elements of Hawaii M&A Transaction Term Sheet Guidelines: 1. Legal and Financial Framework: — Ensuring compliance with Hawaii state laws and regulations. — Establishing the contractual basis for the transaction, including confidentiality agreements, exclusivity clauses, and dispute resolution mechanisms. — Specifying the financial aspects of the deal such as purchase price, payment terms, and any contingent payments or earn-outs. 2. Transaction Structure and Timing: — Defining the preferred deal structure, be it a share purchase, asset acquisition, or merger. — Identifying the desired timeline for the transaction, including key milestones, due diligence process, and closing date. 3. Governance and Management: — Addressing leadership and management structure in the post-transaction entity, including executives, board composition, and decision-making mechanisms. — Defining shareholder rights, obligations, and potential restrictions on share transfers. 4. Assets and Liabilities: — Outlining the assets and liabilities to be included in the transaction, distinguishing between tangible and intangible assets, intellectual property, leases, contracts, and debts. — Identifying any specific assets or liabilities subject to exclusions, adjustments, or warranties. 5. Conditions Precedent and Regulatory Approvals: — Listing any conditions that must be met before the transaction can proceed, such as financing contingencies, regulatory approvals, or third-party consents. — Determining which party is responsible for fulfilling these conditions and ensuring their timely completion. Types of Hawaii M&A Transaction Term Sheet Guidelines: 1. Stock Purchase Agreement Term Sheet: This type of term sheet outlines the key components and considerations specific to the acquisition of shares in a target company. 2. Asset Purchase Agreement Term Sheet: Focused on the acquisition of specific assets or business divisions rather than the whole company, this term sheet addresses asset valuation, transfer, and liabilities. 3. Merger Agreement Term Sheet: In mergers, this term sheet highlights the integration of two companies, setting out the terms governing the resulting entity, including share exchange ratios and governance structure. Conclusion: Hawaii's M&A Transaction Term Sheet Guidelines provide a vital framework for executing successful M&A deals in the state. By considering the legal, financial, and operational aspects of the transaction, these guidelines ensure transparency, mitigate risks, and facilitate a smooth transition for the involved parties. Understanding the key elements and different types of term sheet guidelines is essential for all businesses contemplating M&A transactions in Hawaii.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.