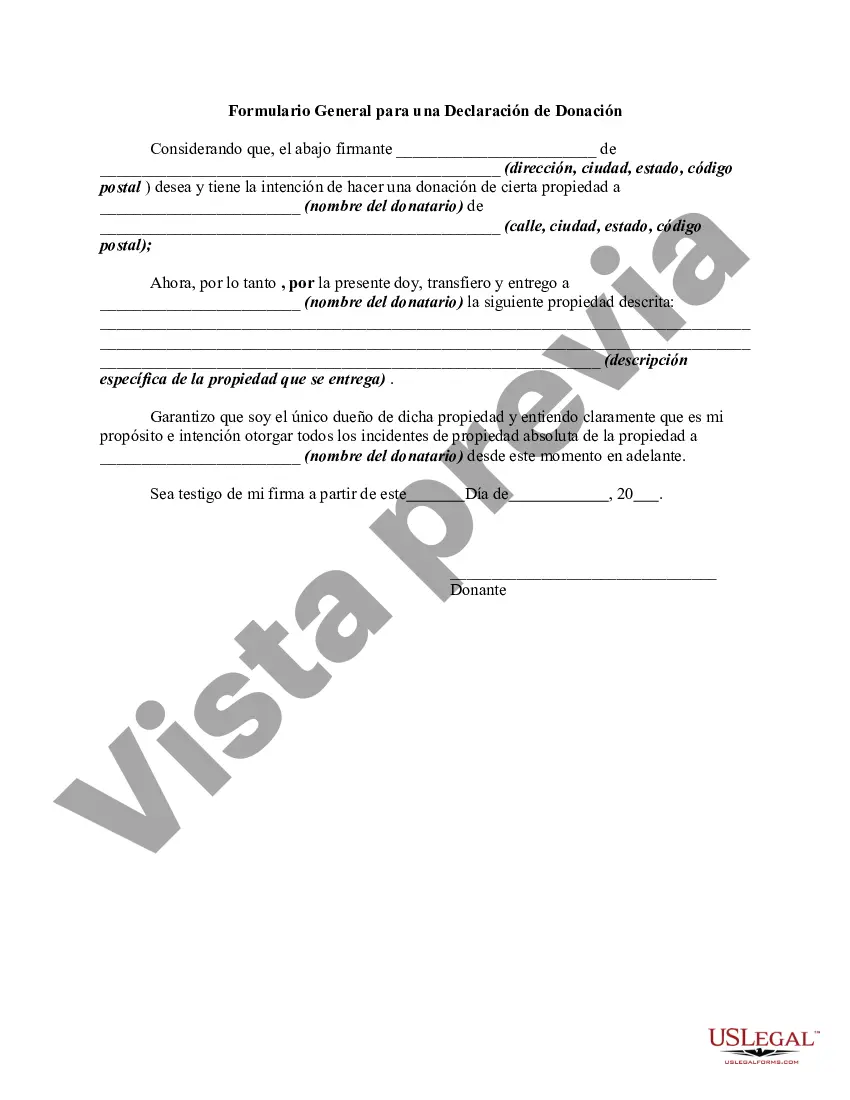

The following form is a general form for a declaration of a gift of property.

The Iowa Declaration of Gift is a legally binding document that allows individuals to make voluntary transfers of their property or assets without any consideration or compensation in return. It serves as an important tool in estate planning and is governed by specific laws and regulations in the state of Iowa. The key purpose of the Iowa Declaration of Gift is to ensure that an individual's intention to make a gift is clearly stated and legally recognized. It provides a framework for individuals to donate or give away their property to another person or entity while remaining fully aware of the consequences and implications of their actions. One type of Iowa Declaration of Gift is the inter vivos gift, which refers to a gift made during the donor's lifetime. This can include various types of property such as real estate, vehicles, cash, or securities. The Declaration of Gift outlines the specifics of the transfer, including the identity of the donor and recipient, a detailed description of the property being gifted, and any conditions or restrictions attached to the gift. Another type of Iowa Declaration of Gift is a testamentary gift, which is made through a person's will and takes effect after their death. This type of gift allows individuals to designate specific assets or property to be transferred to designated beneficiaries upon their passing. It is essential to ensure that the Declaration of Gift within a person's will is properly executed, witnessed, and meets all legal requirements for validity. The Iowa Declaration of Gift is a crucial legal document that helps protect the interests of both the donor and the recipient. It provides clarity and transparency in the gift-giving process, ensuring that the intentions of the donor are upheld and legally enforced. Individuals using the Declaration of Gift should consult with an attorney or legal professional to ensure compliance with Iowa state laws and regulations. In summary, the Iowa Declaration of Gift allows individuals to make voluntary transfers of their assets or property without any consideration in return. It includes various types, such as inter vivos gifts made during the donor's lifetime and testamentary gifts designated in a person's will. It is important to approach the creation and execution of this document with legal guidance to ensure compliance with the applicable laws and to protect the interests of all parties involved.The Iowa Declaration of Gift is a legally binding document that allows individuals to make voluntary transfers of their property or assets without any consideration or compensation in return. It serves as an important tool in estate planning and is governed by specific laws and regulations in the state of Iowa. The key purpose of the Iowa Declaration of Gift is to ensure that an individual's intention to make a gift is clearly stated and legally recognized. It provides a framework for individuals to donate or give away their property to another person or entity while remaining fully aware of the consequences and implications of their actions. One type of Iowa Declaration of Gift is the inter vivos gift, which refers to a gift made during the donor's lifetime. This can include various types of property such as real estate, vehicles, cash, or securities. The Declaration of Gift outlines the specifics of the transfer, including the identity of the donor and recipient, a detailed description of the property being gifted, and any conditions or restrictions attached to the gift. Another type of Iowa Declaration of Gift is a testamentary gift, which is made through a person's will and takes effect after their death. This type of gift allows individuals to designate specific assets or property to be transferred to designated beneficiaries upon their passing. It is essential to ensure that the Declaration of Gift within a person's will is properly executed, witnessed, and meets all legal requirements for validity. The Iowa Declaration of Gift is a crucial legal document that helps protect the interests of both the donor and the recipient. It provides clarity and transparency in the gift-giving process, ensuring that the intentions of the donor are upheld and legally enforced. Individuals using the Declaration of Gift should consult with an attorney or legal professional to ensure compliance with Iowa state laws and regulations. In summary, the Iowa Declaration of Gift allows individuals to make voluntary transfers of their assets or property without any consideration in return. It includes various types, such as inter vivos gifts made during the donor's lifetime and testamentary gifts designated in a person's will. It is important to approach the creation and execution of this document with legal guidance to ensure compliance with the applicable laws and to protect the interests of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.