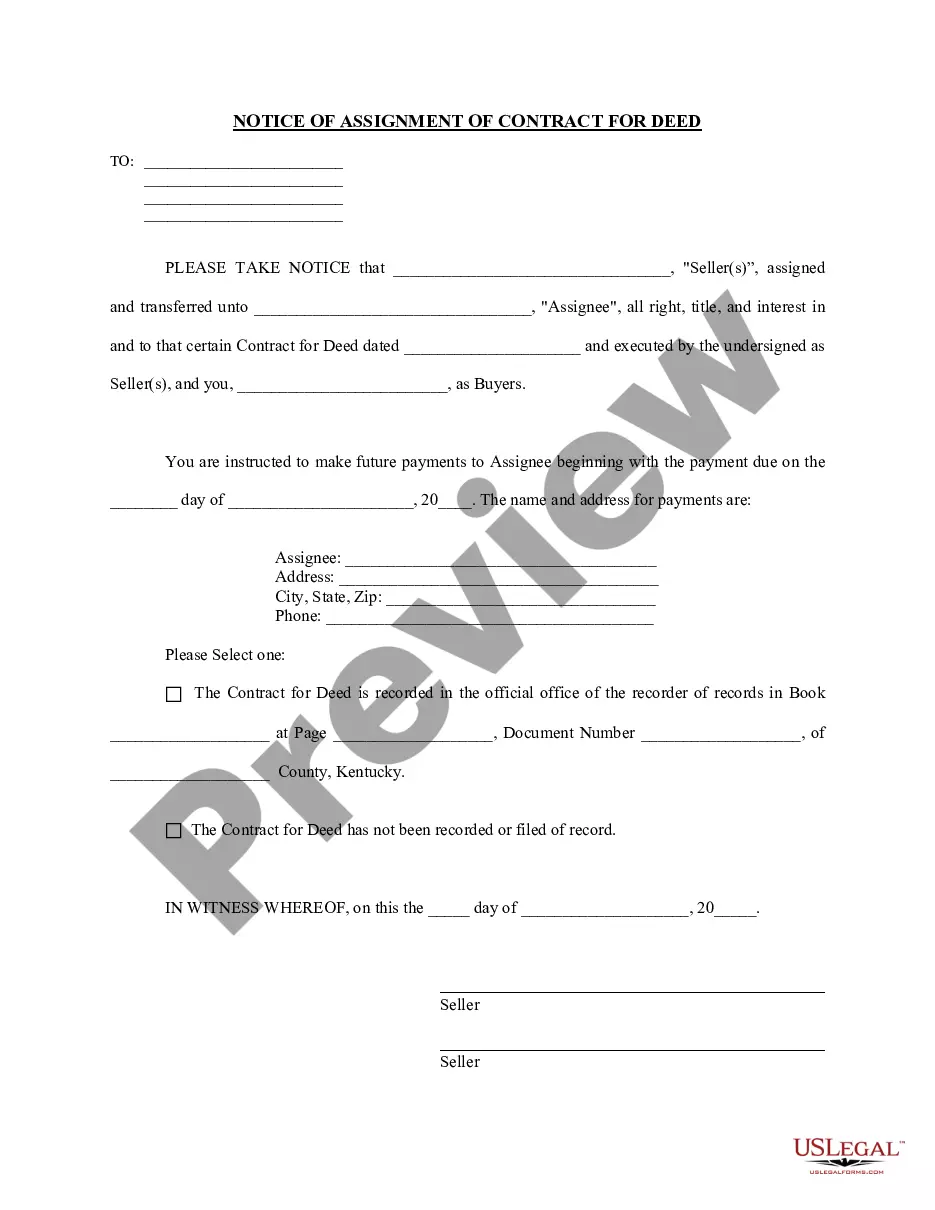

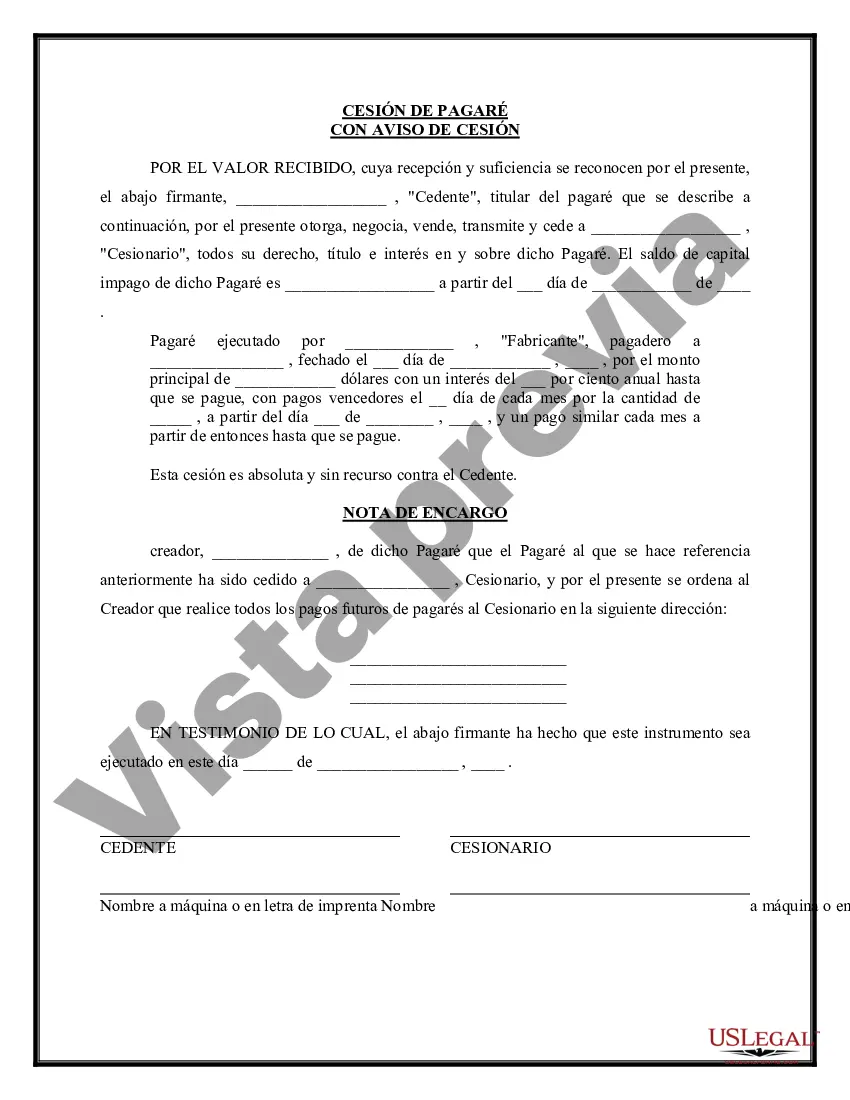

In Iowa, a Promissory Note Assignment and Notice of Assignment refer to the legal documentation involved in transferring the rights and ownership of a promissory note from one party to another. This process allows the original lender (assignor) to assign their rights and interest in the promissory note to a third party (assignee). The Notice of Assignment serves as a notification to the debtor (the borrower) about the change in ownership and the new party to whom the outstanding debt is owed. The Iowa Promissory Note Assignment is a crucial legal instrument utilized when the original lender wishes to transfer their interest in a promissory note to another entity. This assignment involves a written agreement between the assignor and assignee, whereby the assignor officially transfers all rights, title, and interest in the promissory note to the assignee. The Promissory Note Assignment specifies the terms and conditions of the assignment, outlines any obligations, and highlights the rights and responsibilities of both parties involved in the transfer. This document is typically recorded and filed with the appropriate county office to ensure its validity and enforceability. The Notice of Assignment, on the other hand, is a written communication that informs the borrower about the assignment of their promissory note to a new entity. This notice serves as an acknowledgment of the change in ownership and establishes the new party as the creditor to whom the borrower is required to fulfill their obligations. The Notice of Assignment is sent by the assignee to the debtor, clearly stating the details of the assignment, including the effective date, assigned amount, contact information, and any updated payment instructions. It is important to note that there may be variations in the types of Iowa Promissory Note Assignment and Notice of Assignment depending on the specific circumstances and the entities involved. For instance, assignments can be made to individuals, corporations, or other financial institutions. Additionally, there may be different forms or formats for the assignment and notice based on the specific requirements established by the lender, assignor, or assignee. In summary, the Iowa Promissory Note Assignment is a legal agreement utilized to transfer ownership of a promissory note, while the Notice of Assignment acts as a formal communication notifying the borrower about the change in ownership. These documents play a significant role in ensuring the proper assignment of rights and responsibilities, and they protect the interests of all parties involved in the transaction.

In Iowa, a Promissory Note Assignment and Notice of Assignment refer to the legal documentation involved in transferring the rights and ownership of a promissory note from one party to another. This process allows the original lender (assignor) to assign their rights and interest in the promissory note to a third party (assignee). The Notice of Assignment serves as a notification to the debtor (the borrower) about the change in ownership and the new party to whom the outstanding debt is owed. The Iowa Promissory Note Assignment is a crucial legal instrument utilized when the original lender wishes to transfer their interest in a promissory note to another entity. This assignment involves a written agreement between the assignor and assignee, whereby the assignor officially transfers all rights, title, and interest in the promissory note to the assignee. The Promissory Note Assignment specifies the terms and conditions of the assignment, outlines any obligations, and highlights the rights and responsibilities of both parties involved in the transfer. This document is typically recorded and filed with the appropriate county office to ensure its validity and enforceability. The Notice of Assignment, on the other hand, is a written communication that informs the borrower about the assignment of their promissory note to a new entity. This notice serves as an acknowledgment of the change in ownership and establishes the new party as the creditor to whom the borrower is required to fulfill their obligations. The Notice of Assignment is sent by the assignee to the debtor, clearly stating the details of the assignment, including the effective date, assigned amount, contact information, and any updated payment instructions. It is important to note that there may be variations in the types of Iowa Promissory Note Assignment and Notice of Assignment depending on the specific circumstances and the entities involved. For instance, assignments can be made to individuals, corporations, or other financial institutions. Additionally, there may be different forms or formats for the assignment and notice based on the specific requirements established by the lender, assignor, or assignee. In summary, the Iowa Promissory Note Assignment is a legal agreement utilized to transfer ownership of a promissory note, while the Notice of Assignment acts as a formal communication notifying the borrower about the change in ownership. These documents play a significant role in ensuring the proper assignment of rights and responsibilities, and they protect the interests of all parties involved in the transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.