Iowa Employment Contract of Consultant with Nonprofit Corporation is a legal agreement outlining the terms and conditions of employment between a consultant and a nonprofit corporation based in Iowa. This contract is designed to protect the rights and obligations of both parties involved in the consulting arrangement. The Iowa Employment Contract of Consultant with Nonprofit Corporation typically consists of the following key components: 1. Parties: This section identifies the consultant and the nonprofit corporation, stating their legal names, addresses, and contact information. 2. Term: The contract specifies the duration of the consulting engagement, starting from the commencement date and ending on a specific date or upon completion of the agreed-upon services. 3. Services: The contract outlines the specific services the consultant will be providing to the nonprofit corporation. It includes a detailed description of the consultant's role, responsibilities, and objectives. 4. Compensation: This section details the financial terms of the consultant's employment. It includes the consultant's fee or hourly rate, payment schedule, reimbursement policies, and any applicable taxes or deductions. 5. Confidentiality and Non-Disclosure: To protect sensitive information, this section establishes confidentiality obligations on the consultant, such as not disclosing trade secrets, proprietary information, or any confidential data of the nonprofit corporation. 6. Intellectual Property: In cases where the consultant generates intellectual property during the engagement, this section specifies whether ownership rights belong to the consultant or the nonprofit corporation. 7. Termination: The contract defines the conditions under which the agreement can be terminated by either party, such as breaches of contract, non-performance, or completion of the services. Types of Iowa Employment Contracts of Consultant with Nonprofit Corporation may include: 1. General Consulting Contract: This type of contract is used for engaging consultants who provide a wide range of specialized services, such as strategic planning, financial consulting, marketing, or organizational development. 2. Project-based Contract: This contract is utilized when consultants are hired for specific projects or initiatives, like grant writing, program evaluation, fundraising campaigns, or event planning. 3. Long-term Contract: Nonprofit corporations may enter into long-term contracts with consultants for ongoing services, such as human resources management, legal advice, or IT consulting. 4. Non-compete Contract: If confidentiality and non-compete agreements are required, this type of contract may be used to protect the nonprofit corporation's interests in case the consultant establishes a competing business or works with a competitor. 5. Independent Contractor Agreement: In situations where the consultant is considered an independent contractor, an agreement is tailored to reflect their status, responsibilities, and tax-related considerations. It is essential for both the consultant and the nonprofit corporation to carefully review and understand all the terms and conditions outlined in the Iowa Employment Contract of Consultant with Nonprofit Corporation before signing. Legal guidance may be necessary to ensure compliance with Iowa employment laws and to address any specific requirements or provisions unique to the nonprofit sector.

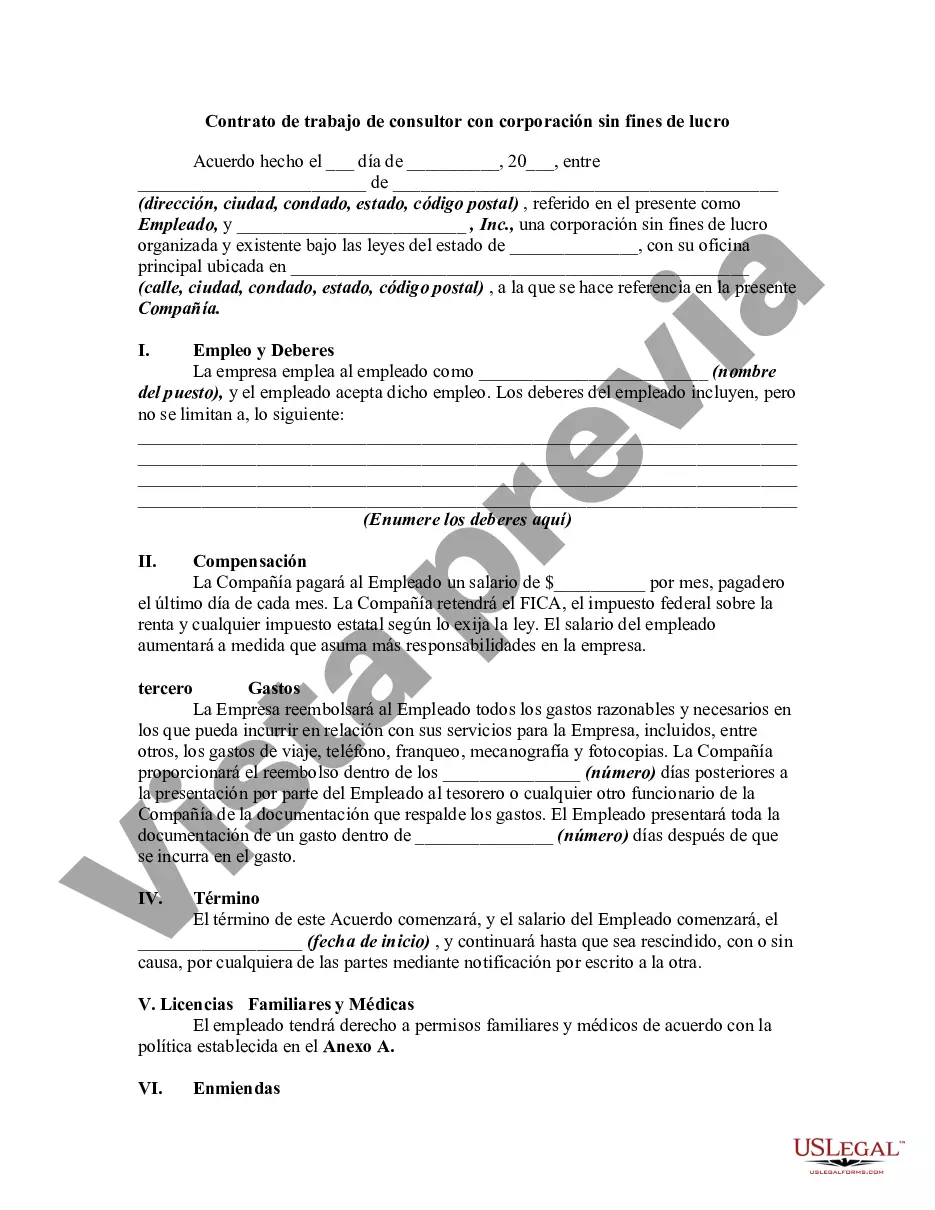

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Iowa Contrato de trabajo de consultor con corporación sin fines de lucro - Employment Contract of Consultant with Nonprofit Corporation

Description

How to fill out Iowa Contrato De Trabajo De Consultor Con Corporación Sin Fines De Lucro?

You may devote several hours online attempting to find the authorized file web template that fits the federal and state specifications you will need. US Legal Forms offers 1000s of authorized kinds that happen to be analyzed by professionals. It is simple to obtain or produce the Iowa Employment Contract of Consultant with Nonprofit Corporation from the services.

If you have a US Legal Forms bank account, you can log in and click the Acquire option. Next, you can comprehensive, change, produce, or signal the Iowa Employment Contract of Consultant with Nonprofit Corporation. Every authorized file web template you acquire is your own property for a long time. To get an additional duplicate for any acquired form, go to the My Forms tab and click the related option.

If you work with the US Legal Forms website for the first time, follow the basic recommendations below:

- Initially, be sure that you have selected the right file web template for your region/area of your liking. Browse the form description to make sure you have chosen the right form. If offered, make use of the Review option to search throughout the file web template as well.

- If you wish to discover an additional edition from the form, make use of the Look for area to discover the web template that fits your needs and specifications.

- Upon having discovered the web template you desire, just click Buy now to carry on.

- Find the pricing prepare you desire, type your credentials, and sign up for your account on US Legal Forms.

- Full the deal. You should use your Visa or Mastercard or PayPal bank account to purchase the authorized form.

- Find the structure from the file and obtain it to the gadget.

- Make modifications to the file if needed. You may comprehensive, change and signal and produce Iowa Employment Contract of Consultant with Nonprofit Corporation.

Acquire and produce 1000s of file layouts making use of the US Legal Forms site, that provides the most important selection of authorized kinds. Use expert and state-certain layouts to take on your small business or person needs.