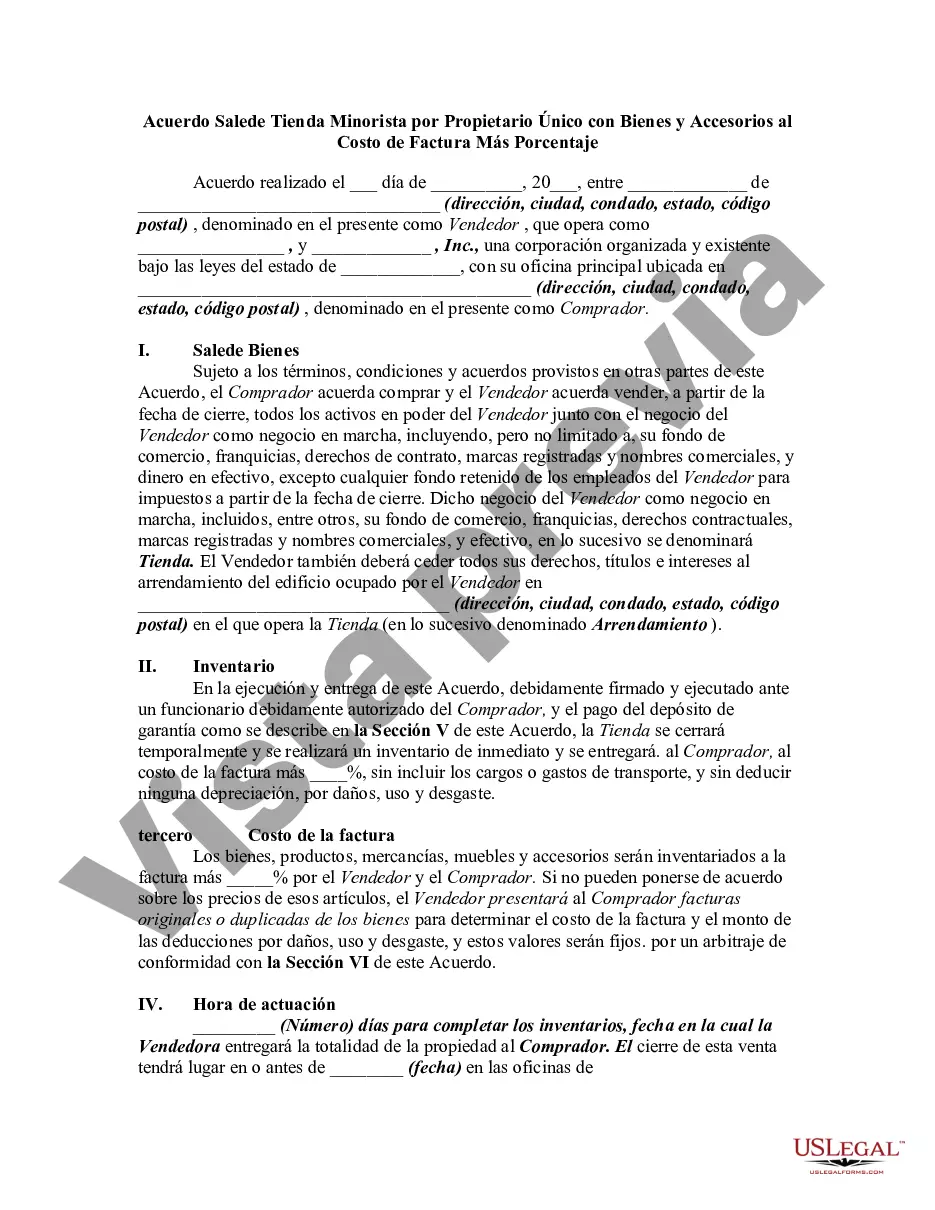

The Iowa Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage is a legal document that outlines the terms and conditions of selling a retail store by a sole proprietorship in the state of Iowa. This agreement involves the transfer of ownership of the store, including its inventory of goods and fixtures, at a price determined by the invoice cost of the items plus an additional percentage. When it comes to different types of Iowa Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage, there might be variations based on specific circumstances or additional clauses included. Some common variations include: 1. Iowa Agreement for Sale of Retail Store with Goods and Fixtures at Invoice Cost Plus Percentage and Lease Transfer: This type of agreement involves not only the sale of the retail store but also the transfer of an existing lease agreement for the premises. It outlines the terms for the assignment and assumption of the lease along with the sale of the store and its inventory. 2. Iowa Agreement for Sale of Retail Store with Inventory and Fixtures at Invoice Cost Plus Percentage: This variation focuses on the sale of a retail store, including its inventory of goods and fixtures, without considering additional factors like lease transfer or other special circumstances. 3. Iowa Agreement for Sale of Retail Store with Assets and Fixtures at Invoice Cost Plus Percentage: In this type of agreement, the sole proprietorship sells the retail store along with all its assets, including physical fixtures, equipment, furniture, and inventory, at a price determined by the invoice cost of these items along with the agreed-upon percentage. 4. Iowa Agreement for Sale of Retail Store Excluding Fixtures, with Goods at Invoice Cost Plus Percentage: This variation specifies that fixtures are not included in the sale, but only the goods or inventory of the retail store will be sold at the invoice cost plus an additional percentage. In summary, the Iowa Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage provides a legal framework for the sale of a retail store, outlining the terms, conditions, and price computation method. Different variations of this agreement may cater to specific circumstances such as lease transfer, asset inclusion, or exclusion of fixtures. It is crucial to consult a legal professional when drafting or executing such agreements to ensure compliance with Iowa state laws and to protect the interests of both the seller and buyer.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Iowa Acuerdo para la Venta de Tienda Minorista por Propietario Único con Bienes y Accesorios al Costo de Factura Más Porcentaje - Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage

Description

How to fill out Iowa Acuerdo Para La Venta De Tienda Minorista Por Propietario Único Con Bienes Y Accesorios Al Costo De Factura Más Porcentaje?

US Legal Forms - one of the biggest libraries of authorized forms in America - gives an array of authorized record web templates it is possible to download or printing. Utilizing the internet site, you can find 1000s of forms for enterprise and specific reasons, sorted by groups, claims, or search phrases.You can get the most up-to-date versions of forms like the Iowa Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage in seconds.

If you have a membership, log in and download Iowa Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage from your US Legal Forms collection. The Obtain key will show up on every single develop you perspective. You have access to all earlier delivered electronically forms in the My Forms tab of your respective accounts.

If you wish to use US Legal Forms the first time, listed here are easy directions to obtain began:

- Be sure to have picked the best develop for the town/region. Select the Preview key to review the form`s information. Read the develop information to ensure that you have chosen the proper develop.

- When the develop does not match your specifications, make use of the Lookup discipline near the top of the display to find the one who does.

- Should you be pleased with the shape, affirm your option by visiting the Buy now key. Then, choose the costs program you favor and offer your credentials to register to have an accounts.

- Process the purchase. Make use of your credit card or PayPal accounts to accomplish the purchase.

- Select the formatting and download the shape on your system.

- Make modifications. Load, edit and printing and indication the delivered electronically Iowa Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage.

Every web template you put into your money does not have an expiration day and is the one you have forever. So, if you want to download or printing one more version, just visit the My Forms segment and click on around the develop you require.

Gain access to the Iowa Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage with US Legal Forms, the most considerable collection of authorized record web templates. Use 1000s of expert and status-certain web templates that meet your small business or specific demands and specifications.