A triple net lease (NNN lease) is a type of lease agreement commonly used in commercial real estate transactions. In Iowa, the triple net lease allows the landlord to transfer a significant portion of the financial responsibilities associated with owning and maintaining the property to the tenant. This arrangement shifts the burden of property taxes, property insurance, and maintenance costs onto the tenant, in addition to the base rent payment. The Iowa triple net lease for commercial real estate is highly beneficial for landlords, as it ensures a steady rental income while avoiding additional expenses. On the other hand, tenants should carefully consider the financial implications before entering into such an agreement, as they might encounter higher costs compared to a standard lease. It's worth noting that there are different types of Iowa triple net leases for commercial real estate, each with its own unique considerations: 1. Single Net Lease: This lease type places the responsibility of property taxes on the tenant, while the landlord retains responsibility for property insurance and maintenance. It grants the tenant some level of financial burden reduction while still sharing some expenses with the landlord. 2. Double Net Lease: A double net lease expands upon the single net lease, requiring the tenant to cover property taxes and property insurance. The landlord remains responsible for property maintenance. This lease type provides further cost distribution to the tenant while reducing the landlord's financial obligations. 3. Absolute Triple Net Lease: An absolute triple net lease represents the most comprehensive form of financial responsibility transfer. Tenants are responsible for property taxes, property insurance, and all maintenance costs, including structural repairs and replacements. This lease type affords landlords maximum financial security while almost entirely eliminating their expenditure on property-related expenses. It is important for landlords and tenants to consult with legal professionals well-versed in Iowa real estate laws before entering into any lease agreement, especially when it involves triple net terms. This will ensure both parties fully understand their rights and obligations, leading to a fair and transparent lease agreement.

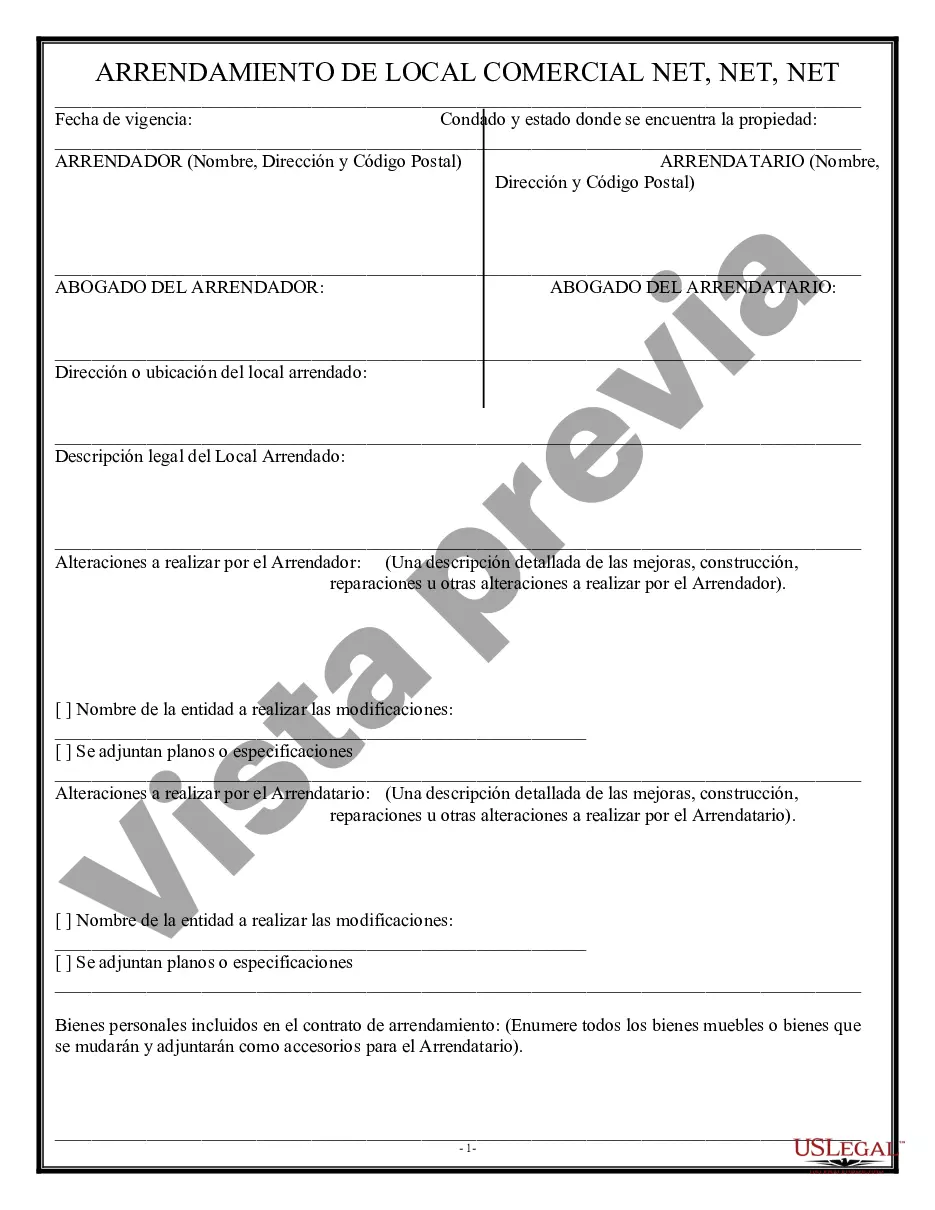

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Iowa Arrendamiento neto triple para bienes raíces comerciales - Triple Net Lease for Commercial Real Estate

Description

How to fill out Iowa Arrendamiento Neto Triple Para Bienes Raíces Comerciales?

If you need to total, down load, or printing legitimate record templates, use US Legal Forms, the largest selection of legitimate varieties, which can be found on the Internet. Utilize the site`s simple and hassle-free research to discover the files you require. Various templates for enterprise and person functions are categorized by groups and states, or keywords and phrases. Use US Legal Forms to discover the Iowa Triple Net Lease for Commercial Real Estate in just a few mouse clicks.

In case you are previously a US Legal Forms customer, log in for your profile and click the Down load key to obtain the Iowa Triple Net Lease for Commercial Real Estate. You can even gain access to varieties you formerly acquired from the My Forms tab of your profile.

If you use US Legal Forms initially, refer to the instructions listed below:

- Step 1. Make sure you have chosen the shape to the proper metropolis/country.

- Step 2. Take advantage of the Review choice to look over the form`s content material. Never overlook to read through the outline.

- Step 3. In case you are unsatisfied with all the type, take advantage of the Lookup field on top of the display screen to locate other variations in the legitimate type format.

- Step 4. After you have found the shape you require, select the Purchase now key. Opt for the prices plan you favor and put your accreditations to sign up for an profile.

- Step 5. Procedure the transaction. You may use your credit card or PayPal profile to perform the transaction.

- Step 6. Find the format in the legitimate type and down load it on the system.

- Step 7. Comprehensive, change and printing or signal the Iowa Triple Net Lease for Commercial Real Estate.

Each and every legitimate record format you acquire is your own property eternally. You have acces to every type you acquired in your acccount. Click the My Forms area and decide on a type to printing or down load once again.

Remain competitive and down load, and printing the Iowa Triple Net Lease for Commercial Real Estate with US Legal Forms. There are millions of specialist and status-specific varieties you can use to your enterprise or person requirements.