This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Iowa Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased is a legal document that outlines the transfer of ownership of personal property in Iowa, while also addressing any existing debts related to the purchased property. This comprehensive agreement ensures transparency and protection for both the buyer and the seller. The Iowa Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased includes essential details such as the names and contact information of both parties involved, a detailed description of the personal property being sold, its condition, and any warranties or guarantees. Additionally, the document establishes the purchase price and the agreed-upon payment terms, including any down payment, installments, or lump sum amounts. When it comes to debts secured by the personal property being purchased, this document allows for the assumption of existing debts by the buyer. This means that the buyer agrees to take over the responsibility of paying off any outstanding loans or debts related to the property. By assuming these debts, the buyer ensures that the property remains secure and avoids any potential legal issues or disputes in the future. In Iowa, there are various types of Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased, tailored to specific purposes or circumstances. Some common types include: 1. Iowa Vehicle Bill of Sale and Assumption of Debt: Specifically designed for the transfer of ownership for vehicles, this document ensures all parties are aware of any debts secured by the vehicle being purchased. It covers important information such as the vehicle's make, model, identification number (VIN), and any existing liens or loans. 2. Iowa Real Estate Bill of Sale and Assumption of Debt: This type of Bill of Sale is used when personal property related to real estate, such as furniture or appliances, is being sold and involves the assumption of any debts associated with the property. 3. Iowa Business Bill of Sale and Assumption of Debt: When a business is being sold, this document outlines the transfer of ownership while addressing any debts secured by the business's personal property. It encompasses details about the business, its assets, liabilities, and any encumbrances attached to the personal property being purchased. Regardless of the specific type, the Iowa Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased serves as a legal record of the transaction and protects both parties involved, ensuring a smooth transfer of ownership while addressing any outstanding debts.The Iowa Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased is a legal document that outlines the transfer of ownership of personal property in Iowa, while also addressing any existing debts related to the purchased property. This comprehensive agreement ensures transparency and protection for both the buyer and the seller. The Iowa Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased includes essential details such as the names and contact information of both parties involved, a detailed description of the personal property being sold, its condition, and any warranties or guarantees. Additionally, the document establishes the purchase price and the agreed-upon payment terms, including any down payment, installments, or lump sum amounts. When it comes to debts secured by the personal property being purchased, this document allows for the assumption of existing debts by the buyer. This means that the buyer agrees to take over the responsibility of paying off any outstanding loans or debts related to the property. By assuming these debts, the buyer ensures that the property remains secure and avoids any potential legal issues or disputes in the future. In Iowa, there are various types of Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased, tailored to specific purposes or circumstances. Some common types include: 1. Iowa Vehicle Bill of Sale and Assumption of Debt: Specifically designed for the transfer of ownership for vehicles, this document ensures all parties are aware of any debts secured by the vehicle being purchased. It covers important information such as the vehicle's make, model, identification number (VIN), and any existing liens or loans. 2. Iowa Real Estate Bill of Sale and Assumption of Debt: This type of Bill of Sale is used when personal property related to real estate, such as furniture or appliances, is being sold and involves the assumption of any debts associated with the property. 3. Iowa Business Bill of Sale and Assumption of Debt: When a business is being sold, this document outlines the transfer of ownership while addressing any debts secured by the business's personal property. It encompasses details about the business, its assets, liabilities, and any encumbrances attached to the personal property being purchased. Regardless of the specific type, the Iowa Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased serves as a legal record of the transaction and protects both parties involved, ensuring a smooth transfer of ownership while addressing any outstanding debts.

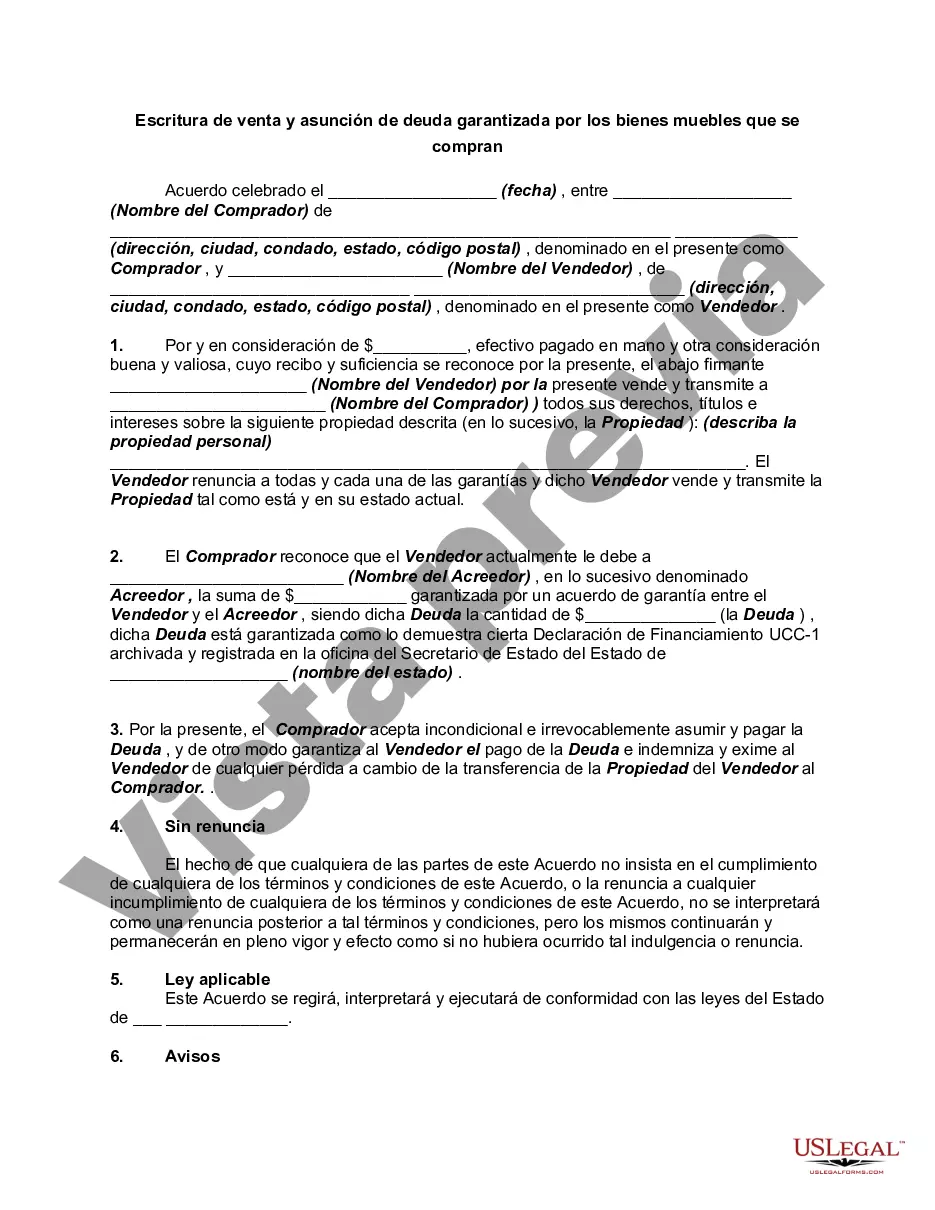

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.