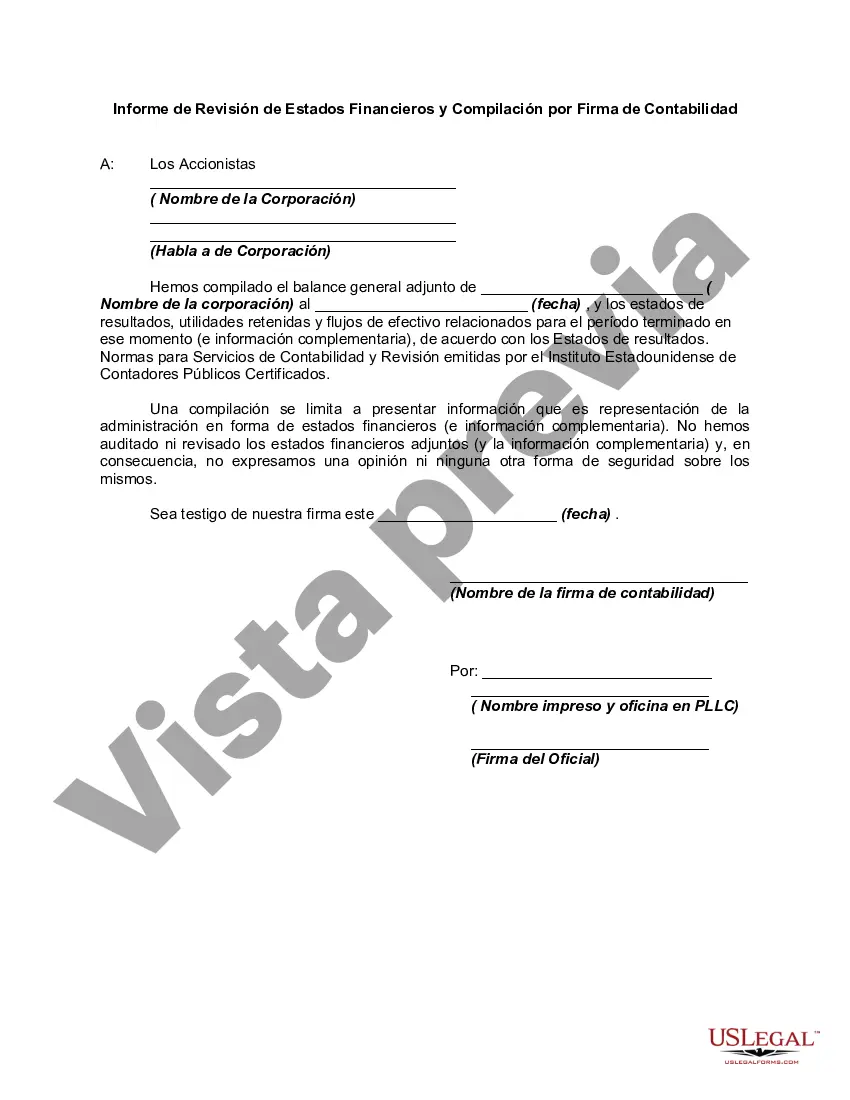

In a compilation engagement, the accountant presents in the form of financial statements information that is the representation of management (owners) without undertaking to express any assurance on the statements. In other words, using management's records, the accountant creates financial statements without gathering evidence or opining about the validity of those underlying records. Because compiled financial statements provide the reader no assurance regarding the statements, they represent the lowest level of financial statement service accountants can provide to their clients. Accordingly, standards governing compilation engagements require that financial statements presented by the accountant to the client or third parties must at least be compiled.

Iowa Report from Review of Financial Statements and Compilation by Accounting Firm: A Comprehensive Guide Introduction: In the realm of financial reporting, Iowa Report from Review of Financial Statements and Compilation by Accounting Firm is a crucial document that provides an objective evaluation of a company's financial statements. These reports are prepared by accounting firms, such as CPA's, who are well-versed in the accounting principles and standards established by the state of Iowa. This comprehensive guide will explore the intricacies of Iowa Reports, including their purpose, types, and key components. Purpose: The primary objective of an Iowa Report from Review of Financial Statements and Compilation by Accounting Firm is to provide an independent and unbiased analysis of a company's financial position, performance, and cash flows. This report serves various stakeholders, such as investors, lenders, shareholders, creditors, and regulatory authorities, who rely on it to make informed decisions regarding the company's financial health. Types of Iowa Reports: 1. Compilation Report: A Compilation Report is the most basic form of an Iowa Report, where the accounting firm assists in the preparation and presentation of financial statements without providing any assurance about their accuracy or compliance with relevant accounting standards. It includes a disclaimer stating that the accounting firm did not audit or review the financial statements. 2. Review Report: The Review Report represents a higher level of assurance than the Compilation Report. Here, the accounting firm performs analytical procedures and inquiries to obtain limited assurance that the financial statements are free from material misstatement. While not as comprehensive as an audit, the Review Report offers a moderate level of assurance to users. 3. Audit Report (not exclusive to Iowa): Though not specific to Iowa, an Audit Report is worth mentioning as it represents the highest level of assurance an accounting firm can provide. It involves extensive examination of financial statements, internal controls, and supporting evidence to express an opinion on whether the financial statements are presented fairly and in accordance with generally accepted accounting principles. Key Components of an Iowa Report: 1. Statement of the Accounting Firm's Responsibility: This section outlines the responsibility of the accounting firm for conducting the review or compilation engagement in accordance with applicable professional standards. 2. Management's Responsibility: It details the responsibility of the company's management for preparing and presenting the financial statements in accordance with accounting principles generally accepted in the United States of America. 3. Scope of the Review/Compilation Engagement: This component explains the procedures performed by the accounting firm during the review or compilation process. 4. Accountant's Conclusion: A vital aspect of the report, this section presents the accounting firm's opinion or conclusion regarding the financial statements. For a Compilation Report, it explicitly states that no assurance is provided, while a Review Report includes limited assurance. 5. Supplementary Information: If applicable, this segment includes any additional disclosures or explanations deemed necessary by the accounting firm to enhance the understanding of the financial statements. Conclusion: Iowa Reports from Review of Financial Statements and Compilation by Accounting Firm play a crucial role in assessing the credibility and reliability of financial information provided by companies operating in Iowa. Accounting firms employ their expertise and adherence to professional standards to ensure the accuracy and integrity of the financial statements. Stakeholders can rely on these reports to make informed decisions about investments, lending, and other financial matters pertaining to Iowa-based companies.Iowa Report from Review of Financial Statements and Compilation by Accounting Firm: A Comprehensive Guide Introduction: In the realm of financial reporting, Iowa Report from Review of Financial Statements and Compilation by Accounting Firm is a crucial document that provides an objective evaluation of a company's financial statements. These reports are prepared by accounting firms, such as CPA's, who are well-versed in the accounting principles and standards established by the state of Iowa. This comprehensive guide will explore the intricacies of Iowa Reports, including their purpose, types, and key components. Purpose: The primary objective of an Iowa Report from Review of Financial Statements and Compilation by Accounting Firm is to provide an independent and unbiased analysis of a company's financial position, performance, and cash flows. This report serves various stakeholders, such as investors, lenders, shareholders, creditors, and regulatory authorities, who rely on it to make informed decisions regarding the company's financial health. Types of Iowa Reports: 1. Compilation Report: A Compilation Report is the most basic form of an Iowa Report, where the accounting firm assists in the preparation and presentation of financial statements without providing any assurance about their accuracy or compliance with relevant accounting standards. It includes a disclaimer stating that the accounting firm did not audit or review the financial statements. 2. Review Report: The Review Report represents a higher level of assurance than the Compilation Report. Here, the accounting firm performs analytical procedures and inquiries to obtain limited assurance that the financial statements are free from material misstatement. While not as comprehensive as an audit, the Review Report offers a moderate level of assurance to users. 3. Audit Report (not exclusive to Iowa): Though not specific to Iowa, an Audit Report is worth mentioning as it represents the highest level of assurance an accounting firm can provide. It involves extensive examination of financial statements, internal controls, and supporting evidence to express an opinion on whether the financial statements are presented fairly and in accordance with generally accepted accounting principles. Key Components of an Iowa Report: 1. Statement of the Accounting Firm's Responsibility: This section outlines the responsibility of the accounting firm for conducting the review or compilation engagement in accordance with applicable professional standards. 2. Management's Responsibility: It details the responsibility of the company's management for preparing and presenting the financial statements in accordance with accounting principles generally accepted in the United States of America. 3. Scope of the Review/Compilation Engagement: This component explains the procedures performed by the accounting firm during the review or compilation process. 4. Accountant's Conclusion: A vital aspect of the report, this section presents the accounting firm's opinion or conclusion regarding the financial statements. For a Compilation Report, it explicitly states that no assurance is provided, while a Review Report includes limited assurance. 5. Supplementary Information: If applicable, this segment includes any additional disclosures or explanations deemed necessary by the accounting firm to enhance the understanding of the financial statements. Conclusion: Iowa Reports from Review of Financial Statements and Compilation by Accounting Firm play a crucial role in assessing the credibility and reliability of financial information provided by companies operating in Iowa. Accounting firms employ their expertise and adherence to professional standards to ensure the accuracy and integrity of the financial statements. Stakeholders can rely on these reports to make informed decisions about investments, lending, and other financial matters pertaining to Iowa-based companies.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.