Iowa Assignment of Debt: Understanding the Types and Process The Iowa Assignment of Debt refers to the legal transfer of debt ownership from one party, known as the assignor, to another party, referred to as the assignee, within the state of Iowa. This legal procedure is crucial in debt collection and allows creditors to sell or assign unpaid debts to third-party debt collectors or collection agencies. The Iowa Assignment of Debt typically occurs when an original creditor, such as a credit card company, bank, or lender, finds it challenging to collect overdue payments from a debtor. In such cases, the creditor may decide to assign the debt to a collection agency or another entity specialized in debt recovery. This assignment enables the original creditor to recoup part of the unpaid balance while transferring the responsibility of debt collection to the assignee. Types of Iowa Assignment of Debt: 1. Assignment for Collection: This type of Iowa Assignment of Debt involves the transfer of unpaid debts from the original creditor to a collection agency. The collection agency, as the assignee, takes charge of the debt recovery process, utilizing various tactics like phone calls, letters, or legal actions to collect the outstanding amount. Upon successful collection, the collection agency retains a percentage of the collected debt as compensation and returns the balance to the original creditor. 2. Assignment for Purchase: This type of Iowa Assignment of Debt happens when the original creditor decides to sell the debt to a third-party debt buyer. The debt buyer becomes the assignee and acquires the rights to collect the debt, aiming to recover the full outstanding amount from the debtor themselves. Debt buyers may purchase debts individually or in bundled portfolios, often at a discounted rate. Any amount collected from the debtor goes entirely to the debt buyer, allowing them to profit from successful collections. Iowa Assignment of Debt Process: The process of Iowa Assignment of Debt involves a few crucial steps: 1. Identification and Documentation: The original creditor identifies problematic accounts with unpaid debts and prepares the necessary documentation to assign them to an assignee, either for collection or purchase. 2. Agreement and Contract: The assignor (original creditor) and the assignee (collection agency or debt buyer) establish a formal agreement that outlines the terms and conditions of the debt assignment. This agreement should include details like the debt amount, debtor information, assignment fees, and how responsibility for collection will be transferred. 3. Notice to Debtor: After the assignment is finalized, the assignee notifies the debtor about the debt transfer, providing updated contact information and outlining changes in the collection process. This notice also ensures that the debtor is aware of their new point of contact for payment and negotiations. 4. Debt Collection: The assignee undertakes debt collection efforts, aiming to recover the unpaid amount from the debtor. This may involve contacting the debtor through phone calls, sending letters or notices, and, if required, pursuing legal actions to enforce payment. 5. Reporting and Remittance: Once the assigned debt has been settled, the assignee typically reports the collection outcomes to the original creditor, providing details of the amount collected and any associated costs. Payment is then remitted by the assignee to the assignor, minus any agreed-upon fees or commissions. In conclusion, the Iowa Assignment of Debt is a vital process that enables original creditors to transfer the responsibility of collecting unpaid debts to assignees, such as collection agencies or debt buyers. Employing various strategies, these assignees strive to recover the outstanding amount, benefitting both themselves and the original creditors. Understanding the different types and processes involved in the Iowa Assignment of Debt can be beneficial for both debtors and creditors involved in debt collection matters.

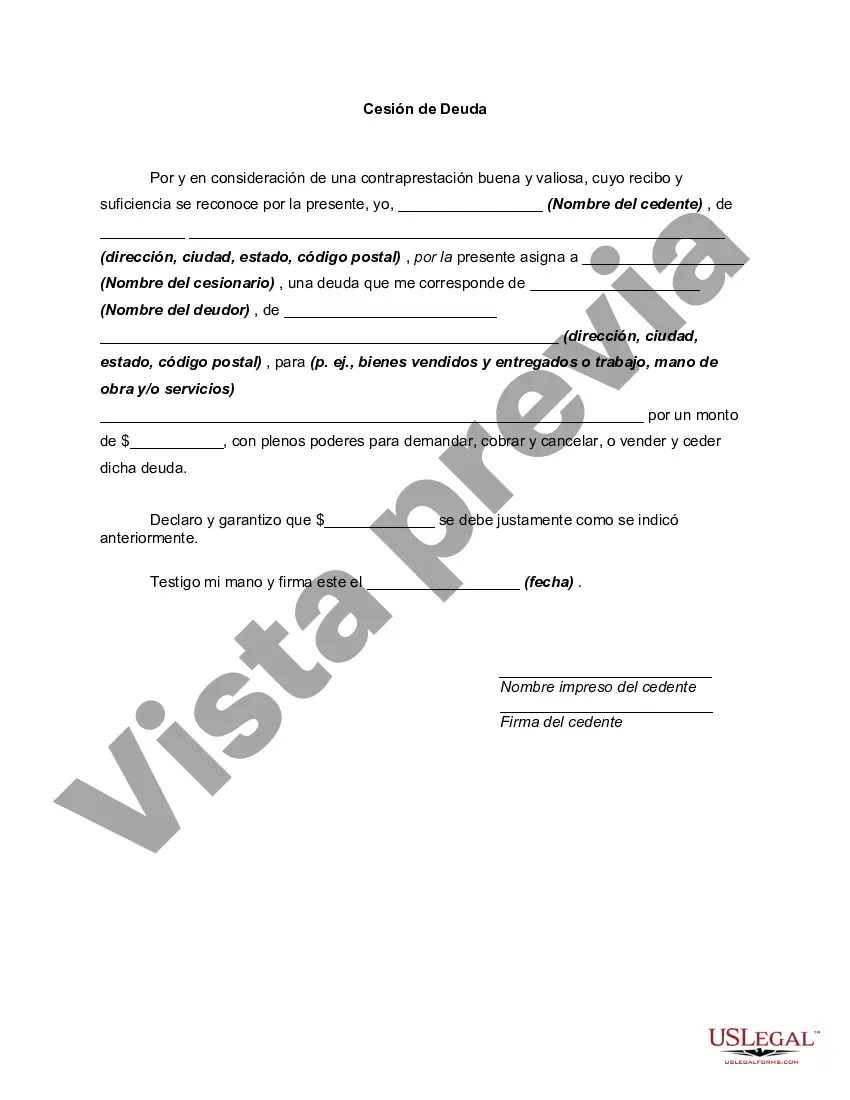

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Iowa Cesión de Deuda - Assignment of Debt

Description

How to fill out Iowa Cesión De Deuda?

US Legal Forms - one of many biggest libraries of legitimate types in the United States - gives a wide range of legitimate papers templates it is possible to download or print. While using web site, you will get a huge number of types for company and personal uses, sorted by types, states, or keywords.You will find the latest types of types just like the Iowa Assignment of Debt in seconds.

If you already possess a membership, log in and download Iowa Assignment of Debt in the US Legal Forms catalogue. The Download switch will show up on every type you perspective. You gain access to all in the past delivered electronically types within the My Forms tab of your bank account.

If you wish to use US Legal Forms for the first time, listed here are simple instructions to help you get started:

- Make sure you have selected the right type for the city/county. Click on the Preview switch to analyze the form`s content material. See the type information to actually have chosen the correct type.

- In case the type doesn`t suit your demands, take advantage of the Lookup discipline near the top of the display to find the one which does.

- Should you be content with the shape, verify your choice by simply clicking the Buy now switch. Then, pick the costs plan you favor and provide your credentials to sign up to have an bank account.

- Process the deal. Make use of your bank card or PayPal bank account to finish the deal.

- Select the format and download the shape on the system.

- Make alterations. Fill up, change and print and indication the delivered electronically Iowa Assignment of Debt.

Every template you put into your account lacks an expiration date and it is your own for a long time. So, if you want to download or print another backup, just go to the My Forms portion and then click in the type you will need.

Gain access to the Iowa Assignment of Debt with US Legal Forms, the most considerable catalogue of legitimate papers templates. Use a huge number of specialist and state-specific templates that satisfy your small business or personal requires and demands.