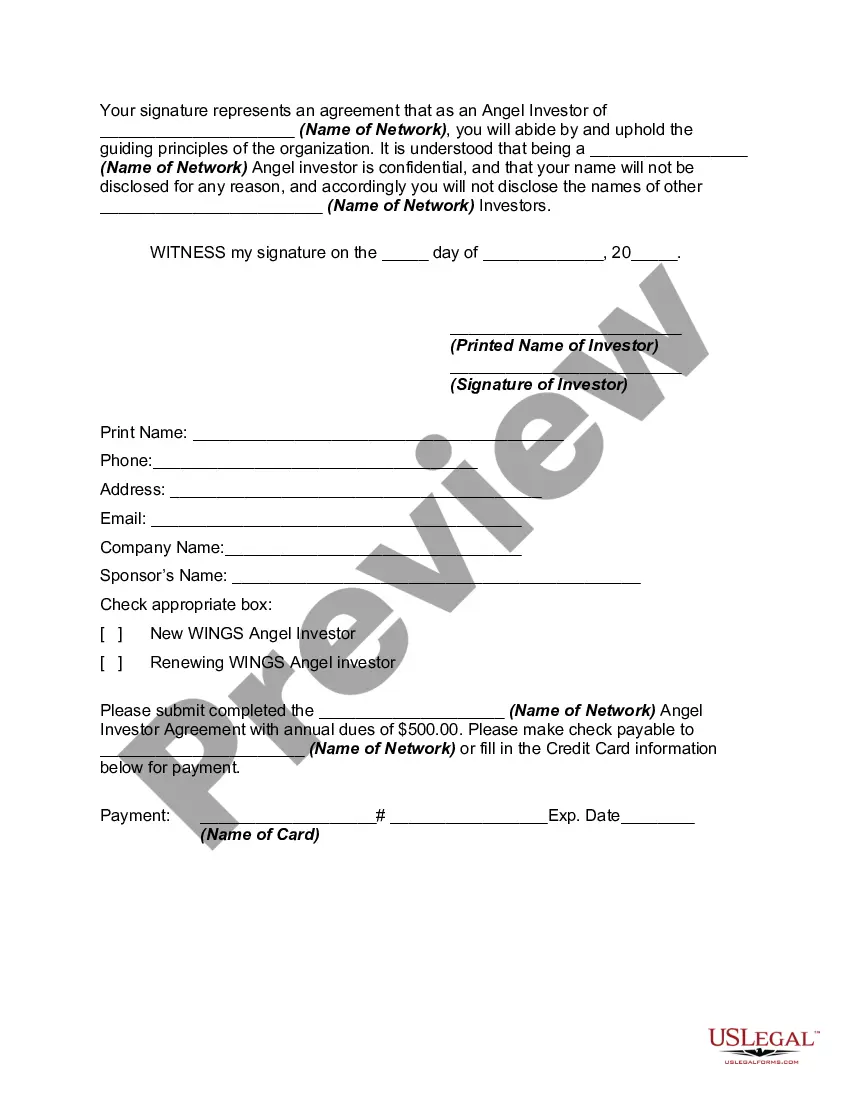

Iowa Angel Investor Agreement

Description

How to fill out Angel Investor Agreement?

You can invest time online trying to locate the appropriate legal document template that meets the state and federal criteria you require.

US Legal Forms offers a vast array of legal documents that have been reviewed by professionals.

You can easily download or print the Iowa Angel Investor Agreement from this service.

If available, utilize the Preview button to view the document format as well. If you wish to find another version of the document, use the Search field to locate the template that suits your needs and expectations.

- If you already have a US Legal Forms account, you can sign in and click the Download button.

- Subsequently, you may complete, modify, print, or sign the Iowa Angel Investor Agreement.

- Each legal document template you obtain is yours permanently.

- To get another copy of the document you purchased, navigate to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document format for your area/town of interest.

- Review the document description to confirm that you have chosen the right template.

Form popularity

FAQ

In Iowa, the homestead tax credit is available to individuals who own and occupy their primary residence. To qualify, you must meet certain income guidelines and file an application with your local assessor. Understanding these requirements can benefit investors and homeowners alike, especially when considering an Iowa Angel Investor Agreement that involves real estate investments.

The $1,200 energy tax credit is available for individuals who make energy-efficient improvements to their homes. This credit can significantly reduce your tax liability, making investments in energy efficiency more appealing. For those involved in an Iowa Angel Investor Agreement, this credit can enhance the financial benefits when investing in sustainable technologies.

To claim your $7500 hybrid tax credit, you must first meet the eligibility requirements set by the state. Complete the necessary forms and submit them along with your tax return, ensuring you provide documentation of your qualified expenses. Using the guidance of an Iowa Angel Investor Agreement can help navigate these requirements, simplifying the process.

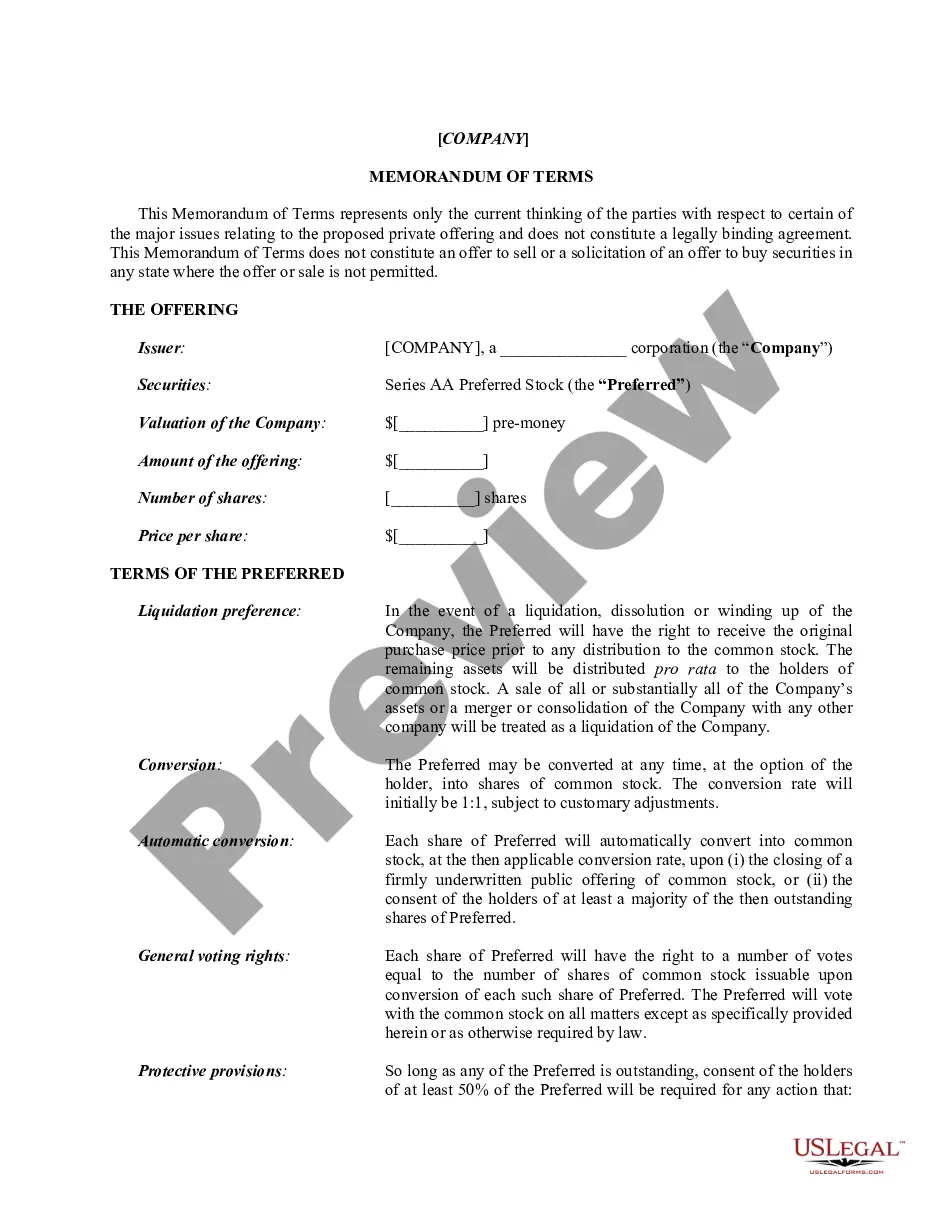

The angel tax credit is an incentive provided by the state to encourage investment in startup companies. By investing in qualified businesses, angel investors can receive a tax credit against their state tax liability. This credit is a significant advantage available to those utilizing an Iowa Angel Investor Agreement, fostering growth in Iowa's entrepreneurial landscape.

Typically, an angel investor receives a percentage of ownership in the company in exchange for their investment. This percentage varies based on the investment amount and valuation of the company. In an Iowa Angel Investor Agreement, you can outline these terms clearly to avoid confusion and ensure fairness for both parties.

Qualifying as an angel investor typically involves meeting certain financial criteria, such as being an accredited investor. You should also possess experience in investing and a strong understanding of business operations. Understanding the Iowa Angel Investor Agreement will help you evaluate potential opportunities and clarify roles during the investment process.

When pitching an idea to an angel investor, ensure you present a clear and engaging story about your business. Use visuals to express your idea and focus on the market need it addresses. By discussing the Iowa Angel Investor Agreement, you can demonstrate professionalism and readiness to establish a beneficial relationship from the start.

To pitch your idea to an angel investor, start with a compelling narrative that outlines your vision and mission. Clearly articulate the problem you solve and the market opportunity, while backing your claims with data. Engage your audience by explaining how the Iowa Angel Investor Agreement serves to clarify expectations, thus fostering a secure investment environment.

Angel investors often seek established businesses, but they can invest in promising ideas too. They usually look for strong potential or unique innovation that stands out in a crowded market. It's important to present a compelling vision and a plan that illustrates how the idea will become a viable business, making the Iowa Angel Investor Agreement relevant for outlining commitment and expectations.

Securing an angel investor can be challenging, depending on your stage of business and the strength of your pitch. Investors typically look for innovative ideas with a solid business model and potential for growth. Having a well-prepared presentation and a clear Iowa Angel Investor Agreement can improve your chances by showing that you are serious and organized.