Iowa Affidavit That There Are No Creditors is a legal document used in the state of Iowa to declare that a deceased person's estate does not have any outstanding debts or creditors. It is an important tool in the probate process and helps ensure a smooth transfer of assets to beneficiaries. The Iowa Affidavit That There Are No Creditors serves as evidence that the deceased individual's estate has been thoroughly examined and all outstanding debts have been settled. This affidavit is typically required by the court or the estate's executor before any remaining assets can be distributed among the heirs. The affidavit should be filed with the probate court along with other estate documents, such as the last will and testament, death certificate, and an inventory of the deceased person's assets. It should contain specific information related to the deceased person, their estate, and the efforts made to identify and settle any outstanding debts. Some relevant keywords associated with the Iowa Affidavit That There Are No Creditors include: 1. Iowa probate process: This pertains to the legal procedure for administering a deceased individual's estate in Iowa, which typically involves filing necessary documents, paying debts, and distributing assets to beneficiaries. 2. Debt settlement: Refers to the process of resolving outstanding debts or claims against the deceased person's estate before the assets can be distributed among beneficiaries. 3. Estate administration: Involves the overall management and distribution of a deceased person's assets, including the filing of necessary documents and ensuring legal requirements are met. 4. Probate court: The court responsible for overseeing the probate process, which includes reviewing documents such as the Iowa Affidavit That There Are No Creditors to validate the deceased person's estate. 5. Beneficiaries: Refers to individuals named in the deceased person's will or designated by law to receive assets from the estate. Different types of Iowa Affidavit That There Are No Creditors may include variations based on the circumstances of the deceased person's estate. For example: 1. Short form affidavit: This is a simplified version of the affidavit used when the estate's assets are minimal, and there is no need for a comprehensive inventory or lengthy document. 2. Long form affidavit: Used when the estate's assets are more complex or substantial, requiring a detailed inventory and assessment of the deceased person's financial situation. 3. Amended affidavit: If additional creditors or debts are discovered after the initial filing of the affidavit, an amended version may be required to ensure the most up-to-date information is provided to the court. It is crucial to consult with an experienced attorney familiar with Iowa probate laws to correctly prepare and file the Iowa Affidavit That There Are No Creditors and any other related estate documents.

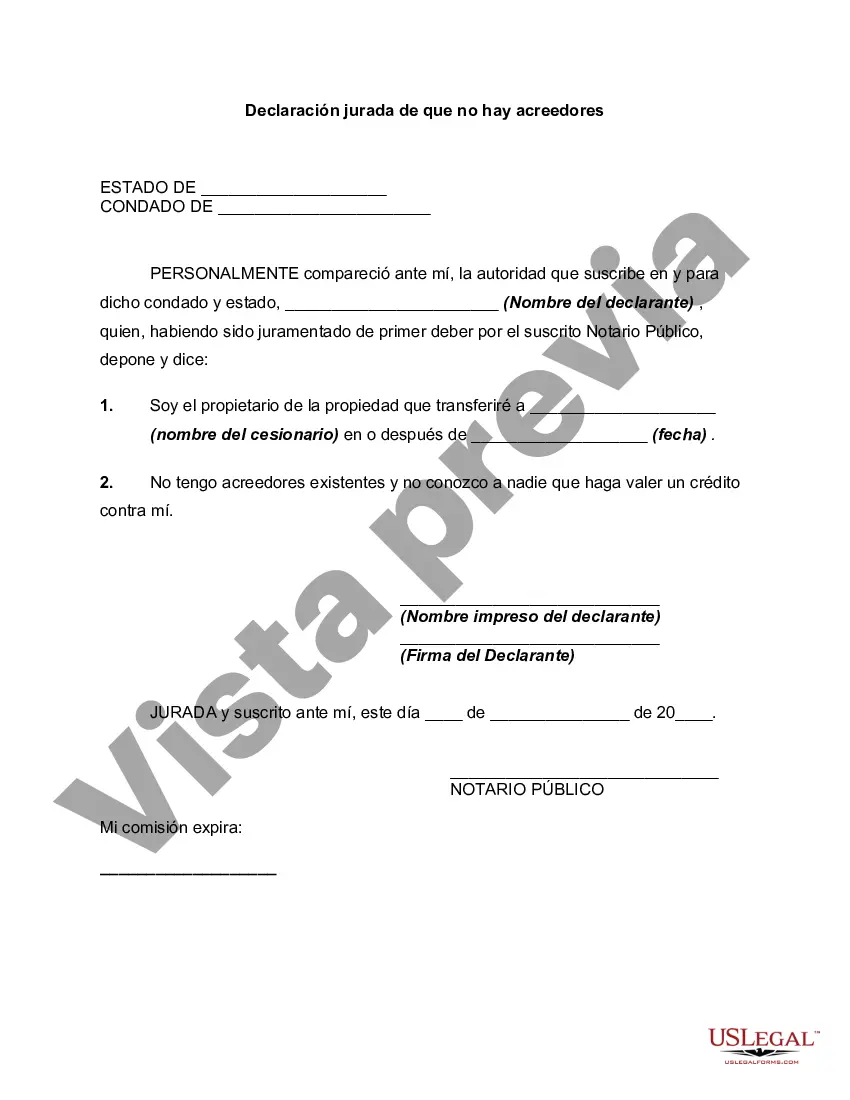

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Iowa Declaración jurada de que no hay acreedores - Affidavit That There Are No Creditors

Description

How to fill out Iowa Declaración Jurada De Que No Hay Acreedores?

If you wish to total, obtain, or produce legal papers themes, use US Legal Forms, the biggest collection of legal types, which can be found online. Use the site`s simple and practical lookup to obtain the files you will need. A variety of themes for business and specific functions are categorized by categories and suggests, or key phrases. Use US Legal Forms to obtain the Iowa Affidavit That There Are No Creditors in just a handful of clicks.

If you are currently a US Legal Forms buyer, log in for your bank account and click on the Download button to have the Iowa Affidavit That There Are No Creditors. You can also accessibility types you earlier saved within the My Forms tab of your respective bank account.

If you use US Legal Forms for the first time, refer to the instructions below:

- Step 1. Be sure you have selected the shape for the appropriate metropolis/nation.

- Step 2. Make use of the Preview solution to look over the form`s information. Never neglect to learn the explanation.

- Step 3. If you are not happy together with the kind, take advantage of the Search discipline near the top of the display screen to get other models of the legal kind web template.

- Step 4. When you have located the shape you will need, select the Purchase now button. Choose the costs plan you prefer and put your references to sign up on an bank account.

- Step 5. Method the transaction. You can use your charge card or PayPal bank account to accomplish the transaction.

- Step 6. Select the format of the legal kind and obtain it on the gadget.

- Step 7. Total, change and produce or signal the Iowa Affidavit That There Are No Creditors.

Each and every legal papers web template you acquire is yours eternally. You may have acces to every single kind you saved inside your acccount. Click on the My Forms area and pick a kind to produce or obtain once more.

Remain competitive and obtain, and produce the Iowa Affidavit That There Are No Creditors with US Legal Forms. There are thousands of professional and status-specific types you can utilize to your business or specific requires.