Iowa Credit Memo is a financial document used to record transactions involving credits or refunds in the state of Iowa. It is an essential part of accounting and provides an organized way to track and adjust customer accounts. The Iowa Credit Memo can be classified into various types, depending on the nature and purpose of the credit or refund. Some of these types include: 1. Sales Return Credit Memo: This type of credit memo is issued when a customer returns a product to the seller. It is used to reverse the original sale and adjust the customer's account accordingly. 2. Damage or Defective Goods Credit Memo: If a customer receives damaged or defective goods, the seller may issue a credit memo to compensate for the inconvenience. This type of credit memo helps rectify the error and maintain customer satisfaction. 3. Overpayment Credit Memo: In case a customer accidentally overpays for a product or service, the seller issues an overpayment credit memo to refund the excess amount. It ensures accurate account balances and fosters positive customer relations. 4. Pricing Discrepancy Credit Memo: If there is a pricing discrepancy or an incorrect charge made to a customer, a credit memo is issued to rectify the error. This type of credit memo helps maintain transparency and build trust with customers. 5. Promotional or Marketing Credit Memo: Iowa businesses often use promotional tactics or marketing strategies to attract customers. In such cases, a credit memo may be issued to provide discounts, refunds, or other incentives as part of a promotional campaign. Iowa Credit Memos generally contain essential information such as the customer name, date of issuance, credit amount, reason for the credit, and any supporting documentation. These documents play a vital role in maintaining accurate financial records, ensuring customer satisfaction, and complying with relevant taxes and regulations. In conclusion, the Iowa Credit Memo is a crucial tool for businesses in Iowa to handle various credit and refund scenarios. It helps track transactions accurately, maintain customer relationships, and ensure compliance with financial reporting requirements.

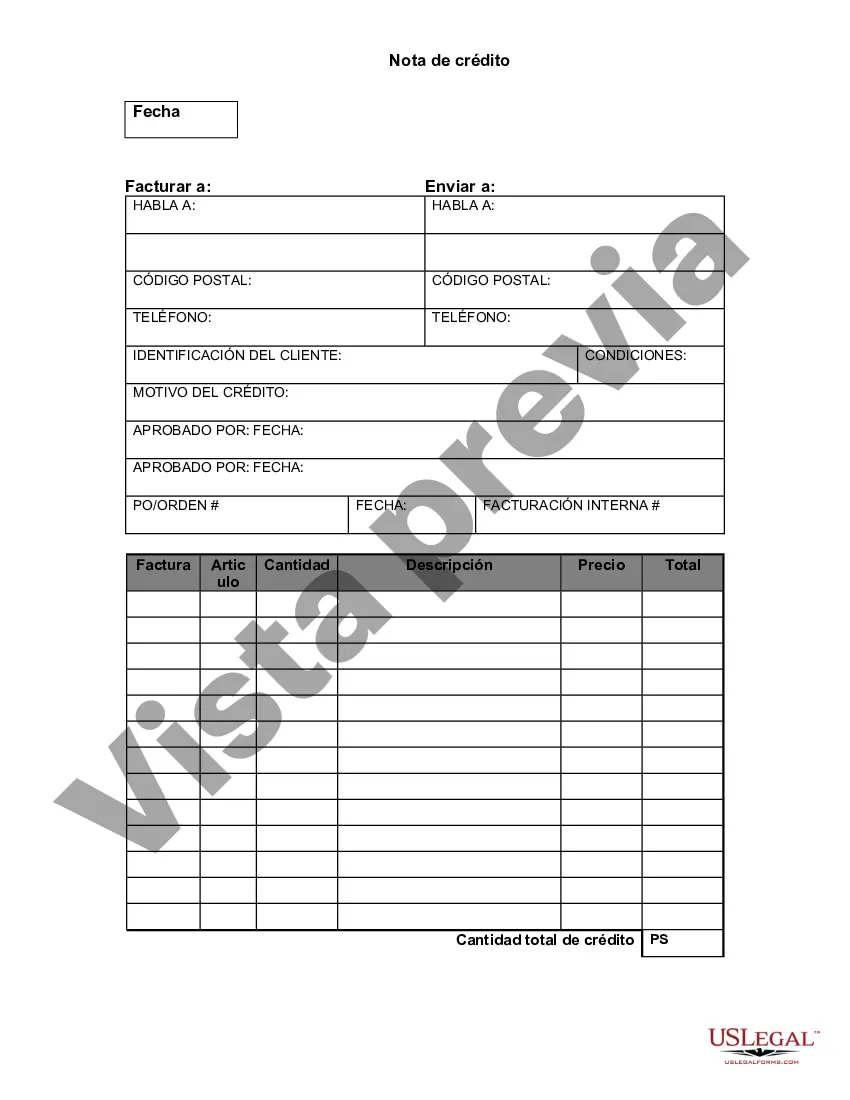

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Iowa Nota de crédito - Credit Memo

Description

How to fill out Iowa Nota De Crédito?

Are you presently within a place where you require documents for possibly company or personal reasons almost every day time? There are plenty of legitimate document layouts available on the net, but finding types you can trust is not straightforward. US Legal Forms gives 1000s of kind layouts, like the Iowa Credit Memo, that happen to be written to meet state and federal specifications.

When you are previously informed about US Legal Forms web site and possess a free account, just log in. Following that, you may down load the Iowa Credit Memo web template.

Unless you come with an account and need to begin to use US Legal Forms, adopt these measures:

- Get the kind you want and make sure it is for your correct area/area.

- Take advantage of the Review switch to analyze the shape.

- Browse the description to ensure that you have chosen the correct kind.

- If the kind is not what you are looking for, take advantage of the Look for field to find the kind that meets your needs and specifications.

- If you obtain the correct kind, click Acquire now.

- Choose the rates plan you desire, complete the necessary information and facts to produce your account, and purchase your order with your PayPal or Visa or Mastercard.

- Choose a practical data file formatting and down load your backup.

Discover every one of the document layouts you have purchased in the My Forms food list. You can obtain a extra backup of Iowa Credit Memo at any time, if needed. Just click on the needed kind to down load or print out the document web template.

Use US Legal Forms, one of the most considerable variety of legitimate varieties, in order to save time and prevent faults. The services gives appropriately manufactured legitimate document layouts that you can use for a variety of reasons. Generate a free account on US Legal Forms and start generating your way of life easier.