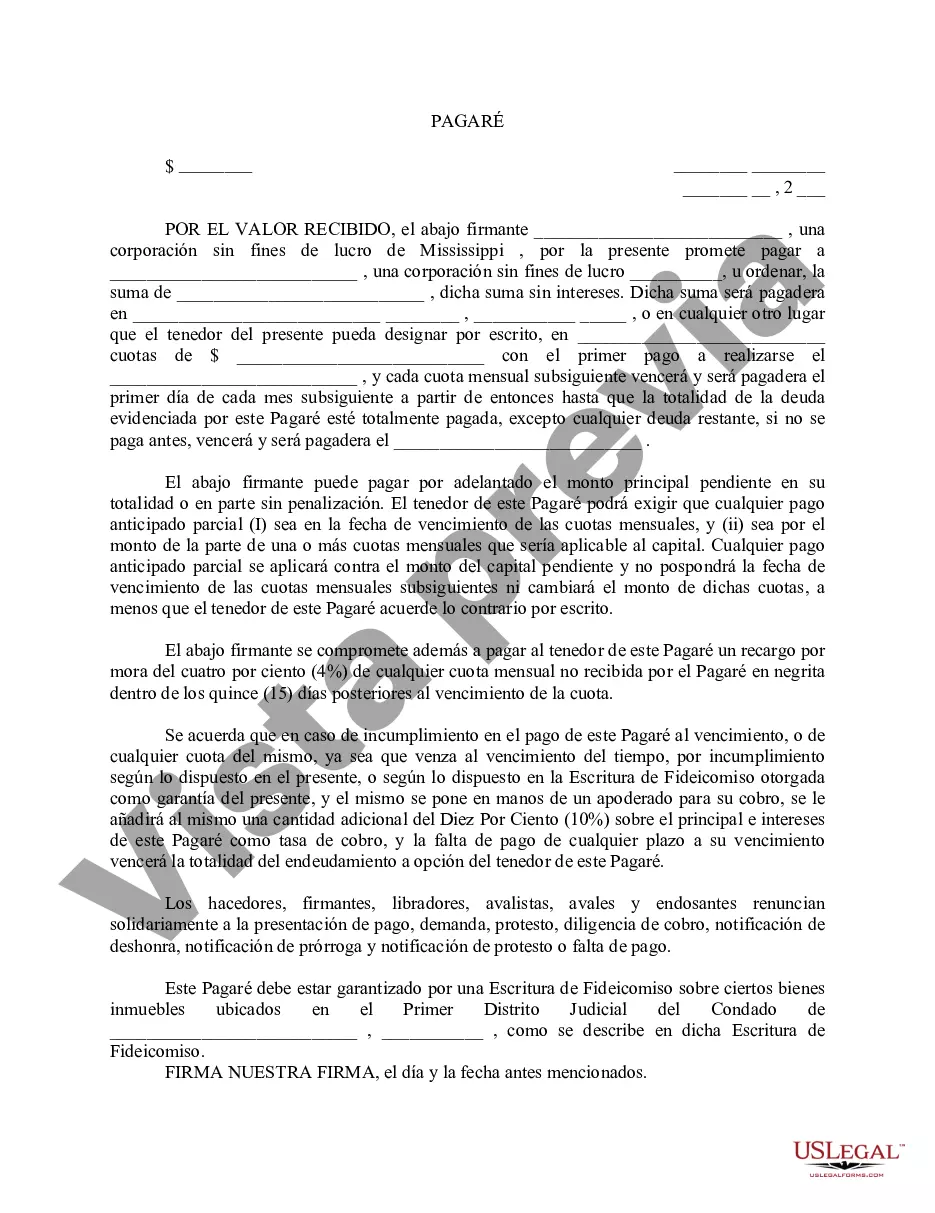

Iowa Promissory Note College to Church is a legally binding document that outlines a financial agreement between a college and a church in the state of Iowa. It is an important tool used to formalize the terms and conditions of a loan or financial transaction between these two entities. This Promissory Note serves as evidence of the borrowing and lending arrangement, safeguarding the interests of both the college and the church. By signing this note, the college acknowledges its obligation to repay a specified amount of money to the church within a defined timeframe. It acts as a commitment to honor the financial agreement and to ensure timely repayment. Additionally, the note may include interest rates, payment schedules, and any additional terms that both parties have agreed upon. The Iowa Promissory Note College to Church is crucial for churches that provide financial assistance to colleges or educational institutions, enabling them to contribute to the growth and development of these educational entities. It enables churches to make meaningful contributions to the academic and spiritual formation of students, fostering the bond between education and faith-based organizations. Different types of Iowa Promissory Note College to Church may include: 1. Unsecured Promissory Note: This type of note does not require any collateral to secure the loan amount. It relies solely on the creditworthiness and trust between the college and the church. 2. Secured Promissory Note: In this case, the note is backed by collateral, such as real estate or other valuable assets owned by the college. This provides an additional layer of security for the church in case of default. 3. Fixed-Rate Promissory Note: This note specifies a fixed interest rate for the loan, ensuring that the repayment amount remains constant throughout the loan term. 4. Variable-Rate Promissory Note: This note includes an adjustable interest rate, which fluctuates based on market conditions. The interest rate may change periodically, affecting the amount of repayment required. In conclusion, the Iowa Promissory Note College to Church is a vital document that outlines the financial relationship between educational institutions and faith-based organizations in Iowa. It protects the interests of both parties and ensures transparency and accountability in financial transactions. The various types of promissory notes available allow for flexibility and customization based on the specific needs and preferences of the college and the church involved in the agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Iowa Pagaré Colegio a Iglesia - Promissory Note College to Church

Description

How to fill out Iowa Pagaré Colegio A Iglesia?

It is possible to spend hours on the web searching for the lawful document format which fits the federal and state demands you require. US Legal Forms offers a large number of lawful forms that are evaluated by specialists. You can easily down load or print out the Iowa Promissory Note College to Church from the support.

If you already possess a US Legal Forms bank account, you can log in and then click the Down load option. After that, you can total, change, print out, or sign the Iowa Promissory Note College to Church. Every single lawful document format you acquire is your own forever. To acquire an additional version of the obtained form, visit the My Forms tab and then click the related option.

If you work with the US Legal Forms site the very first time, stick to the basic directions beneath:

- Initial, make sure that you have chosen the correct document format for your state/town of your choosing. Browse the form description to make sure you have chosen the appropriate form. If accessible, use the Review option to look from the document format at the same time.

- If you wish to find an additional edition from the form, use the Research industry to discover the format that meets your needs and demands.

- Once you have located the format you need, click on Purchase now to proceed.

- Choose the rates plan you need, key in your accreditations, and sign up for an account on US Legal Forms.

- Total the financial transaction. You can use your Visa or Mastercard or PayPal bank account to cover the lawful form.

- Choose the format from the document and down load it to the gadget.

- Make adjustments to the document if possible. It is possible to total, change and sign and print out Iowa Promissory Note College to Church.

Down load and print out a large number of document web templates while using US Legal Forms web site, which offers the biggest assortment of lawful forms. Use expert and status-distinct web templates to handle your business or specific demands.