This multistate form relates to Section 200 of the California Corporate Code that provides in part as follows:

(a) One or more natural persons, partnerships, associations or corporations, domestic or foreign, may form a corporation under this division by executing and filing articles of incorporation.

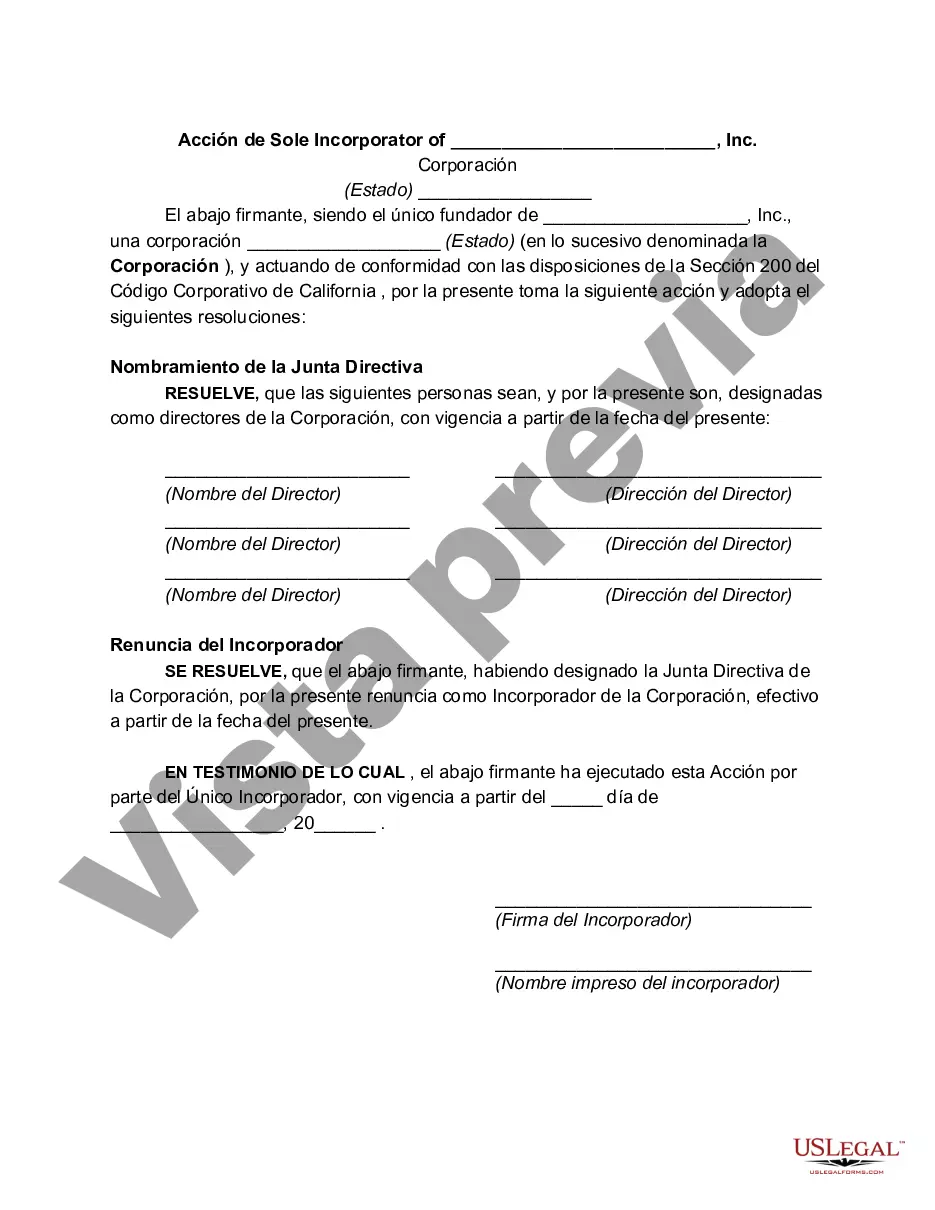

(b) If initial directors are named in the articles, each director named in the articles shall sign and acknowledge the articles; if initial directors are not named in the articles, the articles shall be signed by one or more persons described in subdivision (a) who thereupon are the incorporators of the corporation.

(c) The corporate existence begins upon the filing of the articles and continues perpetually, unless otherwise expressly provided by law or in the articles.

Iowa Action by Sole Incorporated of Corporation refers to the legal process undertaken by an individual who is the sole incorporated of a corporation in the state of Iowa. This action involves a set of procedures that the incorporated must follow to establish the corporation as a separate legal entity. The process of an Iowa Action by Sole Incorporated of Corporation begins with the individual preparing and filing the necessary documents with the Iowa Secretary of State's office. These documents typically include the Articles of Incorporation, which outline the corporation's name, purpose, registered agent, and other essential information. Upon the completion and submission of the Articles of Incorporation, the sole incorporated must pay the required filing fees to the Secretary of State. The fees may vary depending on the type and size of the corporation being formed. Following the filing, the Secretary of State will review the documents for compliance with Iowa's corporation laws. This review ensures that the necessary information has been provided correctly, and any additional requirements are met. Once the Secretary of State approves the filing, the sole incorporated receives a Certificate of Incorporation. This official document serves as proof of the corporation's formation and grants the company its legal existence. With the Certificate of Incorporation in hand, the sole incorporated must now take the necessary steps to establish the corporation's internal structure. This typically involves appointing directors, adopting bylaws, and implementing corporate governance policies. In addition to the general Iowa Action by Sole Incorporated of Corporation, there are a few different types or variations that may be relevant in specific situations: 1. Iowa Action by Sole Incorporated of Nonprofit Corporation: This variation applies when the sole incorporated is establishing a nonprofit corporation. It involves adhering to additional requirements and regulations specific to nonprofit organizations, such as obtaining tax-exempt status. 2. Iowa Action by Sole Incorporated of Professional Corporation: In certain professions, including law, medicine, and accounting, professionals are required to form professional corporations. This variation involves an additional set of regulations designed to protect public interests and ensure professional standards are maintained. 3. Iowa Action by Sole Incorporated of Close Corporation: A close corporation is a type of corporation that operates with a limited number of shareholders and has less stringent formalities compared to larger corporations. The sole incorporated seeking to establish a close corporation may follow specific rules to meet the unique characteristics of this type of entity. Ultimately, an Iowa Action by Sole Incorporated of Corporation is a crucial process for individuals looking to establish a corporation on their own in Iowa. It is essential to understand and comply with the legal requirements and consult legal professionals for guidance during the incorporation process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.