Title: Iowa Sample Letter for Demand on Guarantor — Ensuring Fulfilled Obligations Keywords: Iowa demand letter, guarantor, legal document, debt collection, guarantee agreement, obligations, repayment, default, breach, legal action, contractual terms, financial responsibility Introduction: A Sample Letter for Demand on Guarantor is a crucial legal document typically used in Iowa to pursue prompt repayment of a debt or fulfillment of financial obligations as agreed upon in a guarantee agreement. This letter serves as an official notice to the guarantor, reminding them of their commitment and informing them of their default or breach, while emphasizing the potential consequences and legal actions if necessary. Types of Iowa Sample Letter for Demand on Guarantor: 1. Debt Repayment Demand Letter: This type of sample letter is used when the original debtor has failed to repay their debts as specified in the original contract or agreement. The guarantor is reminded of their responsibility to fulfill the terms of the guarantee agreement and is requested to promptly settle the outstanding amount on behalf of the debtor. 2. Performance Guarantee Demand Letter: In cases where a guarantor has provided a performance guarantee to ensure the successful completion of a project or fulfillment of contractual obligations by a party involved, this type of demand letter is drafted. It emphasizes the breach or failure to meet the agreed-upon performance standards and demands that the guarantor fulfill their responsibility. 3. Lease Guarantee Demand Letter: When a guarantor has committed to securing rental payments for a tenant, and the tenant fails to meet their financial obligations under the lease agreement, this demand letter can be utilized. It seeks the guarantor's compliance with the guarantee agreement by making them aware of the tenant's default and requesting immediate payment of the outstanding rent. Content of an Iowa Sample Letter for Demand on Guarantor: 1. Parties involved: The letter should clearly identify the guarantor, the original debtor, and any relevant parties affiliated with the contract or agreement. 2. Reminder of the guarantee agreement: Briefly outline the terms and conditions of the guarantee agreement, including the guarantor's obligation to repay debts or ensure fulfillment of obligations. 3. Notification of default or breach: Clearly state the facts and circumstances that constitute the default or breach of the original agreement by the debtor. 4. Specific demands: Clearly specify the requested actions the guarantor is expected to take, such as paying off the outstanding debt, fulfilling performance standards, or ensuring rent payments. 5. Consequences and legal action: Explain the potential consequences of non-compliance, which may include legal action, damage to credit, or other applicable penalties. 6. Deadline and contact information: Set a reasonable deadline for the guarantor to fulfil their obligations and provide appropriate contact details for further communication. Conclusion: Iowa Sample Letters for Demand on Guarantor serve as essential tools in asserting financial responsibility and ensuring obligations are fulfilled promptly. By clearly outlining the breaches or defaults and firmly requesting appropriate action, these letters lay the foundation for resolving issues either through direct compliance or initiating legal proceedings, if necessary.

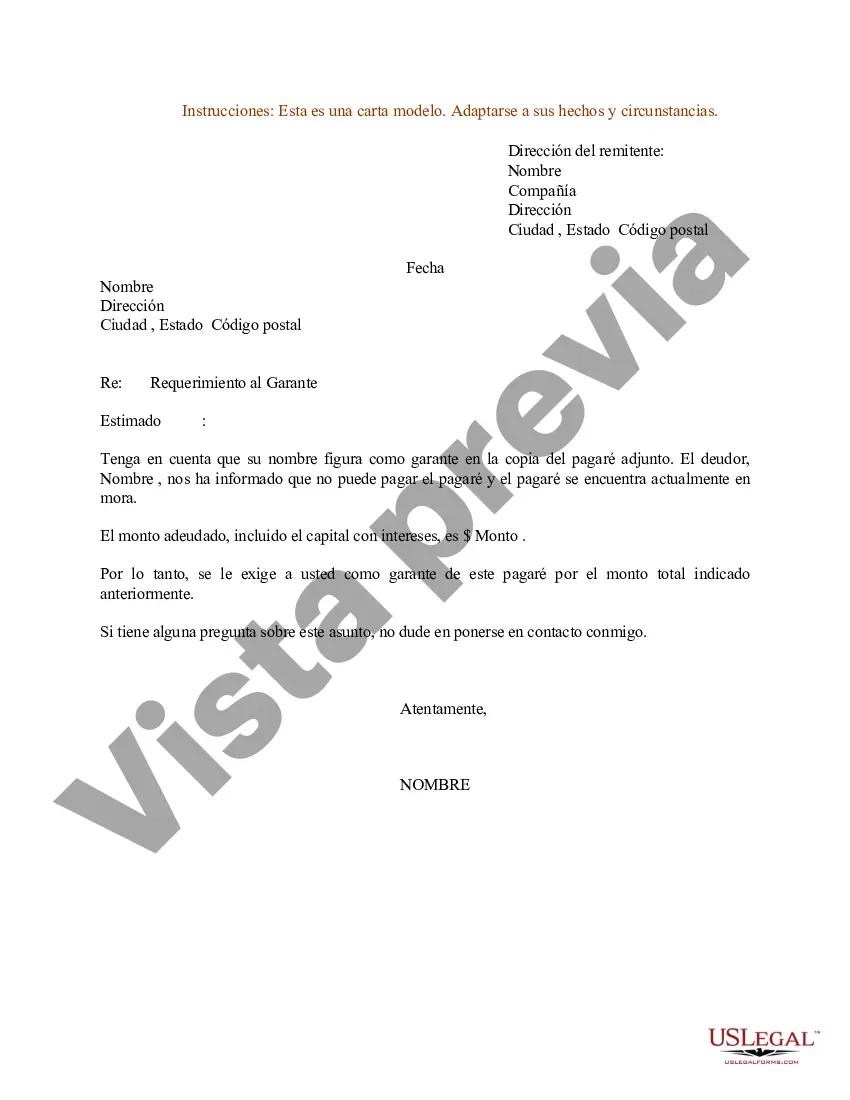

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Iowa Ejemplo de carta de demanda del garante - Sample Letter for Demand on Guarantor

Description

How to fill out Iowa Ejemplo De Carta De Demanda Del Garante?

Choosing the right authorized file web template might be a battle. Of course, there are tons of themes available on the net, but how can you discover the authorized type you require? Use the US Legal Forms internet site. The support provides a huge number of themes, including the Iowa Sample Letter for Demand on Guarantor, which you can use for business and personal requirements. Each of the kinds are checked by pros and fulfill federal and state demands.

In case you are currently listed, log in to your accounts and click on the Acquire option to have the Iowa Sample Letter for Demand on Guarantor. Use your accounts to look with the authorized kinds you may have ordered in the past. Proceed to the My Forms tab of your own accounts and have yet another backup of your file you require.

In case you are a new user of US Legal Forms, listed here are simple recommendations that you should comply with:

- Initial, ensure you have selected the appropriate type to your metropolis/area. You can look through the shape while using Preview option and browse the shape outline to make sure it will be the best for you.

- In case the type does not fulfill your needs, utilize the Seach industry to discover the right type.

- When you are sure that the shape is suitable, select the Buy now option to have the type.

- Opt for the pricing program you want and enter in the required information. Build your accounts and buy the order making use of your PayPal accounts or charge card.

- Opt for the document file format and down load the authorized file web template to your product.

- Comprehensive, change and print out and indicator the obtained Iowa Sample Letter for Demand on Guarantor.

US Legal Forms will be the largest library of authorized kinds where you can find numerous file themes. Use the service to down load skillfully-manufactured files that comply with state demands.

Form popularity

FAQ

One example of a guarantor could occur when someone who is under 21 applies for a credit card but is unable to provide proof that they are capable of making minimum payments on the card. The card company may require a guarantor, who becomes liable for repaying any charges on the credit card.

Section 134 of the ICA provides that the guarantor shall stand discharged from its liabilities under a contract of guarantee in case of any agreement arrived at between the creditor and the principal debtor, by which the principal debtor is released.

A bank guarantee is a promise from a lending institution that ensures the bank will step up if a debtor can't cover a debt. Letters of credit are also financial promises on behalf of one party in a transaction and are especially significant in international trade.

Letter of Guarantee for a Call Writer The letter of guarantee must be in a form that the exchange, and potentially the Options Clearing Corporation, accepts. The issuing bank agrees to give the broker the underlying securities if the call writer's account is assigned.

Answers (3) Yes, a guarantor to a loan can sue the principal debtor if he defaults and the guarantor had to pay on his behalf.

Guarantors resemble debtors, then, in that a guarantor, upon default by the primary debtor, owes payment on an obligation secured.

If the creditor takes possession of the collateral without the guarantor's consent, the guarantor can deduct the value of the collateral from what they owe as the guarantor. Other defenses The guarantor can also claim defenses separate from the debtor. For example, the guarantor can claim: Fraud.

To write a guarantor letter, start by writing the date at the top of the paper, followed by your full name and address. Below your information, address the letter to the company you're dealing with and begin the letter by identifying yourself and the person you're guaranteeing.

If you are a loan guarantor, keep an eye on the repayments of the borrower. Zulfiquar Memon, Managing Partner, MZM Legal says, In case a borrower has opted for a loan moratorium, then the guarantor should get a copy of the moratorium approval.

A guarantor letter is a legally binding document that commits a third-party cosigner to pay a future debt in case a person applying for credit defaults. The cosigner adds his creditworthiness and credentials to the transaction, buttressing the applicant's position so the transaction can be completed.