Iowa Reorganization of Partnership by Modification of Partnership Agreement

Description

How to fill out Reorganization Of Partnership By Modification Of Partnership Agreement?

Are you currently in a situation where you need documentation for organizational or personal reasons almost every day.

There is a myriad of legal document templates available online, but finding trustworthy ones isn't easy.

US Legal Forms offers a vast collection of form templates, such as the Iowa Reorganization of Partnership by Amendment of Partnership Agreement, which are designed to comply with state and federal requirements.

Once you find the correct form, click on Purchase now.

Select the pricing plan you want, fill in the necessary information to create your account, and pay for your order using PayPal or credit card. Choose a convenient file format and download your copy. Find all the document templates you’ve purchased in the My documents list. You can download another copy of Iowa Reorganization of Partnership by Amendment of Partnership Agreement at any time, simply select the specific form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service offers professionally crafted legal document templates that you can use for a variety of purposes. Create your account on US Legal Forms and start making your life a little easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Iowa Reorganization of Partnership by Amendment of Partnership Agreement template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Choose the form you need and ensure it is for your specific city/state.

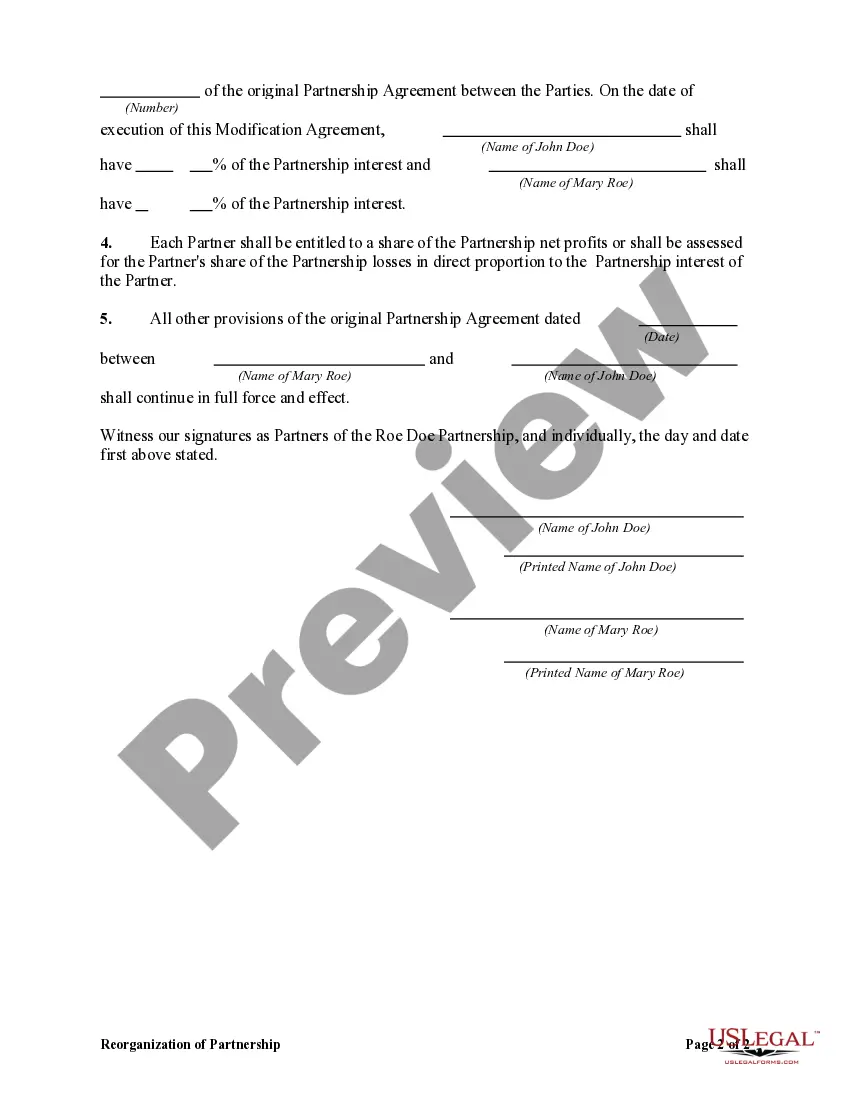

- Use the Review feature to examine the form.

- Read the description to confirm you have selected the appropriate form.

- If the form isn’t what you're looking for, use the Search feature to find the document that meets your requirements.

Form popularity

FAQ

Dissociation of a partnership occurs when a partner decides to leave the partnership, whether voluntarily or involuntarily. This could be the result of a partner's death, withdrawal, or expulsion due to a breach of agreement. A proper understanding of dissociation is crucial for the partnership’s stability, especially when considering an Iowa Reorganization of Partnership by Modification of Partnership Agreement, as it may affect the remaining partners.

A partnership may be dissolved under various circumstances, including the expiration of its term, mutual consent among partners, or injury to its purpose. A partnership can also be dissolved when legal battles arise, or if a partner becomes incapacitated. Understanding these conditions is vital, especially during the Iowa Reorganization of Partnership by Modification of Partnership Agreement process, as it may affect the partnership's future.

A partnership agreement becomes legally binding when it meets certain criteria, such as including clear terms, being signed by all partners, and complying with state laws. Specifically, an Iowa Reorganization of Partnership by Modification of Partnership Agreement must outline the roles, responsibilities, and obligations of each partner. It is essential that each partner understands and agrees to the terms to ensure its enforceability.

A partnership may be terminated in three primary ways: by mutual agreement, by operation of law, or by the completion of the partnership's purpose. Mutual agreement often occurs when partners decide to dissolve their partnership together. In some cases, a partnership may also be terminated automatically due to changes in regulations or specific events outlined in the partnership agreement.

Yes, most partnerships must file a Form 1065, except for specific types such as a single-member LLC. Filing this form is essential for accurately reporting income and activities to the IRS. During the Iowa Reorganization of Partnership by Modification of Partnership Agreement, ensure that your partnership fulfills this filing requirement to avoid penalties and maintain good standing.

The composite return for Iowa partnerships allows partnerships to file a single tax return on behalf of their non-resident partners. This simplifies the tax process, as non-resident partners do not need to file separate Iowa returns. It is particularly beneficial during an Iowa Reorganization of Partnership by Modification of Partnership Agreement, as it streamlines tax obligations and promotes efficient management of partnership finances.

A partnership return form is a document that partnerships file to report their earnings and tax obligations. This form provides a comprehensive overview of the partnership's financial activities for a tax year. If you're navigating the Iowa Reorganization of Partnership by Modification of Partnership Agreement, knowing this return form will facilitate proper documentation and maintain your compliance with state requirements.

The Form 1065 is a tax return used by partnerships to report their income, deductions, and other financial information. This return helps the IRS understand how much income the partnership generates and how it allocates profits and losses among partners. When dealing with the Iowa Reorganization of Partnership by Modification of Partnership Agreement, understanding Form 1065 is crucial for compliance and accurate reporting.

Iowa does generally require nonresident withholding for partnerships that distribute income to nonresident partners. This requirement helps ensure compliance with state tax laws and protects the interests of the state. As you navigate the intricacies of the Iowa reorganization of partnership by modification of partnership agreement, being aware of these withholding rules is vital.

Certain entities, such as trusts and some tax-exempt organizations, may be exempt from Iowa withholding on income. It's essential to check the specific criteria outlined by the Iowa Department of Revenue. Understanding these exemptions can simplify financial management, particularly in the context of the Iowa reorganization of partnership by modification of partnership agreement.