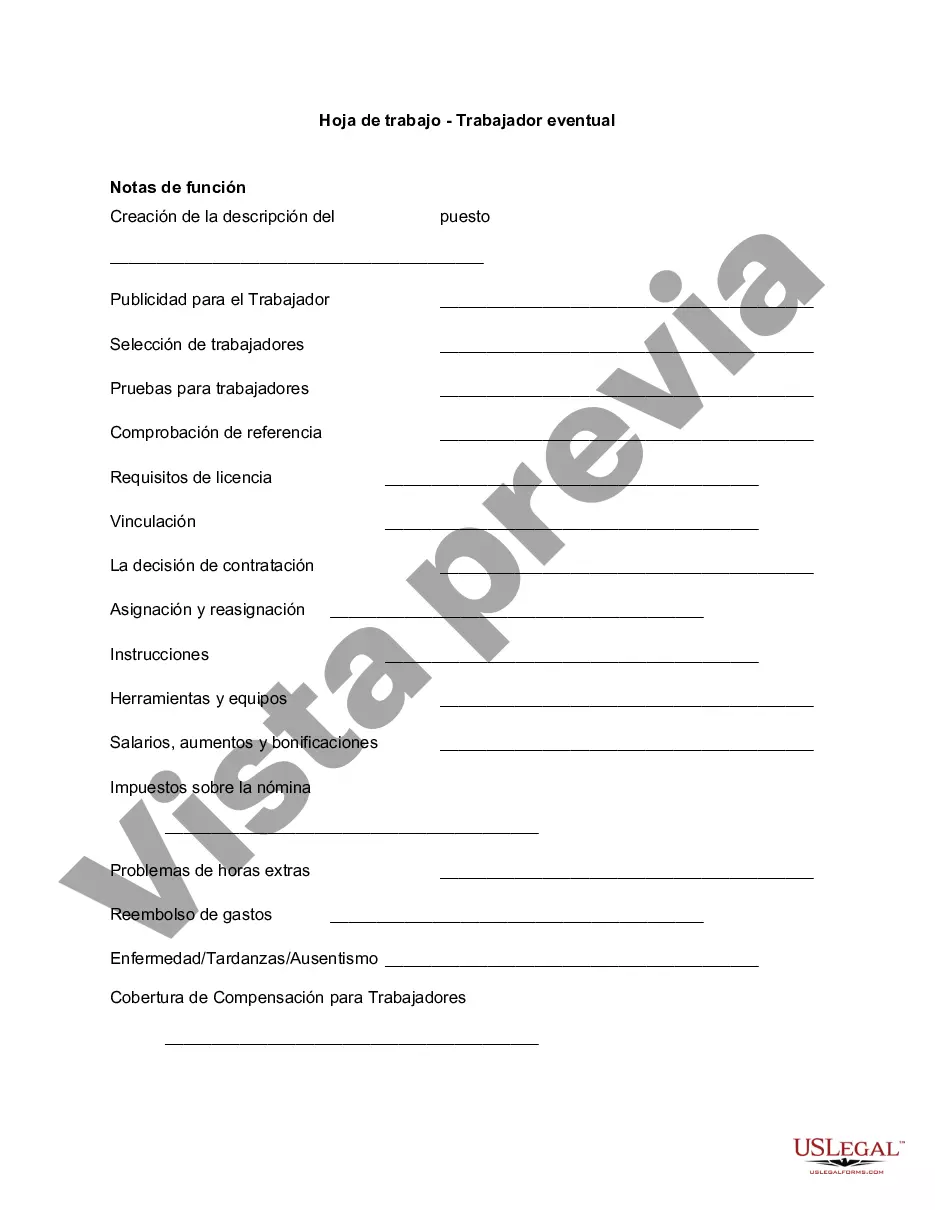

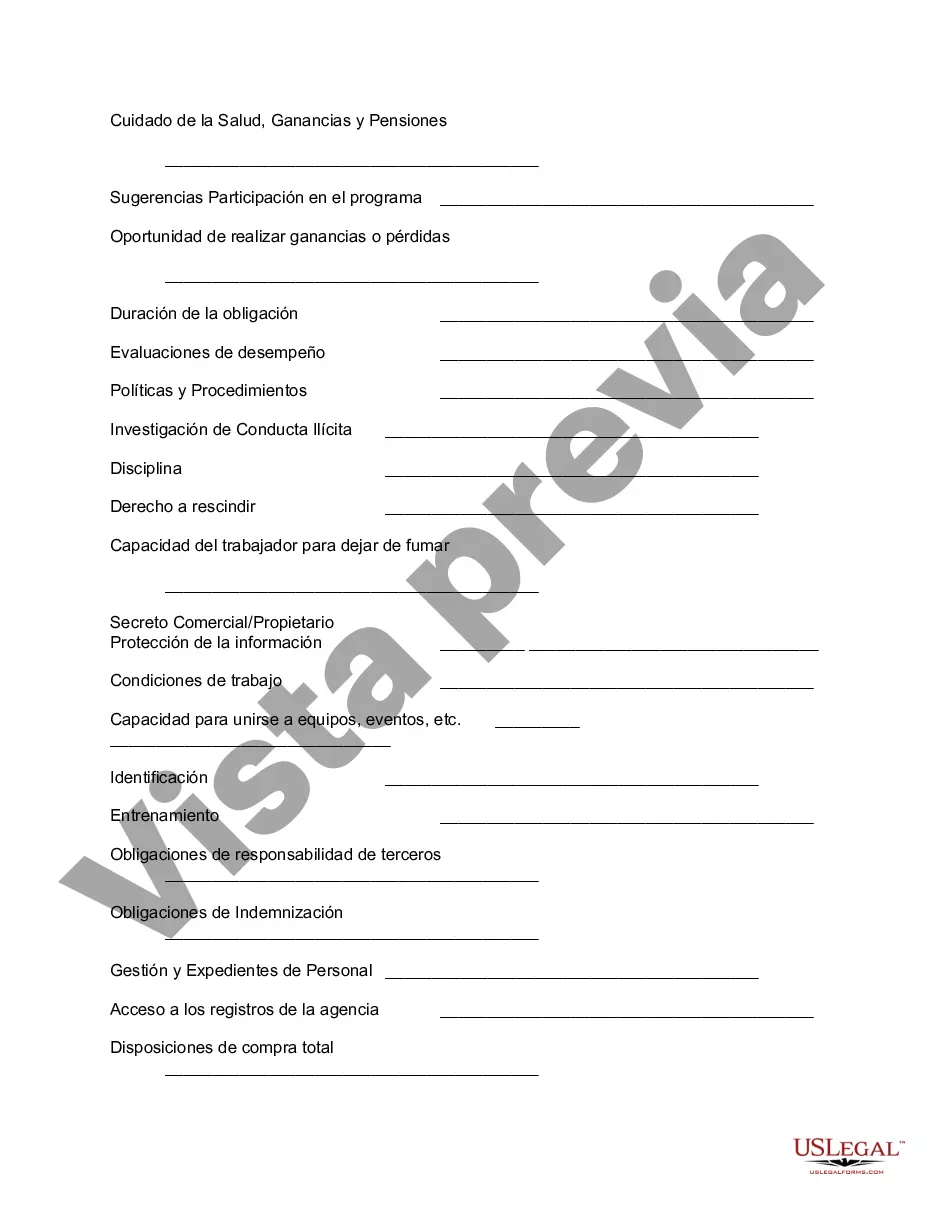

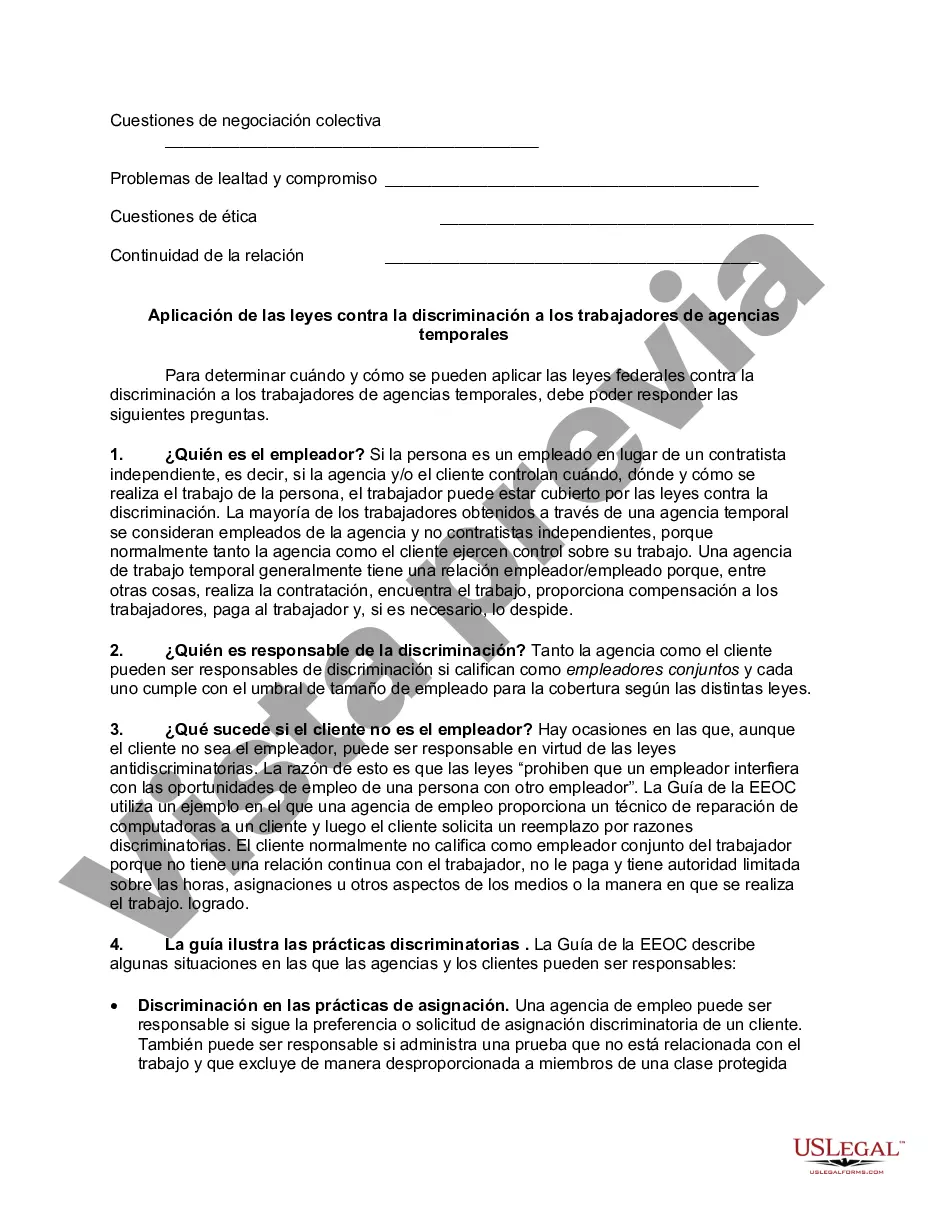

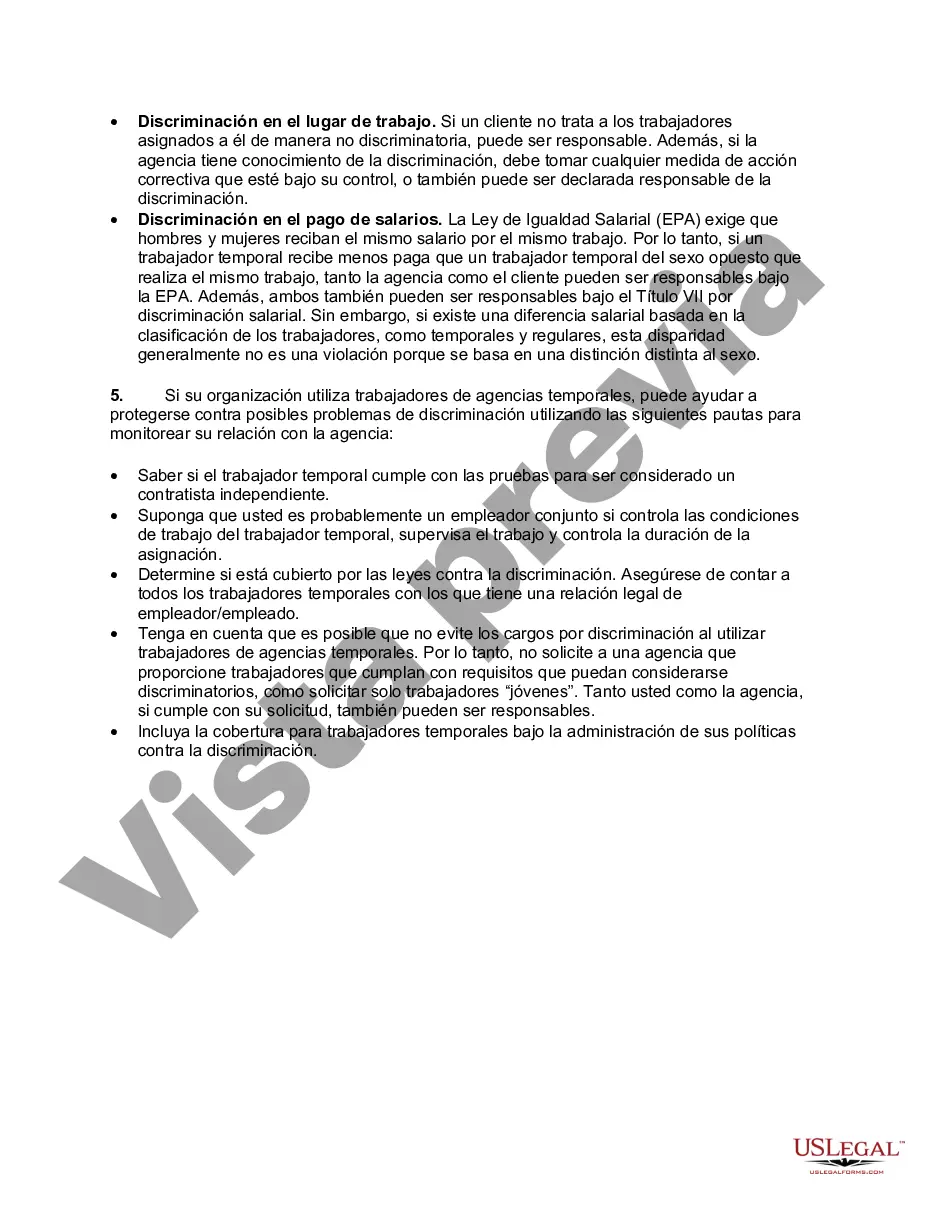

Iowa Worksheet — Contingent Worker is a form that is often used in Iowa to document information related to contingent workers. Contingent workers are individuals who are hired on a temporary or on-demand basis, usually through a staffing agency or as independent contractors. These workers are not considered employees of the company for which they perform services. The Iowa Worksheet — Contingent Worker is designed to collect important details regarding these workers, ensuring compliance with tax and labor regulations. This document includes various sections to record information such as the worker's full name, social security number or tax identification number, address, date of birth, and contact details. Moreover, the worksheet gathers information about the contingent worker's employer or client, including the name of the company, address, federal employer identification number (VEIN), and the nature of work being performed. Additionally, the form may include sections to gather details about the worker's compensation, such as the hourly rate, total hours worked, and payment frequency. This information assists in calculating the worker's wages, withholding taxes, and determining their eligibility for certain benefits or protections. While there may not be different types of Iowa Worksheets specifically tailored for contingent workers, variations of the worksheet can exist to accommodate specific industries or unique requirements. For instance, in certain sectors like healthcare or construction, additional fields may be included to capture specific certifications or safety-related information. Overall, the Iowa Worksheet — Contingent Worker serves as a vital tool for businesses and organizations who engage with contingent workers. It helps establish a comprehensive record of the worker's employment arrangement, facilitating correct taxation, complying with legal obligations, and ensuring fair treatment for these temporary personnel.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Iowa Hoja de trabajo - Trabajador eventual - Worksheet - Contingent Worker

Description

How to fill out Iowa Hoja De Trabajo - Trabajador Eventual?

If you want to total, acquire, or print lawful record web templates, use US Legal Forms, the biggest collection of lawful types, that can be found on-line. Utilize the site`s basic and hassle-free research to obtain the papers you will need. Numerous web templates for business and specific uses are categorized by categories and suggests, or keywords and phrases. Use US Legal Forms to obtain the Iowa Worksheet - Contingent Worker within a handful of click throughs.

If you are previously a US Legal Forms client, log in to your bank account and then click the Obtain option to find the Iowa Worksheet - Contingent Worker. You can even accessibility types you in the past saved inside the My Forms tab of the bank account.

Should you use US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the shape for that appropriate town/country.

- Step 2. Make use of the Preview solution to look over the form`s content. Never forget about to read through the explanation.

- Step 3. If you are unsatisfied with all the form, utilize the Search industry near the top of the screen to get other types in the lawful form template.

- Step 4. After you have located the shape you will need, click the Buy now option. Select the prices strategy you prefer and add your qualifications to register to have an bank account.

- Step 5. Method the financial transaction. You should use your credit card or PayPal bank account to finish the financial transaction.

- Step 6. Find the formatting in the lawful form and acquire it on your own device.

- Step 7. Complete, edit and print or indication the Iowa Worksheet - Contingent Worker.

Each lawful record template you get is your own property permanently. You may have acces to every form you saved with your acccount. Click the My Forms segment and select a form to print or acquire once again.

Be competitive and acquire, and print the Iowa Worksheet - Contingent Worker with US Legal Forms. There are millions of specialist and express-particular types you can utilize for your personal business or specific requires.