The Iowa General Power of Attorney for Bank Account Operations is a legal document that authorizes an assigned individual, commonly known as the agent or attorney-in-fact, to act on behalf of the principal or account holder in managing and making decisions regarding their bank accounts. This specific type of power of attorney provides the agent with the authority to perform a wide range of financial transactions and tasks related to the principal's bank accounts. With an Iowa General Power of Attorney for Bank Account Operations, the agent can handle several crucial activities including depositing and withdrawing funds, writing checks, making electronic transfers, managing investments, paying bills, accessing safe deposit boxes, and executing other financial functions associated with the principal's bank accounts. This power of attorney comes into effect upon signing and remains in effect until the principal revokes it, becomes incapacitated, or passes away. In Iowa, there may be different variations or types of General Power of Attorney for Bank Account Operations available, tailored to meet specific needs or circumstances. These variations include: 1. Limited General Power of Attorney for Bank Account Operations: This type of power of attorney grants the agent the authority to handle specific financial transactions or account operations designated by the principal. It limits the scope of the agent's powers, allowing them to only act within specific boundaries defined in the document. 2. Durable General Power of Attorney for Bank Account Operations: A durable power of attorney remains effective even if the principal becomes mentally incapacitated or unable to make decisions for themselves. It enables the agent to continue managing the principal's bank accounts and financial affairs during their incapacity. 3. Springing General Power of Attorney for Bank Account Operations: Unlike a durable power of attorney, a springing power of attorney only becomes effective if a certain event or condition, specified in the document, occurs. For instance, this could be the principal's incapacitation or a medical professional's determination of their inability to make decisions for themselves. It is crucial to consult with an attorney experienced in Iowa law to determine which type of General Power of Attorney for Bank Account Operations best suits your needs and to ensure that the document complies with all legal requirements in the state. Moreover, it is recommended to review and update this power of attorney periodically, especially after major life events or changes in the principal's financial circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Iowa Poder General para Operaciones de Cuentas Bancarias - General Power of Attorney for Bank Account Operations

Description

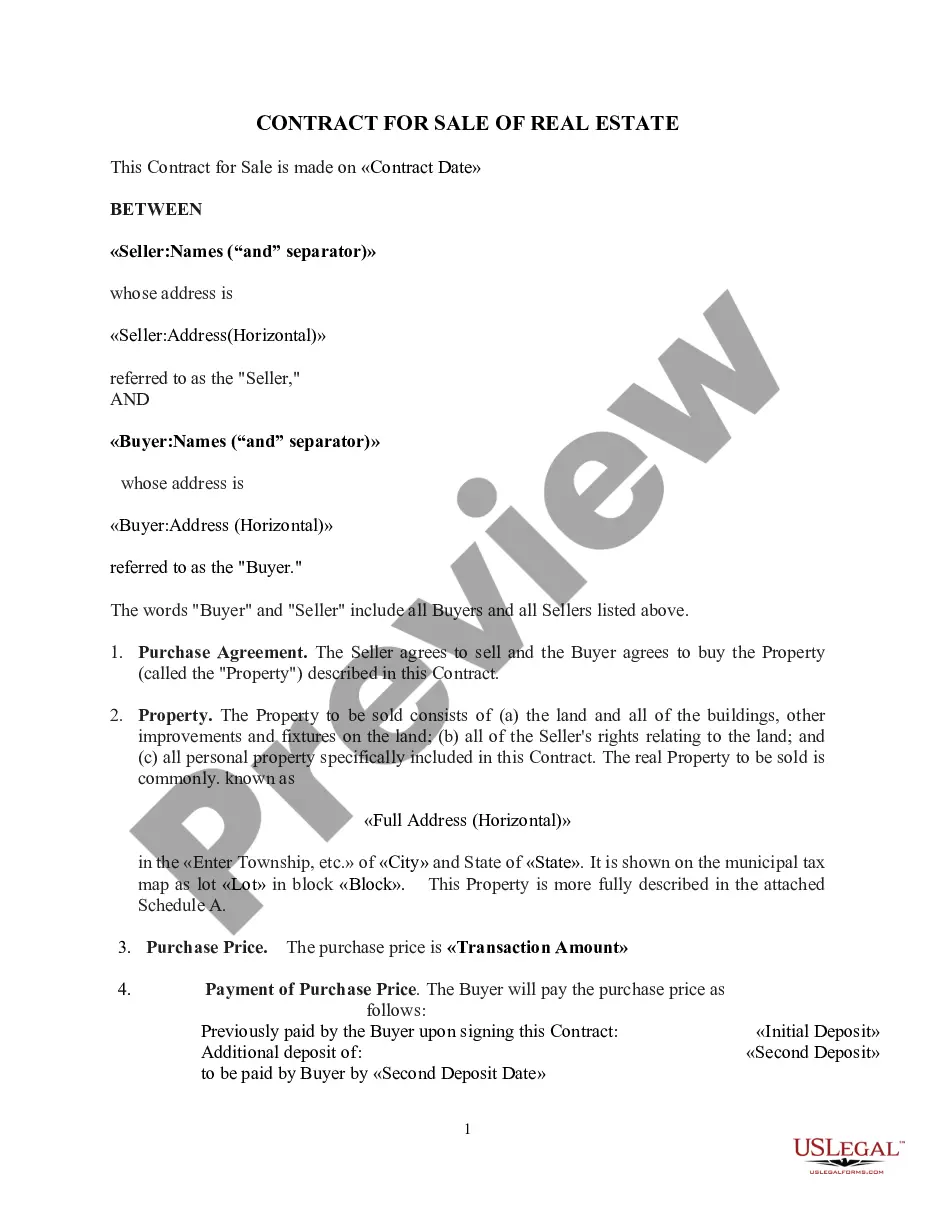

How to fill out Iowa Poder General Para Operaciones De Cuentas Bancarias?

Are you in the placement where you will need paperwork for sometimes company or specific functions nearly every working day? There are tons of lawful file themes available online, but locating ones you can trust isn`t easy. US Legal Forms offers 1000s of type themes, much like the Iowa General Power of Attorney for Bank Account Operations, that happen to be written in order to meet state and federal demands.

If you are already familiar with US Legal Forms site and possess a free account, basically log in. Following that, you can acquire the Iowa General Power of Attorney for Bank Account Operations design.

Unless you offer an account and want to begin to use US Legal Forms, abide by these steps:

- Find the type you require and ensure it is for the correct area/area.

- Utilize the Review switch to check the form.

- Look at the explanation to actually have selected the correct type.

- When the type isn`t what you are looking for, take advantage of the Research field to get the type that fits your needs and demands.

- Whenever you discover the correct type, just click Get now.

- Select the costs program you would like, complete the specified info to generate your money, and purchase the transaction utilizing your PayPal or Visa or Mastercard.

- Select a practical document format and acquire your duplicate.

Locate all of the file themes you may have bought in the My Forms food list. You can aquire a further duplicate of Iowa General Power of Attorney for Bank Account Operations any time, if necessary. Just go through the needed type to acquire or produce the file design.

Use US Legal Forms, one of the most comprehensive selection of lawful forms, to save lots of efforts and avoid faults. The assistance offers appropriately manufactured lawful file themes that you can use for a variety of functions. Make a free account on US Legal Forms and commence creating your life easier.