Iowa Equipment Lease with Lessor to Purchase Equipment Specified by Lessee is a type of leasing agreement in the state of Iowa, USA, that allows businesses and individuals to acquire essential equipment for their operations without the burden of upfront purchasing costs. This arrangement enables lessees to utilize equipment for a specific period while having the option to purchase it at the end of the lease term. With this lease agreement, lessees have the flexibility to specify the equipment they require for their operations. This can include a wide range of equipment types, such as construction machinery, agricultural implements, medical devices, office equipment, or any other necessary equipment essential for their respective industries. Iowa offers various types of equipment leases with lessor to purchase options that cater to the diverse needs of businesses and individuals. These leases are tailored to provide customized solutions based on the lessee's requirements. Some common variations of Iowa Equipment Lease with Lessor to Purchase Equipment Specified by Lessee include: 1. Construction Equipment Lease: This type of lease addresses the specific needs of construction companies by allowing them to lease heavy machinery, tools, and equipment required for construction projects. The lessee can specify the particular equipment required, such as excavators, bulldozers, cranes, or loaders. 2. Agricultural Equipment Lease: This lease is designed for farmers and agribusinesses in Iowa, who often require specialized equipment for planting, harvesting, or transporting crops. Lessees can specify equipment like tractors, combines, seeders, or sprayers, among others. 3. Medical Equipment Lease: Healthcare providers and facilities can benefit from this lease, enabling them to lease medical equipment such as MRI machines, X-ray equipment, ultrasound devices, or surgical instruments. 4. Office Equipment Lease: This type of lease caters to businesses in need of office-related equipment. It can include leasing computers, printers, copiers, telecommunication equipment, or other office supplies. Iowa Equipment Lease with Lessor to Purchase Equipment Specified by Lessee allows businesses and individuals to access state-of-the-art equipment without the financial strain associated with upfront purchases. Lessees can negotiate lease terms, including lease duration, monthly payments, and the purchase price if they decide to exercise the option to buy. This lease arrangement offers flexibility, efficiency, and cost-effectiveness while enabling lessees in Iowa to meet their equipment requirements and enhance their operational capabilities.

Iowa Equipment Lease with Lessor to Purchase Equipment Specified by Lessee

Description

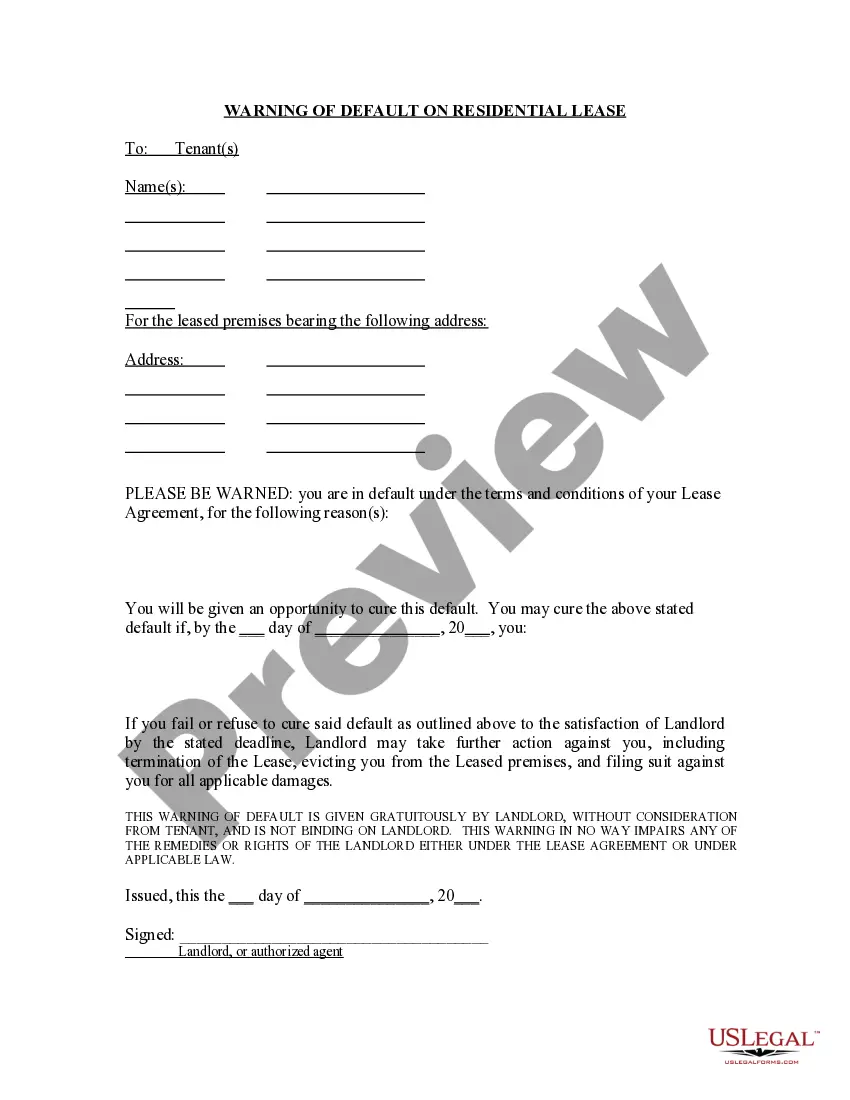

How to fill out Equipment Lease With Lessor To Purchase Equipment Specified By Lessee?

Have you been inside a place where you require paperwork for either organization or individual uses virtually every day? There are plenty of legal file templates available online, but finding versions you can depend on isn`t straightforward. US Legal Forms gives a large number of develop templates, such as the Iowa Equipment Lease with Lessor to Purchase Equipment Specified by Lessee, that are published to fulfill federal and state needs.

In case you are presently familiar with US Legal Forms web site and have a free account, basically log in. After that, you may download the Iowa Equipment Lease with Lessor to Purchase Equipment Specified by Lessee template.

Should you not come with an account and would like to begin to use US Legal Forms, follow these steps:

- Get the develop you want and ensure it is for your appropriate metropolis/state.

- Take advantage of the Preview button to review the form.

- Look at the description to actually have selected the correct develop.

- In the event the develop isn`t what you`re looking for, take advantage of the Lookup field to obtain the develop that meets your needs and needs.

- If you get the appropriate develop, click on Acquire now.

- Choose the pricing plan you desire, submit the required information to make your bank account, and purchase the transaction with your PayPal or bank card.

- Select a hassle-free file formatting and download your copy.

Find each of the file templates you have bought in the My Forms food selection. You can aquire a additional copy of Iowa Equipment Lease with Lessor to Purchase Equipment Specified by Lessee whenever, if possible. Just go through the necessary develop to download or produce the file template.

Use US Legal Forms, the most extensive assortment of legal forms, to save time and prevent mistakes. The service gives appropriately made legal file templates which can be used for an array of uses. Generate a free account on US Legal Forms and start producing your life easier.

Form popularity

FAQ

The following are considered sales of tangible personal property and are taxable: Engraving. Equipment and tangible personal property rental.

In the state of Iowa, any rentals for a minimum of 60 days will be considered to be subject to additional automobile rental excise tax. Any leases for at least one year is considered to be exempt from general use tax, but will be subject to the long-term lease tax.

Iowa does generally charge sales tax on the renting and leasing of tangible personal property unless a specific exemption applies.

Sales tax applies to flourless granola bars, chewing gum, pet food, cigarettes, firearms and soda pop. But plain bulk sugar is exempt. Breakfast cereals, bottled water, cakes, cookies and ice cream, take-and-bake pizza, napkins, paper plates, milk and eggnog are also sales tax-free.

The three main types of leasing are finance leasing, operating leasing and contract hire.

A lease will always have at least two parties: the lessor and the lessee. The lessor is the person or business that owns the equipment. The lessee is the person or business renting the equipment. The lessee will make payments to the lessor throughout the contract.

What is equipment leasing? Equipment leasing is a type of financing in which you rent equipment rather than purchase it outright. You can lease expensive equipment for your business, such as machinery, vehicles or computers.

What is equipment leasing? Equipment leasing is a type of financing in which you rent equipment rather than purchase it outright. You can lease expensive equipment for your business, such as machinery, vehicles or computers.

Learn more about Equipment Leasing!Sale/Leaseback: (allows you to use your equipment to get working capital)True Lease or Operating Equipment Leases: (Also known as fair market value leases)The P.U.T. Option Lease (Purchase upon Termination)TRAC Equipment Leases.More items...

Equipment renting payments are considered external expenses and are therefore deductible from the company's taxable profit under common law provisions. This taxable profit determines the taxable portion of earnings for corporation tax, or income tax.