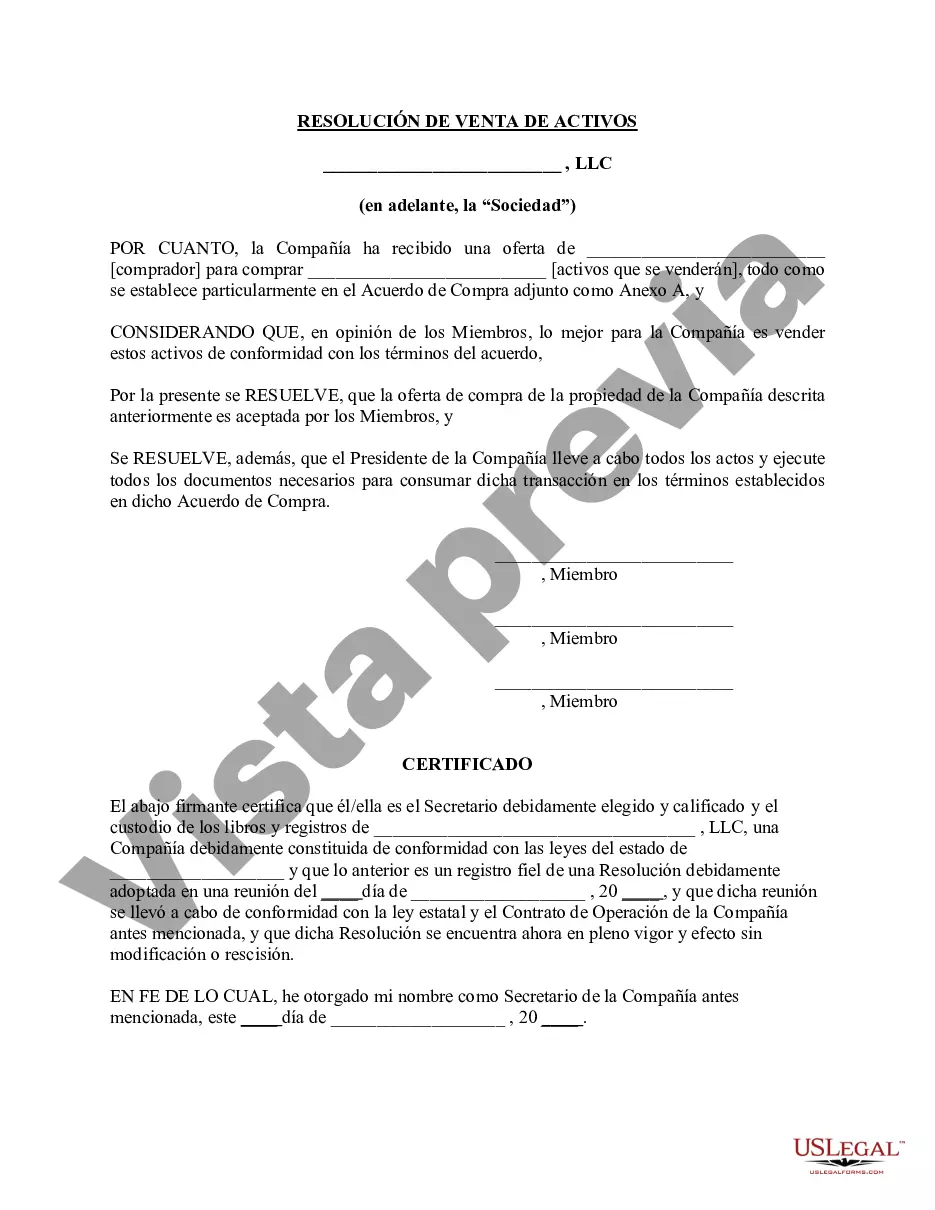

Iowa Resolution of Meeting of LLC Members to Sell Assets is a legally binding document that outlines the decision of LLC members to sell the assets of the company. By implementing this resolution, LLC members can collectively agree to undertake the process of selling the company's assets, thereby ensuring transparency, legality, and proper consent. When drafting an Iowa Resolution of Meeting of LLC Members to Sell Assets, certain keywords must be included to ensure its relevance and accuracy. These keywords include: 1. Iowa: This keyword signifies that the resolution is designed specifically for the state of Iowa and is compliant with its laws and regulations. It ensures that the resolution is valid and enforceable within the jurisdiction. 2. Resolution: This keyword denotes that the document is a formal decision or an agreement made by the members of the LLC. It conveys the sense of authority and importance associated with the decision to sell assets. 3. Meeting: This term represents the gathering or assembly of LLC members where the proposed sale of assets was discussed and resolved. It emphasizes the importance of proper communication and deliberation among the members in reaching a consensus. 4. LLC Members: This keyword points to the owners or individuals who hold ownership stakes in the limited liability company. It highlights that the resolution must be agreed upon by all relevant members to carry out the sale of assets collectively. 5. Sell Assets: This phrase specifies that the purpose of the resolution is to authorize the sale of the company's assets. It can encompass various types of assets, including real estate, equipment, intellectual property, or any other property owned by the LLC. Different types of Iowa Resolutions of Meetings of LLC Members to Sell Assets typically revolve around specific scenarios or circumstances. Some possible variations may include: 1. General Resolution: This type of resolution is a broad authorization to sell any assets of the LLC, giving the members flexibility in choosing which assets are to be sold. 2. Specific Asset Resolution: In this case, the resolution specifically targets the sale of a particular asset or group of assets. The resolution would outline the details of the asset(s) involved, such as a specific property or a particular type of equipment. 3. Percentage-Based Resolution: This type of resolution allows the LLC members to collectively decide on selling a predetermined percentage of the company's total assets. It specifies the proportion of assets that can be sold, ensuring certain limits or constraints are in place. 4. Time-limited Resolution: This resolution sets a defined timeframe during which the sale of assets is authorized. This type of resolution might be useful in situations where immediate action is required, such as a time-sensitive business opportunity or financial urgency. It is important to consult with legal professionals or experts in Iowa's business laws to determine the most appropriate type of Iowa Resolution of Meeting of LLC Members to Sell Assets for a specific situation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Iowa Resolución de la reunión de miembros de la LLC para vender activos - Resolution of Meeting of LLC Members to Sell Assets

Description

How to fill out Iowa Resolución De La Reunión De Miembros De La LLC Para Vender Activos?

You are able to commit time on the Internet attempting to find the authorized file design that fits the state and federal requirements you will need. US Legal Forms gives a huge number of authorized forms which are evaluated by professionals. You can easily obtain or produce the Iowa Resolution of Meeting of LLC Members to Sell Assets from my assistance.

If you already possess a US Legal Forms bank account, you may log in and then click the Acquire switch. Next, you may complete, edit, produce, or signal the Iowa Resolution of Meeting of LLC Members to Sell Assets. Each authorized file design you acquire is your own property eternally. To have yet another backup associated with a purchased develop, proceed to the My Forms tab and then click the related switch.

If you work with the US Legal Forms web site the first time, keep to the basic instructions below:

- Very first, make sure that you have chosen the correct file design to the area/town of your choice. See the develop explanation to make sure you have picked the right develop. If readily available, use the Review switch to appear throughout the file design too.

- If you want to get yet another version in the develop, use the Lookup industry to get the design that meets your needs and requirements.

- When you have identified the design you would like, click on Acquire now to continue.

- Select the rates prepare you would like, enter your references, and sign up for an account on US Legal Forms.

- Total the deal. You can use your charge card or PayPal bank account to fund the authorized develop.

- Select the structure in the file and obtain it to the device.

- Make adjustments to the file if required. You are able to complete, edit and signal and produce Iowa Resolution of Meeting of LLC Members to Sell Assets.

Acquire and produce a huge number of file web templates utilizing the US Legal Forms Internet site, that provides the greatest selection of authorized forms. Use expert and status-certain web templates to deal with your company or individual requirements.

Form popularity

FAQ

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...

An LLC member resolution is the written record of a member vote authorizing a specific business action. Formal resolutions aren't necessary for small, everyday decisions. However, they're useful for granting authority to members to transact significant business actions, such as taking out a loan on behalf of the LLC.

What should a resolution to open a bank account include?LLC name and address.Bank name and address.Bank account number.Date of meeting when resolution was adopted.Certifying signature and date.

All Resolved clauses within a resolution should use the objective form of the verb (for example, Resolved, that the American Library Association (ALA), on behalf of its members: (1) supports...; (2) provides...; and last resolved urges....") rather than the subjunctive form of the verb (for example, Resolved,

Elements of a Certified Board ResolutionExplanation of the action being taken by the board of directors and the reason for doing so. Name of the secretary. Legal name of the corporation and state of incorporation. Names of the board of directors voting for approval of the resolution.

An LLC does not have to make resolutions, but there are times it could be useful: An LLC member makes a decision regarding the business's organization. A member must establish their authority to open a bank account for the LLC. Members must prove their authority to sign a loan on the LLC's behalf.

A corporate resolution form is used by a board of directors. Its purpose is to provide written documentation that a business is authorized to take specific action. This form is most often used by limited liability companies, s-corps, c-corps, and limited liability partnerships.

How to Write a ResolutionFormat the resolution by putting the date and resolution number at the top.Form a title of the resolution that speaks to the issue that you want to document.Use formal language in the body of the resolution, beginning each new paragraph with the word, whereas.More items...?