If you are an investor looking to confirm your accredited investor status in Iowa, there are certain documentation requirements that you need to fulfill. Iowa has specific guidelines and regulations to determine the accredited investor status. To help you understand the process better, we will provide a detailed description of the Iowa Documentation Required to Confirm Accredited Investor Status, along with relevant keywords and types of documentation. Iowa follows the guidelines provided by the Securities and Exchange Commission (SEC) to determine accredited investor status. According to the SEC, an accredited investor is an individual or entity that meets certain income or net worth thresholds, demonstrating their financial sophistication and ability to bear the risks associated with investing in certain securities. To confirm your accredited investor status in Iowa, the following documentation may be required: 1. Income Verification: — Tax Returns: Providing copies of the past two years' federal tax returns, including all schedules and attachments, can help validate your income. — W-2 Forms: Submitting your W-2 forms for the previous two years can provide evidence of your income. — Pay Stubs: Presenting recent pay stubs showcasing your current income can support your claim as an accredited investor. — 1099 Forms: If you receive income from sources other than employment, such as investment income or rentals, providing the relevant 1099 forms can help verify your income. 2. Net Worth Verification: — Bank Statements: Submitting bank statements for the previous three months can help confirm your net worth. — Brokerage Statements: Providing statements from brokerage accounts, including investment holdings, can establish your net worth. — Property Valuations: Presenting property valuations, such as real estate appraisals or market evaluations, can contribute to your net worth calculation. — Loan Statements: Furnishing details of outstanding loans or mortgages can be used to offset the liabilities while calculating your net worth. 3. Professional Certification: — CPA Certification: Providing a certificate from a Certified Public Accountant (CPA) can validate your income and net worth figures. — Attorney Certification: Obtaining a declaration from an attorney affirming your financial status can help support your accredited investor claim. It is important to note that additional documentation may be requested by regulators or investment firms to confirm your accredited investor status, depending on the specific circumstances. Therefore, it is advisable to consult with legal and financial professionals to ensure you fulfill all necessary documentation requirements accurately and comprehensively. Keywords: Iowa, Documentation Required, Confirm Accredited Investor Status, income verification, tax returns, W-2 forms, pay stubs, 1099 forms, net worth verification, bank statements, brokerage statements, property valuations, loan statements, professional certification, CPA certification, attorney certification.

Iowa Documentation Required to Confirm Accredited Investor Status

Description

How to fill out Iowa Documentation Required To Confirm Accredited Investor Status?

You can invest time on the Internet trying to find the legitimate file template that fits the federal and state demands you want. US Legal Forms offers a huge number of legitimate varieties that are evaluated by specialists. It is simple to download or produce the Iowa Documentation Required to Confirm Accredited Investor Status from the support.

If you already possess a US Legal Forms account, you can log in and click the Acquire switch. After that, you can total, revise, produce, or indicator the Iowa Documentation Required to Confirm Accredited Investor Status. Each and every legitimate file template you get is your own forever. To acquire another copy of any obtained form, go to the My Forms tab and click the related switch.

If you work with the US Legal Forms internet site initially, stick to the easy recommendations below:

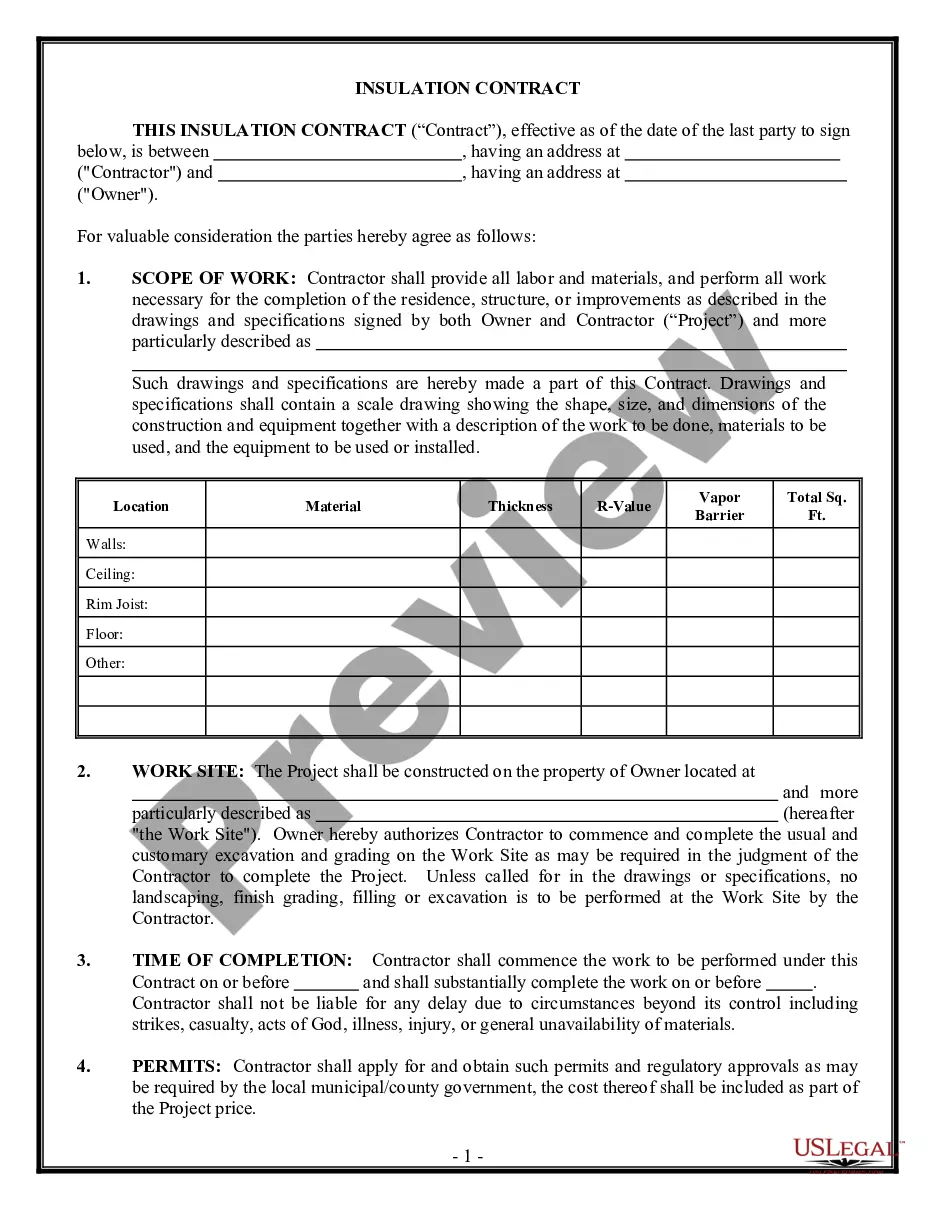

- Initial, make certain you have selected the correct file template for that area/area of your choice. Read the form information to ensure you have picked out the proper form. If available, make use of the Preview switch to search with the file template too.

- In order to locate another model of the form, make use of the Lookup area to get the template that fits your needs and demands.

- Upon having discovered the template you desire, click Get now to carry on.

- Pick the pricing program you desire, type your qualifications, and register for an account on US Legal Forms.

- Full the deal. You can use your charge card or PayPal account to purchase the legitimate form.

- Pick the format of the file and download it in your system.

- Make alterations in your file if possible. You can total, revise and indicator and produce Iowa Documentation Required to Confirm Accredited Investor Status.

Acquire and produce a huge number of file themes utilizing the US Legal Forms site, that offers the most important selection of legitimate varieties. Use professional and state-distinct themes to tackle your business or person requires.