The Idaho Order Refunding Bond is a financial instrument issued by the state of Idaho to refinance existing debt obligations. These bonds are primarily used to replace higher interest rate bonds with lower interest rate ones in order to reduce the overall cost of debt. The Idaho Order Refunding Bond serves as a way for the state government to save money by refinancing outstanding debt at more favorable terms. It can result in significant interest savings, allowing the state to free up funds for other important projects and initiatives. There are several types of Idaho Order Refunding Bonds, each designed to cater to specific financing needs. These include: 1. General Obligation Refunding Bonds: These bonds are backed by the full faith and credit of the state. They are used to refinancing general obligation debt that was issued for various purposes such as infrastructure development, education, or public safety. 2. Revenue Refunding Bonds: These bonds are secured by specific revenue sources such as tolls, fees, or dedicated taxes. They are used to refunding debt that was initially issued to finance revenue-generating projects, such as highways, utilities, or public facilities. 3. Special Tax Refunding Bonds: These bonds are secured by special taxes, such as sales taxes or hotel occupancy taxes. They are used to refunding debt that was initially issued for specific projects or purposes, such as tourism promotion or environmental initiatives. 4. Municipal Utility Refunding Bonds: These bonds are issued by municipal utility authorities to refund debt related to the construction or improvement of utility infrastructure. They help reduce utility bills for residents by lowering the cost of debt service. Overall, the Idaho Order Refunding Bond program plays a crucial role in the state's financial management strategy. By refinancing existing debt obligations, the state can achieve interest savings, improve its credit profile, and ensure better financial stability for the benefit of its residents.

Idaho Order Refunding Bond

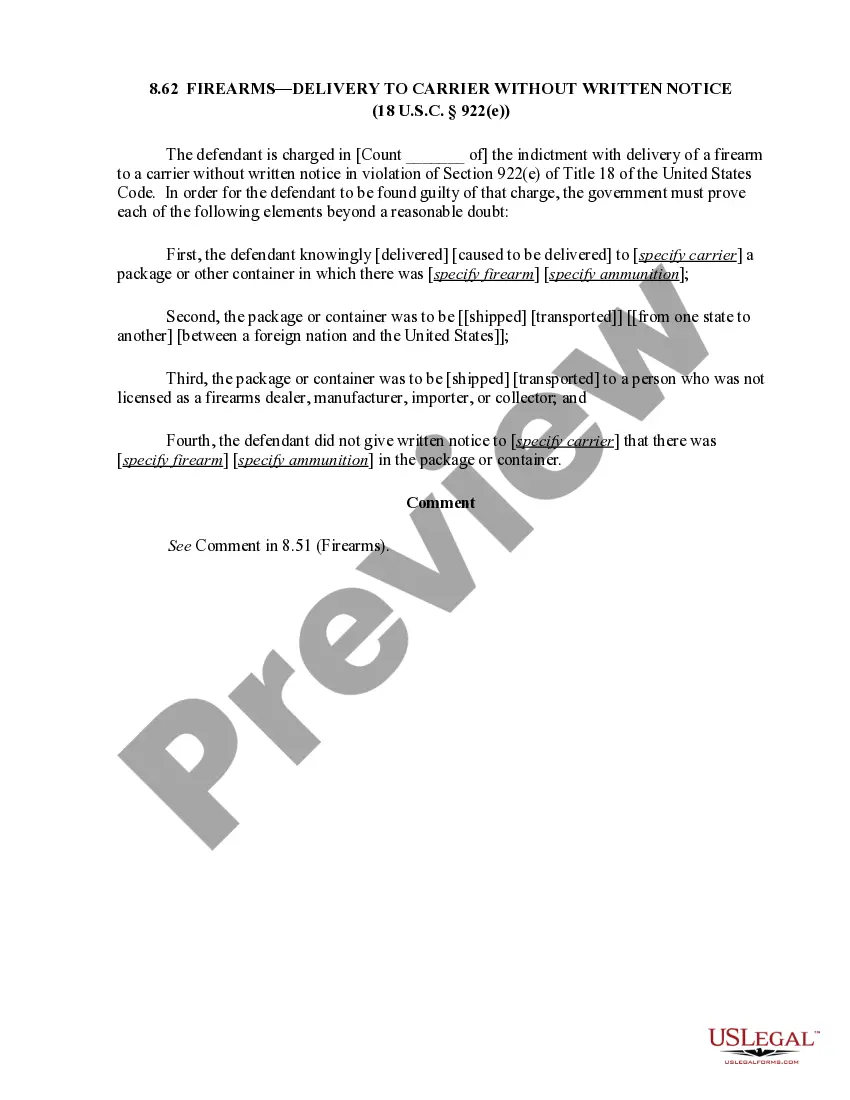

Description

How to fill out Idaho Order Refunding Bond?

If you wish to comprehensive, obtain, or print out legal file templates, use US Legal Forms, the most important assortment of legal types, that can be found on-line. Take advantage of the site`s easy and practical lookup to discover the documents you need. Various templates for business and person purposes are sorted by classes and says, or keywords. Use US Legal Forms to discover the Idaho Order Refunding Bond within a few mouse clicks.

Should you be currently a US Legal Forms buyer, log in to the bank account and click on the Obtain key to get the Idaho Order Refunding Bond. You can even access types you in the past acquired from the My Forms tab of your own bank account.

Should you use US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the shape for that appropriate area/region.

- Step 2. Use the Preview solution to look through the form`s articles. Never overlook to see the explanation.

- Step 3. Should you be unhappy using the kind, utilize the Lookup discipline on top of the screen to discover other variations in the legal kind format.

- Step 4. Once you have found the shape you need, go through the Acquire now key. Opt for the costs prepare you like and put your qualifications to sign up on an bank account.

- Step 5. Procedure the financial transaction. You can use your credit card or PayPal bank account to accomplish the financial transaction.

- Step 6. Select the structure in the legal kind and obtain it in your device.

- Step 7. Full, change and print out or sign the Idaho Order Refunding Bond.

Each legal file format you acquire is the one you have eternally. You have acces to every kind you acquired in your acccount. Click the My Forms segment and select a kind to print out or obtain yet again.

Compete and obtain, and print out the Idaho Order Refunding Bond with US Legal Forms. There are many skilled and state-specific types you can use for the business or person demands.