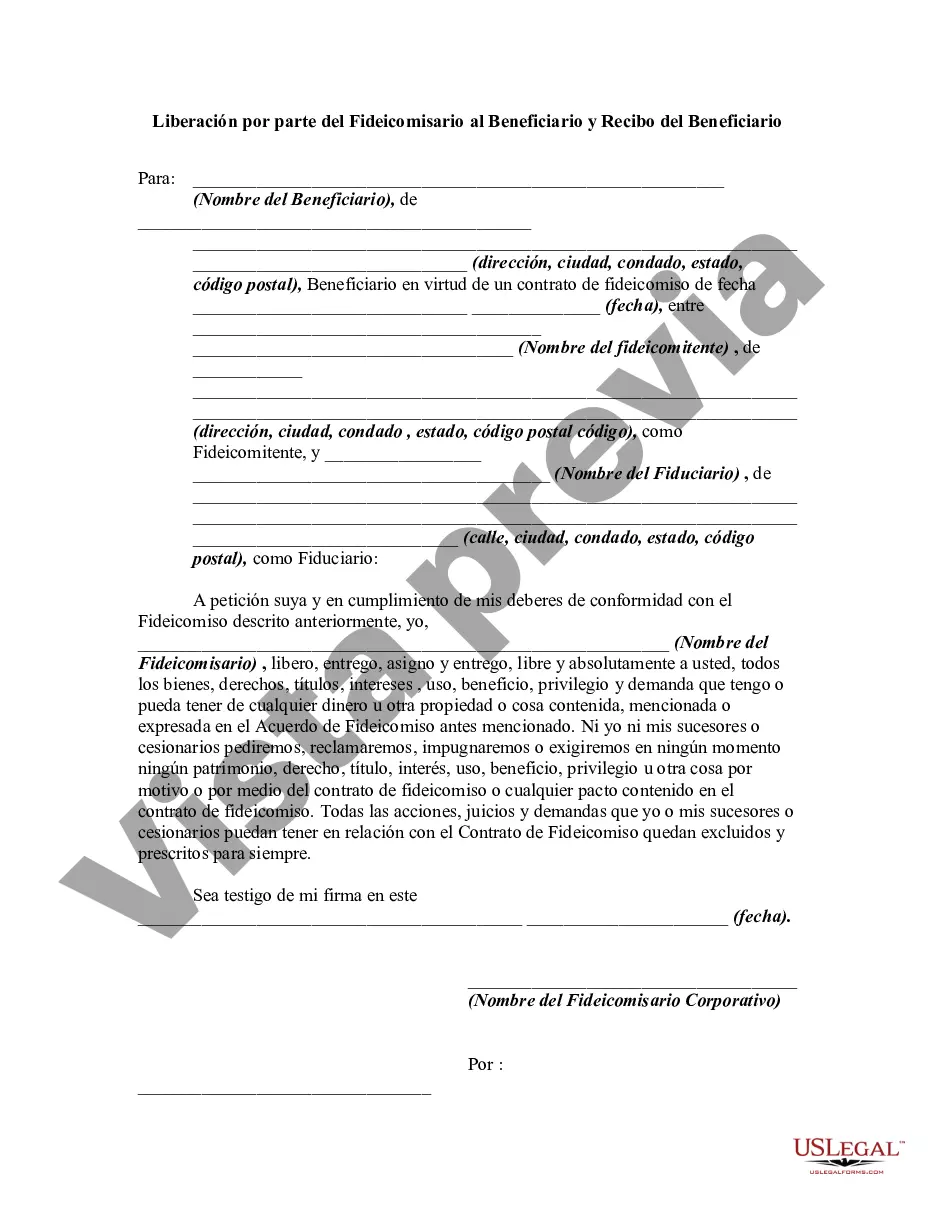

This form is a sample of a release given by the trustee of a trust agreement transferring all property held by the trustee pursuant to the trust agreement to the beneficiary and releasing all claims to the said property. This form assumes that the trust has ended and that the beneficiary has requested release of the property to him/her. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Idaho Release by Trustee to Beneficiary and Receipt from Beneficiary are legal documents that play a pivotal role in the administration of trusts in the state of Idaho. These documents indicate the transfer of assets or property from the trustee to the beneficiary, releasing the trustee from any further obligations. The Idaho Release by Trustee to Beneficiary and Receipt from Beneficiary serves as proof of the final distribution made by the trustee to the beneficiary, effectively closing the trust. It signifies the completion of the trust's purpose and ensures that all assets are appropriately transferred to the beneficiary. Different types of Idaho Release by Trustee to Beneficiary and Receipt from Beneficiary may include: 1. Full Release and Receipt: This document is used when the trust administration is concluded, and the trustee has fully carried out all necessary actions to distribute the trust's assets to the beneficiary. It releases the trustee from any further responsibility related to the trust. 2. Partial Release and Receipt: In some cases, a trust may be structured in a way that allows for partial distributions over time or based on certain conditions. This type of release and receipt acknowledges the trustee's partial transfer of assets to the beneficiary, while indicating that the trust remains active for further distributions. 3. Final Release and Receipt: When a trust is nearing its completion and only a final distribution is pending, this type of release and receipt is used. It acknowledges that the trustee has performed their duties to the fullest extent, and the beneficiary acknowledges receipt of the remaining assets or property. All Idaho Release by Trustee to Beneficiary and Receipt from Beneficiary documents typically require key information, including the names and contact details of the trustee and beneficiary, the details of the trust being administered, a detailed list of distributed assets, and the date of the release. It's important for both parties to understand the legal implications of signing such documents. The beneficiary should ensure that they have received all entitled assets, while the trustee should verify the completion of their duties before signing the release and receipt. Consulting an experienced attorney specializing in trust administration is highly recommended drafting or review the Idaho Release by Trustee to Beneficiary and Receipt from Beneficiary, as it is essential to comply with the laws and regulations governing trusts in Idaho.Idaho Release by Trustee to Beneficiary and Receipt from Beneficiary are legal documents that play a pivotal role in the administration of trusts in the state of Idaho. These documents indicate the transfer of assets or property from the trustee to the beneficiary, releasing the trustee from any further obligations. The Idaho Release by Trustee to Beneficiary and Receipt from Beneficiary serves as proof of the final distribution made by the trustee to the beneficiary, effectively closing the trust. It signifies the completion of the trust's purpose and ensures that all assets are appropriately transferred to the beneficiary. Different types of Idaho Release by Trustee to Beneficiary and Receipt from Beneficiary may include: 1. Full Release and Receipt: This document is used when the trust administration is concluded, and the trustee has fully carried out all necessary actions to distribute the trust's assets to the beneficiary. It releases the trustee from any further responsibility related to the trust. 2. Partial Release and Receipt: In some cases, a trust may be structured in a way that allows for partial distributions over time or based on certain conditions. This type of release and receipt acknowledges the trustee's partial transfer of assets to the beneficiary, while indicating that the trust remains active for further distributions. 3. Final Release and Receipt: When a trust is nearing its completion and only a final distribution is pending, this type of release and receipt is used. It acknowledges that the trustee has performed their duties to the fullest extent, and the beneficiary acknowledges receipt of the remaining assets or property. All Idaho Release by Trustee to Beneficiary and Receipt from Beneficiary documents typically require key information, including the names and contact details of the trustee and beneficiary, the details of the trust being administered, a detailed list of distributed assets, and the date of the release. It's important for both parties to understand the legal implications of signing such documents. The beneficiary should ensure that they have received all entitled assets, while the trustee should verify the completion of their duties before signing the release and receipt. Consulting an experienced attorney specializing in trust administration is highly recommended drafting or review the Idaho Release by Trustee to Beneficiary and Receipt from Beneficiary, as it is essential to comply with the laws and regulations governing trusts in Idaho.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.