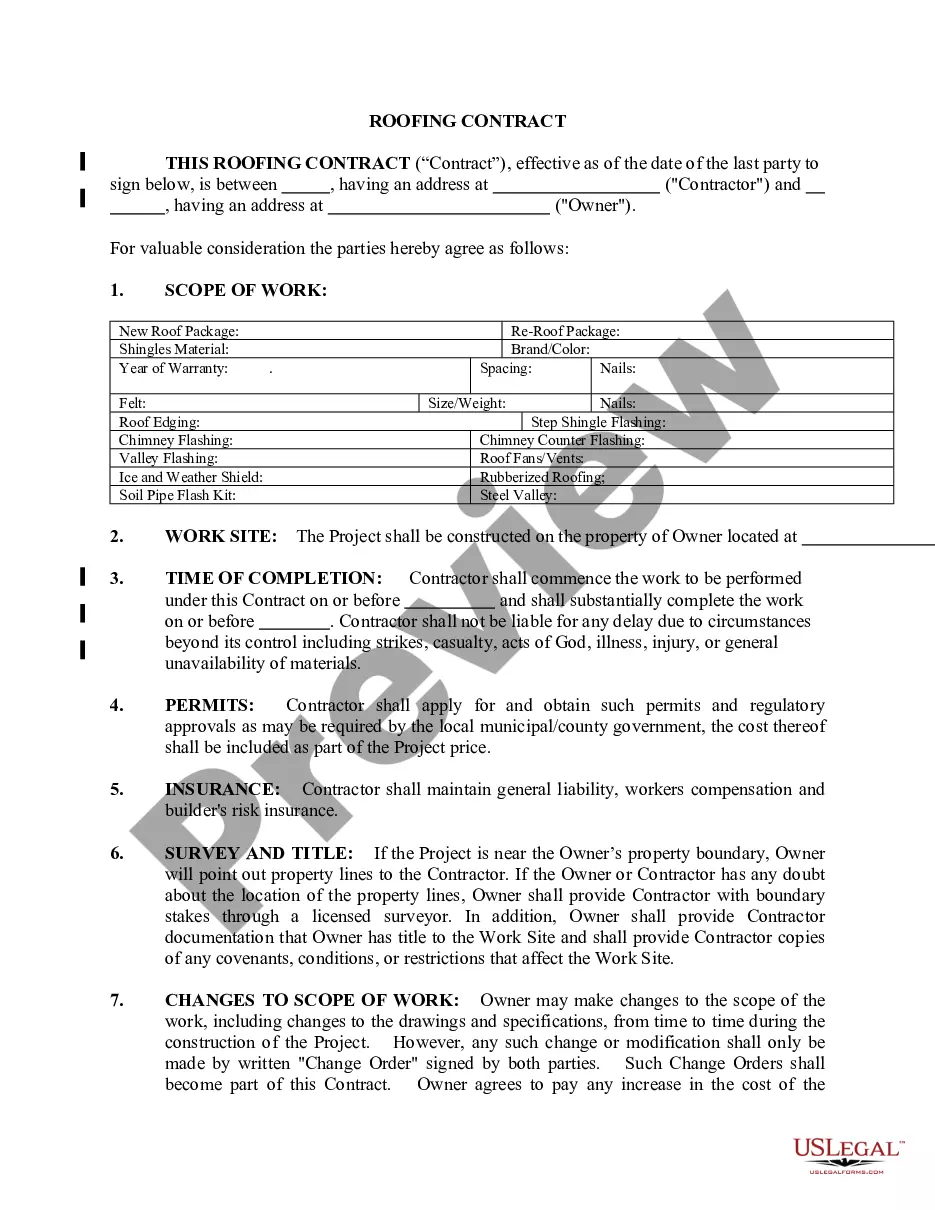

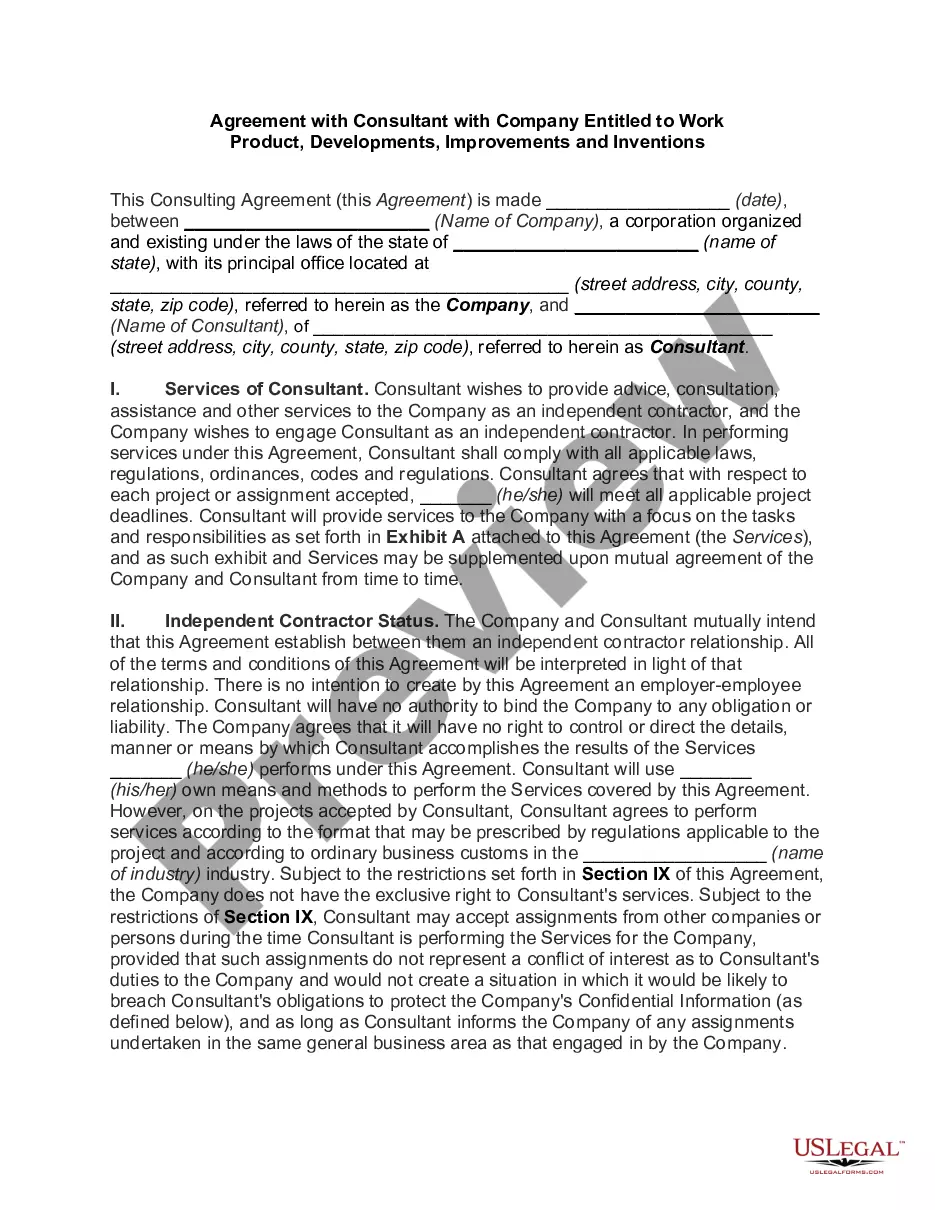

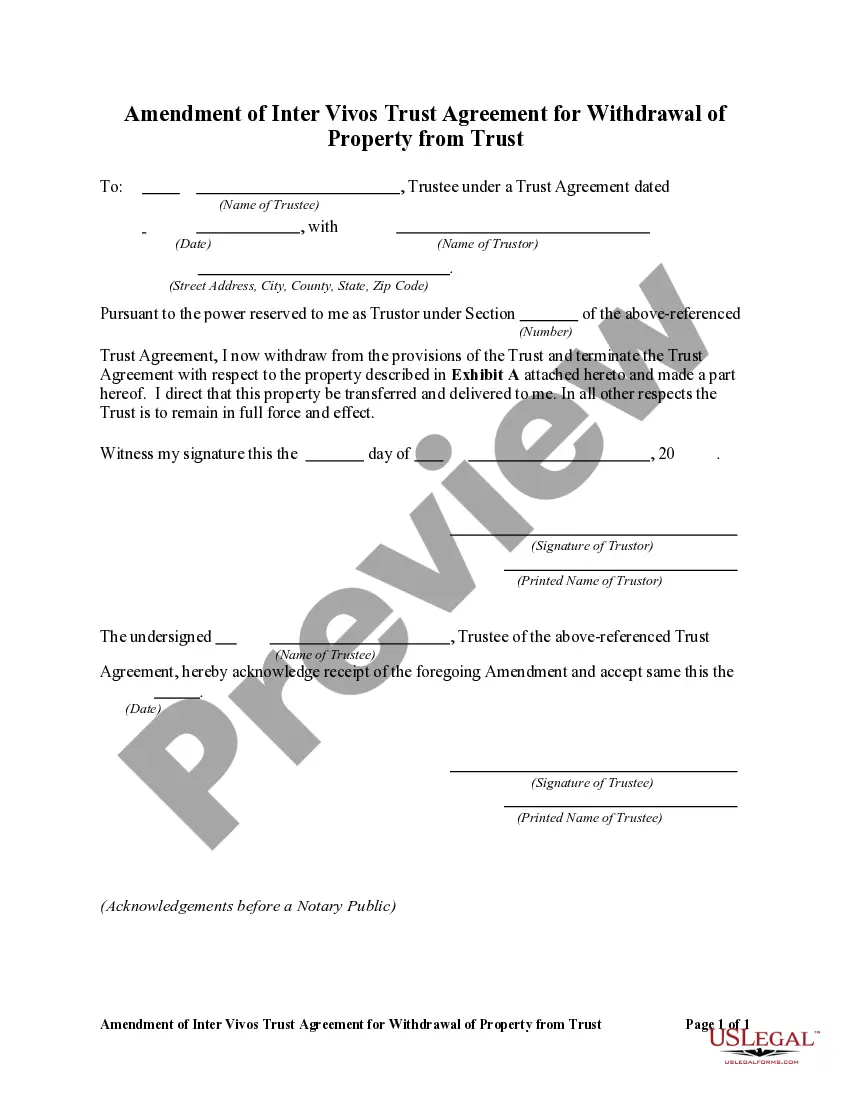

The Idaho Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust is an important legal document that allows individuals in Idaho to modify their existing inter vivos trust agreements and make changes regarding the withdrawal of specific property from the trust. This amendment ensures that trust creators have the flexibility to update and adjust their trusts as their circumstances change over time. When it comes to the different types of Idaho Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust, there are several categories that may be relevant, depending on the specific circumstances of the trust. Some of these categories include: 1. Real Estate Withdrawal Amendment: This type of amendment allows the trust creator to withdraw specific real estate properties from the trust. It provides a detailed description of the property being withdrawn, including its legal description, address, and any relevant documentation pertaining to the transfer of ownership. 2. Financial Asset Withdrawal Amendment: In situations where the trust includes various financial assets such as stocks, bonds, or investment accounts, this type of amendment allows the trust creator to identify and withdraw these assets from the trust. It may require providing information about the financial institution, account numbers, and the value of the assets being removed. 3. Personal Property Withdrawal Amendment: This amendment is used to withdraw personal property items from the trust, such as artwork, jewelry, vehicles, or other valuable possessions. It typically requires a detailed list or inventory of the personal property items being withdrawn, including their estimated value and any necessary transfer documents. 4. Business Interest Withdrawal Amendment: If the trust includes ownership interests in a business or partnership, this type of amendment allows the trust creator to withdraw or transfer these interests. It may involve providing information about the business entity, ownership percentages, and any relevant agreements or contracts related to the business transfer. 5. Beneficiary Designation Amendment: Sometimes, the trust creator may need to modify the designated beneficiaries of certain trust assets. This amendment allows for the removal or addition of beneficiaries, ensuring that the trust aligns with the creator's intentions regarding the distribution of assets. In conclusion, the Idaho Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust provides a comprehensive framework for modifying existing trusts by withdrawing specific properties. Whether it involves real estate, financial assets, personal property, business interests, or beneficiary designations, this amendment allows trust creators in Idaho to tailor their trusts to meet their changing needs and preferences. It is essential to consult with an attorney or legal professional to ensure that each amendment accurately reflects the intentions of the trust creator and complies with Idaho state laws.

Idaho Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust

Description

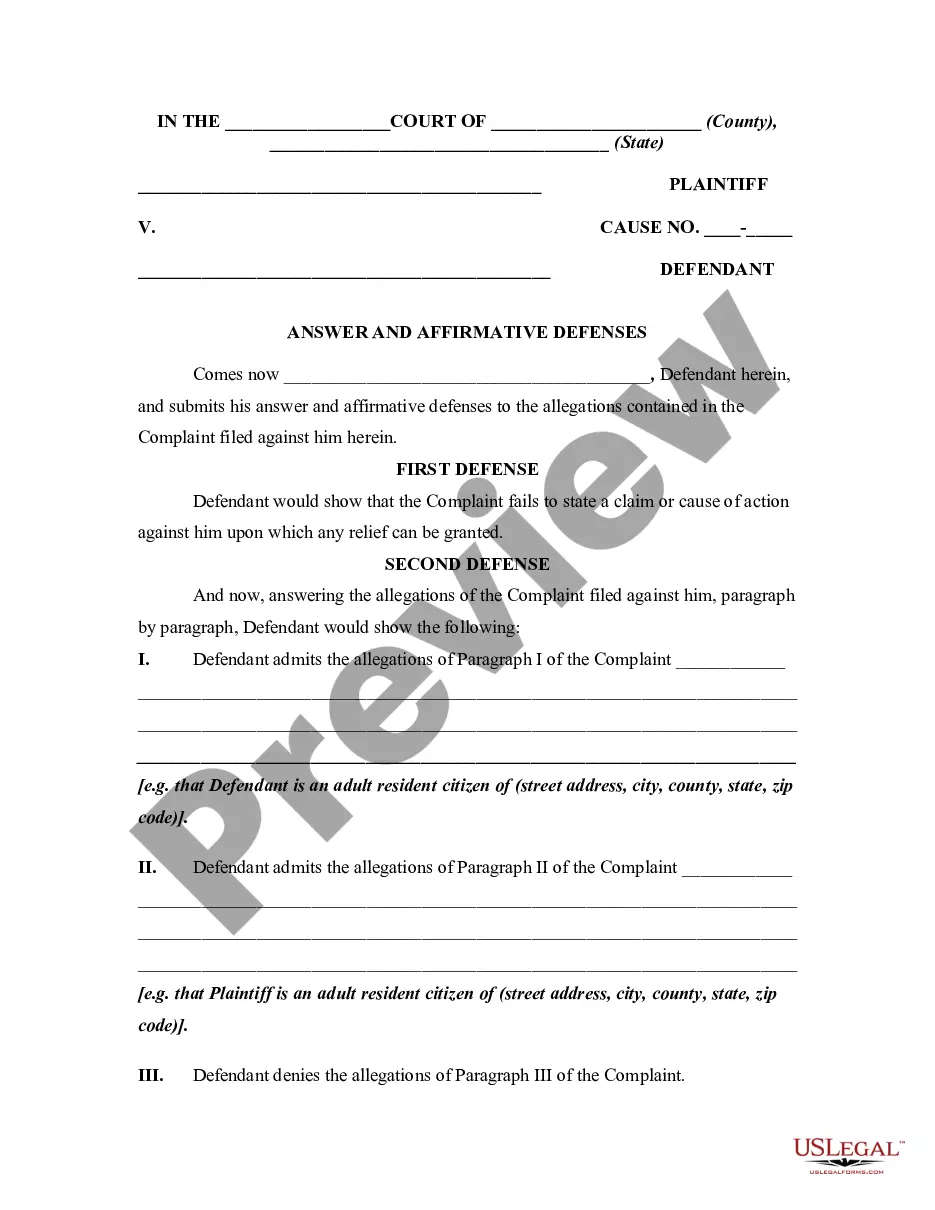

How to fill out Amendment Of Inter Vivos Trust Agreement For Withdrawal Of Property From Trust?

If you need to finalize, download, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the website's user-friendly and efficient search to find the documents you require.

Numerous templates for commercial and personal purposes are categorized by subjects and states, or keywords.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

Step 6. Choose the format of the legal form and download it to your device.

- Utilize US Legal Forms to obtain the Idaho Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and tap the Download button to locate the Idaho Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to review the form's content. Be sure to read the summary.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the page to find other versions in the legal form format.

- Step 4. After you have found the form you require, click the Acquire now button. Choose the payment plan you prefer and enter your information to register for the account.

Form popularity

FAQ

Writing an amendment to a trust requires a clear understanding of what needs changing. Begin by titling the document as an Idaho Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust and state the specific provisions you are altering. Clearly express your intentions and ensure you comply with all legal signing requirements. Utilizing resources from US Legal Forms can help ensure that your amendment is both compliant and professionally prepared.

To write an addendum to a trust, start by clearly identifying the trust in question and referencing the specific section you are modifying. Then, articulate your desired changes in simple language, ensuring the Idaho Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust is easy to understand. Complete the addendum by signing it before necessary witnesses, if required by state law. Engaging with platforms like US Legal Forms can simplify the drafting process significantly.

The best way to amend a trust involves drafting a clear Idaho Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust. You should specify the changes you wish to make, ensuring the document reflects your current intentions accurately. Always sign the amendment in accordance with state laws and consider having it notarized for added security. If you feel uncertain, using a reliable service like US Legal Forms can guide you through the process smoothly.

Amending a trust is often a straightforward process, especially with the right resources. Using the Idaho Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust template from US Legal Forms simplifies the task. Typically, it involves filling out the form, having it signed, and following any state requirements that apply, so you can navigate the process with confidence.

To obtain a trust amendment form, consider visiting US Legal Forms, which offers a variety of customizable templates. You can quickly download the Idaho Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust form. This method saves time and ensures that you receive a legally sound document, allowing you to make amendments efficiently.

You can find a trust amendment form specific to the Idaho Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust on various legal websites, including US Legal Forms. This platform provides easily accessible templates tailored for your needs. By using these resources, you can ensure your amendment is compliant with Idaho laws, making the process seamless.

Withdrawal rights refer to the authority granted to beneficiaries that allows them to remove assets from a trust before its terms are fully executed. These rights must be clearly stated in the trust document to prevent disputes. When working with the Idaho Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust, it’s vital to define these rights explicitly.

Idaho Code 15 7 403 outlines the rules surrounding trustees and their duties to beneficiaries. This code establishes fiduciary responsibilities and clarifies withdrawal provisions. Understanding this is crucial when evaluating the Idaho Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust.

Withdrawal rights of a trust define a beneficiary's ability to take property or assets from the trust before it is fully distributed. These rights can vary significantly based on the terms set forth in the trust agreement. When considering the Idaho Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust, it's important to be clear about these rights to ensure proper distribution and compliance.

Idaho Code 15 7 101 generally covers the definitions and general provisions related to trusts. This code lays the foundation for understanding various trust-related terminology and concepts. Familiarity with this code is beneficial when navigating the Idaho Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust.