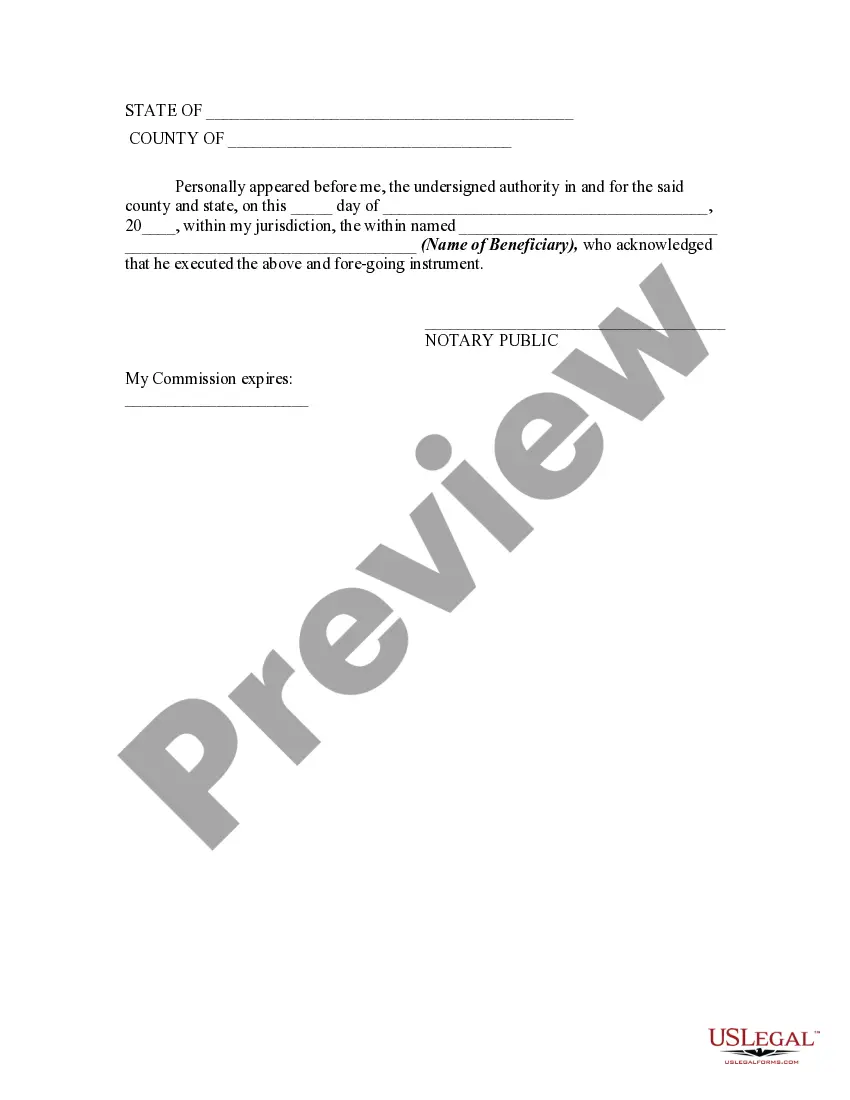

An assignment by a beneficiary of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Idaho Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary

Description

How to fill out Assignment By Beneficiary Of An Interest In The Trust Formed For The Benefit Of Beneficiary?

Are you in a situation where you require documents for either business or personal use almost every workday.

There are numerous legal document templates available online, but finding ones you can trust is challenging.

US Legal Forms offers a wide array of document templates, like the Idaho Assignment by Beneficiary of an Interest in the Trust Created for the Benefit of Beneficiary, which can be downloaded to meet state and federal standards.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can download an additional copy of the Idaho Assignment by Beneficiary of an Interest in the Trust Created for the Benefit of Beneficiary at any time, if needed. Click on the desired template to download or print the document design. Use US Legal Forms, the most extensive collection of legal templates, to save time and avoid mistakes. The service provides professionally crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Idaho Assignment by Beneficiary of an Interest in the Trust Created for the Benefit of Beneficiary template.

- If you do not have an account and wish to start utilizing US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/region.

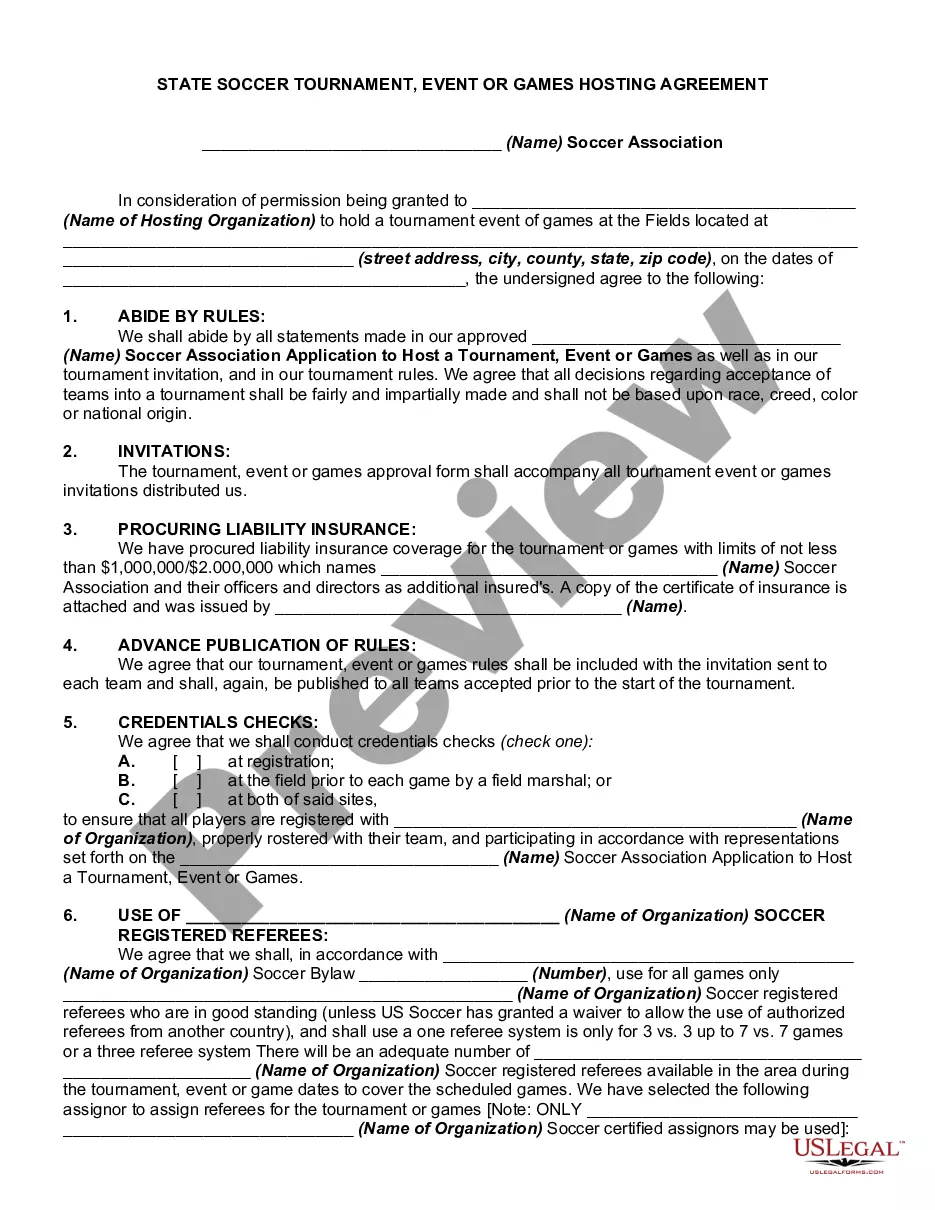

- Utilize the Review button to inspect the form.

- Read the description to confirm that you have selected the correct template.

- If the form is not what you are searching for, use the Search field to find the template that meets your needs and specifications.

- Once you obtain the correct form, click Purchase now.

- Select the pricing plan you desire, fill in the necessary information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

Form popularity

FAQ

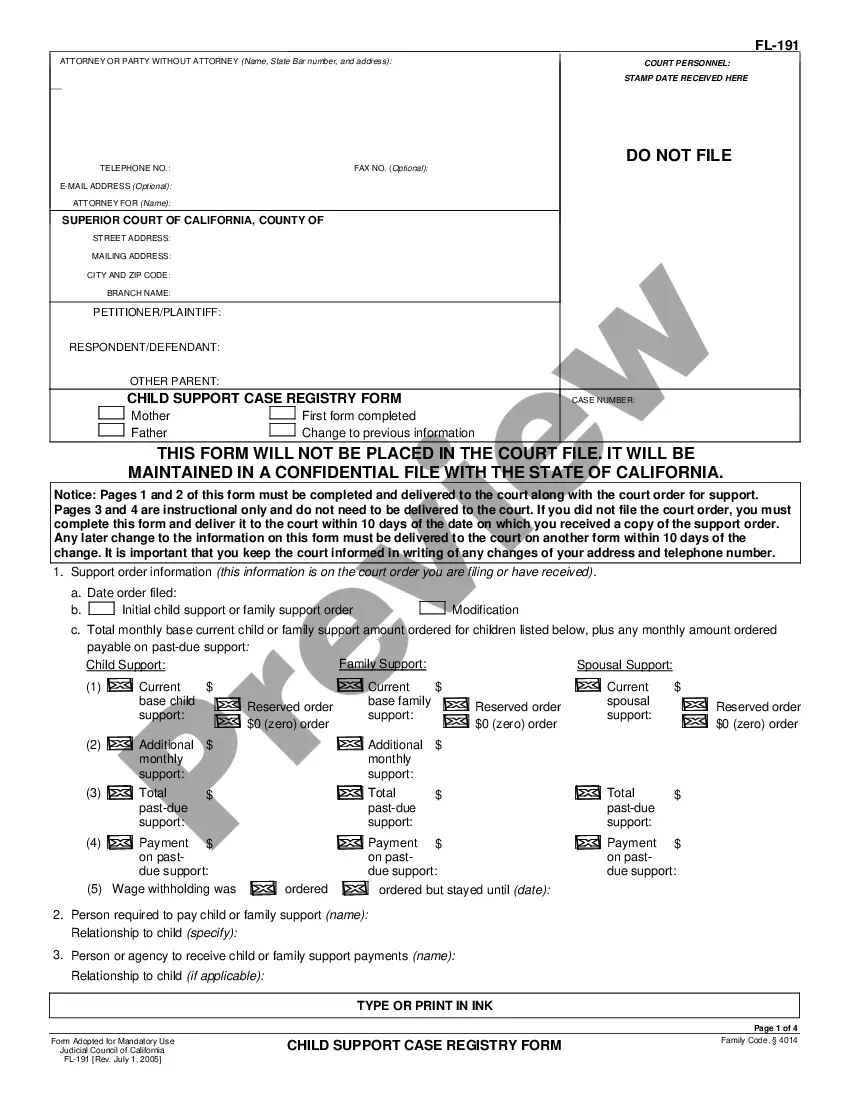

Form IL 1041 should be mailed to the specific address provided in the form's instructions. This ensures that your form is directed to the correct department for processing. If you're dealing with an Idaho Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, make certain that all forms are properly completed to avoid complications in the filing process.

If a simple trust does not distribute income, it may face penalties and taxes on the undistributed income. The trust's beneficiaries will not receive their share, potentially leading to dissatisfaction or disputes. For those managing an Idaho Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, it’s crucial to stay compliant with distribution requirements to better serve the beneficiaries.

To file IL 1041, you need to send it to the Illinois Department of Revenue's designated address for fiduciary returns. Ensure you include all pertinent documents to avoid delays. If you're navigating the complexities of an Idaho Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, using a reliable platform like uslegalforms can simplify the process.

You should mail your Illinois tax return to the address listed on the instruction guide that accompanies your tax return form. Make sure to check for any specific instructions related to estates or trusts, especially if you are handling an Idaho Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary. Proper mailing ensures timely processing of your return.

Form 1041 allows certain deductions for expenses related to estate or trust administration. Common deductions include professional fees, tax-related expenses, and charitable contributions. If you manage an Idaho Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, understanding these deductions can help optimize tax obligations for the beneficiaries.

An Idaho K-1 form is a tax document used to report income, deductions, and credits from partnerships, S corporations, and trusts. If you receive distributions from an Idaho Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, your K-1 may reflect these amounts. It's vital to understand this form as it affects your overall tax obligations in Idaho.

To file your Illinois estate tax return, you should send it to the Illinois Department of Revenue. It's essential to include all required documentation along with your return. However, if your estate involves an Idaho Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, you may want to consult a professional to ensure compliance with both Idaho and Illinois laws.

Yes, a beneficiary can typically assign their interest in a trust to another party. This assignment happens through a legal document that details the transfer of rights from one beneficiary to another. Understanding the specifics of the Idaho Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary is crucial in ensuring that this process complies with your trust's terms and applicable laws. Platforms like USLegalForms can help you draft the necessary documents to facilitate this assignment smoothly.

Idaho Code Section 45 1504 addresses the voluntary assignment of real property interests. It requires that such assignments be made in writing and specifies required elements for a valid assignment. If your dealings involve an Idaho Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, this section is key to ensure compliance with state laws.

barred debt in Idaho refers to a debt that is no longer enforceable in court due to the expiration of the statute of limitations. Typically, this period can range from 4 to 6 years, depending on the type of debt. If you hold an Idaho Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, knowing about timebarred debts is crucial for protecting your interests.