A sample of an acceleration clause in a promissory note would be: "the failure to pay any installment when due shall mature the entire indebtedness at the option of the holder of this Note." A sample of a prepayment clause in a promissory note would be: "the undersigned may prepay the principal amount outstanding in whole or in part without penalty."

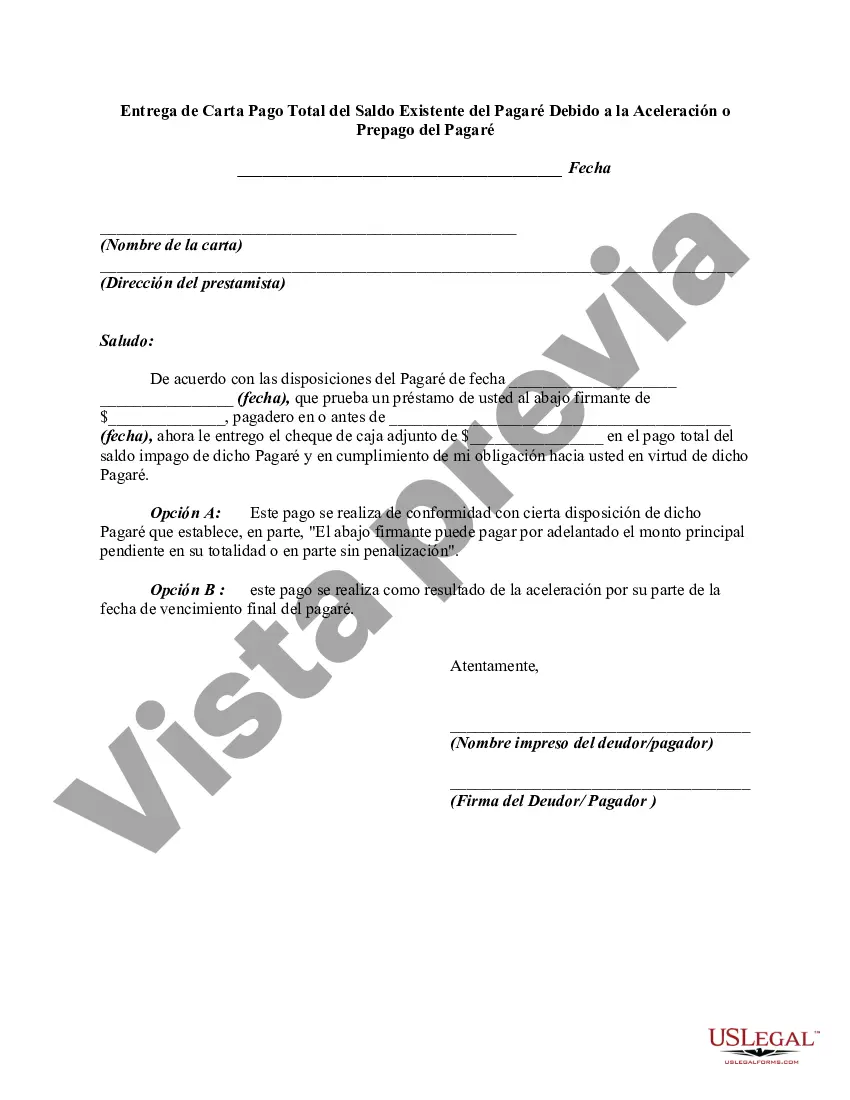

Title: Idaho Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note Introduction: In Idaho, a letter tendering full payment of an existing balance of a promissory note due to acceleration or prepayment of the note can be an essential legal document. This detailed description aims to outline the significance of this letter, its contents, the necessary steps to generate it, and any potential variations that may exist. Content: 1. Importance of an Idaho Letter Tendering Full Payment: This legal document serves as formal communication between the borrower and the lender, initiating the pay-off process. When a borrower decides to accelerate or prepay the promissory note fully, this letter is crucial to formally communicate such intentions, resolve any outstanding obligations, and ensure a smooth transaction. 2. Content of the Idaho Letter Tendering Full Payment: — Sender's Information: Include the legal name, address, and contact details of the borrower (sender). — Recipient's Information: Clearly state the lender's legal name, address, and contact details. — Introduction: Begin the letter by stating its purpose, i.e., tendering full payment and fulfilling obligations related to a promissory note due to acceleration or prepayment. — Promissory Note Details: Provide all relevant information related to the promissory note, such as the original loan amount, interest rate, date of execution, and maturity date. — Payment Details: Specify the exact outstanding balance, including principal and any accrued interest up to the current date. — Method of Payment: Outline the preferred payment method, such as a certified check, wire transfer, or any other acceptable form. — Request for Receipt: Kindly ask the recipient to acknowledge the receipt of the payment and provide a written confirmation of the note's satisfaction. — Closing: Express gratitude for the lender's past assistance and cooperation. Provide contact details for any further communication or clarification if required. — Notary/ Witness: If necessary, include a section for notary/public witness authentication. 3. Variations of Idaho Letter Tendering Full Payment: Depending on specific circumstances, the Idaho Letter Tendering Full Payment may have different variations, including: — Idaho Letter Tendering Full Payment of an Accelerated Promissory Note: Specifically addresses a note that has been called due before its original maturity date. — Idaho Letter Tendering Full Payment of a Prepaid Promissory Note: Focuses on a promissory note being paid off prior to its scheduled payoff date. Conclusion: Writing an Idaho Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment is an essential step towards fulfilling obligations and ensuring a smooth transition for both the borrower and lender. By following the suggested content and variations if applicable, you will be able to create a comprehensive and effective letter tailored to your specific circumstances.Title: Idaho Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note Introduction: In Idaho, a letter tendering full payment of an existing balance of a promissory note due to acceleration or prepayment of the note can be an essential legal document. This detailed description aims to outline the significance of this letter, its contents, the necessary steps to generate it, and any potential variations that may exist. Content: 1. Importance of an Idaho Letter Tendering Full Payment: This legal document serves as formal communication between the borrower and the lender, initiating the pay-off process. When a borrower decides to accelerate or prepay the promissory note fully, this letter is crucial to formally communicate such intentions, resolve any outstanding obligations, and ensure a smooth transaction. 2. Content of the Idaho Letter Tendering Full Payment: — Sender's Information: Include the legal name, address, and contact details of the borrower (sender). — Recipient's Information: Clearly state the lender's legal name, address, and contact details. — Introduction: Begin the letter by stating its purpose, i.e., tendering full payment and fulfilling obligations related to a promissory note due to acceleration or prepayment. — Promissory Note Details: Provide all relevant information related to the promissory note, such as the original loan amount, interest rate, date of execution, and maturity date. — Payment Details: Specify the exact outstanding balance, including principal and any accrued interest up to the current date. — Method of Payment: Outline the preferred payment method, such as a certified check, wire transfer, or any other acceptable form. — Request for Receipt: Kindly ask the recipient to acknowledge the receipt of the payment and provide a written confirmation of the note's satisfaction. — Closing: Express gratitude for the lender's past assistance and cooperation. Provide contact details for any further communication or clarification if required. — Notary/ Witness: If necessary, include a section for notary/public witness authentication. 3. Variations of Idaho Letter Tendering Full Payment: Depending on specific circumstances, the Idaho Letter Tendering Full Payment may have different variations, including: — Idaho Letter Tendering Full Payment of an Accelerated Promissory Note: Specifically addresses a note that has been called due before its original maturity date. — Idaho Letter Tendering Full Payment of a Prepaid Promissory Note: Focuses on a promissory note being paid off prior to its scheduled payoff date. Conclusion: Writing an Idaho Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment is an essential step towards fulfilling obligations and ensuring a smooth transition for both the borrower and lender. By following the suggested content and variations if applicable, you will be able to create a comprehensive and effective letter tailored to your specific circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.