Idaho Triple Net Lease for Commercial Real Estate is a type of lease agreement commonly used in the commercial real estate industry. It is a favorable option for landlords who want to shift some responsibilities and expenses to the tenant, making it a popular choice for both parties involved. In an Idaho Triple Net Lease agreement, the tenant is responsible for paying the property's real estate taxes, insurance premiums, and maintenance costs, in addition to the base rent. This provides the landlord with a predictable income stream while minimizing their involvement in day-to-day property management. There are several variations of the Idaho Triple Net Lease, each with its own unique provisions, terms, and responsibilities. Some common types include: 1. Absolute Triple Net Lease: This lease type places virtually all responsibilities on the tenant, including structural repairs and replacements, utility costs, and other expenses typically borne by the property owner. 2. Double Net Lease: In this lease agreement, the tenant is responsible for two out of the three "nets," usually property taxes and insurance. However, the landlord remains responsible for structural repairs and maintenance. 3. Triple Net Ground Lease: This lease specifically applies to land leasing, allowing tenants to construct their own buildings while handling all costs associated with the land, including property taxes, insurance, and maintenance. 4. Modified Gross Lease: Although not strictly considered a Triple Net Lease, the Modified Gross Lease is a popular option in Idaho, where the tenant and landlord agree on a fixed monthly rent which includes some or all of the property's operating expenses. This differs from a Triple Net Lease, as it typically includes property management duties. Investors and businesses seeking commercial properties in Idaho often find the Triple Net Lease option beneficial, as it offers stability, cost-sharing advantages, and reduces the landlord's involvement in property operations. It is essential for both landlords and tenants to carefully review the terms and conditions of any lease agreement before signing, ensuring a clear understanding of the responsibilities and obligations associated with each party.

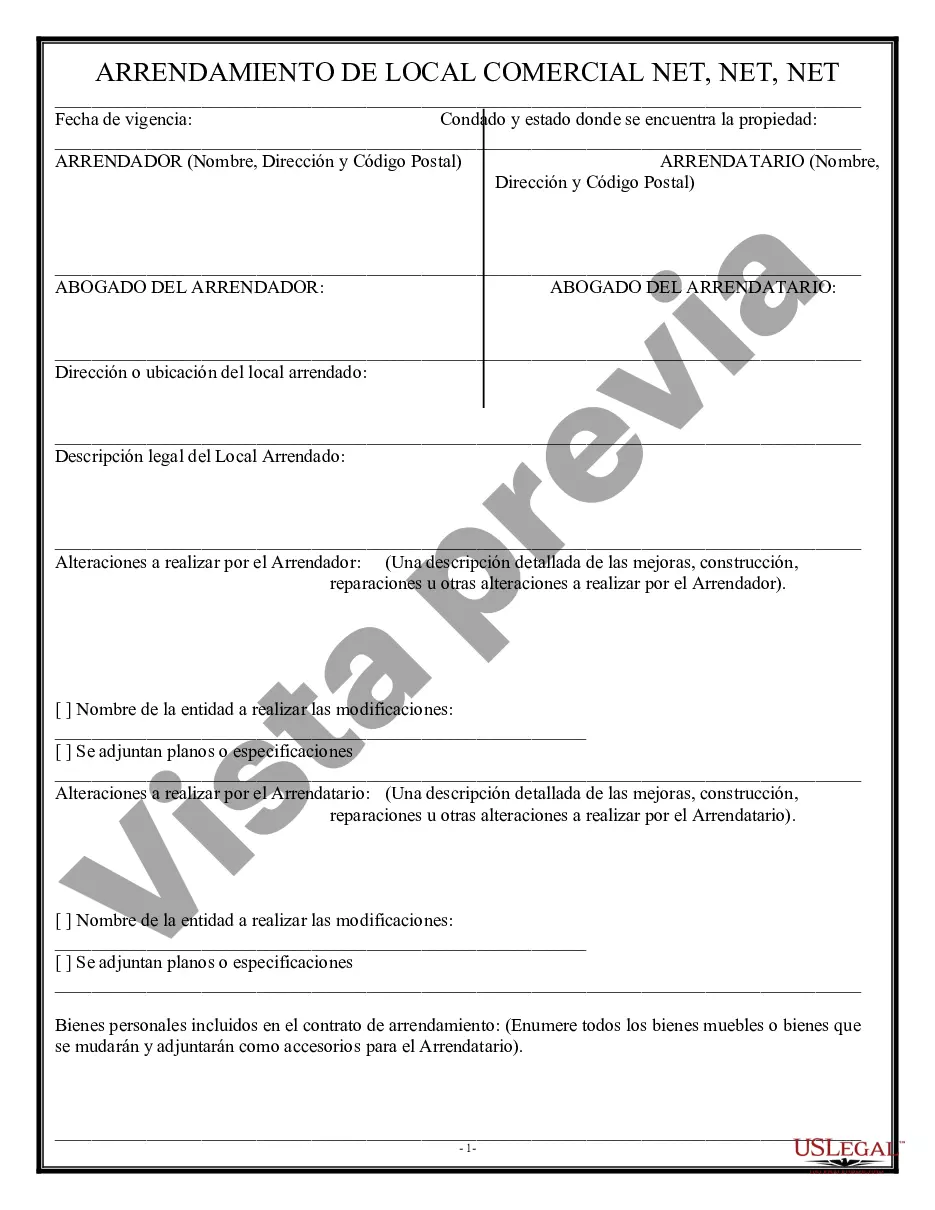

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Idaho Arrendamiento neto triple para bienes raíces comerciales - Triple Net Lease for Commercial Real Estate

Description

How to fill out Idaho Arrendamiento Neto Triple Para Bienes Raíces Comerciales?

Discovering the right authorized document web template can be a have difficulties. Of course, there are tons of themes accessible on the Internet, but how can you discover the authorized kind you require? Make use of the US Legal Forms site. The service offers 1000s of themes, like the Idaho Triple Net Lease for Commercial Real Estate, that you can use for company and personal demands. All of the forms are checked by pros and fulfill federal and state requirements.

In case you are previously authorized, log in to your accounts and click on the Download button to get the Idaho Triple Net Lease for Commercial Real Estate. Make use of your accounts to look throughout the authorized forms you might have purchased in the past. Go to the My Forms tab of your own accounts and have an additional duplicate from the document you require.

In case you are a new customer of US Legal Forms, listed below are basic guidelines that you can adhere to:

- Initially, be sure you have chosen the right kind for the area/county. You can look over the form using the Preview button and browse the form information to make sure it will be the right one for you.

- When the kind fails to fulfill your needs, use the Seach field to obtain the proper kind.

- When you are certain that the form is suitable, click the Purchase now button to get the kind.

- Pick the rates prepare you would like and type in the required info. Make your accounts and purchase your order utilizing your PayPal accounts or Visa or Mastercard.

- Opt for the submit formatting and acquire the authorized document web template to your gadget.

- Comprehensive, edit and printing and signal the received Idaho Triple Net Lease for Commercial Real Estate.

US Legal Forms is definitely the most significant catalogue of authorized forms that you can find various document themes. Make use of the service to acquire expertly-created documents that adhere to express requirements.