Disclosure of credit terms should have the content and form required under the federal Truth in Lending Act (15 U.S.C.A. §§ 1601 et seq.) and applicable regulations (Regulation Z, 12 C.F.R. § 226), and under state consumer credit laws to the extent that they differ from the federal Act. In connection with specified installment sales and other consumer credit transactions, these enactments require written disclosure and advice as to finance charges, annual percentage rates and other matters relating to credit. Under the federal Act, the disclosures may be set forth in the contract document itself or in a separate statement or statements.

A federal notice regarding preservation of the consumer's claims and defenses is required on all consumer credit contracts by Federal Trade Commission regulation. 16 C.F.R. § 433.2. The notice must appear in 10-point bold type or print and must be worded as set forth in the above form.

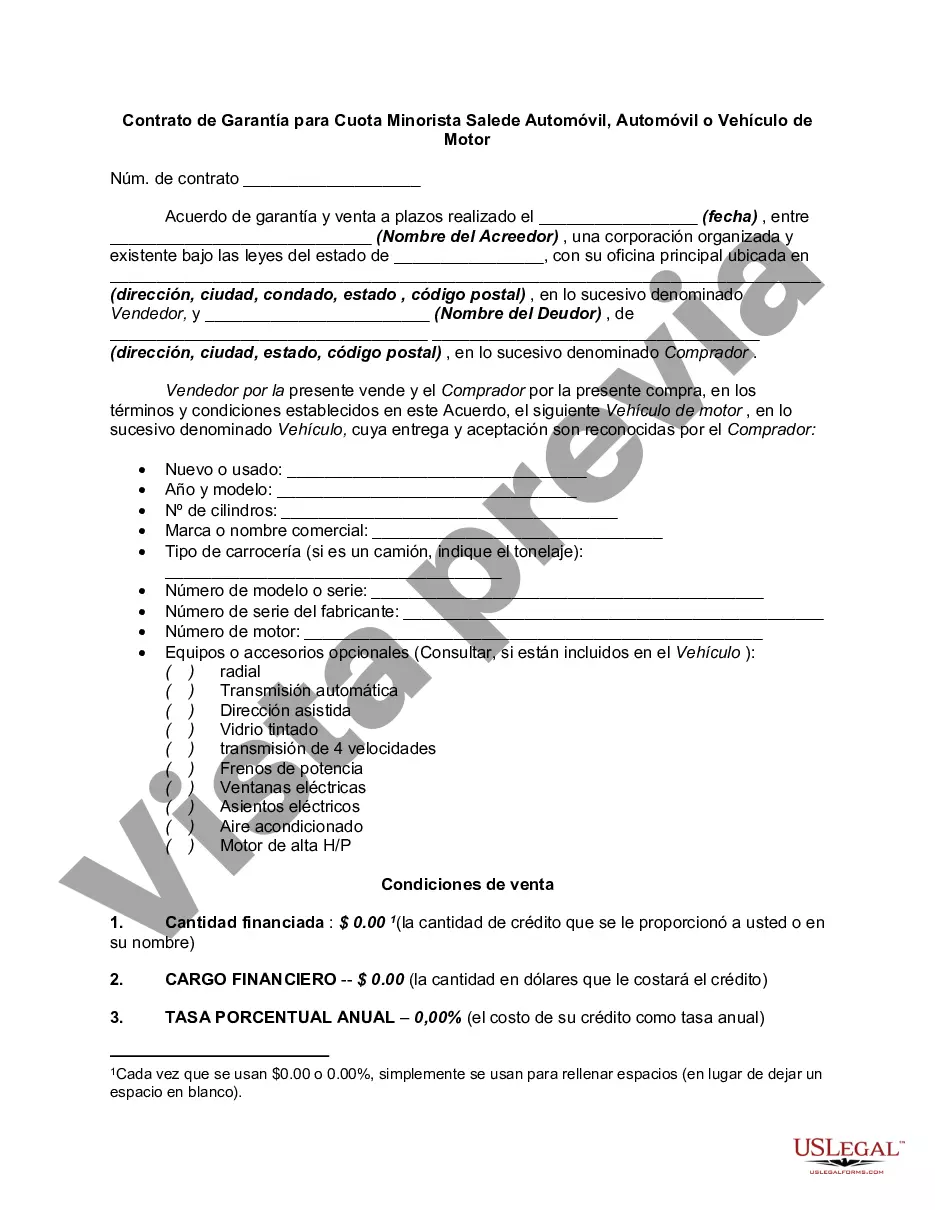

Idaho Security Agreement for Retail Installment Sale of Automobile, Car, or Motor Vehicle is a legal document that outlines the terms and conditions of a sales agreement between a buyer and a seller when purchasing a vehicle on an installment basis in the state of Idaho. The agreement serves as a binding contract that protects the interests of both parties involved. Keywords: Idaho, Security Agreement, Retail Installment Sale, Automobile, Car, Motor Vehicle, legal document, terms and conditions, sales agreement, buyer, seller, installment basis, binding contract. Different types of Idaho Security Agreements for Retail Installment Sale of Automobile, Car, or Motor Vehicle: 1. Standard Security Agreement: This is the most common type of security agreement used for retail installment sales in Idaho. It includes all the essential terms, conditions, and details of the sales transaction, such as the identification of the vehicle, purchase price, finance charges, payment schedule, default clauses, and rights and obligations of both the buyer and seller. 2. Balloon Payment Security Agreement: This type of security agreement allows the buyer to make smaller monthly payments over the installment period, with a larger "balloon" payment due at the end of the term. It provides flexibility to buyers who may have limited financial resources in the early stages of ownership but expect to have larger funds available towards the end of the agreement. 3. Refinancing Security Agreement: In certain cases, buyers may choose to refinance their vehicle purchase through a different lender. This type of security agreement outlines the terms of the new loan and supersedes the original agreement, ensuring that the rights and responsibilities of the buyer and seller are transferred accordingly. 4. Second Chance Security Agreement: This agreement is designed for individuals with less-than-perfect credit or a history of financial difficulties. It typically includes higher interest rates and stricter terms to mitigate the risks associated with lending to buyers who may have a higher likelihood of defaulting on their payments. However, it provides an opportunity for these individuals to secure financing for a vehicle purchase. 5. Buy Here Pay Security Agreement: This type of security agreement is commonly used by dealerships that offer in-house financing options. It enables buyers to secure financing directly from the dealership, which acts as the lender. These agreements often have more relaxed credit requirements but higher interest rates to compensate for the increased risk. In conclusion, the Idaho Security Agreement for Retail Installment Sale of Automobile, Car, or Motor Vehicle is a crucial document that outlines the terms, conditions, and responsibilities involved in purchasing a vehicle on an installment basis in Idaho. Understanding the different types of security agreements available enables buyers and sellers to choose the approach that best suits their needs and financial situation.Idaho Security Agreement for Retail Installment Sale of Automobile, Car, or Motor Vehicle is a legal document that outlines the terms and conditions of a sales agreement between a buyer and a seller when purchasing a vehicle on an installment basis in the state of Idaho. The agreement serves as a binding contract that protects the interests of both parties involved. Keywords: Idaho, Security Agreement, Retail Installment Sale, Automobile, Car, Motor Vehicle, legal document, terms and conditions, sales agreement, buyer, seller, installment basis, binding contract. Different types of Idaho Security Agreements for Retail Installment Sale of Automobile, Car, or Motor Vehicle: 1. Standard Security Agreement: This is the most common type of security agreement used for retail installment sales in Idaho. It includes all the essential terms, conditions, and details of the sales transaction, such as the identification of the vehicle, purchase price, finance charges, payment schedule, default clauses, and rights and obligations of both the buyer and seller. 2. Balloon Payment Security Agreement: This type of security agreement allows the buyer to make smaller monthly payments over the installment period, with a larger "balloon" payment due at the end of the term. It provides flexibility to buyers who may have limited financial resources in the early stages of ownership but expect to have larger funds available towards the end of the agreement. 3. Refinancing Security Agreement: In certain cases, buyers may choose to refinance their vehicle purchase through a different lender. This type of security agreement outlines the terms of the new loan and supersedes the original agreement, ensuring that the rights and responsibilities of the buyer and seller are transferred accordingly. 4. Second Chance Security Agreement: This agreement is designed for individuals with less-than-perfect credit or a history of financial difficulties. It typically includes higher interest rates and stricter terms to mitigate the risks associated with lending to buyers who may have a higher likelihood of defaulting on their payments. However, it provides an opportunity for these individuals to secure financing for a vehicle purchase. 5. Buy Here Pay Security Agreement: This type of security agreement is commonly used by dealerships that offer in-house financing options. It enables buyers to secure financing directly from the dealership, which acts as the lender. These agreements often have more relaxed credit requirements but higher interest rates to compensate for the increased risk. In conclusion, the Idaho Security Agreement for Retail Installment Sale of Automobile, Car, or Motor Vehicle is a crucial document that outlines the terms, conditions, and responsibilities involved in purchasing a vehicle on an installment basis in Idaho. Understanding the different types of security agreements available enables buyers and sellers to choose the approach that best suits their needs and financial situation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.