Idaho Partnership Agreement Involving Silent Partner: Types and Details In Idaho, a partnership agreement involving a silent partner refers to a legally binding contract that outlines the rights, responsibilities, and roles of each partner in a business venture where one partner remains silent or inactive in its everyday operations. This agreement ensures a smooth functioning of the partnership while protecting the interests of both active and silent partners. 1. Limited Partnership Agreement: In this type of partnership agreement, an active partner runs the business and makes all operational decisions, while the silent partner contributes capital but has no involvement in the management of the enterprise. The agreement clearly defines the division of profits, loss sharing, and the extent of liability for each partner. 2. General Partnership Agreement: This partnership agreement involves multiple active partners running the business together without a designated silent partner. However, in some cases, a general partnership may involve a silent partner who contributes capital but has no involvement in the decision-making process or company management. Key Components of an Idaho Partnership Agreement Involving Silent Partner: 1. Identification of Partners: The agreement should list the names and addresses of all partners involved. It must clearly distinguish between active partners responsible for management and silent partners who provide financial contributions without direct involvement. 2. Roles and Contributions: The partnership agreement should outline the duties, responsibilities, and contributions expected from each partner. It will specify which partner(s) will actively manage the business and the rights of the silent partner regarding decision-making authority. 3. Profit and Loss Sharing: The agreement will establish the percentage of profits and losses allocated to each partner according to their contribution or as otherwise mutually agreed upon. It will also define how and when profits will be distributed. 4. Capital Contributions: A clear outline of the initial capital contributions made by each partner, as well as guidelines for additional capital injections, should be included in the agreement. It will specify the share of the silent partner's capital and any limitations on future contributions. 5. Partnership Duration: The agreement should state the intended duration of the partnership. It can be indefinite or for a specific term, with provisions for extension or dissolution. 6. Decision-Making Authority: The agreement should specify how decision-making powers are divided between active and silent partners. Active partners typically make day-to-day operational decisions, while significant matters might require mutual consent or a different mechanism. 7. Dissolution and Exit Strategy: The agreement should outline the procedure for dissolving the partnership or when a partner wishes to exit the partnership voluntarily or involuntarily. It should address the distribution of assets, liabilities, and procedures to resolve disputes. 8. Confidentiality and Non-Compete Clauses: To protect the interests of all partners, the agreement may include clauses prohibiting partners from disclosing proprietary information, engaging in competing businesses, or soliciting employees or clients of the partnership. In summary, an Idaho Partnership Agreement Involving Silent Partner is a contractual document outlining the terms, responsibilities, and obligations between active and silent partners in a business undertaking. The agreement aims to ensure a harmonious partnership while protecting the interests of all parties involved.

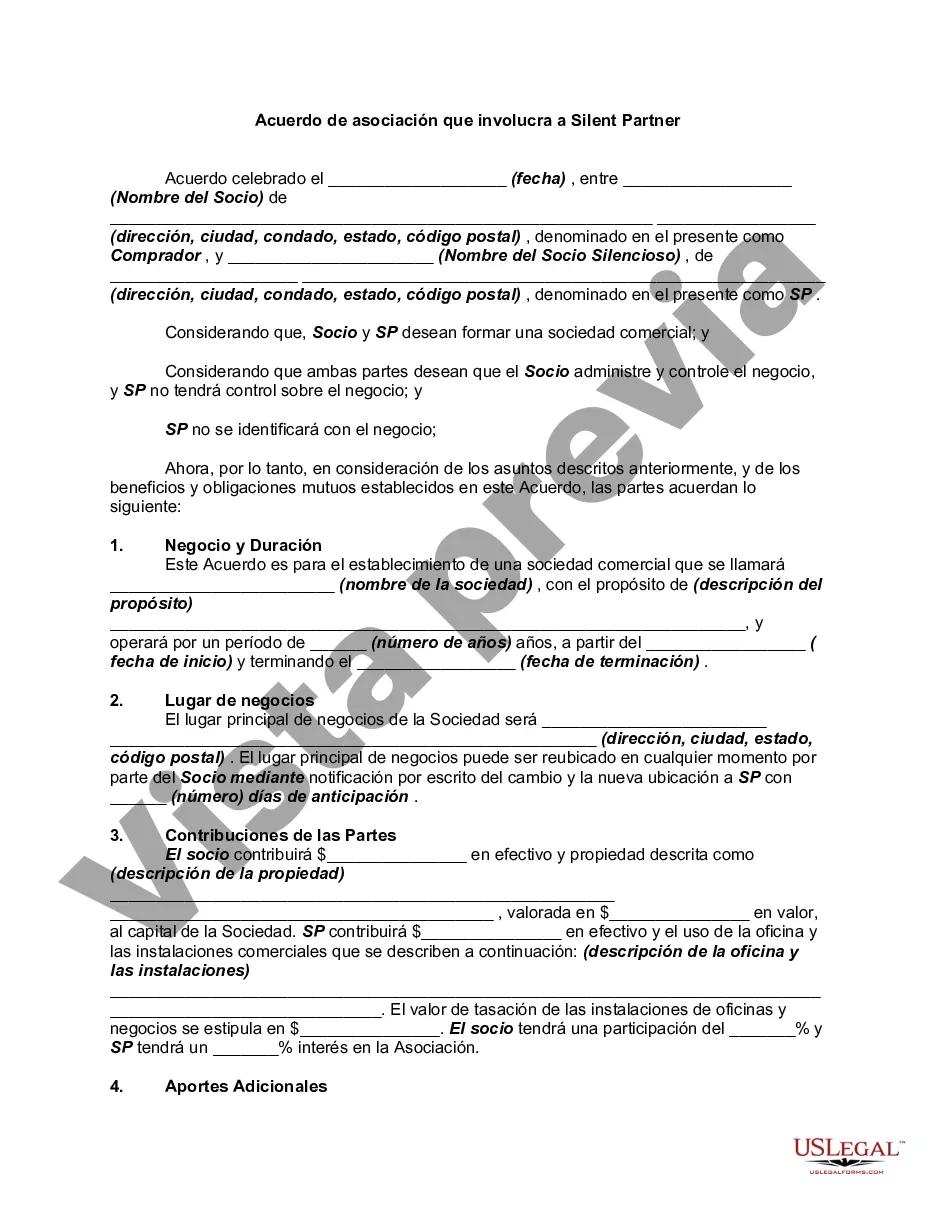

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Idaho Acuerdo de asociación que involucra a Silent Partner - Partnership Agreement Involving Silent Partner

Description

How to fill out Idaho Acuerdo De Asociación Que Involucra A Silent Partner?

You can invest time on-line trying to find the legitimate document design which fits the federal and state demands you want. US Legal Forms gives a huge number of legitimate varieties which are analyzed by experts. You can easily download or produce the Idaho Partnership Agreement Involving Silent Partner from my services.

If you already have a US Legal Forms accounts, you can log in and click the Obtain option. Afterward, you can comprehensive, edit, produce, or signal the Idaho Partnership Agreement Involving Silent Partner. Each legitimate document design you get is your own property forever. To acquire one more copy of the purchased kind, proceed to the My Forms tab and click the corresponding option.

If you are using the US Legal Forms web site for the first time, stick to the simple recommendations beneath:

- Initially, make sure that you have chosen the proper document design for that state/area of your liking. See the kind explanation to ensure you have chosen the right kind. If accessible, utilize the Preview option to search from the document design too.

- If you would like find one more version of your kind, utilize the Look for field to discover the design that meets your needs and demands.

- Upon having found the design you desire, simply click Get now to proceed.

- Select the prices strategy you desire, enter your credentials, and sign up for your account on US Legal Forms.

- Full the financial transaction. You can use your Visa or Mastercard or PayPal accounts to fund the legitimate kind.

- Select the format of your document and download it for your product.

- Make modifications for your document if needed. You can comprehensive, edit and signal and produce Idaho Partnership Agreement Involving Silent Partner.

Obtain and produce a huge number of document themes utilizing the US Legal Forms site, that provides the most important variety of legitimate varieties. Use expert and state-distinct themes to deal with your business or person demands.