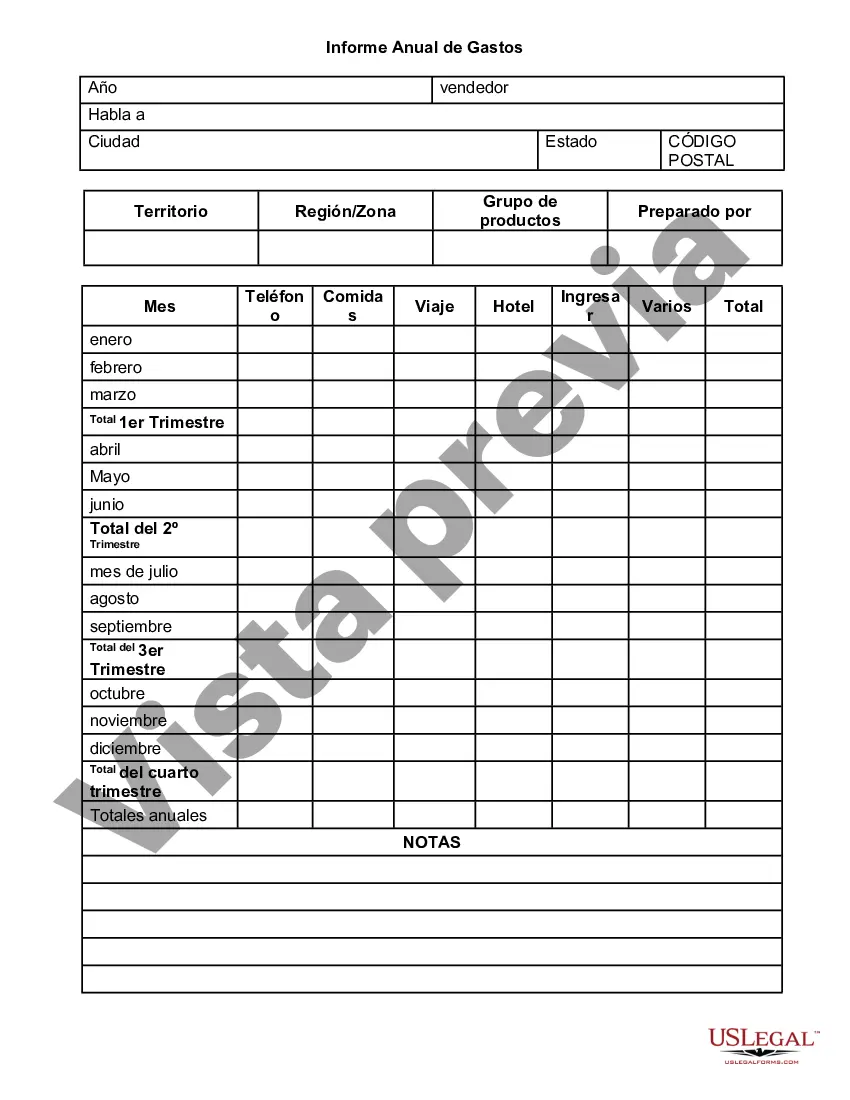

The Idaho Annual Expense Report is a document that provides a comprehensive breakdown of an individual or entity's expenses over the course of a year within the state of Idaho. It serves as a financial record and is crucial for tracking and monitoring spending patterns, budgeting, and tax compliance. Keywords: Idaho, Annual Expense Report, detailed description, expenses, financial record, spending patterns, budgeting, tax compliance The Idaho Annual Expense Report comprises various categories that encompass both personal and business expenses. These categories include but are not limited to: 1. Personal Expenses: This category covers an individual's day-to-day personal expenditures, such as housing costs (rent or mortgage payments), utility bills (electricity, gas, water), transportation expenses (vehicle maintenance, fuel, public transportation), groceries, healthcare, insurance premiums, and entertainment expenses. 2. Business Expenses: For entities operating in Idaho, this section includes all costs related to business operations. It encompasses expenditures on office space rental, employee wages, equipment and supplies purchases, travel expenses, marketing and advertising costs, software or technology subscriptions, professional services fees (accounting, legal, consulting), and insurance (business liability, property insurance). 3. Income-Generating Activities: This segment of the report focuses on detailing the various sources of income or revenue generation during the assessed year. It includes income received from regular employment, business profits, investments, rental or leasing activities, dividends, and any other forms of taxable income. 4. Tax Deductible Expenses: Idaho Annual Expense Report also highlights expenses that are eligible for tax deductions, thereby assisting in reducing one's tax liability. These expenses may include retirement contributions, medical expenses, education costs, mortgage interest, property taxes, and charitable donations. 5. Other Expenses: This section covers additional miscellaneous expenditures that do not fit into the aforementioned categories. It could include expenses like subscriptions (newspapers, magazines), membership fees (gym, clubs, professional organizations), childcare expenses, home improvement costs, auto financing payments, and debt payments. By accurately documenting and categorizing expenses, the Idaho Annual Expense Report facilitates effective financial management and planning. It aids in identifying areas of overspending or potential cost-saving opportunities. Moreover, it ensures compliance with tax regulations, allowing individuals and businesses to claim eligible deductions and credits, ultimately minimizing their tax obligations. Different types of Idaho Annual Expense Reports may exist, tailored to specific sectors or entities such as individual taxpayers, small businesses, large corporations, nonprofit organizations, or government agencies. Although the underlying principles of tracking expenses remain consistent across these variations, certain nuances may apply based on the unique requirements and regulations governing each entity type.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Idaho Informe Anual de Gastos - Annual Expense Report

Description

How to fill out Idaho Informe Anual De Gastos?

If you have to full, down load, or printing legal document layouts, use US Legal Forms, the most important variety of legal kinds, which can be found online. Utilize the site`s simple and convenient search to get the files you will need. Different layouts for organization and person functions are categorized by classes and claims, or key phrases. Use US Legal Forms to get the Idaho Annual Expense Report with a number of clicks.

Should you be previously a US Legal Forms customer, log in in your accounts and then click the Download switch to have the Idaho Annual Expense Report. Also you can accessibility kinds you formerly delivered electronically from the My Forms tab of your own accounts.

Should you use US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Make sure you have chosen the form to the right town/country.

- Step 2. Take advantage of the Review method to examine the form`s content material. Do not overlook to read the information.

- Step 3. Should you be unhappy together with the type, make use of the Look for field at the top of the display screen to get other types from the legal type web template.

- Step 4. Upon having found the form you will need, select the Purchase now switch. Choose the prices program you favor and add your credentials to register for the accounts.

- Step 5. Process the transaction. You should use your Мisa or Ьastercard or PayPal accounts to perform the transaction.

- Step 6. Select the formatting from the legal type and down load it on the gadget.

- Step 7. Comprehensive, modify and printing or sign the Idaho Annual Expense Report.

Each legal document web template you buy is the one you have forever. You have acces to every type you delivered electronically with your acccount. Click on the My Forms portion and choose a type to printing or down load once again.

Compete and down load, and printing the Idaho Annual Expense Report with US Legal Forms. There are many specialist and express-certain kinds you can use for your organization or person requires.