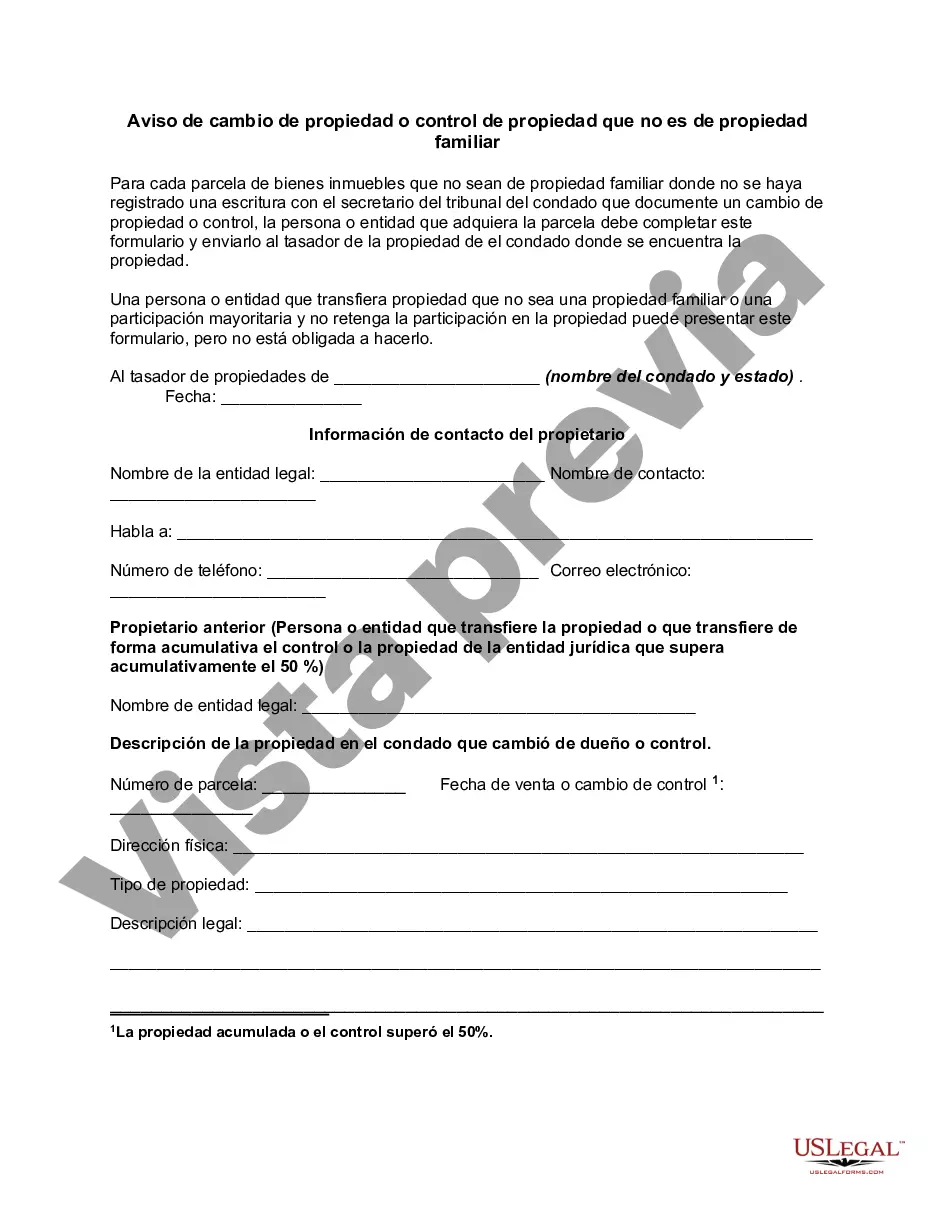

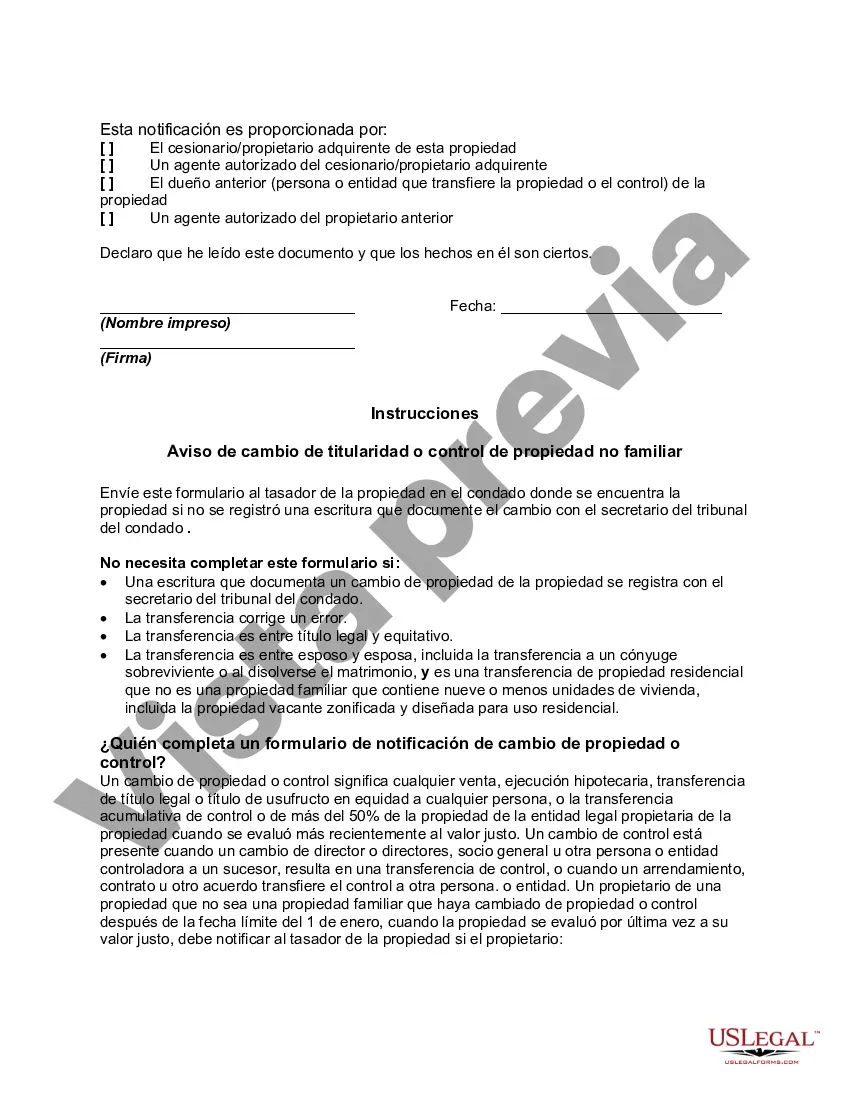

For each parcel of non-homestead real property where a deed has not been recorded with the county clerk of court documenting a change of ownership or control, the person or entity who acquires the parcel may have to complete a form similar to this and send it to the property appraiser of the county where the property is located.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Idaho Notice of Change of Ownership or Control Non-Homestead Property is a legal document that is required to be filed when there is a transfer of ownership or control of non-homestead property in the state of Idaho. This notice serves as official notification to the Idaho State Tax Commission and other relevant authorities regarding the change in ownership or control of the property. Keywords: Idaho, Notice of Change of Ownership or Control, Non-Homestead Property, legal document, transfer of ownership, transfer of control, Idaho State Tax Commission, authorities. There are different types of Idaho Notice of Change of Ownership or Control Non-Homestead Property based on the specific circumstances of the transfer. Some common types include: 1. Sale or Purchase: This type of notice is submitted when there is a sale or purchase of non-homestead property in Idaho. It includes details such as the names of the buyer and seller, property identification, date of transfer, and any relevant supporting documentation. 2. Transfer due to Inheritance: In cases where non-homestead property is transferred due to inheritance, this type of notice is filed. It requires the identification of the deceased property owner, the heir(s) or devised(s) receiving the property, and other relevant details regarding the transfer. 3. Change in Corporate Ownership or Control: When there is a change in ownership or control of non-homestead property owned by a corporation, this type of notice is filed. It includes information about the corporation, the new owner or controlling entity, and any necessary documentation. 4. Change in Partnership Ownership or Control: In cases where non-homestead property is owned by a partnership and there is a change in ownership or control, this specific notice is submitted. It requires details about the partnership, the partners involved in the transfer, and any supporting documentation. 5. Change in Trust Ownership or Control: This type of notice is filed when there is a change in ownership or control of non-homestead property held in a trust. It includes information about the trust, the new trustee(s) or beneficiary(IES), and any relevant documentation. It is important to note that the specific requirements and forms for the Idaho Notice of Change of Ownership or Control Non-Homestead Property may vary based on the county where the property is located. Therefore, it is advisable to consult with the Idaho State Tax Commission or relevant county authorities to obtain the correct form and ensure compliance with all regulations.The Idaho Notice of Change of Ownership or Control Non-Homestead Property is a legal document that is required to be filed when there is a transfer of ownership or control of non-homestead property in the state of Idaho. This notice serves as official notification to the Idaho State Tax Commission and other relevant authorities regarding the change in ownership or control of the property. Keywords: Idaho, Notice of Change of Ownership or Control, Non-Homestead Property, legal document, transfer of ownership, transfer of control, Idaho State Tax Commission, authorities. There are different types of Idaho Notice of Change of Ownership or Control Non-Homestead Property based on the specific circumstances of the transfer. Some common types include: 1. Sale or Purchase: This type of notice is submitted when there is a sale or purchase of non-homestead property in Idaho. It includes details such as the names of the buyer and seller, property identification, date of transfer, and any relevant supporting documentation. 2. Transfer due to Inheritance: In cases where non-homestead property is transferred due to inheritance, this type of notice is filed. It requires the identification of the deceased property owner, the heir(s) or devised(s) receiving the property, and other relevant details regarding the transfer. 3. Change in Corporate Ownership or Control: When there is a change in ownership or control of non-homestead property owned by a corporation, this type of notice is filed. It includes information about the corporation, the new owner or controlling entity, and any necessary documentation. 4. Change in Partnership Ownership or Control: In cases where non-homestead property is owned by a partnership and there is a change in ownership or control, this specific notice is submitted. It requires details about the partnership, the partners involved in the transfer, and any supporting documentation. 5. Change in Trust Ownership or Control: This type of notice is filed when there is a change in ownership or control of non-homestead property held in a trust. It includes information about the trust, the new trustee(s) or beneficiary(IES), and any relevant documentation. It is important to note that the specific requirements and forms for the Idaho Notice of Change of Ownership or Control Non-Homestead Property may vary based on the county where the property is located. Therefore, it is advisable to consult with the Idaho State Tax Commission or relevant county authorities to obtain the correct form and ensure compliance with all regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.