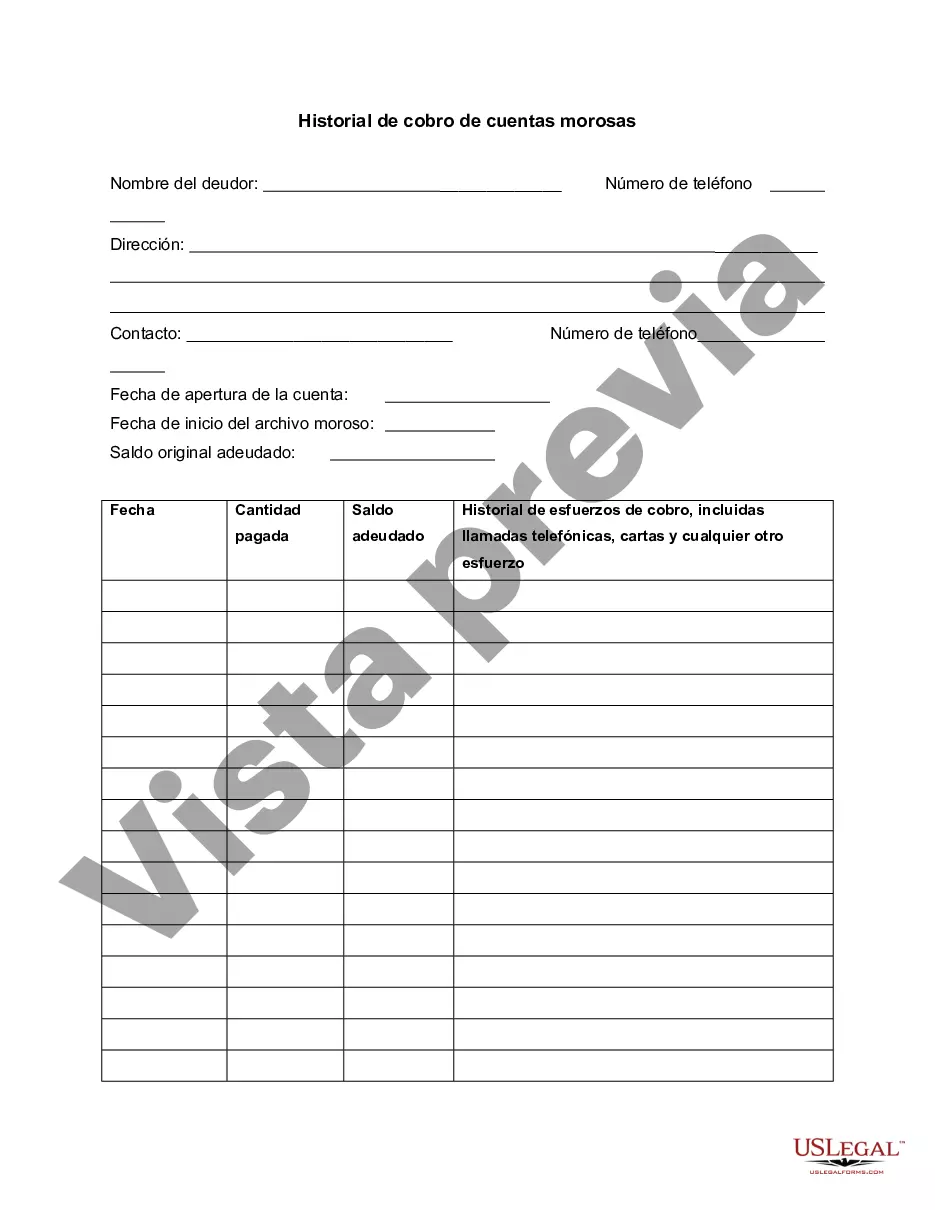

This is a form to track progress on a delinquent customer account and to record collection efforts.

Idaho Delinquent Account Collection History refers to the record of past due or outstanding accounts that have been handed over to a collections' agency in the state of Idaho. When individuals or businesses fail to make payments on time, their accounts may become delinquent. It is important to note that there are various types of Idaho Delinquent Account Collection History, each with its own specific terminology and characteristics. Some different types include: 1. Personal Delinquent Account Collection History: This type of delinquency involves unpaid debts from individuals such as credit card bills, consumer loans, medical bills, or student loans. When individuals fail to make payments on these accounts, they can be sent to collections agencies for further action. 2. Commercial Delinquent Account Collection History: Businesses or organizations that have unpaid debts, such as unpaid invoices, overdue lease payments, or outstanding vendor bills, fall under this category. When commercial entities fail to fulfill their financial obligations, the concerned parties can engage collections agencies to recover the outstanding amounts. 3. Tax Delinquent Account Collection History: This pertains to unpaid or overdue taxes owed to the state or federal government. It includes unpaid income taxes, property taxes, sales taxes, or other forms of outstanding tax liabilities. Taxing authorities have specific procedures in place to collect these overdue amounts, which may involve the use of collections agencies. 4. Utility Delinquent Account Collection History: When consumers fail to pay their utility bills for services such as electricity, water, gas, or internet, their accounts become delinquent. Utility companies often have procedures in place to handle these delinquencies, which may eventually involve collections agencies if the outstanding amounts remain unpaid. In Idaho, collections agencies are bound by state and federal regulations such as the Fair Debt Collection Practices Act (FD CPA), which outlines the rights and responsibilities of both debtors and collectors. It is important for consumers and businesses to understand their rights when dealing with delinquent account collection agencies and to engage in open communication to resolve outstanding debts. Managing delinquent accounts responsibly is essential for individuals and businesses to maintain a healthy financial profile.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.