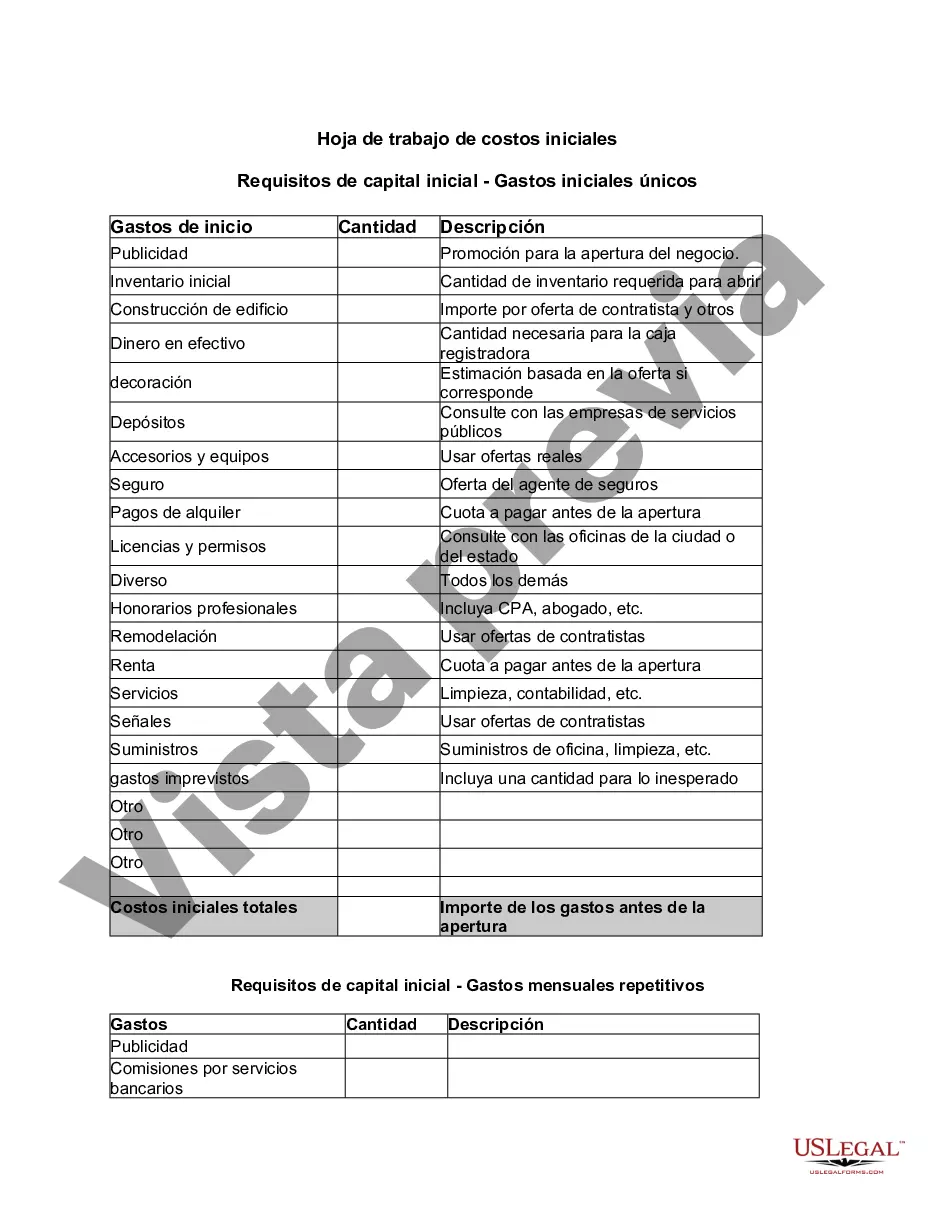

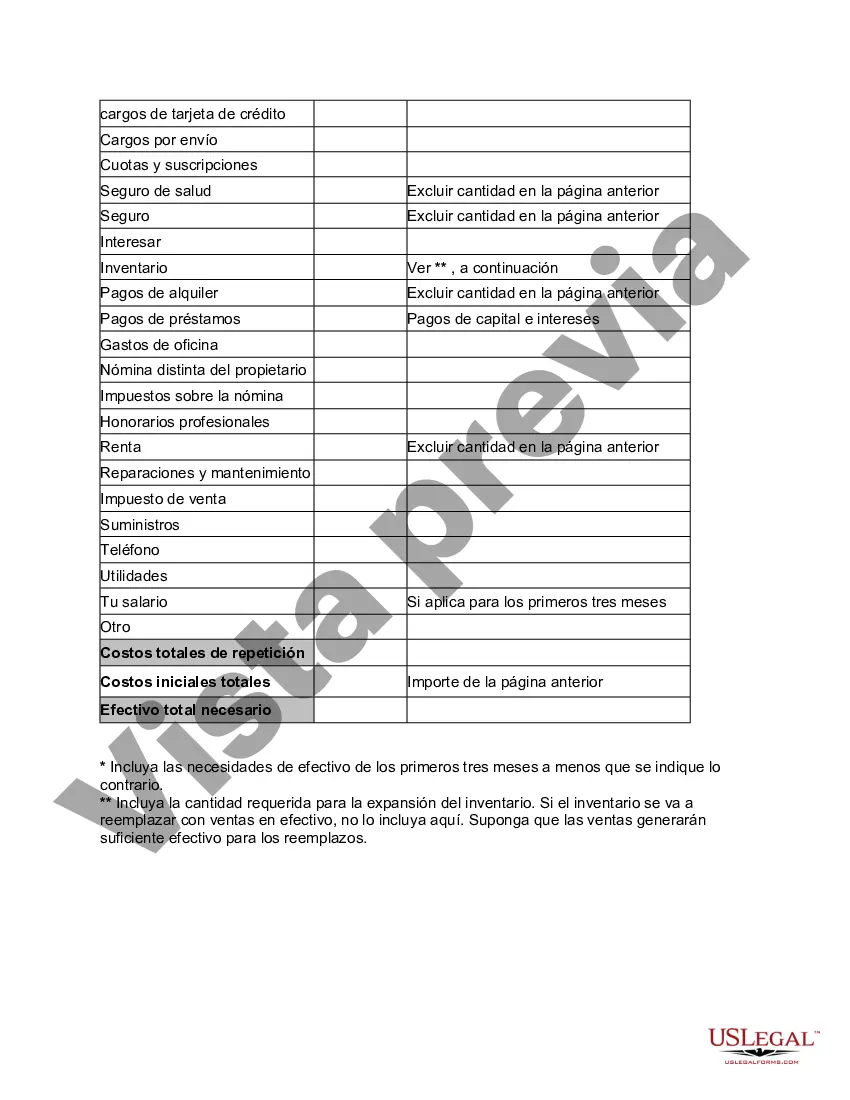

Idaho Startup Costs Worksheet is a helpful tool designed to assist entrepreneurs and small business owners in evaluating and estimating their initial expenses when launching a new venture in Idaho. This comprehensive worksheet guides individuals through a detailed breakdown of various costs associated with starting a business in the state. The Idaho Startup Costs Worksheet covers a wide range of expenses that entrepreneurs need to consider when planning their business venture. It includes both one-time startup expenses and ongoing monthly costs. This worksheet helps entrepreneurs determine the financial requirements needed to successfully launch their business and maintain its operations in Idaho. Some key components covered in the Idaho Startup Costs Worksheet include: 1. Legal and Licensing Fees: This section outlines the costs associated with obtaining necessary licenses, permits, and legal fees required to establish a business in Idaho. 2. Rent and Utilities: It covers the anticipated costs of leasing a commercial space and monthly utility bills like electricity, water, and internet services. 3. Fixed Assets and Equipment: This section helps entrepreneurs estimate the costs of purchasing or leasing equipment, furniture, technology, and any other necessary fixed assets needed for their specific business. 4. Inventory and Supplies: It accounts for the expenses related to acquiring initial inventory, raw materials, and supplies required for the daily operations of the business. 5. Marketing and Advertising: This section addresses the costs involved in marketing and promoting the business, including website development, advertising campaigns, and any other promotional materials. 6. Employee Salaries and Benefits: It takes into account the costs associated with hiring and compensating employees, including wages, benefits, and payroll taxes. 7. Insurance and Permits: This portion outlines the expenses related to acquiring business insurance coverage, permits, and compliance with legal requirements in Idaho. 8. Miscellaneous Costs: It includes any additional expenses that may arise during the startup phase, such as professional services (consultants, accountants, etc.), travel expenses, and other miscellaneous costs. Idaho Startup Costs Worksheet assists entrepreneurs in calculating their total startup costs, enabling them to create a more accurate and realistic business plan. This helps entrepreneurs secure funding from banks, investors, or other sources, as they can provide a well-defined and detailed breakdown of their financial needs. It also serves as a useful tool for tracking expenses and monitoring the financial health of the business. Overall, the Idaho Startup Costs Worksheet is a crucial resource for entrepreneurs and small business owners looking to establish and manage their business effectively in Idaho. It provides clarity and transparency regarding the financial requirements involved in starting a business, helping them make informed decisions and achieve long-term success. Different types of Idaho Startup Costs Worksheets may exist depending on specific industries or business models. For example: 1. Retail Startup Costs Worksheet: Tailored for entrepreneurs planning to launch a retail business, this worksheet might include sections specifically related to inventory management and visual merchandising costs. 2. Restaurant Startup Costs Worksheet: Geared towards individuals starting a restaurant or food service business, this worksheet might incorporate areas for menu development, kitchen equipment, and staff training expenses. 3. Service-Based Startup Costs Worksheet: Designed for entrepreneurs offering professional services like consulting or freelancing, this worksheet would likely emphasize marketing and client acquisition costs rather than physical assets. 4. Manufacturing Startup Costs Worksheet: Targeting individuals entering the manufacturing industry, this worksheet may place greater emphasis on machinery, production equipment, raw materials, and supply chain logistics. These specialized versions of the Idaho Startup Costs Worksheet provide tailored guidance and ensure that entrepreneurs have a comprehensive understanding of their sector-specific startup expenses.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Idaho Hoja de trabajo de costos iniciales - Startup Costs Worksheet

Description

How to fill out Idaho Hoja De Trabajo De Costos Iniciales?

It is possible to devote time online searching for the authorized record template that meets the state and federal specifications you want. US Legal Forms gives a huge number of authorized varieties which can be reviewed by specialists. It is simple to download or print the Idaho Startup Costs Worksheet from our support.

If you already possess a US Legal Forms accounts, you may log in and click on the Down load key. After that, you may comprehensive, modify, print, or indicator the Idaho Startup Costs Worksheet. Each authorized record template you get is your own permanently. To acquire one more version for any purchased develop, go to the My Forms tab and click on the related key.

If you work with the US Legal Forms website for the first time, adhere to the easy guidelines under:

- Initially, be sure that you have chosen the proper record template to the region/city that you pick. Read the develop explanation to make sure you have selected the proper develop. If readily available, utilize the Preview key to search throughout the record template also.

- If you wish to get one more version of your develop, utilize the Lookup industry to get the template that meets your requirements and specifications.

- Upon having identified the template you would like, click on Get now to move forward.

- Find the costs prepare you would like, type in your references, and register for a merchant account on US Legal Forms.

- Comprehensive the deal. You can utilize your credit card or PayPal accounts to pay for the authorized develop.

- Find the file format of your record and download it for your gadget.

- Make adjustments for your record if necessary. It is possible to comprehensive, modify and indicator and print Idaho Startup Costs Worksheet.

Down load and print a huge number of record layouts making use of the US Legal Forms site, which provides the biggest assortment of authorized varieties. Use professional and state-specific layouts to tackle your company or person requirements.