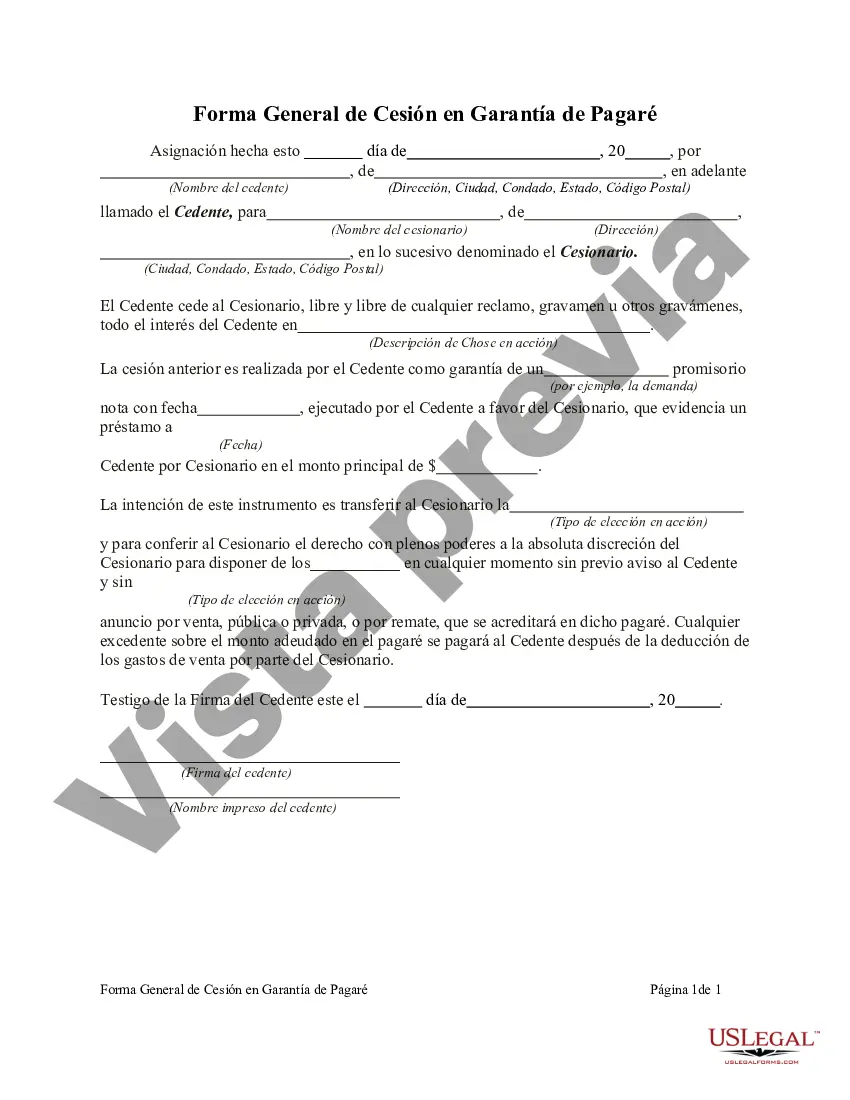

Idaho General Form of Assignment as Collateral for Note is a legal document used in Idaho to secure a loan or debt using collateral. This assignment serves as a guarantee that in case of default or non-payment of the note, the lender will have a right to claim the specified collateral as compensation. The collateral can be any valuable property, such as real estate, vehicles, or other assets. In Idaho, there are two main types of General Form of Assignment as Collateral for Note: 1. Real Estate Collateral Assignment: This form of assignment is commonly used when the collateral is a property or real estate. The borrower assigns their interest in the property to the lender as collateral for the note. This type of assignment grants the lender the right to foreclose on the property if the borrower fails to meet their debt obligations. 2. Personal Property Collateral Assignment: When the collateral for the note is personal property, such as vehicles, equipment, or valuable assets, this form is utilized. The borrower assigns their ownership rights in the personal property to the lender as collateral. In case of default, the lender can seize and sell the assigned property to recover the outstanding debt. Both types of Idaho General Form of Assignment as Collateral for Note protect the lender's interest in providing a legal basis for them to claim the collateral in the event of non-payment. Additionally, these forms outline the borrower's responsibilities and consequences, such as potential loss of ownership rights to the assigned collateral. It is essential to consult with a qualified attorney to ensure compliance with Idaho laws and to draft the appropriate General Form of Assignment as Collateral for Note tailored to the specific circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Idaho Forma General de Cesión en Garantía de Pagaré - General Form of Assignment as Collateral for Note

Description

How to fill out Idaho Forma General De Cesión En Garantía De Pagaré?

US Legal Forms - among the most significant libraries of legitimate varieties in the United States - gives a wide array of legitimate file themes you are able to download or produce. Utilizing the site, you can find thousands of varieties for business and person purposes, sorted by types, states, or search phrases.You can find the most recent variations of varieties such as the Idaho General Form of Assignment as Collateral for Note within minutes.

If you currently have a membership, log in and download Idaho General Form of Assignment as Collateral for Note from your US Legal Forms catalogue. The Obtain key will show up on every form you perspective. You gain access to all previously acquired varieties in the My Forms tab of your respective profile.

If you would like use US Legal Forms the very first time, here are simple directions to get you started off:

- Ensure you have picked the correct form for your personal town/state. Select the Preview key to review the form`s articles. Browse the form outline to ensure that you have chosen the right form.

- In case the form doesn`t suit your specifications, take advantage of the Research field at the top of the screen to get the one that does.

- When you are happy with the shape, validate your option by visiting the Purchase now key. Then, pick the costs prepare you prefer and give your accreditations to register on an profile.

- Method the purchase. Utilize your charge card or PayPal profile to finish the purchase.

- Choose the formatting and download the shape on your own product.

- Make alterations. Load, revise and produce and sign the acquired Idaho General Form of Assignment as Collateral for Note.

Every single web template you put into your money does not have an expiry time and is your own for a long time. So, if you want to download or produce another duplicate, just check out the My Forms area and then click on the form you will need.

Obtain access to the Idaho General Form of Assignment as Collateral for Note with US Legal Forms, probably the most substantial catalogue of legitimate file themes. Use thousands of expert and condition-specific themes that fulfill your organization or person demands and specifications.