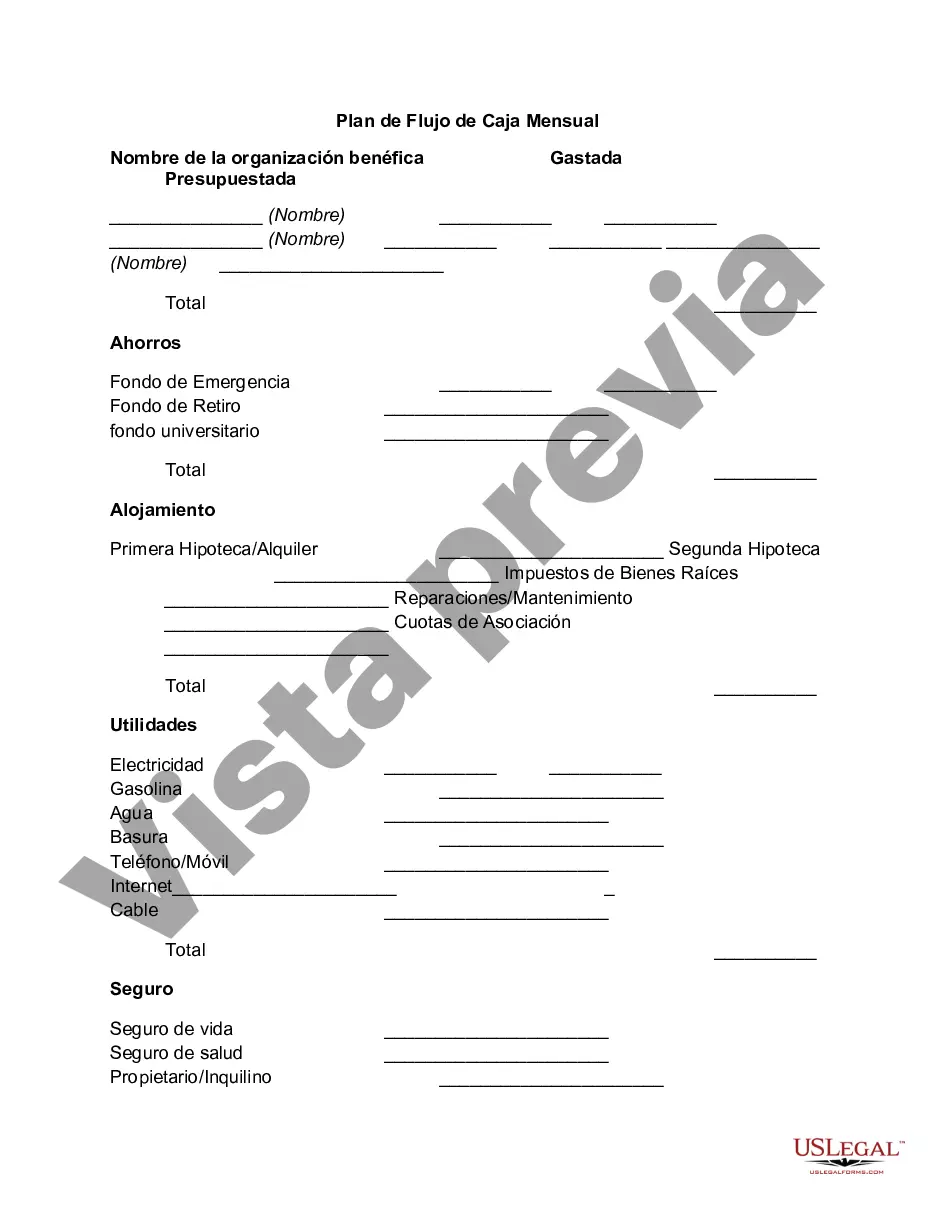

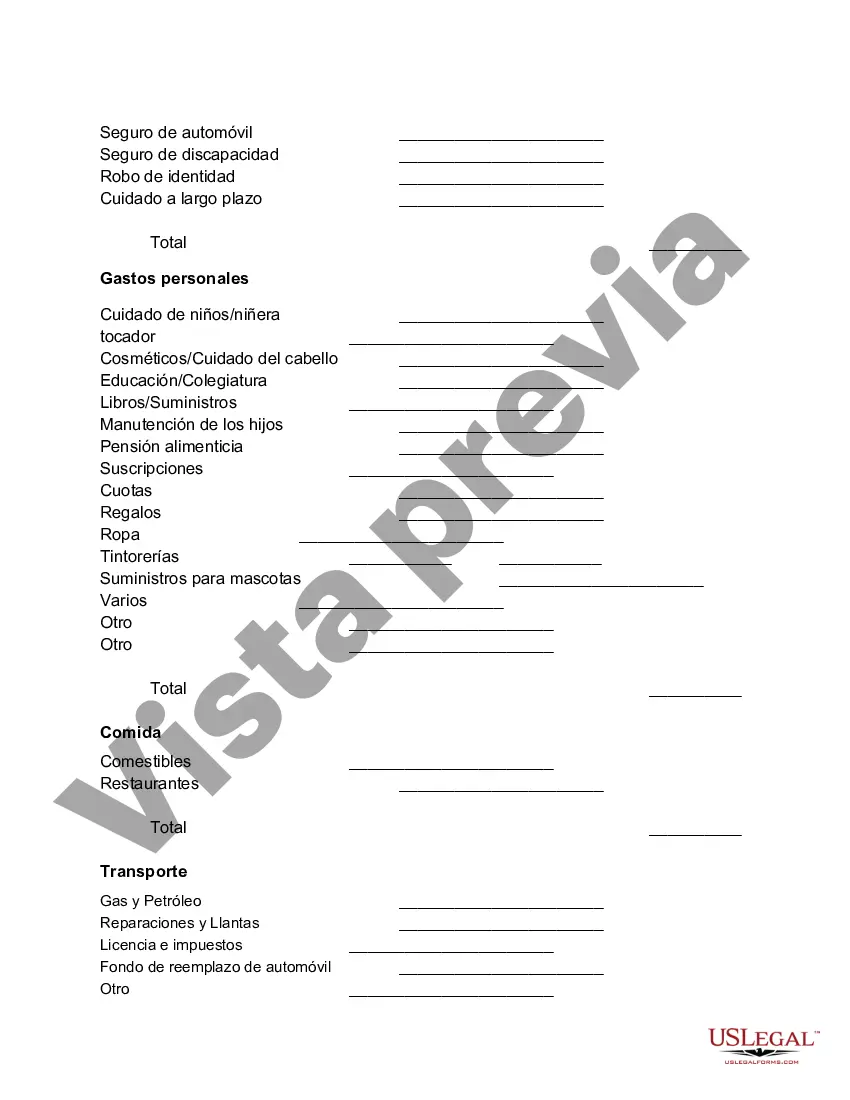

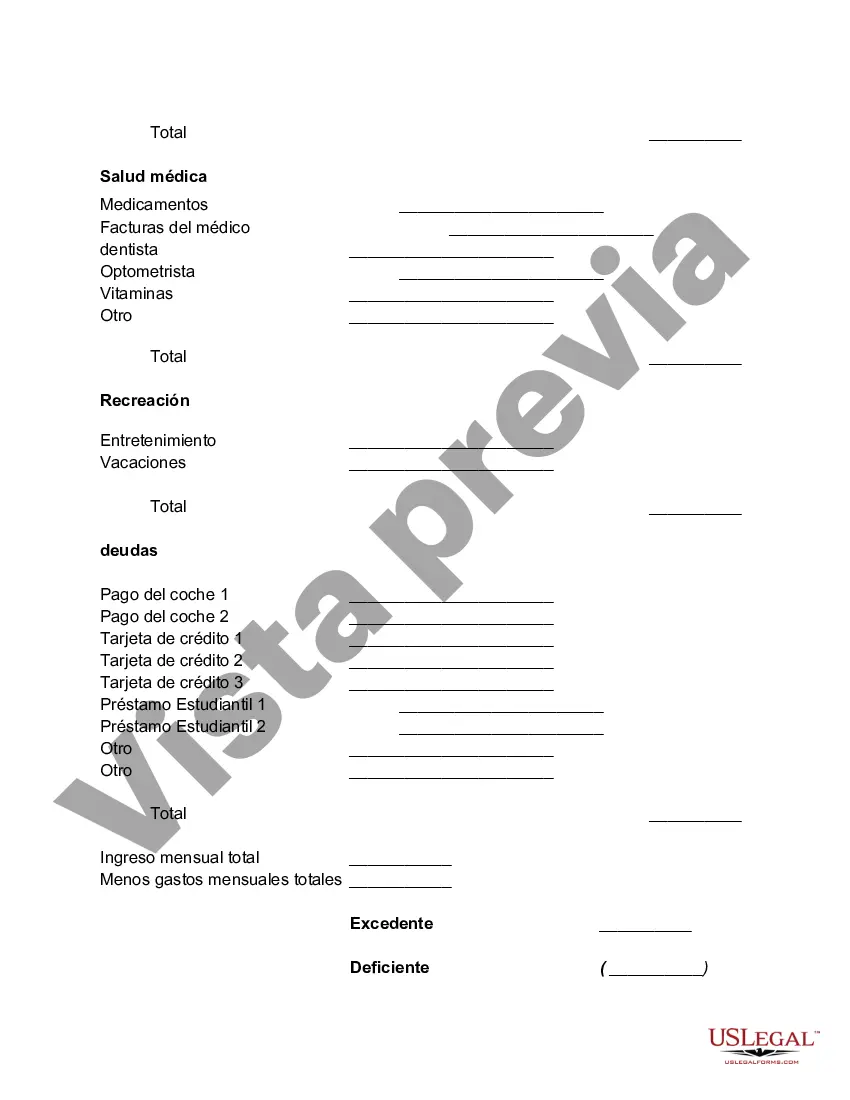

The Idaho Monthly Cash Flow Plan is a comprehensive financial tool designed to help individuals and families effectively manage their expenses, savings, and income on a month-to-month basis. By outlining specific financial goals and tracking both fixed and variable expenses, this plan enables users to stay on top of their finances and make informed decisions. The key aspect of the Idaho Monthly Cash Flow Plan is its ability to provide a clear understanding of one's cash inflows and outflows. By categorizing income sources, such as wages, investments, or business income, users can accurately estimate their monthly earnings. This detailed analysis empowers individuals to take control of their finances and maximize their saving potential. One of the significant components of the Idaho Monthly Cash Flow Plan is the identification and categorization of various expenses. Fixed expenses, such as rent or mortgage payments, insurance premiums, and utilities, are essential outflows that often recur monthly without significant variation. Variable expenses, on the other hand, include flexible categories like groceries, entertainment, transportation costs, and miscellaneous expenses. By itemizing and keeping track of these expenses, individuals can anticipate their financial obligations and strategize accordingly. The Idaho Monthly Cash Flow Plan also encourages users to set specific financial goals and allocate a portion of their income towards savings, debt repayment, and investments. By prioritizing these objectives and establishing realistic timelines, individuals can work towards achieving long-term financial stability and security. While there may not be different types of the Idaho Monthly Cash Flow Plan, it can be customized and tailored to suit individual preferences and financial situations. Some users may prefer a simplified version that focuses solely on tracking income and expenses, while others may opt for a more detailed plan that includes additional elements like debt reduction strategies, emergency fund allocation, and retirement planning. In conclusion, the Idaho Monthly Cash Flow Plan is an invaluable financial tool that helps individuals and families manage their income, expenses, and savings effectively. By organizing and tracking financial information, setting goals, and making informed decisions, users can gain control of their finances, reduce debt, save for the future, and achieve a more stable and prosperous financial outlook.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Idaho Plan de Flujo de Caja Mensual - Monthly Cash Flow Plan

Description

How to fill out Idaho Plan De Flujo De Caja Mensual?

US Legal Forms - one of the most significant libraries of authorized types in the USA - offers a wide array of authorized papers web templates you can down load or print. While using web site, you may get a huge number of types for organization and individual reasons, categorized by types, says, or key phrases.You will find the most recent versions of types like the Idaho Monthly Cash Flow Plan within minutes.

If you already possess a subscription, log in and down load Idaho Monthly Cash Flow Plan through the US Legal Forms catalogue. The Down load key will show up on every type you look at. You have accessibility to all earlier saved types from the My Forms tab of the account.

If you wish to use US Legal Forms initially, here are straightforward guidelines to help you get started out:

- Be sure you have picked out the right type to your metropolis/county. Click the Preview key to check the form`s content material. Look at the type outline to actually have chosen the appropriate type.

- If the type does not fit your needs, make use of the Research area towards the top of the display to obtain the one who does.

- In case you are satisfied with the shape, verify your option by clicking the Purchase now key. Then, choose the pricing plan you prefer and provide your credentials to sign up to have an account.

- Procedure the deal. Utilize your charge card or PayPal account to perform the deal.

- Choose the file format and down load the shape on the device.

- Make changes. Fill up, change and print and signal the saved Idaho Monthly Cash Flow Plan.

Every format you put into your account lacks an expiration day and is also yours permanently. So, if you want to down load or print another backup, just visit the My Forms area and then click around the type you require.

Gain access to the Idaho Monthly Cash Flow Plan with US Legal Forms, probably the most comprehensive catalogue of authorized papers web templates. Use a huge number of professional and state-particular web templates that fulfill your small business or individual requires and needs.