Idaho Pot Testamentary Trust: A Detailed Description and Types In the realm of estate planning and asset protection, the Idaho Pot Testamentary Trust serves as a valuable tool, allowing individuals to safeguard and manage their assets for their loved ones even after their demise. This type of trust specifically focuses on the inheritance of assets related to the legal cannabis industry in Idaho, where marijuana has been legalized for medical purposes. The Idaho Pot Testamentary Trust, also known as a testamentary trust, is established through a legally binding document called a Last Will and Testament. It outlines the desires and intentions of the trust creator, commonly referred to as the granter or settler, for the distribution and management of their assets upon their death. The purpose of this trust is to protect the inherited assets, such as cannabis-related businesses, properties, licenses, or stocks, from potential risks, creditors, taxation, and mismanagement. This testamentary trust employs a trustee, who is responsible for managing and administering the trust assets according to the granter's instructions. The trustee can be an individual, a corporate entity, or even a trusted law firm, particularly experienced in handling trust administration. Their fiduciary duty is to act in the best interest of the trust beneficiaries, ensuring the trust assets are safeguarded and utilized wisely. It's important to note that there may be variations or different types of Idaho Pot Testamentary Trusts, depending on the specific needs and preferences of the granter. Some of these variations include: 1. Standard Idaho Pot Testamentary Trust: This is the most common type, designed to provide general protection and controlled distribution of the inherited cannabis-related assets. It may include provisions for the beneficiaries' health, education, and general well-being. 2. Spendthrift Idaho Pot Testamentary Trust: This type of trust adds an extra layer of protection, safeguarding the trust assets from potential creditors or financial mismanagement by the beneficiaries. It limits their ability to access or liquidate the assets independently. 3. Special Needs Idaho Pot Testamentary Trust: This variant caters to beneficiaries with special needs or disabilities who are eligible for government assistance programs. It allows them to receive the benefits while still enjoying the inherited cannabis-related assets, without disqualifying them from such supportive programs. 4. Charitable Idaho Pot Testamentary Trust: Granters passionate about philanthropy can establish this trust to support charitable organizations or causes related to the cannabis industry in Idaho. It ensures the assets are distributed to selected charities or used for specific purposes that align with the granter's intentions. In conclusion, the Idaho Pot Testamentary Trust offers an effective means to protect and control the distribution of inherited assets originating from the legal cannabis industry in Idaho. By utilizing different types and variations of this trust, individuals can tailor their estate plans to suit their unique circumstances, ensuring their assets are managed with care and alignment to their intentions. Keywords: Idaho Pot Testamentary Trust, legal cannabis industry, inheritance, estate planning, asset protection, Last Will and Testament, testamentary trust, trust creator, granter, settler, distribution, management, trustee, trust beneficiaries, protection, creditors, taxation, trust administration, variations, spendthrift, special needs, charitable.

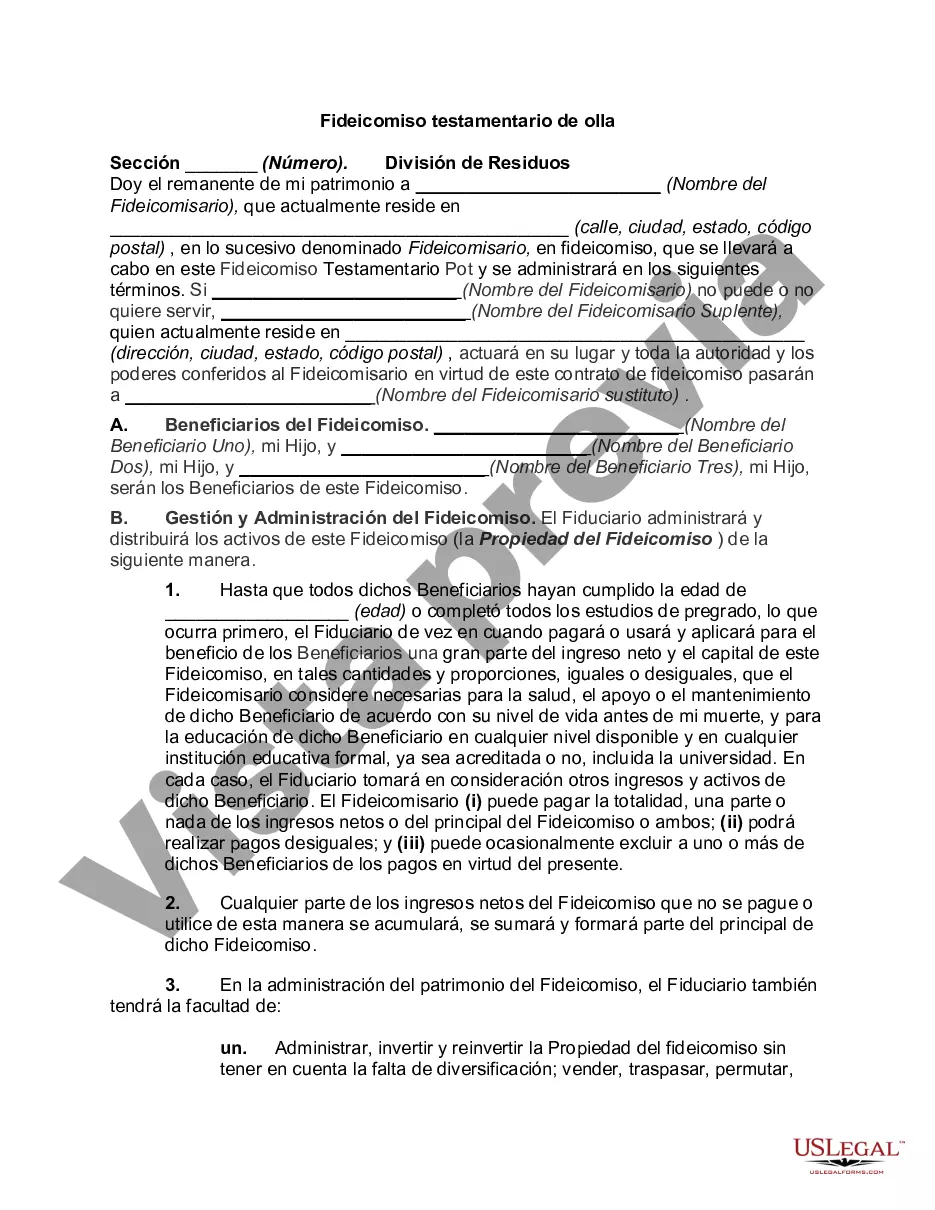

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Idaho Fideicomiso testamentario de olla - Pot Testamentary Trust

Description

How to fill out Idaho Fideicomiso Testamentario De Olla?

Are you presently within a position the place you need documents for possibly business or individual functions almost every time? There are plenty of legitimate record templates available on the net, but discovering ones you can rely on isn`t straightforward. US Legal Forms delivers thousands of develop templates, just like the Idaho Pot Testamentary Trust, that are composed to satisfy federal and state needs.

When you are presently informed about US Legal Forms web site and also have a merchant account, basically log in. Next, you can acquire the Idaho Pot Testamentary Trust design.

Should you not come with an profile and need to begin using US Legal Forms, abide by these steps:

- Discover the develop you require and make sure it is for the correct city/county.

- Make use of the Preview switch to analyze the shape.

- Read the outline to ensure that you have selected the right develop.

- In the event the develop isn`t what you are searching for, utilize the Lookup discipline to obtain the develop that meets your needs and needs.

- If you find the correct develop, click Purchase now.

- Opt for the rates prepare you desire, complete the specified details to produce your bank account, and buy an order making use of your PayPal or Visa or Mastercard.

- Pick a convenient document format and acquire your version.

Find every one of the record templates you might have purchased in the My Forms menus. You may get a further version of Idaho Pot Testamentary Trust at any time, if possible. Just click on the necessary develop to acquire or print the record design.

Use US Legal Forms, the most extensive selection of legitimate varieties, to conserve time and stay away from mistakes. The services delivers appropriately produced legitimate record templates which can be used for a range of functions. Generate a merchant account on US Legal Forms and begin producing your lifestyle a little easier.