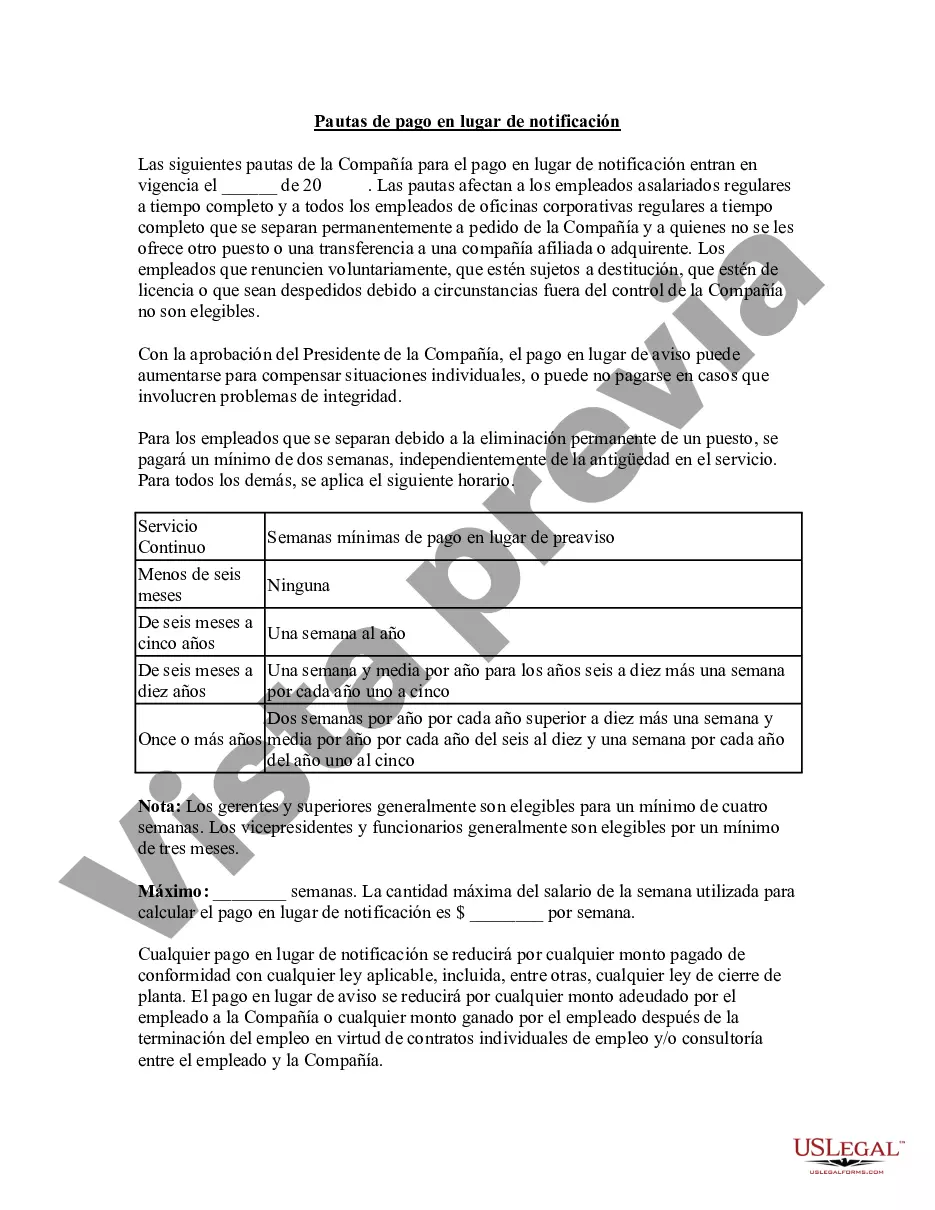

Idaho Pay in Lieu of Notice Guidelines are provisions that determine the employer's obligations to compensate an employee when terminating their employment without providing the requisite notice period. Pay in Lieu of Notice (PILOT) refers to the compensation amount that an employer must provide in place of actual notice of termination. In Idaho, there are specific guidelines that outline the requirements for the payment of PILOT. These guidelines are designed to protect the rights of both employers and employees and ensure fair treatment during termination situations. The key elements and aspects of Idaho Pay in Lieu of Notice Guidelines include: 1. Notice Period: The Idaho Department of Labor defines the notice period as the time frame an employer must give to an employee before terminating their employment. The duration of the notice period depends on various factors such as employment length, contractual agreements, and circumstances of termination. 2. Eligibility: Not all employees may be entitled to pay in lieu of notice. The guidelines usually apply to employees who have completed a certain minimum period of service, often referred to as a qualifying period. This qualifying period can vary depending on employment contracts, statutory laws, and the employer's policies. 3. Calculation of Payment: Idaho Pay in Lieu of Notice Guidelines typically establish a method for calculating the amount that an employer must pay to an employee in lieu of providing the actual notice period. The payment is often based on factors such as the employee's regular salary, benefits, and any other remuneration they would have received during the notice period. 4. Exceptions and Exemptions: The guidelines may include provisions that exempt specific types of employment or situations from the requirement of providing pay in lieu of notice. For instance, termination due to misconduct, voluntary resignation, or expiry of temporary contracts may exempt the employer from this obligation. It is essential to note that Idaho Pay in Lieu of Notice Guidelines may vary depending on the specific industry, occupation, or collective bargaining agreements. Different types of Idaho Pay in Lieu of Notice Guidelines may include: 1. Private Sector Guidelines: These guidelines cover employees working in private companies and are primarily derived from state employment laws and regulations. They establish the minimum notice period and the payment owed to eligible employees. 2. Public Sector Guidelines: For public sector employees like state or municipal workers, separate guidelines may be applicable. These guidelines are often set by the relevant government entities or may be outlined in employment contracts and collective bargaining agreements. 3. Unionized Workforce Guidelines: In workplaces where employees are represented by labor unions, the guidelines regarding pay in lieu of notice may be negotiated through collective bargaining. These negotiated agreements can supersede the general state guidelines. It is crucial for both employers and employees in Idaho to familiarize themselves with the specific Idaho Pay in Lieu of Notice Guidelines applicable to their circumstances. Consulting with legal professionals or the Idaho Department of Labor can provide comprehensive and up-to-date information on these guidelines.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Idaho Pautas de pago en lugar de notificación - Pay in Lieu of Notice Guidelines

Description

How to fill out Idaho Pautas De Pago En Lugar De Notificación?

You are able to spend time on the Internet looking for the lawful papers format that meets the state and federal demands you need. US Legal Forms supplies a huge number of lawful types that happen to be reviewed by pros. It is simple to download or print out the Idaho Pay in Lieu of Notice Guidelines from your assistance.

If you already have a US Legal Forms account, you can log in and then click the Down load option. Following that, you can comprehensive, revise, print out, or signal the Idaho Pay in Lieu of Notice Guidelines. Every single lawful papers format you get is the one you have eternally. To acquire an additional version of any obtained kind, proceed to the My Forms tab and then click the related option.

If you are using the US Legal Forms website the very first time, follow the easy guidelines listed below:

- Initially, ensure that you have selected the right papers format to the state/town of your choice. Read the kind outline to ensure you have chosen the proper kind. If accessible, use the Preview option to search through the papers format also.

- If you would like find an additional edition from the kind, use the Look for field to discover the format that fits your needs and demands.

- Upon having found the format you would like, click Get now to move forward.

- Select the prices prepare you would like, type your qualifications, and register for a merchant account on US Legal Forms.

- Complete the transaction. You can use your Visa or Mastercard or PayPal account to fund the lawful kind.

- Select the file format from the papers and download it to your gadget.

- Make alterations to your papers if needed. You are able to comprehensive, revise and signal and print out Idaho Pay in Lieu of Notice Guidelines.

Down load and print out a huge number of papers layouts utilizing the US Legal Forms Internet site, that provides the largest selection of lawful types. Use specialist and state-certain layouts to take on your business or personal requires.