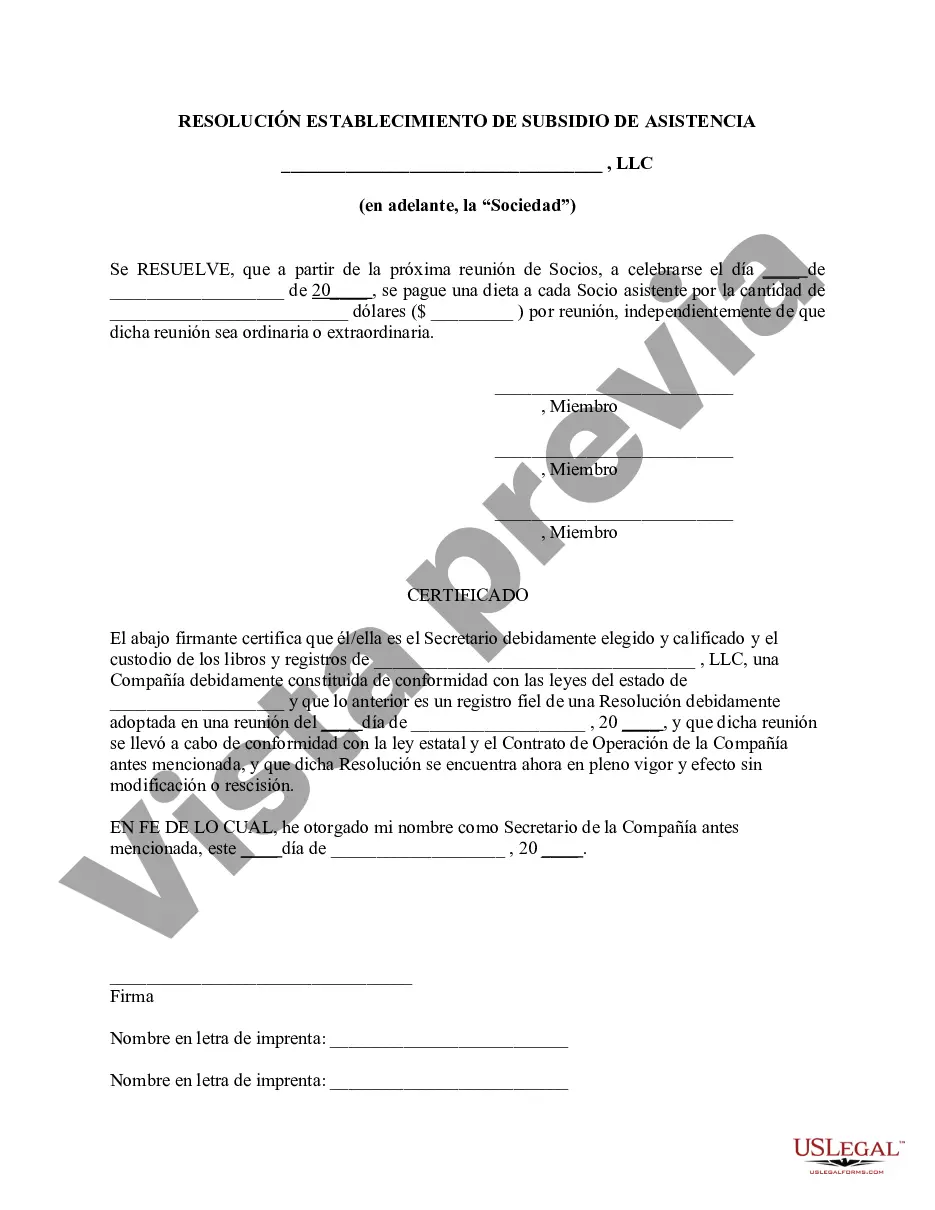

Idaho is a state located in the Northwestern United States known for its diverse landscapes, including rugged mountains, vast forests, and expansive plains. It is the 14th largest state in terms of land area and has a population of over 1.7 million people. Within Idaho's business landscape, the resolution of a meeting of LLC (Limited Liability Company) members to set attendance allowance is an important aspect. This resolution serves as an agreement among the members regarding the allowance or compensation for attending meetings related to the LLC's operations and decision-making processes. There can be various types of Idaho resolutions of meetings of LLC members to set attendance allowance, depending on the specific needs and circumstances of the LLC. Some of these types may include: 1. Standard Attendance Allowance Resolution: This type of resolution outlines the standard monetary or non-monetary allowance offered to LLC members for attending regular meetings. It may specify a fixed amount or a percentage of the LLC's profits or revenues. 2. Performance-Based Attendance Allowance Resolution: In some cases, an LLC may opt for a performance-based attendance allowance, which rewards members based on their contributions or achievements. This type of resolution can motivate members to actively participate in meetings and contribute to the LLC's success. 3. Extraordinary Meeting Attendance Allowance Resolution: LCS occasionally hold extraordinary meetings to discuss and make decisions about crucial matters outside regular meetings. This resolution addresses the attendance allowance for such meetings, which may differ from the standard attendance allowance. 4. Hybrid Attendance Allowance Resolution: LCS with unique requirements may adopt a hybrid attendance allowance resolution. This type combines elements from different allowance structures to accommodate specific circumstances or address the LLC's unique needs. When drafting and implementing a resolution of a meeting of LLC members to set attendance allowance in Idaho, it is crucial to consider the LLC's operating agreement, applicable state laws, and the best interests of the members and the LLC as a whole. Remember, it is always recommended seeking advice from legal professionals or experienced business consultants to ensure compliance and optimal utilization of attendance allowance resolutions in Idaho LCS.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Idaho Resolución de la reunión de miembros de la LLC para establecer la asignación de asistencia - Resolution of Meeting of LLC Members to Set Attendance Allowance

Description

How to fill out Idaho Resolución De La Reunión De Miembros De La LLC Para Establecer La Asignación De Asistencia?

US Legal Forms - one of several greatest libraries of authorized types in the United States - gives a wide array of authorized papers layouts you may obtain or print out. Utilizing the internet site, you can get thousands of types for company and specific uses, categorized by types, says, or key phrases.You can get the most recent models of types like the Idaho Resolution of Meeting of LLC Members to Set Attendance Allowance in seconds.

If you already possess a membership, log in and obtain Idaho Resolution of Meeting of LLC Members to Set Attendance Allowance in the US Legal Forms catalogue. The Down load key can look on every single develop you look at. You gain access to all in the past saved types inside the My Forms tab of your respective bank account.

If you wish to use US Legal Forms initially, here are easy guidelines to help you get started out:

- Ensure you have chosen the best develop to your area/state. Click on the Preview key to check the form`s content. See the develop explanation to actually have chosen the proper develop.

- If the develop doesn`t match your demands, use the Search discipline at the top of the screen to discover the one who does.

- Should you be satisfied with the shape, confirm your selection by visiting the Get now key. Then, select the costs program you want and provide your credentials to sign up on an bank account.

- Process the transaction. Make use of your Visa or Mastercard or PayPal bank account to perform the transaction.

- Find the formatting and obtain the shape in your device.

- Make alterations. Load, modify and print out and signal the saved Idaho Resolution of Meeting of LLC Members to Set Attendance Allowance.

Each template you put into your bank account lacks an expiration day which is yours for a long time. So, if you would like obtain or print out an additional backup, just proceed to the My Forms area and click on on the develop you require.

Gain access to the Idaho Resolution of Meeting of LLC Members to Set Attendance Allowance with US Legal Forms, the most considerable catalogue of authorized papers layouts. Use thousands of professional and status-particular layouts that meet up with your small business or specific requirements and demands.