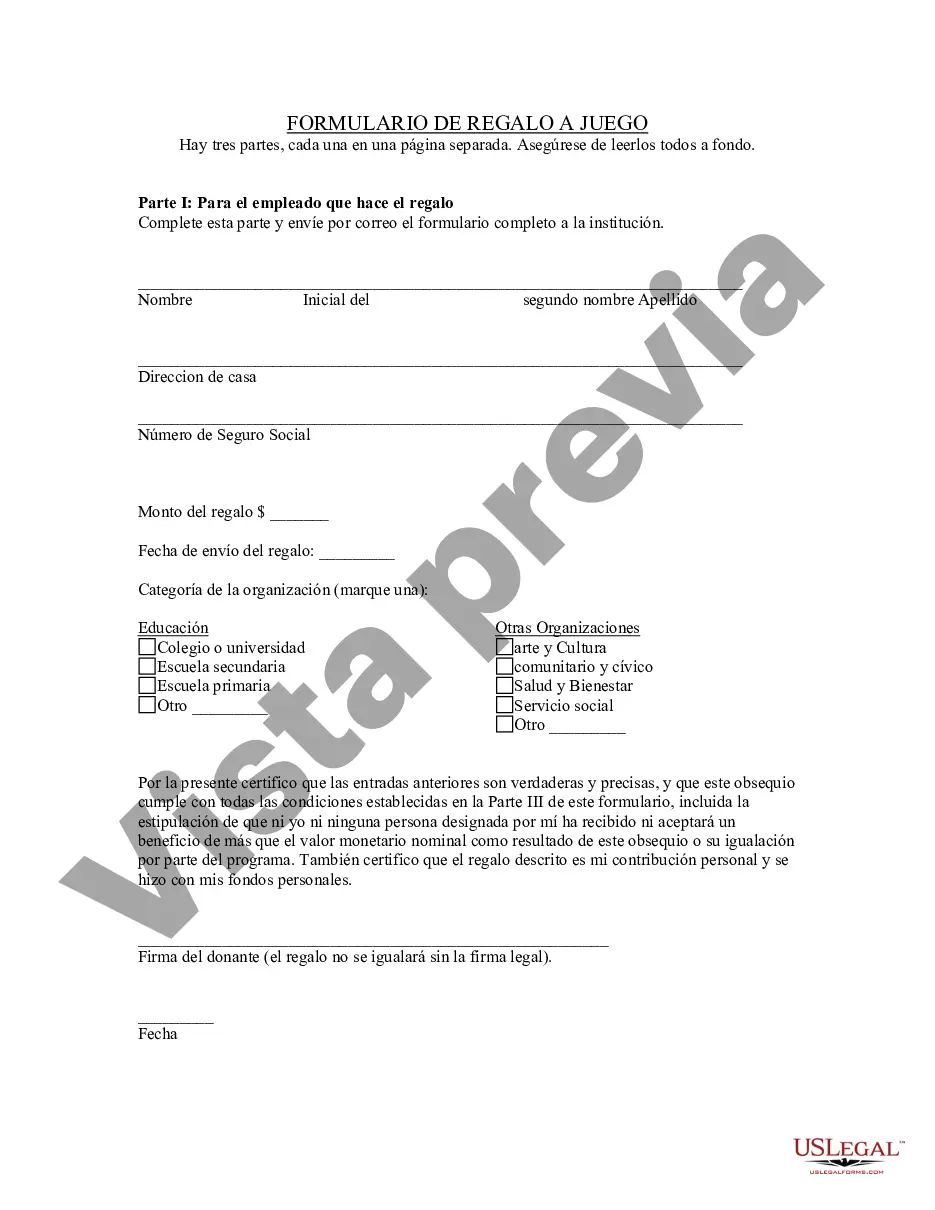

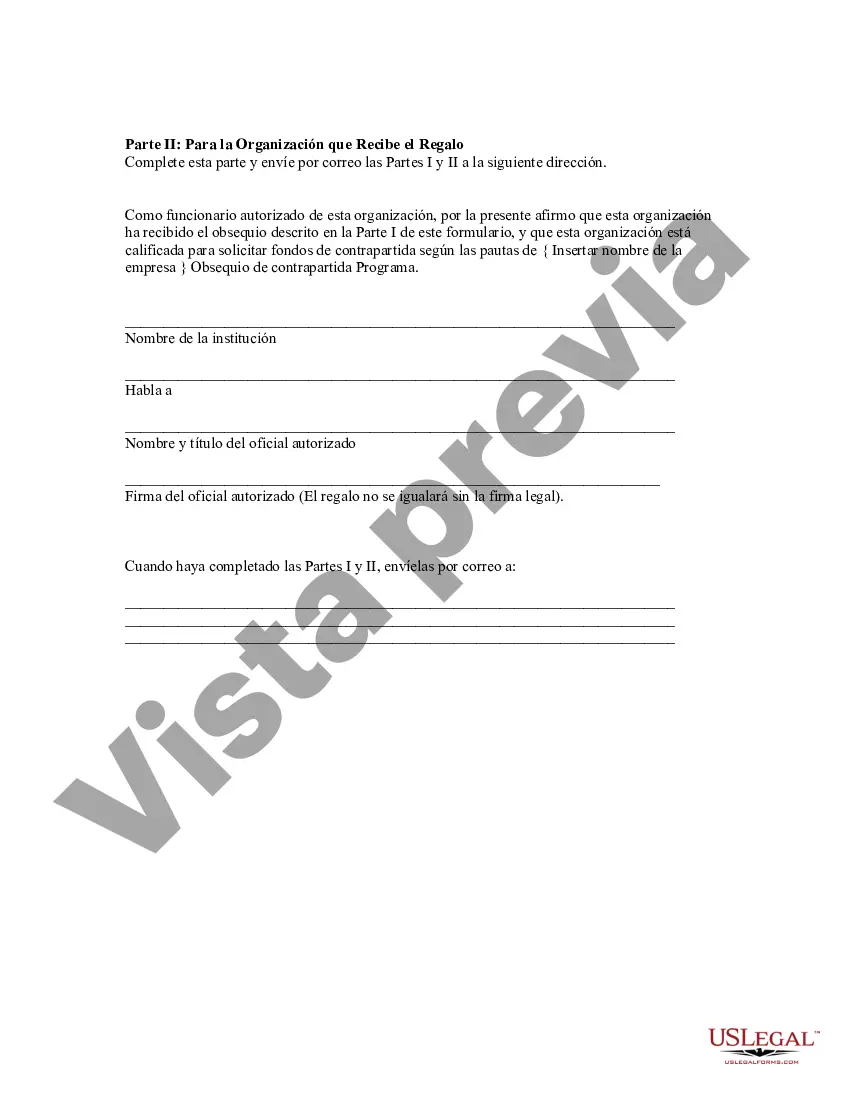

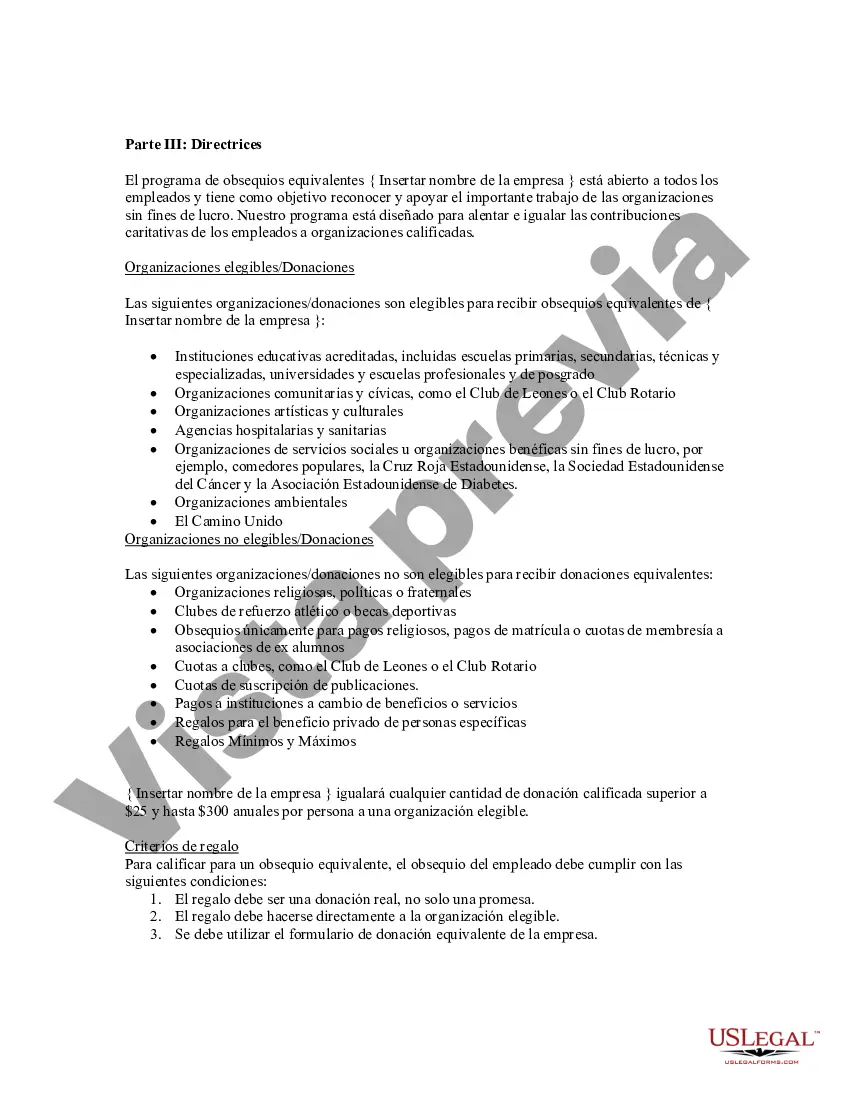

The Idaho Matching Gift Form is a tool used by Idaho-based organizations and businesses to facilitate employee giving programs. This form specifically relates to corporate matching gift programs where employers agree to match their employees' charitable donations to eligible nonprofits. The form formalizes the process for employees to request their employer's match and provides essential information required by employers to process the matching gift. The Idaho Matching Gift Form typically requires the following details: 1. Employee Information: This section captures the employee's name, address, contact details, and, in some cases, employee identification number or email address. 2. Donor Information: Here, the employee needs to provide the information related to their original donation, such as donation amount, date, and the name of the nonprofit organization to which they made the contribution. 3. Employer Information: This part of the form requests the details of the employing organization, including the company's name, address, and any specific matching gift program guidelines or instructions. 4. Nonprofit Organization Information: This section requires the employee to indicate the name and contact information of the nonprofit organization they donated to, including the organization's tax identification number (TIN) or Employer Identification Number (EIN). 5. Proof of Donation: Often, employees are required to attach a copy of their donation receipt or acknowledgment from the nonprofit organization to validate their donation. Different employers may have their own customized Idaho Matching Gift Forms to align with their specific matching gift program guidelines. These forms may vary in structure, layout, and required information, but the core purpose remains the same: to facilitate the employer's process of verifying and matching their employees' charitable donations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Idaho Formulario de regalo a juego - Matching Gift Form

Description

How to fill out Idaho Formulario De Regalo A Juego?

Are you in the placement where you require files for either company or individual purposes nearly every day time? There are a variety of legal document layouts available on the Internet, but finding types you can trust is not effortless. US Legal Forms delivers thousands of type layouts, like the Idaho Matching Gift Form, that happen to be created to fulfill state and federal specifications.

Should you be already acquainted with US Legal Forms website and possess an account, basically log in. Afterward, you are able to obtain the Idaho Matching Gift Form web template.

Should you not have an account and want to begin to use US Legal Forms, abide by these steps:

- Get the type you require and ensure it is for that appropriate town/state.

- Make use of the Review switch to analyze the form.

- See the outline to actually have selected the appropriate type.

- In case the type is not what you are trying to find, use the Research field to obtain the type that fits your needs and specifications.

- Whenever you obtain the appropriate type, click on Purchase now.

- Choose the pricing prepare you need, complete the required details to produce your account, and pay for an order making use of your PayPal or charge card.

- Pick a convenient file formatting and obtain your duplicate.

Discover every one of the document layouts you possess purchased in the My Forms food list. You can get a more duplicate of Idaho Matching Gift Form whenever, if necessary. Just go through the needed type to obtain or print out the document web template.

Use US Legal Forms, by far the most considerable assortment of legal forms, to conserve some time and avoid blunders. The assistance delivers appropriately created legal document layouts which can be used for an array of purposes. Produce an account on US Legal Forms and commence creating your way of life easier.