Idaho Nonqualified Stock Option Plan of the Banker's Note, Inc.

Description

How to fill out Nonqualified Stock Option Plan Of The Banker's Note, Inc.?

Discovering the right legal record format could be a battle. Of course, there are plenty of templates accessible on the Internet, but how can you get the legal form you will need? Use the US Legal Forms web site. The services offers 1000s of templates, including the Idaho Nonqualified Stock Option Plan of the Banker's Note, Inc., that can be used for company and personal demands. Every one of the varieties are checked by specialists and meet state and federal demands.

In case you are previously signed up, log in to the account and click the Acquire option to find the Idaho Nonqualified Stock Option Plan of the Banker's Note, Inc.. Use your account to look throughout the legal varieties you have purchased in the past. Proceed to the My Forms tab of the account and have yet another duplicate in the record you will need.

In case you are a new consumer of US Legal Forms, listed here are easy directions that you can comply with:

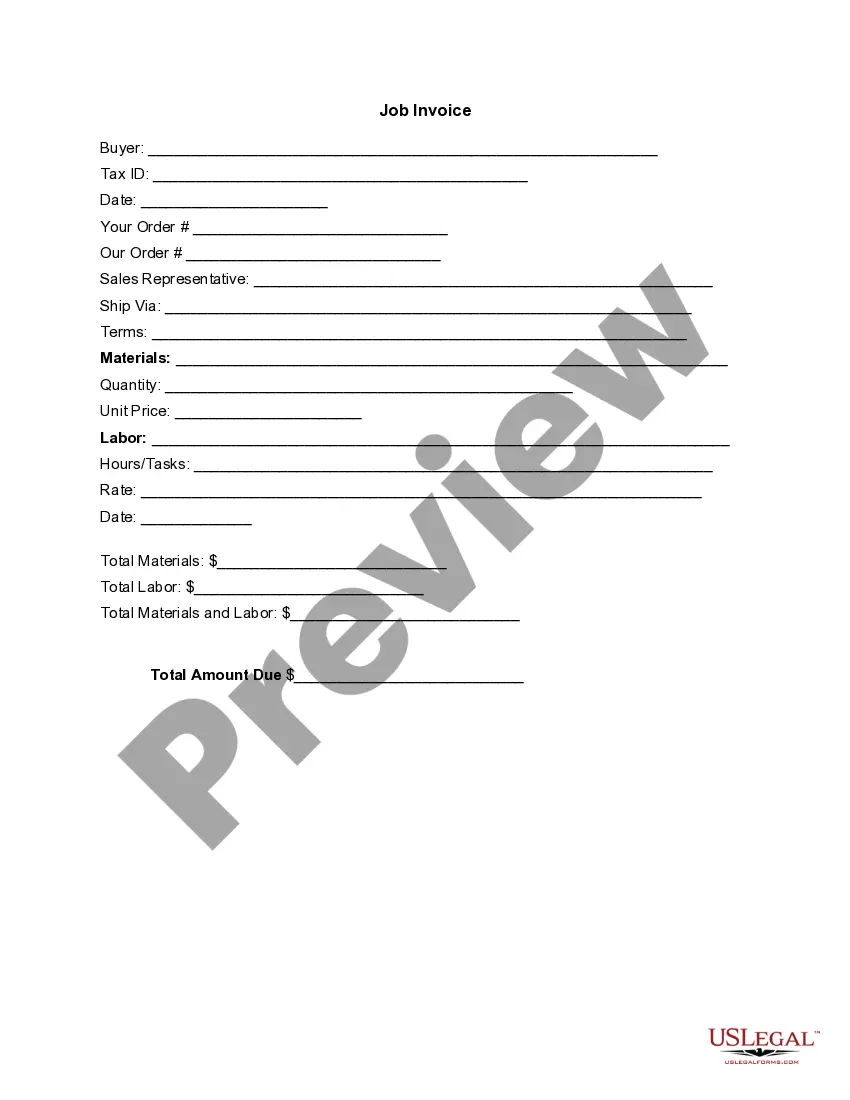

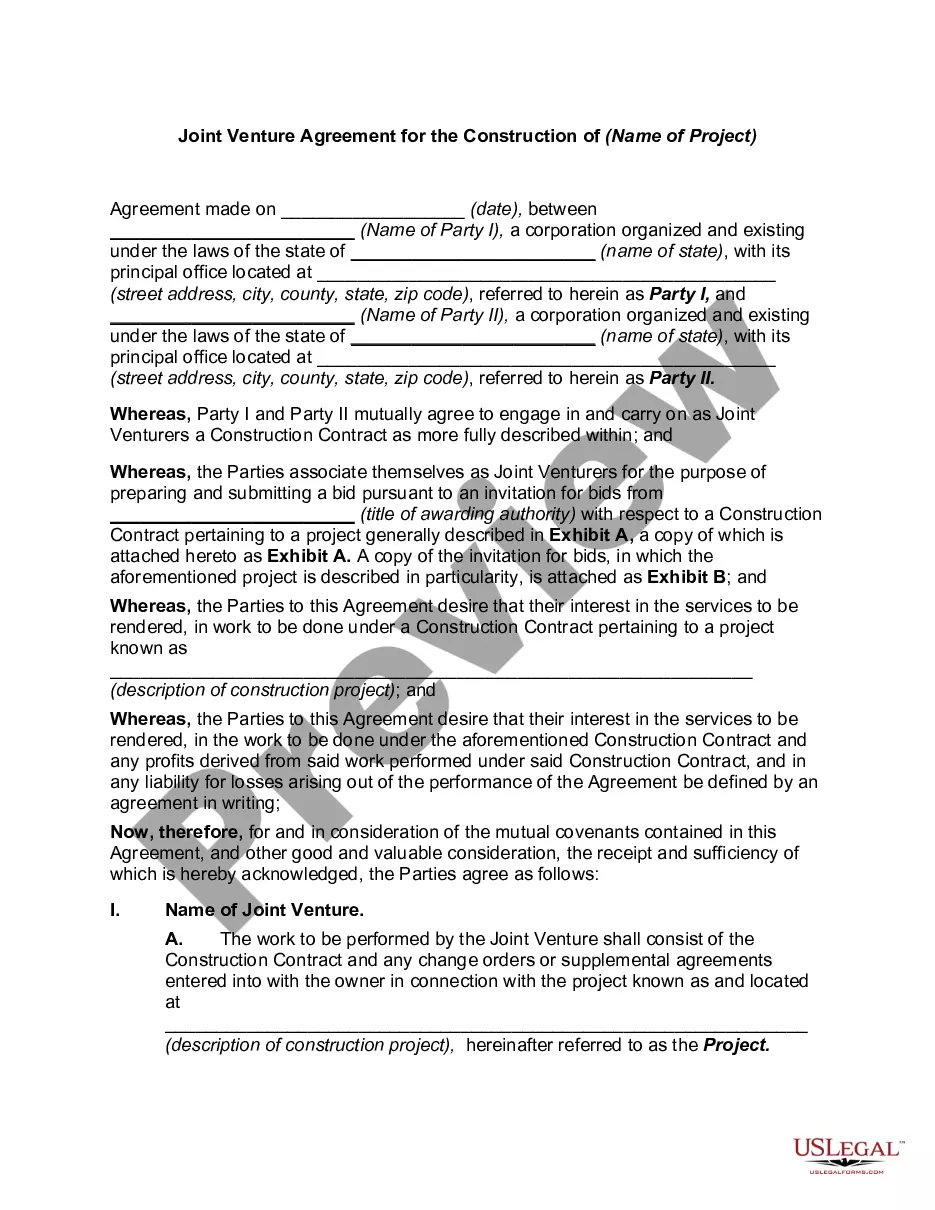

- Initial, ensure you have selected the proper form to your area/area. You may look through the form using the Preview option and browse the form outline to ensure this is basically the right one for you.

- In case the form does not meet your needs, utilize the Seach industry to get the right form.

- Once you are sure that the form is proper, go through the Buy now option to find the form.

- Opt for the rates prepare you would like and enter in the necessary info. Create your account and buy an order with your PayPal account or charge card.

- Choose the file structure and acquire the legal record format to the product.

- Full, modify and produce and signal the acquired Idaho Nonqualified Stock Option Plan of the Banker's Note, Inc..

US Legal Forms is definitely the most significant catalogue of legal varieties that you can discover a variety of record templates. Use the service to acquire skillfully-made papers that comply with condition demands.

Form popularity

FAQ

If you are on track toward meeting a retirement goal that is 10+ years out, it makes sense to choose options over RSUs. On the other hand, if you want to earmark this equity compensation for a retirement or education goal that is in five years or less, opting for more RSUs might be a better choice.

NSOs vs. RSUs NSOs give you the option to buy stock, but you might decide to never exercise them if the company's valuation falls below your strike price. In comparison, restricted stock units (RSUs) are actual shares that you acquire as they vest. You don't have to pay to exercise RSUs; you simply receive the shares.

Non-qualified stock options give employees the right, within a designated timeframe, to buy a set number of shares of their company's shares at a preset price. It may be offered as an alternative form of compensation to workers and also as a means to encourage their loyalty with the company. 1?

RSUs are easier to understand, manage, and most often considered less risky, with less downside. NSOs are more complex, harder to manage, and riskier, with more downside. Generally, you will receive more NSOs than RSUs. It is often helpful to breakout your considerations into tax and investment issues.

What Is a Non-Qualified Stock Option (NSO)? A non-qualified stock option (NSO) is a type of employee stock option wherein you pay ordinary income tax on the difference between the grant price and the price at which you exercise the option.

Restricted stock (also called letter stock or section 1244 stock) is usually awarded to company directors and other high-level executives, whereas restricted stock units (RSUs) are typically awarded to lower-level employees. Restricted stock tends to have more conditions and restrictions than an RSU.

Income tax upon exercise When you exercise NSOs and opt to purchase company shares, the difference between the market price of the shares and your NSO strike price is called the ?bargain element.? The bargain element is taxed as compensation, which means you'll need to pay ordinary income tax on that amount.

The income related to the option exercise should be included in the Form W-2 you receive from your employer or 1099-NEC from the company if you are a non-employee. Any capital gain or loss amount may also be reportable on your US Individual Income Tax Return (Form 1040), Schedule D and Form 8949 in the year of sale.