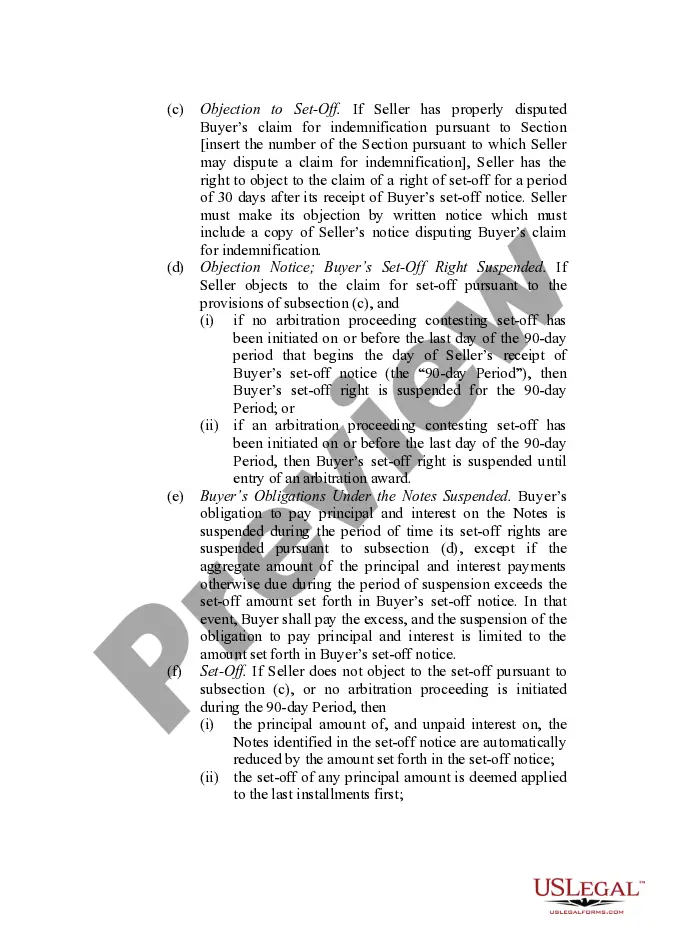

This form provides boilerplate contract clauses that outline means of securing the funds for payment of any indemnity, including use of an escrow fund or set-offs.

Idaho Indemnity Provisions - Means of Securing the Payment of the Indemnity

Description

How to fill out Indemnity Provisions - Means Of Securing The Payment Of The Indemnity?

If you have to total, obtain, or print legitimate record web templates, use US Legal Forms, the most important collection of legitimate forms, that can be found online. Utilize the site`s simple and hassle-free look for to obtain the papers you will need. Numerous web templates for enterprise and individual functions are sorted by types and says, or search phrases. Use US Legal Forms to obtain the Idaho Indemnity Provisions - Means of Securing the Payment of the Indemnity with a few mouse clicks.

When you are presently a US Legal Forms buyer, log in in your profile and click the Download option to get the Idaho Indemnity Provisions - Means of Securing the Payment of the Indemnity. You may also accessibility forms you earlier delivered electronically inside the My Forms tab of the profile.

Should you use US Legal Forms the very first time, follow the instructions under:

- Step 1. Be sure you have chosen the shape to the appropriate town/nation.

- Step 2. Make use of the Review option to look through the form`s content. Do not neglect to see the explanation.

- Step 3. When you are not satisfied with the kind, utilize the Look for field on top of the display screen to get other types from the legitimate kind template.

- Step 4. Upon having located the shape you will need, click the Purchase now option. Opt for the rates plan you prefer and include your qualifications to sign up to have an profile.

- Step 5. Process the deal. You can utilize your Мisa or Ьastercard or PayPal profile to accomplish the deal.

- Step 6. Find the structure from the legitimate kind and obtain it on the device.

- Step 7. Total, change and print or indicator the Idaho Indemnity Provisions - Means of Securing the Payment of the Indemnity.

Each and every legitimate record template you acquire is the one you have for a long time. You might have acces to every single kind you delivered electronically inside your acccount. Select the My Forms area and decide on a kind to print or obtain yet again.

Be competitive and obtain, and print the Idaho Indemnity Provisions - Means of Securing the Payment of the Indemnity with US Legal Forms. There are many expert and status-specific forms you may use to your enterprise or individual needs.

Form popularity

FAQ

Example 1: A service provider asking their customer to indemnify them to protect against misuse of their work product. Example 2: A rental car company, as the rightful owner of the car, having their customer indemnify them from any damage caused by the customer during the course of the retnal. Indemnification Clause: Meaning & Samples (2022) - Contracts Counsel contractscounsel.com ? indemnification-clause contractscounsel.com ? indemnification-clause

How to Write an Indemnity Agreement Consider the Indemnity Laws in Your Area. ... Draft the Indemnification Clause. ... Outline the Indemnification Period and Scope of Coverage. ... State the Indemnification Exceptions. ... Specify How the Indemnitee Notifies the Indemnitor About Claims. ... Write the Settlement and Consent Clause.

In a business transaction, a letter of indemnity (LOI) is a contractual document guaranteeing that specific provisions will be met between two parties in the event of a mishap leading to financial loss or damage to goods. An LOI is drafted by third-party institutions such as banks or insurance companies. What is Letter of Indemnity?| Meaning, Sample, Importance & More dripcapital.com ? en-us ? resources ? blog dripcapital.com ? en-us ? resources ? blog

Indemnifications, or ?hold harmless? provisions, shift risks or potential costs from one party to another. One party to the contract promises to defend and pay costs and expenses of the other if specific circumstances arise (often a claim or dispute with a third party to the contract).

Example 1: A service provider asking their customer to indemnify them to protect against misuse of their work product. Example 2: A rental car company, as the rightful owner of the car, having their customer indemnify them from any damage caused by the customer during the course of the retnal.

Letters of indemnity should include the names and addresses of both parties involved, plus the name and affiliation of the third party. Detailed descriptions of the items and intentions are also required, as are the signatures of the parties and the date of the contract's execution. What Is a Letter of Indemnity (LOI)? Definition and Example - Investopedia investopedia.com ? terms ? letterofindemnity investopedia.com ? terms ? letterofindemnity

For example, in the case of home insurance, the homeowner pays insurance premiums to the insurance company in exchange for the assurance that the homeowner will be indemnified if the house sustains damage from fire, natural disasters, or other perils specified in the insurance agreement. Indemnity: What It Means in Insurance and the Law - Investopedia investopedia.com ? terms ? indemnity investopedia.com ? terms ? indemnity

Letters of indemnity should include the names and addresses of both parties involved, plus the name and affiliation of the third party. Detailed descriptions of the items and intentions are also required, as are the signatures of the parties and the date of the contract's execution.