Illinois Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance

Description

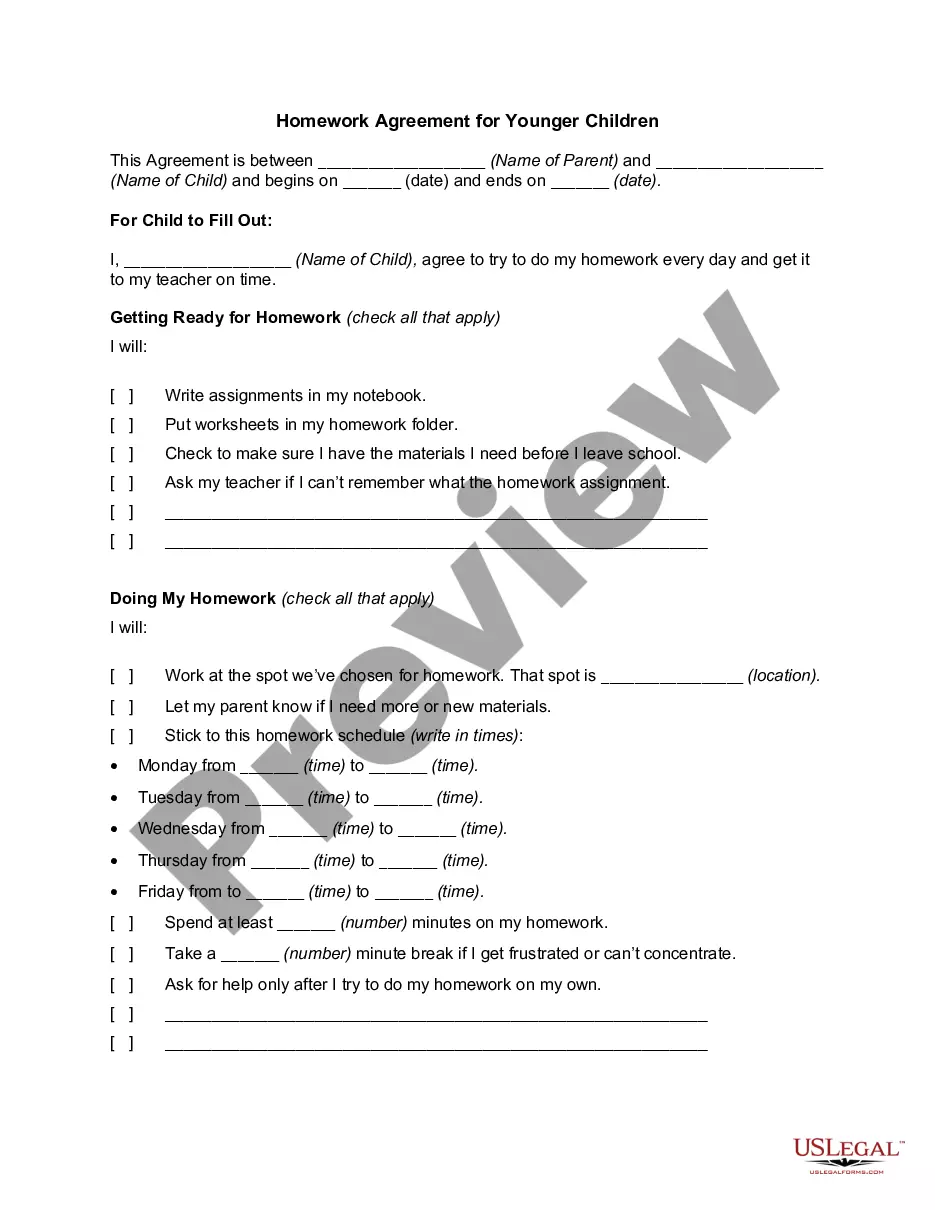

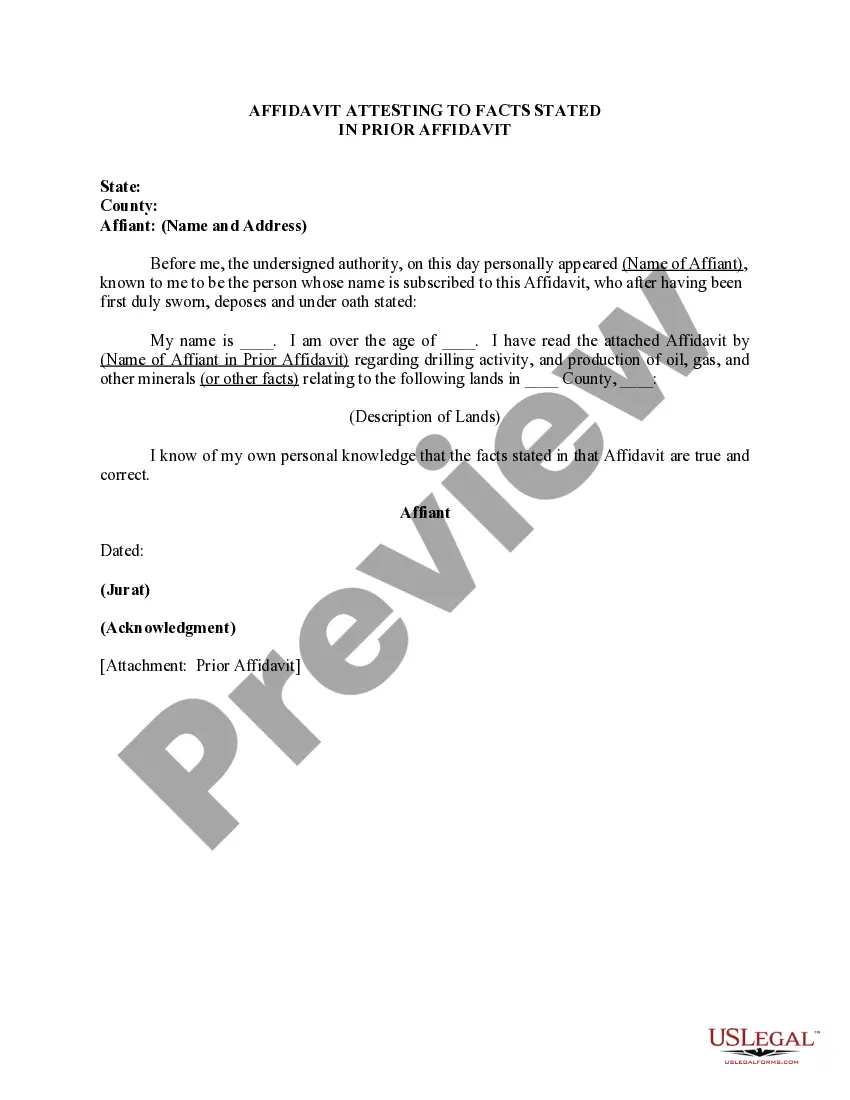

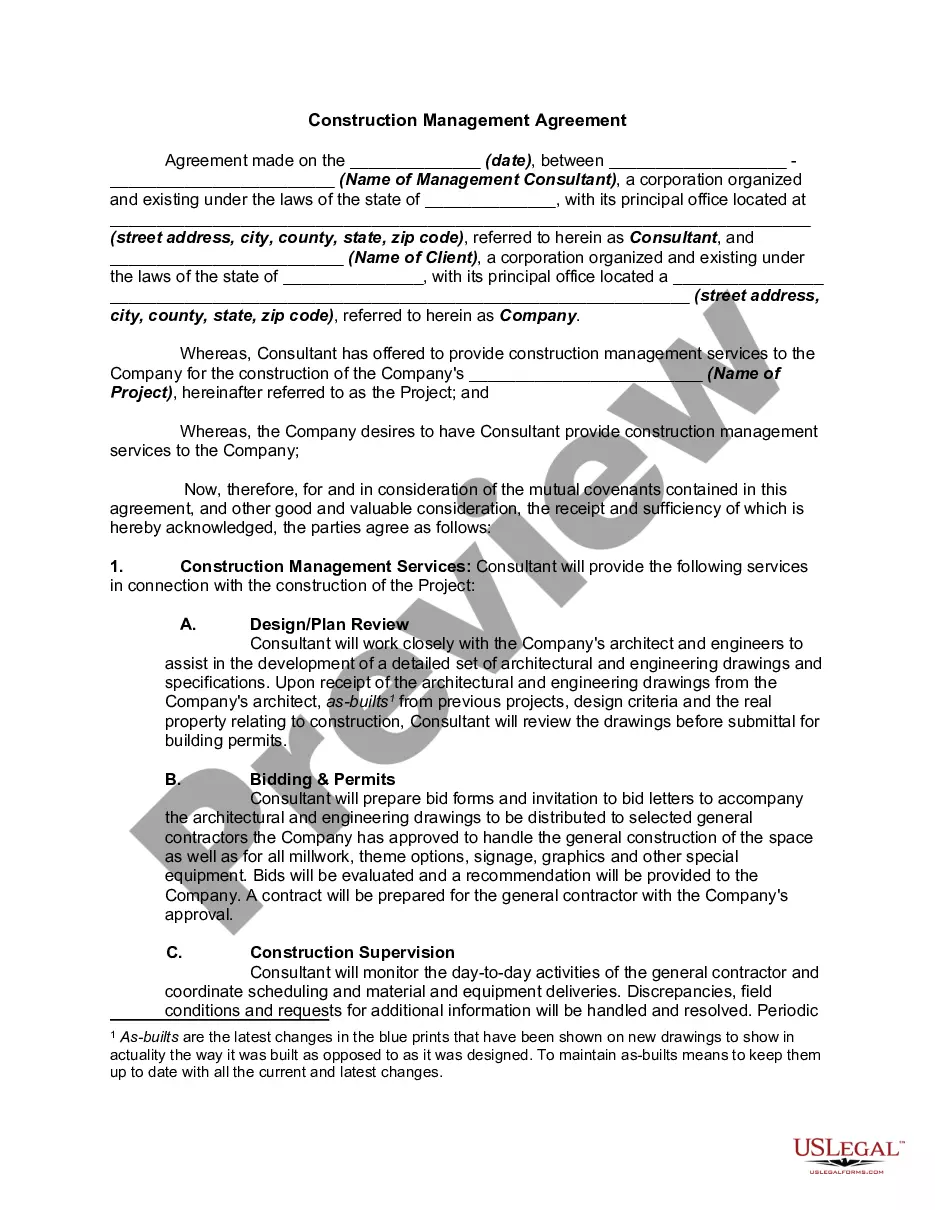

How to fill out Buy Sell Or Stock Purchase Agreement Covering Common Stock In Closely Held Corporation With Option To Fund Purchase Through Life Insurance?

US Legal Forms - one of the largest repositories of legal documents in the USA - offers a broad selection of legal template options that you can download or print.

Using the website, you can discover thousands of forms for business and personal use, organized by categories, states, or keywords. You can find the most recent editions of forms such as the Illinois Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with the Option to Fund Purchase through Life Insurance within moments.

If you have an active subscription, Log In to download the Illinois Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with the Option to Fund Purchase through Life Insurance from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms in the My documents tab of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Make changes. Fill out, modify, and print the downloaded Illinois Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with the Option to Fund Purchase through Life Insurance. Every template you add to your account has no expiration date and is yours indefinitely. Therefore, if you need to download or print another copy, simply visit the My documents section and click on the form you need. Access the Illinois Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with the Option to Fund Purchase through Life Insurance with US Legal Forms, the most extensive repository of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal requirements.

- Ensure you have selected the correct form for your city/state.

- Select the Review option to check the form's details.

- Examine the form summary to verify that you have chosen the appropriate form.

- If the form does not meet your requirements, utilize the Search feature at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Next, choose your preferred pricing plan and provide your details to create an account.

Form popularity

FAQ

The preferred way to fund a buy-sell agreement is through life insurance policies. This method ensures that the necessary financial resources are available immediately upon a triggering event. Additionally, it provides peace of mind to all parties involved, knowing that business continuity is secured. For those navigating the complexities of this agreement, uslegalforms platform offers tailored solutions that simplify the process.

Three common methods for insuring buy-sell agreements include life insurance, mutual funds, and an escrow arrangement. Life insurance stands out as the most effective method, as it directly provides the funds needed for a buyout under unforeseen circumstances. Mutual funds offer an alternative but may not guarantee immediate liquidity. Escrow accounts can also secure funds but require more management and oversight.

Company purchase agreements are essential for transferring the ownership of a business upon a trigger event, such as death or disability. They generally contain the terms and conditions of the sale, including obligations, warranties, and liabilities.

Establish a market for the corporation's stock that might otherwise be difficult to sell; Ensure that the ownership of the business remains with individuals selected by the owners or remains closely held; Provide liquidity to the estate of a deceased shareholder to pay estate taxes and costs; and.

The two most-common buy and sell agreements are cross-purchase, and redemption; some agreements will combine the two. Cross-purchase agreements allow remaining owners to buy the interests of a deceased or selling owner. Redemption agreements require the business entity to buy the interests of the selling owner.

Establish a market for the corporation's stock that might otherwise be difficult to sell; Ensure that the ownership of the business remains with individuals selected by the owners or remains closely held; Provide liquidity to the estate of a deceased shareholder to pay estate taxes and costs; and.

Definition. 1. A buy-sell agreement is an agreement among the owners of the business and the entity. 2. The buy-sell agreement usually provides for the purchase and sale of ownership interests in the business at a price determined in accordance with the agreement, upon the occurrence of certain (usually future) events.

When does a business need a buy-sell agreement? Every co-owned business needs a buy-sell, or buyout agreement the moment the business is formed or as soon after that as possible. A buy-sell, or buyout agreement, protects business owners when a co-owner wants to leave the company (and protects the owner who's leaving).

There are four common buyout structures:Traditional cross purchase plan. Each owner who is left in the business agrees to purchase the co-owner's shares if that individual dies or leaves the business.Entity redemption plan.One-way buy sell plan.Wait-and-see buy sell plan.

A good buy-sell agreement can offer business owners peace of mind and help them to avoid future conflict and retain control of their companies. Once in place, agreements should be reviewed on a regular basis or especially when there is a major change in the business or an anticipated change in ownership.